- FTT is positioned for a potential rally, trading off a demand zone that has catalyzed upward price movements.

- However, FTT could experience a temporary pullback into a support zone.

As a seasoned researcher with a knack for deciphering crypto markets, I find myself quite intrigued by FTX token (FTT) at present. The last month has seen an unprecedented 61.43% surge – a rare feat in today’s market climate.

Over just the past month, the FTX token (FTT) has experienced an exceptional surge of 61.43%. This significant increase is relatively rare for any asset within the current market during such a brief timeframe.

Based on AMBCrypto’s assessment, the bullish trend seems set to continue, implying that FTT might be preparing for a further notable price surge, as detailed in the following:

Demand zone set to drive buying impulse

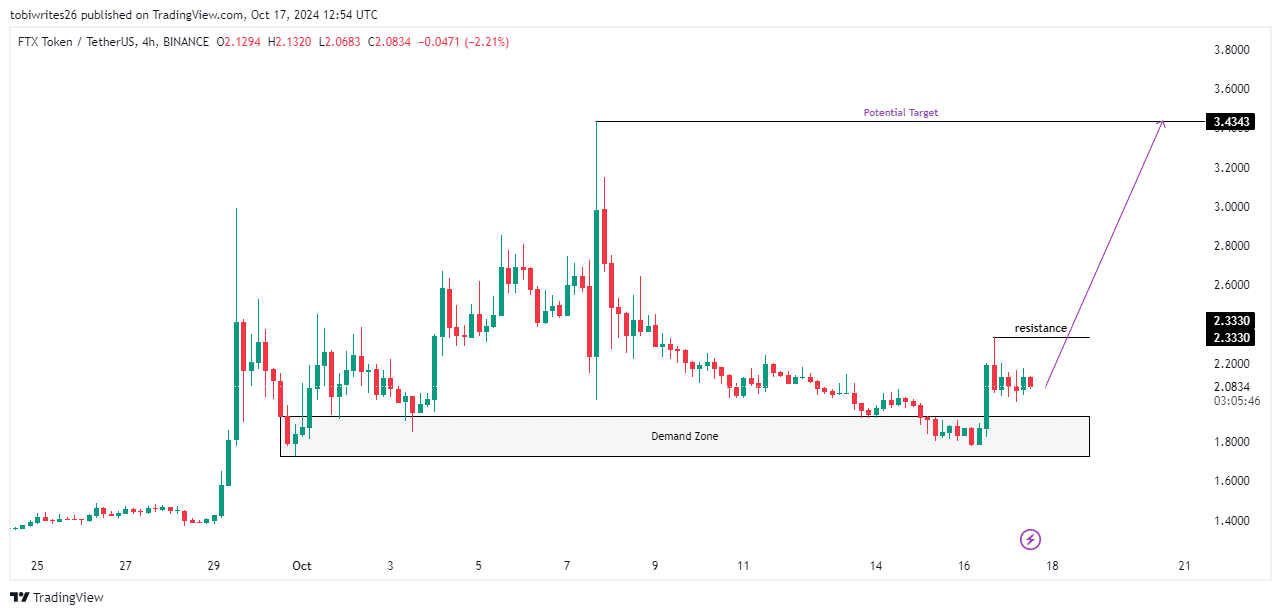

At the current moment, FTT was found to be transacting inside a region of high interest for buyers, often associated with substantial purchasing activity that stimulates price increase. This area has demonstrated its potential to drive growth in the past, on at least two occasions.

The price range for this demand zone is between $1.9305 and $1.7289. Lately, FTT has shown significant regard for these levels, leading to an upward price movement that has increased by approximately 15.36%.

If the ongoing purchasing trend continues, it’s possible that the FTT price may reach a higher barrier at approximately $3.4343. Yet, it’s important to note a potential smaller barrier around $2.3330, slightly above the current rate, which traders should keep an eye on.

Active buyers to drive FTT higher

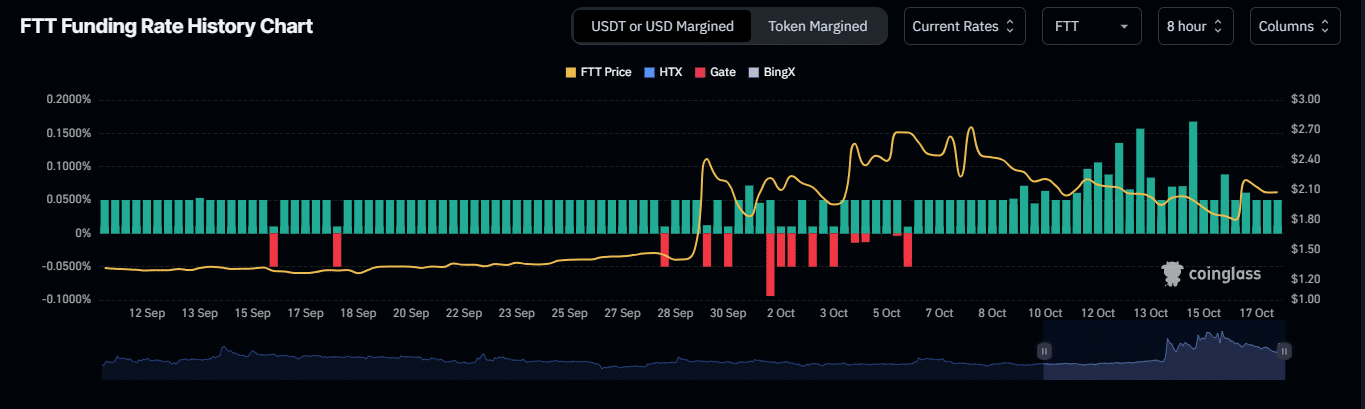

Upon closer examination by AMBCrypto, it was observed that traders were increasingly purchasing FTT. This trend could potentially drive up the price of FTT as the overall mood, as measured by metrics like Funding Rate and Open Interest on Coinglass, becomes more positive.

At the moment of publication, the Funding Rate was 0.0449%, indicating that the cost of borrowing a cryptocurrency’s futures contract is higher than its current market price.

Here, long-term investors (who bet on price rises) are paying a fee to short-term traders (who bet on price decreases), suggesting a positive or optimistic outlook towards the FTT market.

As a researcher, I’m excited to note the surge in Open Interest, which has grown by 2.69%. This now stands at an impressive $1.1 million. This upward trend indicates a rise in the opening of long-term contracts and the maintenance of existing positions, adding confidence to our market analysis.

Despite the negative market sentiment, it seems that a significant surge in the price of FTT is likely, as traders continue to invest in buying FTT even during bearish times.

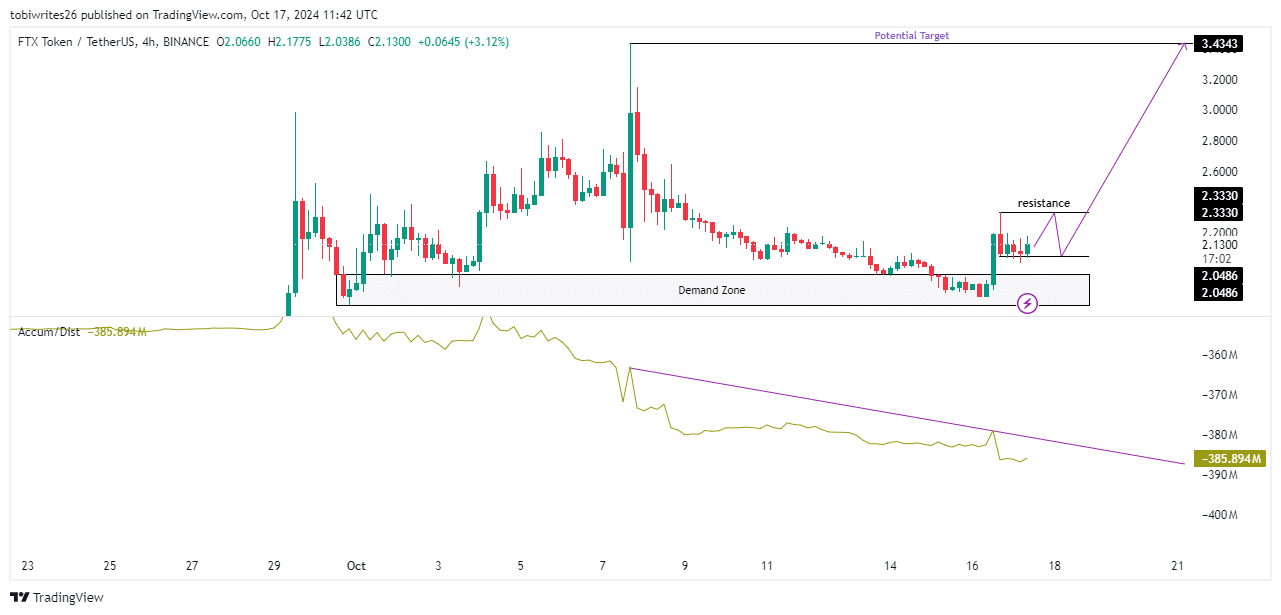

Caution advised despite bullish outlook

As optimism grows about the market, it’s essential that investors exercise caution because the Accumulation/Distribution (A/D) indicator is nearing a notable resistance trendline.

Should the price reach that point (which could align with the earlier noted minor resistance at approximately $2.3330), it’s possible that FTT might momentarily dip to the support level of $2.0486, but then it may continue moving upwards again.

However, for the support at $2.0486 to hold, market sentiment must remain bullish.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-10-17 23:03