- TRON’s bullish momentum is reflected in its rising fees and strong price action, with key resistance at $0.1635.

- On-chain signals remain neutral, but a potential short squeeze and rising social sentiment could fuel further gains.

As a seasoned crypto investor with a knack for spotting trends, I find myself intrigued by TRON’s current bullish momentum. The surge in fees and strong price action have caught my attention, with key resistance at $0.1635 looming on the horizon.

TRON (TRX) has experienced a significant spike in its monthly transaction fees, peaking at around $200 million. This increase suggests robust buying interest and increased need for the platform’s data storage capacity.

At the moment, TRON’s value stands at $0.1604 and has climbed by 0.63%. This increase in price has left some people questioning if this rise in transaction fees might signal an upcoming surge for TRON, potentially leading to its next significant growth phase.

Tron’s chart analysis: Are bullish signals holding firm?

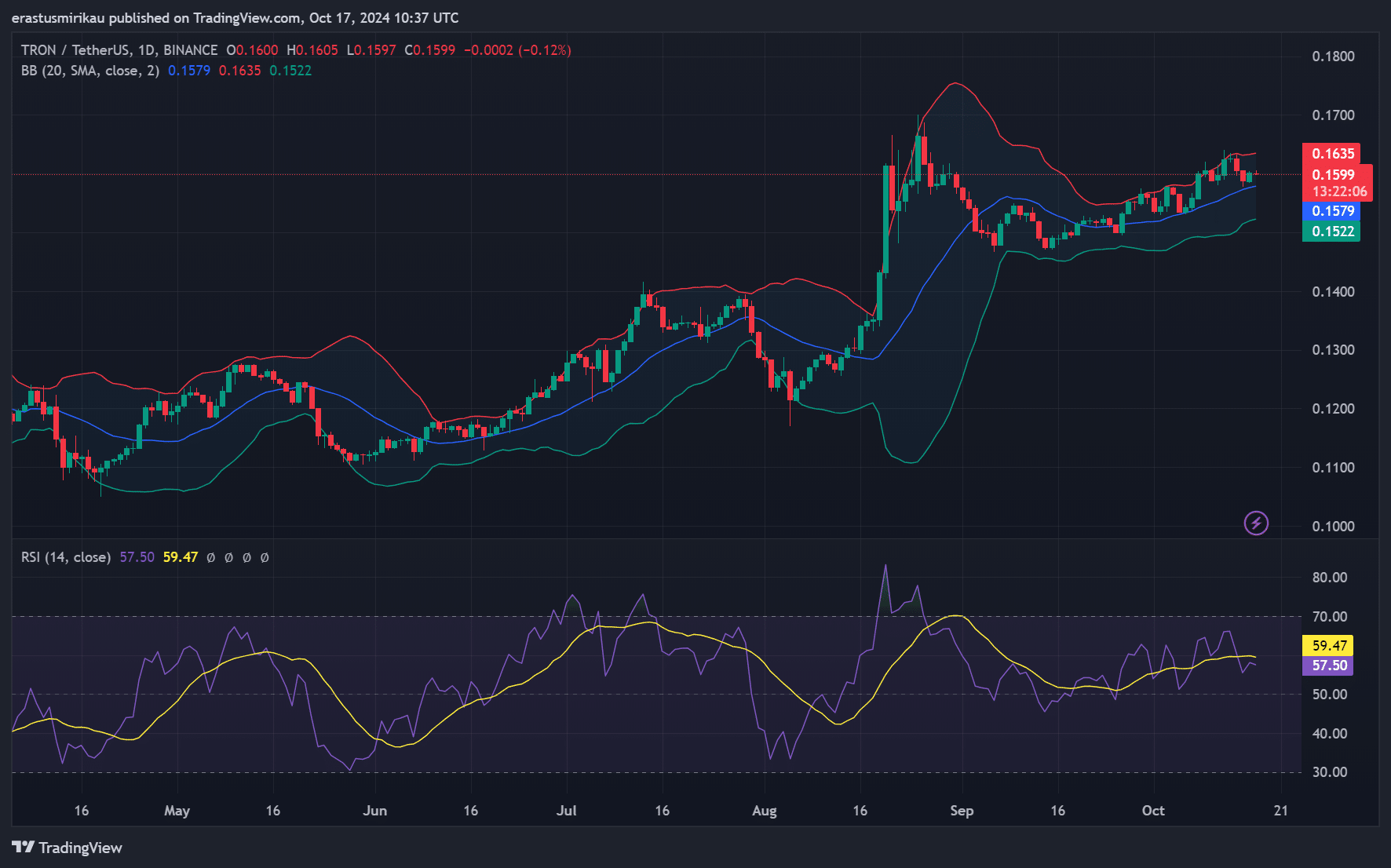

Looking at the graph of TRX’s price, the Bollinger Bands indicate that TRON is close to the upper band, implying a strong upward trend. At present, the price stands around $0.1599, hinting at approaching significant resistance at $0.1635. If it manages to surpass this level, further growth may occur.

Additionally, the Relative Strength Index (RSI) value at 59.47 is within a favorable zone, suggesting that TRX still has potential for upward movement without reaching an overbought state.

As a researcher, I’ve observed that the current surge in TRON shows no signs of slowing down, yet it’s crucial to keep an eye out for potential corrections. If TRON fails to breach the resistance level, there might be a brief pullback. However, at this point, the bullish trend seems to be dominating the market dynamics.

Tron’s on-chain signals: What does the data reveal?

Based on IntoTheBlock’s analysis, the on-chain indicators for TRON present a somewhat ambiguous image. The Net Network Growth stands at 0.59%, suggesting a steady, though not particularly impressive, growth trajectory.

In the Money readings stand at -0.20% bearish, indicating that a slight majority of TRX holders are currently at a loss.

Conversely, larger transactions indicate stable levels at around 0.87%, as these come predominantly from significant investors. This implies that these influential players aren’t actively buying or selling in large quantities at this time, suggesting potential market stability over the short term.

As a crypto investor, I’m observing a situation where the upward price trend is accompanied by relatively neutral on-chain indicators. This suggests that instead of experiencing a sudden, explosive surge, we might be in for a more gradual, sustained rally.

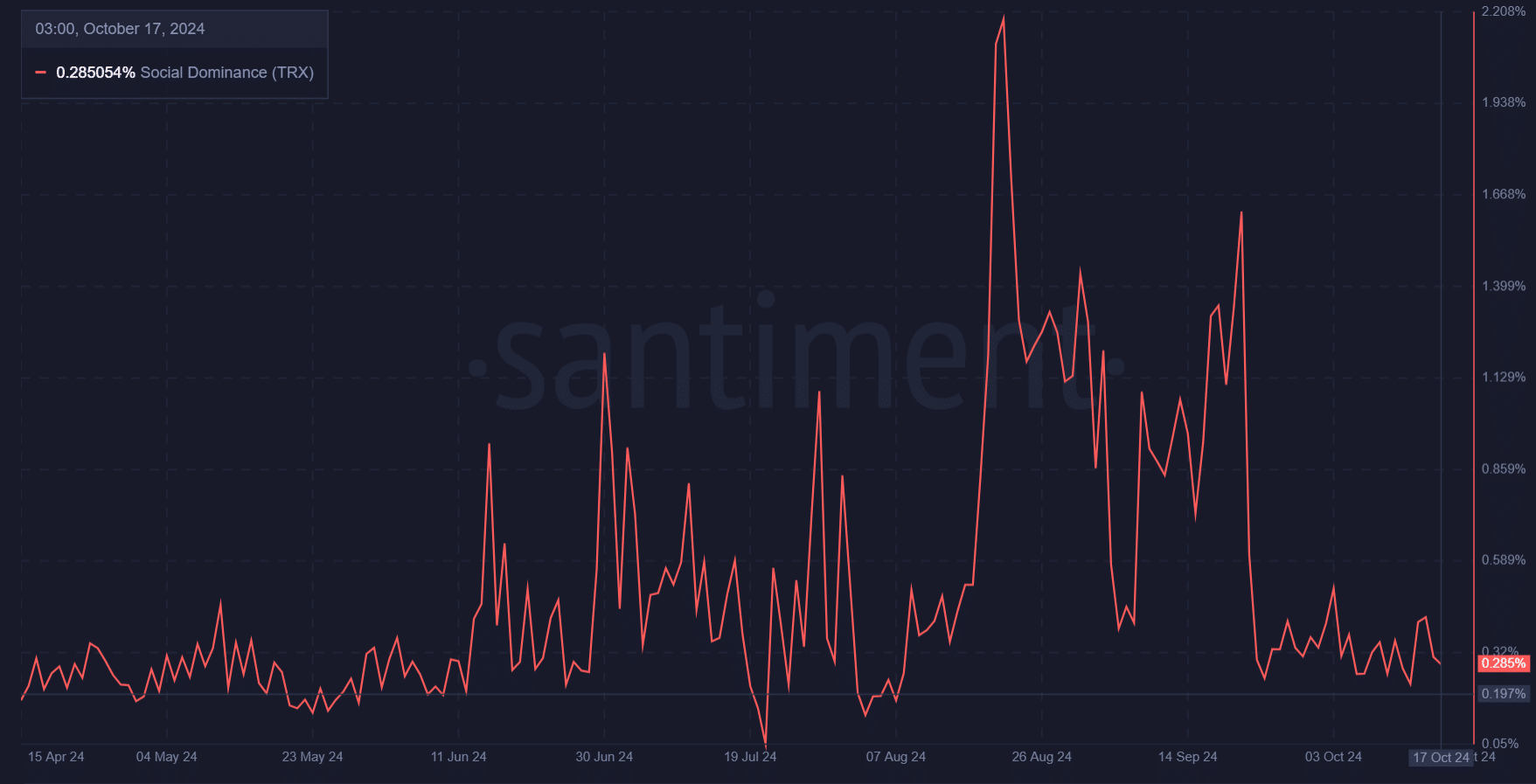

TRON’s influence on social media platforms is relatively small, with just 0.285% dominance, suggesting that it isn’t generating much online chatter. However, the lack of excitement around TRX could actually be advantageous, as it opens up a less crowded space for potential growth.

Should public opinion toward TRON become more positive, the heightened interest might catapult the token to unprecedented peaks.

Long/short ratio: Could a short squeeze fuel the rally?

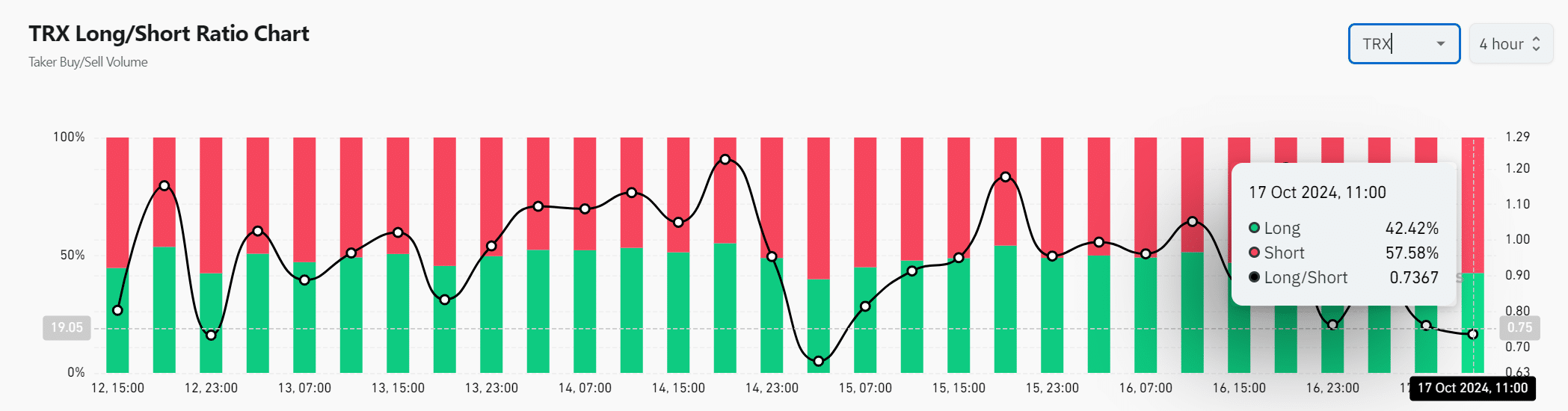

57.58% of traders are currently betting on a decrease in prices, indicating that there’s still a fair amount of doubt or skepticism in the market, even with recent price rises.

On the other hand, if the price keeps increasing, it might lead to a situation where short sellers are compelled to buy back their shares (covering), thus intensifying buying demand.

Realistic or not, here’s TRX market cap in BTC’s terms

TRON’s fee earnings jumping up to $200 million signifies increasing interest in its system, reinforcing a positive outlook. Although on-chain indicators are currently neutral, the bullish market trends and the possibility of a short squeeze might lead to additional growth.

Consequently, this increase in fees could potentially ignite a new surge in TRON’s price, but it’s essential for traders to pay close attention to more robust social and transaction data as evidence of this trend.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- WCT PREDICTION. WCT cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

2024-10-18 01:44