- Bitcoin exchange reserves dropped to a 5-year low, signaling potential bullish rally.

- The majority of Bitcoin holders were enjoying profits, contributing to the market’s positive sentiment.

As a seasoned crypto investor with battle scars from the 2017 bull run and the infamous 2018 bear market, I must say that the current Bitcoin [BTC] situation has me feeling a mix of excitement and caution. The plummeting exchange reserves to their lowest levels since 2017 is reminiscent of those heady days when the moon was within reach for every Bitcoin enthusiast. However, as we all learned then, nothing in crypto moves in a straight line.

Throughout the week, Bitcoin (BTC) stayed a popular topic due to its persistent positive trend.

Recently, Bitcoin (BTC) burst through a bullish flag formation in the cryptocurrency market, stirring optimism about potential future price increases.

From plummeting exchange reserves to surging profits for holders, here’s why the market is buzzing with optimism.

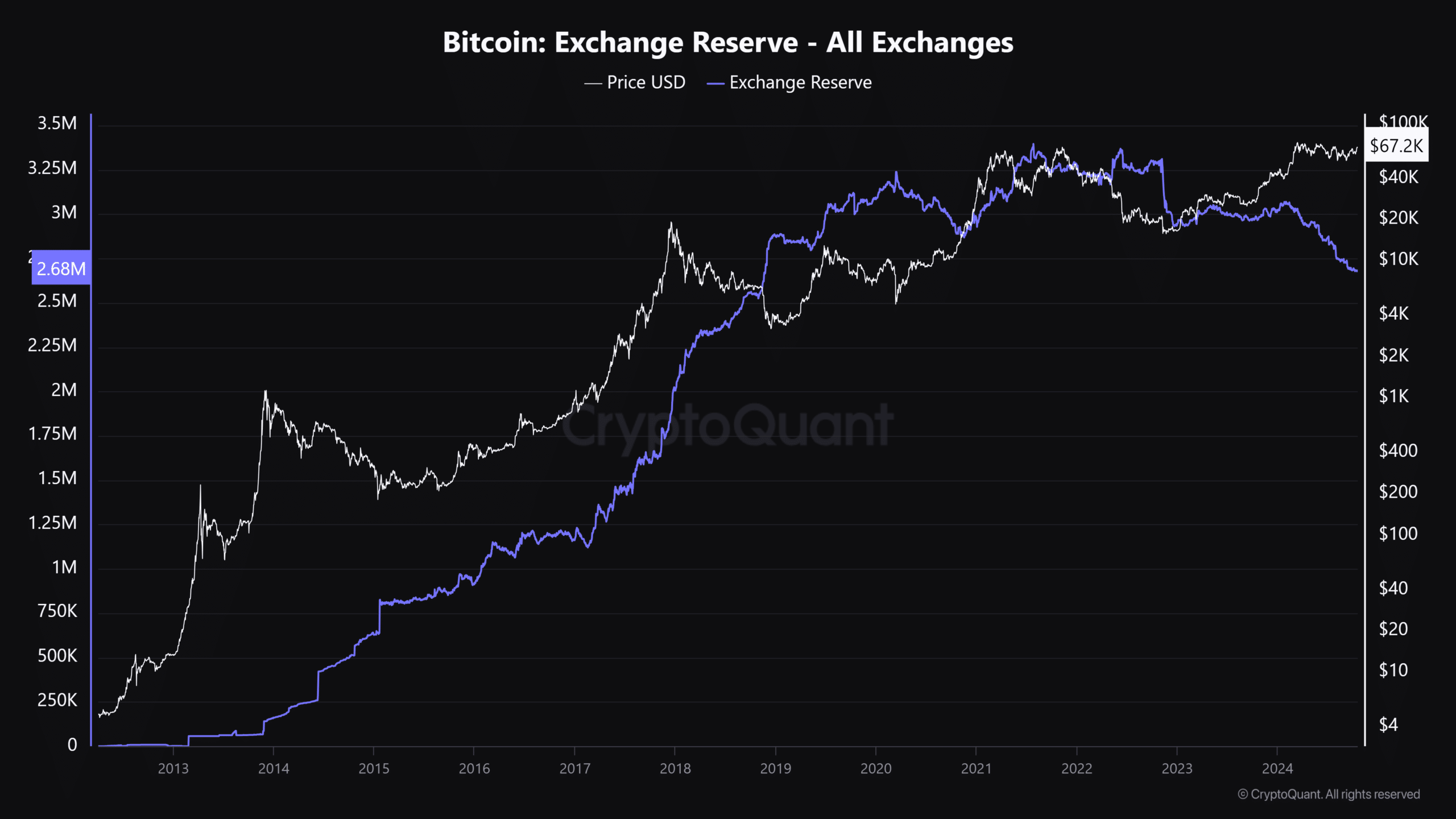

Bitcoin exchange reserves plummet

The amount of Bitcoin held on exchanges is at its lowest point since 2017, as indicated by information from CryptoQuant. In the past, a significant decrease in the quantity of Bitcoin stored on exchanges has often suggested growing demand for purchasing, or increased buying pressure.

Based on the recent surge in Bitcoin’s price, the general feeling might indicate a potential continued increase after the influx of investments.

A low supply of Bitcoin (BTC) ready for quick sale indicates that there might not be enough for immediate withdrawal, potentially causing a rise in its price over the next few days due to increased demand.

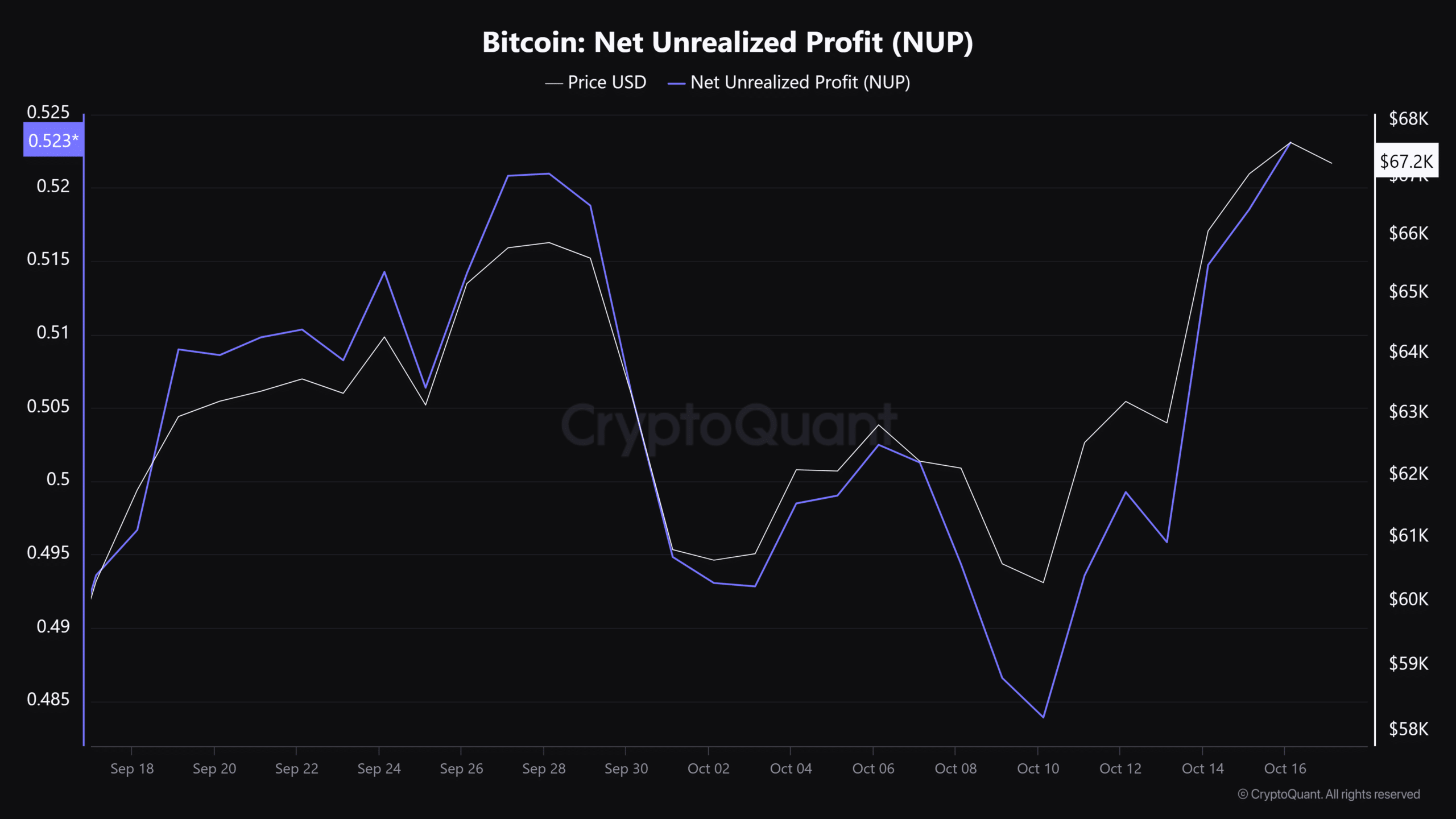

Net unrealized profit spikes

Over the past day, Bitcoin’s accumulated profits have skyrocketed significantly, suggesting that many Bitcoin owners currently possess substantial, untapped profits.

This boosted market confidence led to more investors keeping their earnings, creating a chain reaction of less selling and increasingly optimistic feelings towards Bitcoin.

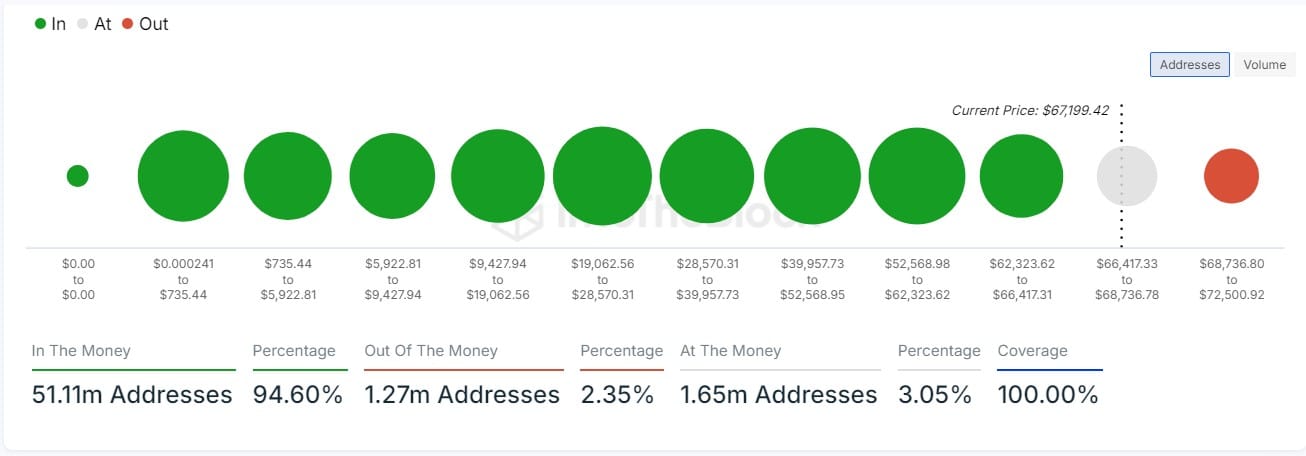

94% of Bitcoin holders are winning

According to AMBCrypto’s examination of IntoTheBlock, an astounding 94% of Bitcoin owners were enjoying profits at that moment, which added a positive, bullish vibe to the market.

When investors have already earned a profit, they tend to refrain from selling even during temporary market swings, thereby reducing the circulating supply of Bitcoin and potentially increasing its value over time.

As more investors find themselves in profit due to an increase in Bitcoin’s value, it seems that the ongoing bullish trend is likely to persist for a longer period.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Additionally, what makes things even more interesting is that the “king coin” has just burst through a bullish flag formation. Typically, this technical indicator suggests that prices will continue to rise in the future.

With the continuing decline in the exchange reserve and robust unrealized profits, the ongoing breakout serves as a compelling argument for a prolonged Bitcoin price surge.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-10-17 20:07