- Asset has been trading within a defined channel, with press time technical indicators suggesting a possible move lower

- A divergence between the Money Flow Index (MFI) and TIA’s price could have a say too

As a seasoned analyst with years of market observation under my belt, I find myself scrutinizing Celestia [TIA]’s current price action with a mix of skepticism and intrigue. The 7.47% dip over the last 24 hours is certainly noteworthy, especially considering its impact on the broader trend that TIA has been maintaining since July.

Currently, Celestia [TIA] is experiencing a downward trend, having dropped by 7.47% in the last 24 hours. This decline has partially undone the progress TIA made over the past week. Given the mounting selling pressure, it’s important to consider various possibilities for TIA’s price evolution as diverse market opinions emerge. These viewpoints could suggest instability, but they also hint at the potential for substantial price fluctuations on the charts.

TIA price movement analysis

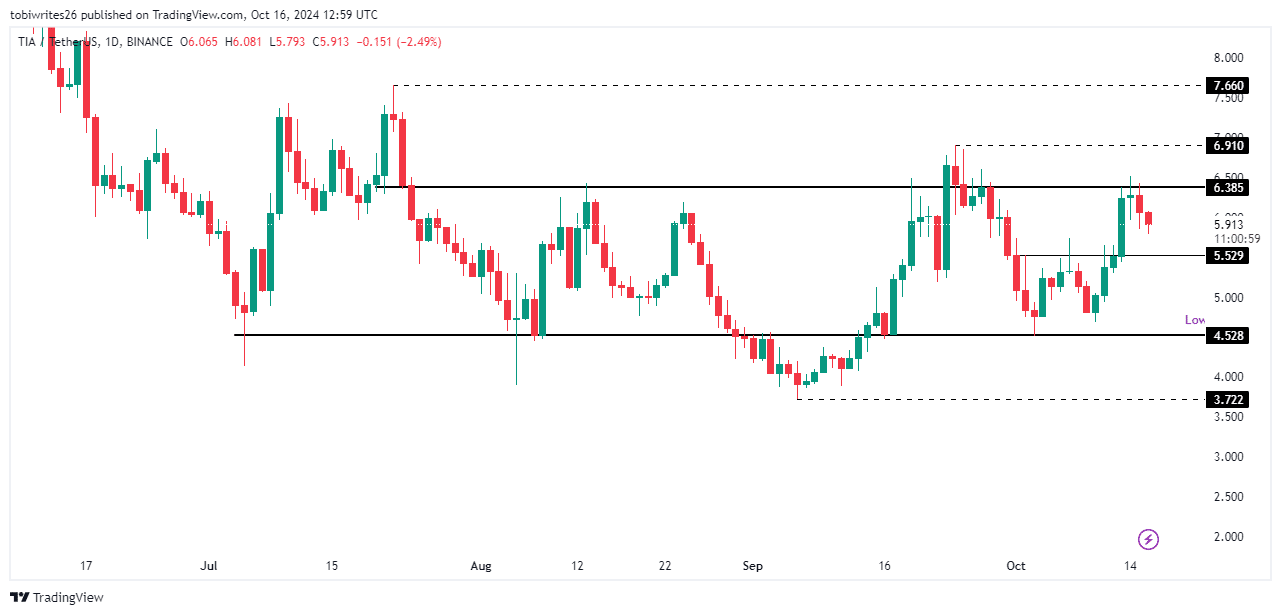

Currently, the TIA appears to be stuck within a consolidation trend lasting about a month, which has been ongoing since July.

Following an obstacle at the top of the channel, TIA has experienced a decrease over the last two days, suggesting a continued downward trend that might push the price to the support level of approximately $4.528. However, it’s worth noting that a brief reversal could occur. If TIA manages to reach the mid-term resistance at around $5.52 – a point with high liquidity – this could trigger a short-term surge, lifting the price before it resumes its downward course.

According to AMBCrypto’s analysis, there seems to be a dominant trader opinion that TIA might continue falling, given its current price of $5.895. In simpler terms, the general feeling among traders is that TIA could go down further.

Traders are selling aggressively

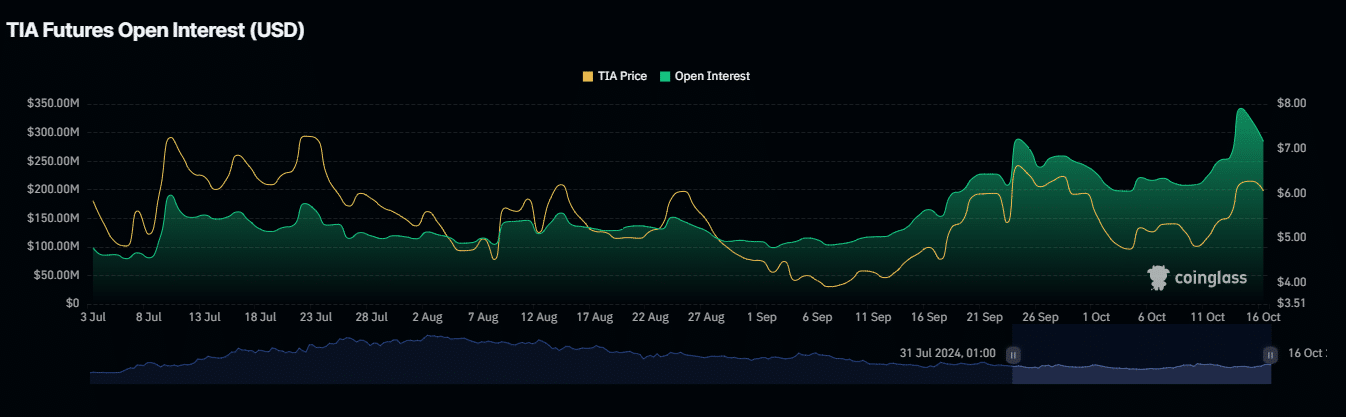

There’s been a noticeable surge in transactions for TIA, as evidenced by several on-chain indicators such as the Funding Rate and Open Interest. At the moment, the Funding Rate for TIA stands at -0.0377%, suggesting that short positions are currently paying long positions, which is often a signal that the contract price could be lower than the market price.

If the current downward pattern persists, the price of TIA may drop even more below its current value at the time of reporting.

Divergence suggested bullish momentum still exists

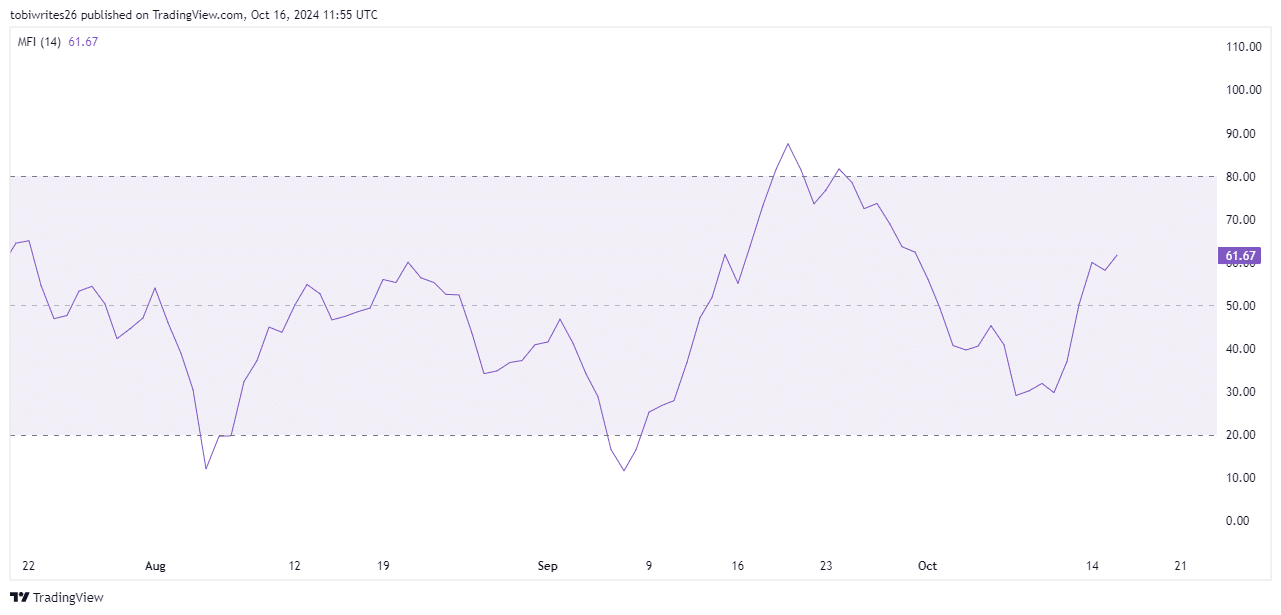

Based on the Money Flow Index (MFI), which gauges the movement of funds into and out of an asset, it appears that TIA might reverse its trend – more likely towards an increase in value. At present, while TIA’s price is falling, the MFI is heading northwards, suggesting a possible bullish indication. This pattern implies that even though the price is decreasing, there could be growing buying interest or accumulation in TIA.

If this trend continues, a reversal could be on the horizon for TIA’s price action.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- BLUR PREDICTION. BLUR cryptocurrency

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

2024-10-17 08:07