- PayPal’s stablecoin market cap has plummeted by 40% to $618 million since August.

- Strategic partnerships and yield changes were impacting PYUSD’s competitive position in the market.

As a seasoned crypto investor with over a decade of experience navigating the ever-changing landscape of digital assets, I’ve seen my fair share of market ebbs and flows. The recent decline of PayPal’s stablecoin, PYUSD, is a stark reminder that even the most promising projects can face challenges in this volatile market.

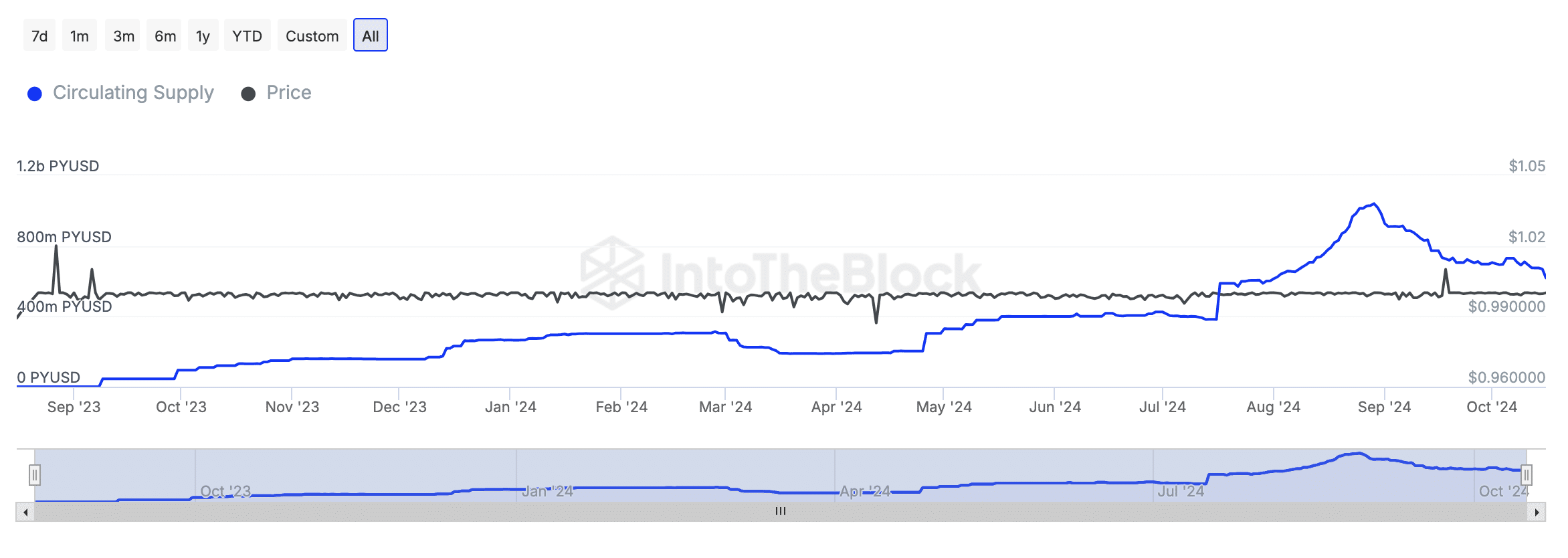

The dollar-backed digital currency, PYUSD by PayPal, has seen a significant drop in value since it reached over $1 billion in late August.

Initially considered the fourth largest cryptocurrency operating on a stable platform, its current market value stands at approximately $618 million, marking a significant drop of around 40% within about a month’s time.

In my analysis, this recent slump has underscored the continuous hurdles faced by PayPal’s digital token in a highly competitive and volatile stablecoin market, where demand is subject to frequent changes.

The journey so far

In August 2023, PayPal’s USD was first introduced on the Ethereum network, and it later expanded to Solana in May 2024. During Q3 2024, this digital currency demonstrated strong growth, showing a notable increase in momentum.

By around mid-August, the amount of this stablecoin available on the Solana network actually exceeded its quantity on Ethereum, making it one of the rapidly expanding stablecoins during that timeframe.

A significant achievement was reached when, during the span between July and August, its market value more than doubled, crossing the $1 billion mark for the very first time.

Yet, more current results suggest a reversal or slowdown, as the token has pulled back from certain advancements made during the last month.

Partnership with Kamino Finance

PayPal’s early expansion received a substantial boost through a strategic alliance with Kamino Finance, a lending service operating on the Solana network.

Through this partnership, PYUSD holders benefited from high-yield opportunities, as PayPal provided incentives to boost their overall earnings.

At its peak, Kamino offered yields of around 17% on PYUSD deposits, drawing substantial interest.

Lately, the returns on PYUSD have dipped below 7%, which may be less enticing for those who hold it.

On comparable SOL-based systems such as Drift and MarginFi, the annualized rewards they provided (which were previously quite high) have been revised as well. This suggests a larger pattern of decreased incentives becoming commonplace within these protocols.

Through a post on X (previously known as Twitter), DragonFly Capital’s managing partner, Haseeb Qureshi, shared his insights on the subject.

The circulating supply of PYUSD has returned to its original holders, as the incentives provided by Kamino Finance have diminished.

But with Kamino now listing PYUSD in their ‘alternative coin market,’ users can now secure loans using popular memecoins such as WIF, POPCAT, and BONK. This could signal a potential change in the trend.

Introducing this strategic move offers fresh motivations, as depositors could jointly win up to $10,000 in PYUSD bonuses every week. This may stimulate increased interaction and interest in our stablecoin.

PYUSD in comparison with USDT and USDC

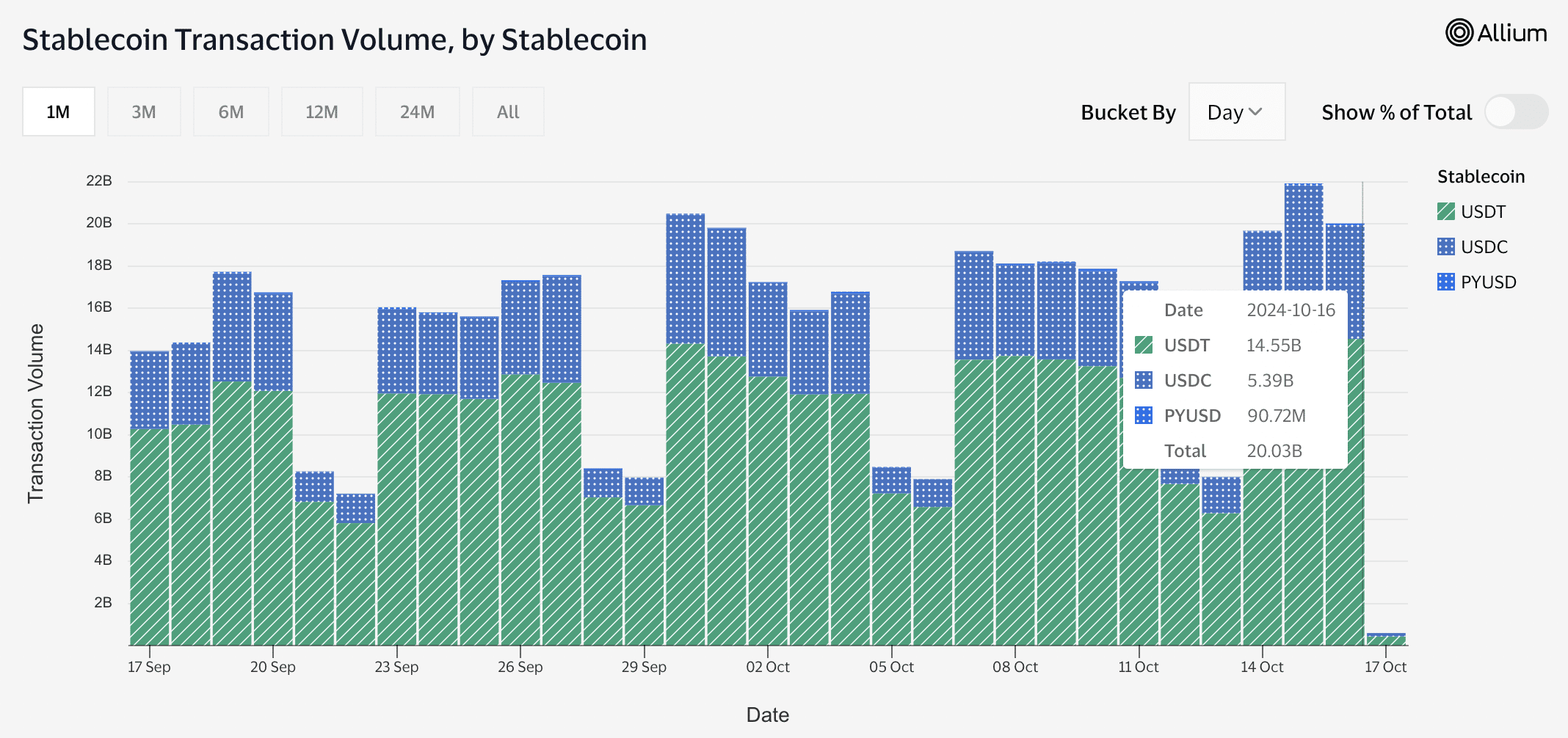

The decrease in PYUSD’s market value, particularly noticeable on Solana, underscores changing patterns within the stablecoin sector, as opposed to the consistency demonstrated by USDT and USDC.

Initially, there was significant interest in PYUSD, but as rewards for holding it decreased, its allure has waned. Consequently, the value of PYUSD on Solana has dropped significantly, from $600 million to $267 million.

In summary, around $350 million of PYUSD was still circulating on the Ethereum network, potentially gaining more traction because of its robust and well-established decentralized finance (DeFi) infrastructure.

Instead, USDT and USDC have kept a steady market value, highlighting their strong position and ongoing popularity across various platforms.

Visa’s on-chain analysis shows a competitive scene among stablecoins as of October 16th. Specifically, USD Coin (USDC) transacted $5.39 billion, while USD Tether (USDT) hit $14.55 billion in transaction volume.

In stark contrast, PYUSD lagged significantly, with just $90.72 million in transaction volume.

Despite this, PYUSD’s total cross-chain market capitalization surged by 375% year-over-year, according to CoinGecko data. This positioned it as the ninth-largest stablecoin by market cap.

Such impressive development suggests a robust adaptability and promise for further growth in the swiftly advancing, dynamic stablecoin marketplace.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- BLUR PREDICTION. BLUR cryptocurrency

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-10-18 01:12