- Bitcoin ETFs are accumulating significant inflows, nearing $20 billion in net inflows

- Bitcoin was valued at $67,847 at press time – A sign of strong resilience amid market developments

As a seasoned crypto investor with a knack for deciphering market trends and understanding their implications, I find myself intrigued by the recent developments unfolding in the Bitcoin [BTC] ecosystem. The impressive inflows into Bitcoin ETFs, nearing $20 billion in net inflows, is a testament to the growing institutional interest in digital assets.

Bitcoin Exchange-Traded Funds (ETFs) have been experiencing a surge of investments lately, with inflows totaling $253.6 million on October 11, $555.9 million on October 14, and another $371 million on October 15. The increasing trend in investment is undeniably strong.

Eric Balchunas’ remarks spark concern

Seeing this, Eric Balchunas, a prominent ETF analyst at Bloomberg, made a bold prediction.

He believes that BTC ETFs are poised to surpass Satoshi Nakamoto, the enigmatic creator of Bitcoin, as the largest holders of the flagship cryptocurrency by Christmas.

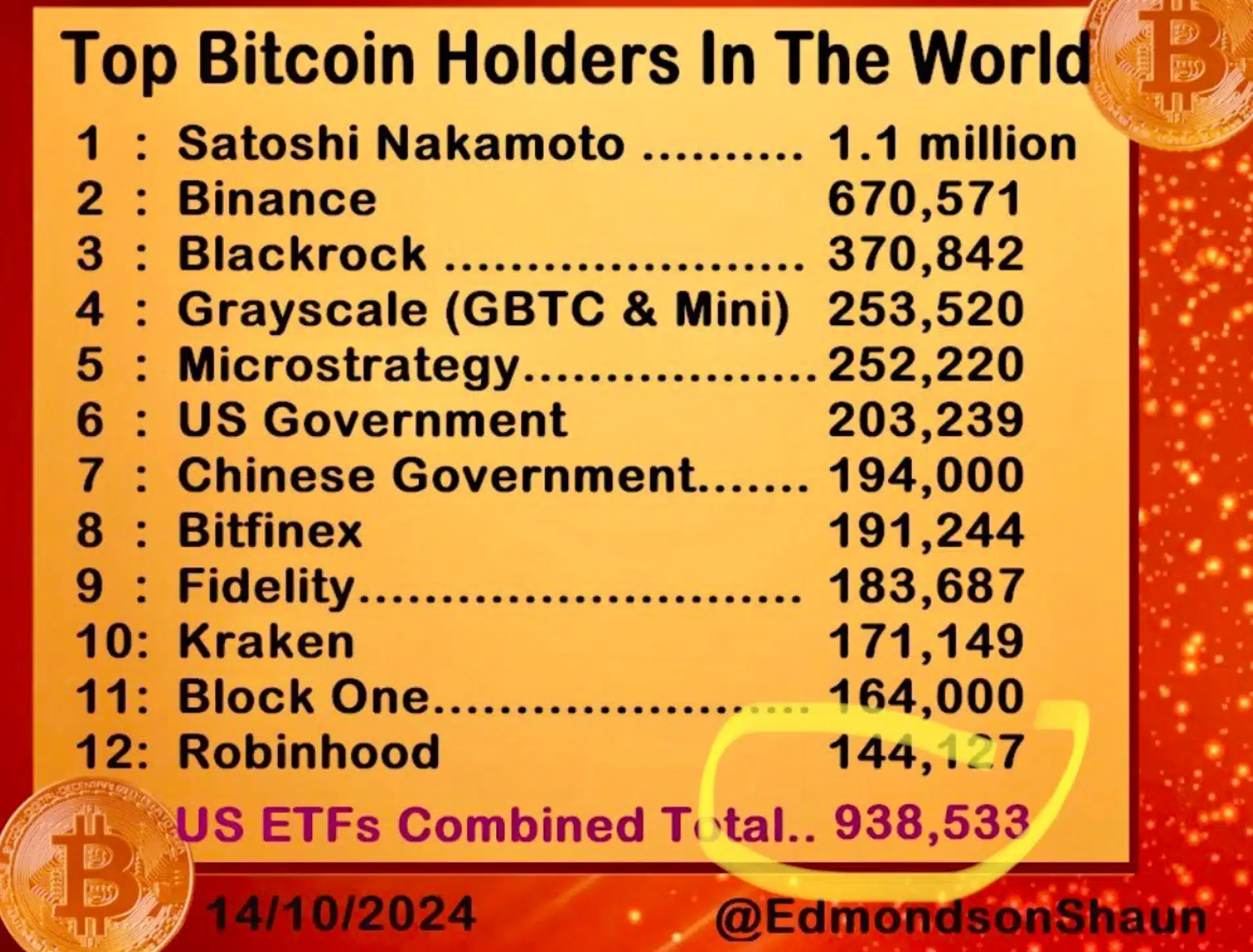

Today marks a significant surge for Bitcoin ETFs, with over half a billion dollars in net flows, just shy of reaching $20 billion. This brings them 94% closer to holding one million Bitcoins and 85% closer to surpassing Satoshi as the world’s largest holder. It’s a real possibility that they might reach this milestone by Christmas. Kudos to Shaun Edmondson for highlighting this.

Currently, the total holdings of Bitcoin ETFs are an impressive 938,533 BTC.

How is the community reacting?

As reported by Farside Investors, Bitcoin Exchange-Traded Funds (ETFs) are close to reaching a substantial achievement of over $20 billion in total investments.

It’s important to point out that experts speculate Satoshi Nakamoto owns approximately 1.1 million Bitcoins, a figure that many institutional Bitcoin Exchange-Traded Funds (ETFs) are rapidly approaching.

Due to the fast-growing popularity and investments in Bitcoin Exchange Traded Funds (ETFs), it seems more likely with each passing day that these funds could soon match or even surpass Satoshi Nakamoto’s Bitcoin holdings.

However, an X user painted a different picture when he said,

“There is no definitive proof Satoshi owns 1 million BTC.”

Another X user soon chimed in, noting,

“How can we have such monster inflows, but weak price action?”

However, this argument was soon dismissed by David Lawant, Head of Research at cryptocurrency brokerage FalconX. He claimed,

It has been found that there’s a notable connection between shifts in ETF investments and their subsequent prices, but it’s not particularly robust. To put it another way, the relationship is reflected in a correlation coefficient of 0.30, which suggests that approximately 9% or less of the price adjustments can be attributed to modifications in net flows.

What else happened in connection to Bitcoin?

It’s worth noting that the revelation occurred only a day after an inactive Bitcoin “whale” from the early days of Satoshi emerged, causing a stir within the cryptocurrency world.

A digital wallet, initially used for mining Bitcoin way back in 2009, stirred up some excitement when it moved around 630,000 dollars’ worth of Bitcoin to the exchange platform Kraken on October 14.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Masters Toronto 2025: Everything You Need to Know

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-10-17 09:12