- Solana’s price momentum is approaching key resistance levels as whale accumulation intensifies.

- Rising open interest and significant liquidations suggest increased market volatility ahead for Solana.

As a seasoned researcher with years of experience navigating the volatile crypto markets, I can confidently say that Solana’s current momentum is indeed intriguing. The recent surge in DEX volume and its flip over Ethereum is a significant development that has caught my attention.

In an unexpected turn of events, Solana (SOL) has overtaken Ethereum in a significant milestone, leading the pack in 7-day trading volume on decentralized exchanges (DEX) with approximately $11.8 billion. On the other hand, Ethereum recorded around $9.2 billion. This rapid increase has sparked speculation among investors about whether Solana is preparing for a significant bullish trend.

To fully grasp whether this might be a significant turning point for the cryptocurrency market, it’s essential to examine closely the trends in Solana’s price movement, whale transactions, liquidation data, and outstanding positions (open interest levels).

Can Solana break resistance and rally?

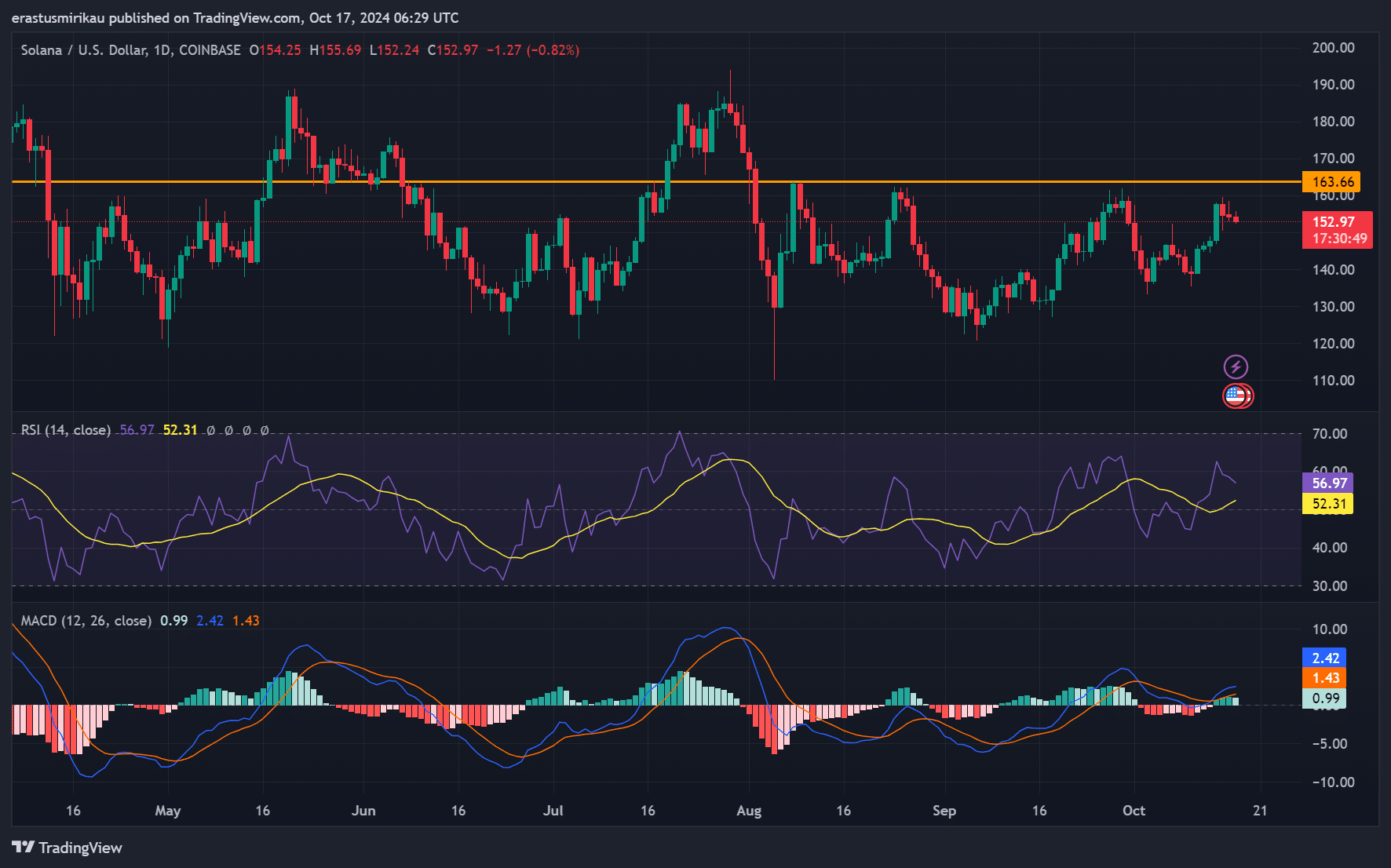

Currently, Solana (SOL) is being traded at $153.09, representing a decrease of 0.99% from the previous day. Yet, it’s important to note that this slight dip doesn’t detract from its overall positive trend.

Significantly, the $163.66 mark serves as a significant barrier for further price increase. Should Solana manage to surpass this threshold, a potential upward trend might ensue.

Furthermore, an RSI value of 52.31 suggests a neutral trend in momentum, yet the MACD indicates growing bullish power. Consequently, investors are watching closely to see if Solana will continue its progress and move upwards.

SOL whale accumulation signals potential surge

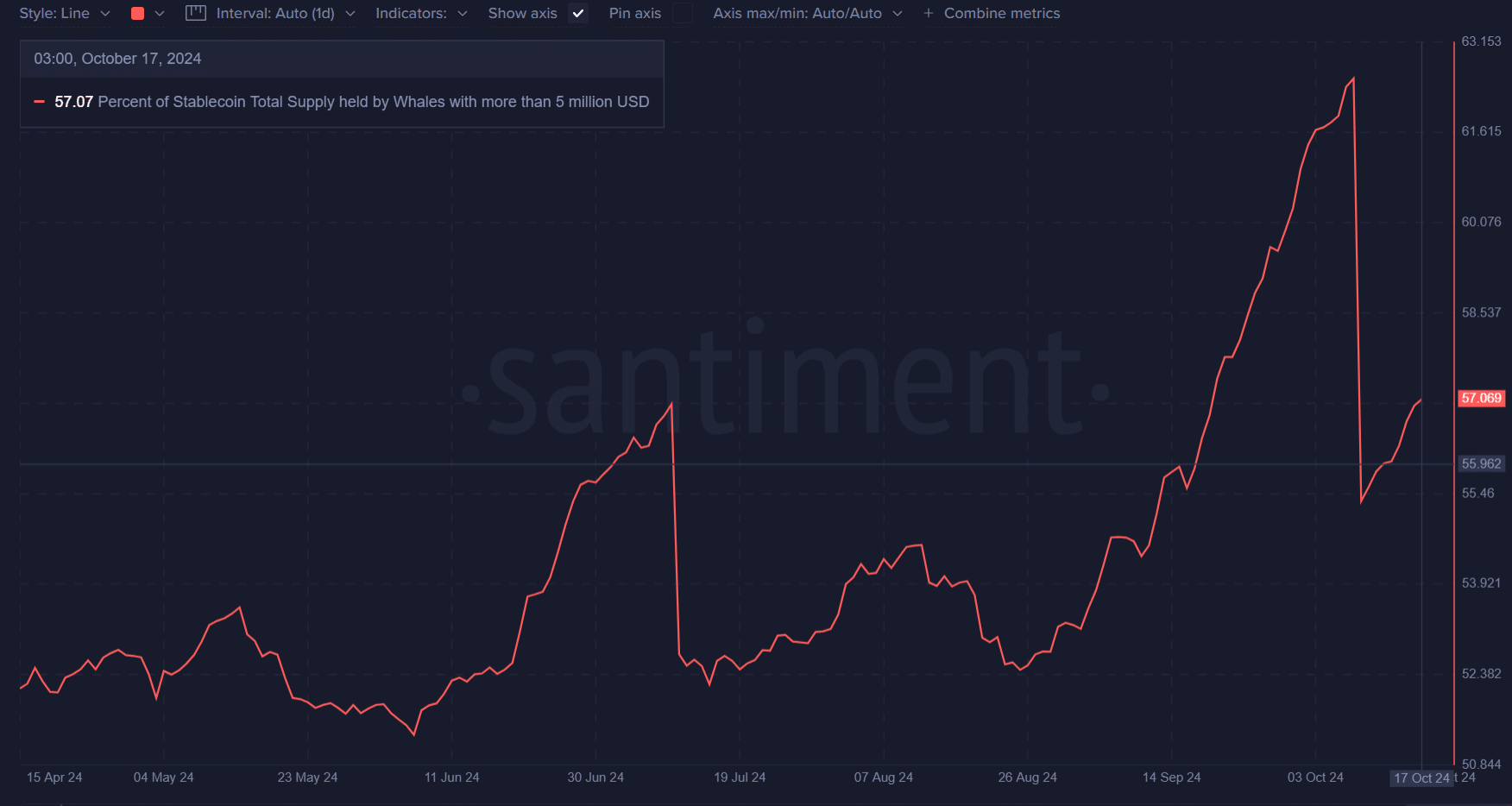

It’s worth noting that the largest Solana token holders, who possess over $5 million, now account for approximately 57.07% of the stablecoin supply. This increase in concentration among these ‘whales’ indicates a strategic amassing of tokens. Typically, such behavior from significant investors has been a precursor to price rises in the past.

As a result of this accumulation, there’s a growing sense that Solana (SOL) might experience substantial price increases in the near future. It seems that the ‘whales’ are preparing to make a powerful move, which suggests they have faith in Solana’s long-term prospects.

Are SOL liquidations setting up for more volatility?

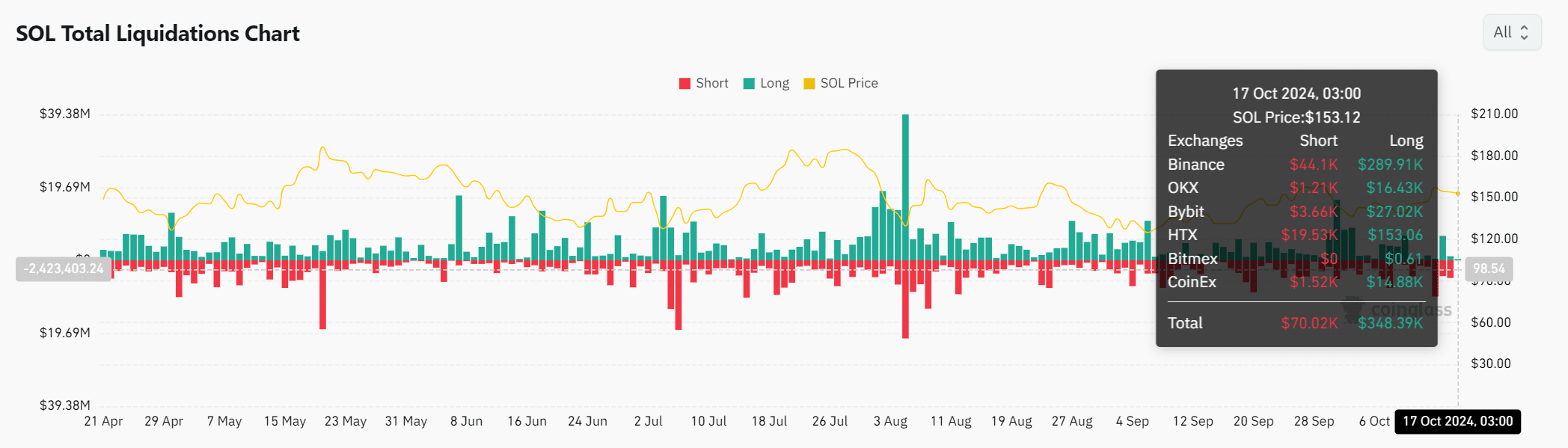

24-hour liquidation statistics show that a total of $348,390 was forfeited from long positions, while $70,020 was lost on short positions. The substantial amount of liquidation in long positions suggests that many traders are speculating on the market’s continued upward trend.

On the other hand, this situation suggests a significant amount of borrowing in the market, which might lead to unfavorable outcomes should crucial resistance levels break down. Consequently, more fluctuations in prices may ensue if the market goes contrary to traders who have extended their positions excessively.

Rising open interest hints at market optimism

Interest in Solana (SOL) has grown by approximately 2.26%, now standing at a value of around $2.45 billion. This increase suggests that traders are becoming more intrigued, potentially indicating a surge in volatility within the next short while.

As a crypto investor, I’ve noticed that Solana has been leading the way in Decentralized Exchange (DEX) trading volumes. This trend suggests that traders are backing its ability to exceed the overall market performance, making it an intriguing investment opportunity.

Considering Solana’s impressive track record and the increased holding by large investors (whales), it’s clear that a significant upward trend (bull run) is highly likely. Should the price manage to overcome resistance levels without any additional sell-offs or liquidations, we might witness a swift market escalation.

However, traders should proceed cautiously due to liquidation risks. Nonetheless, Solana is well-positioned to lead the next major crypto rally.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- WCT PREDICTION. WCT cryptocurrency

2024-10-18 03:03