- BNB Chain started migrating the Beacon Chain’s functionalities in April, initiating the sunset process

- BNB Beacon Chain validators will stop running by mid-November, halting any new transactions

As a seasoned researcher with years of experience in the cryptocurrency market, I have witnessed numerous transitions and transformations within this dynamic landscape. The recent developments surrounding BNB Chain, particularly its migration from the Beacon Chain to the Smart Chain, have caught my attention.

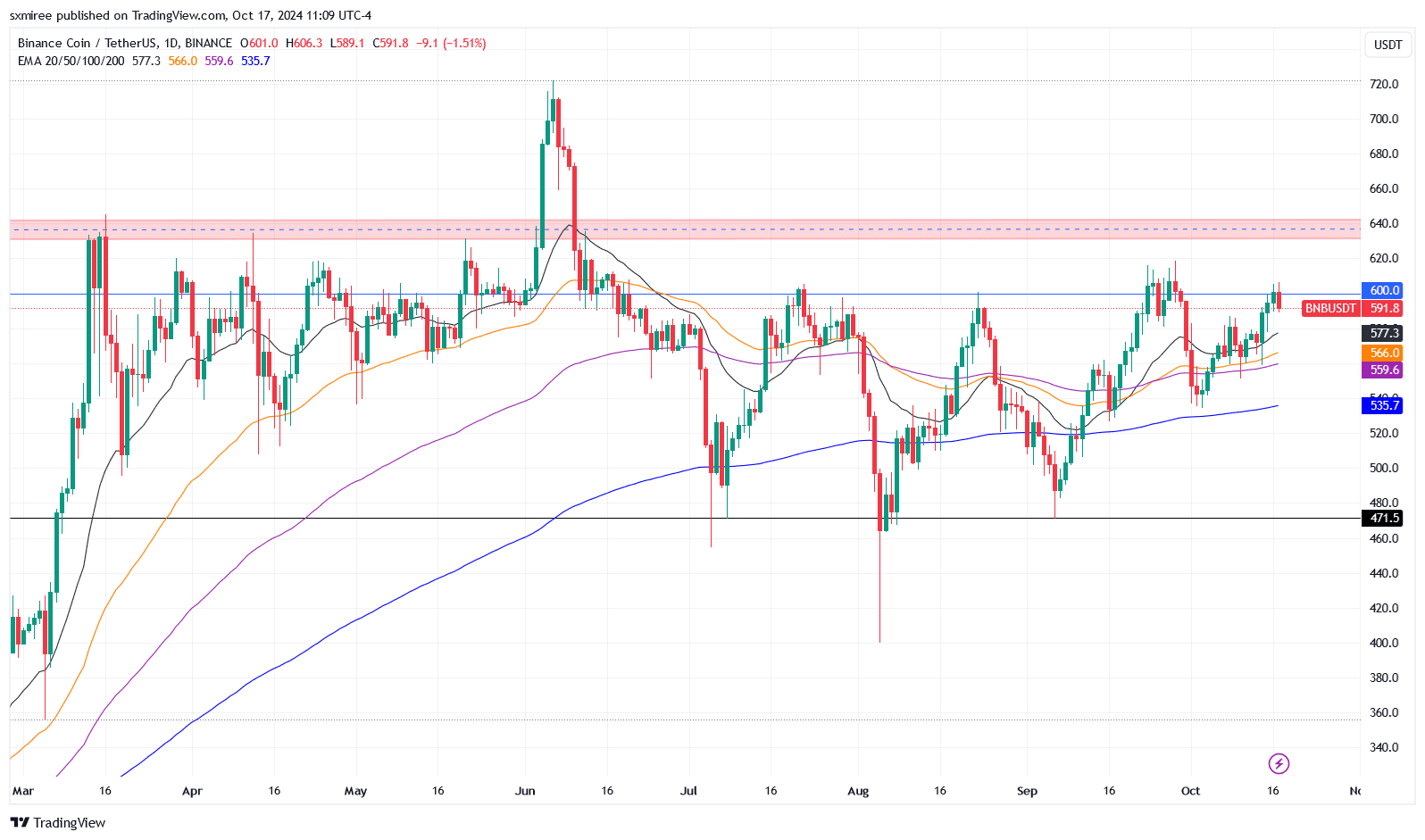

On Wednesday, the majority of cryptocurrencies experienced an increase in value, with Bitcoin (BTC) spearheading the surge, reaching a peak of $68,267 during the day. At the same time, Binance Coin (BNB) climbed up to $606 but later eased back and settled at $592 by the time of publication.

It’s important to point out that Binance Coin (BNB) has increased by approximately 90% this year, which is nearly double the 58% increase Bitcoin achieved during the same timeframe. Additionally, BNB’s gains in the middle of the week have highlighted a significant resistance level close to $600, a point where the token was unsuccessful on three separate attempts since June – With the most recent rejection happening towards the end of September.

Significantly, BNB has yet to encounter a clearly marked obstacle as it moves within reach of its previous annual high of $721 (achieved on 6th June). In fact, a potential resistance area, approximately at $620, was previously established and challenged before the year-high was reached.

BNB Beacon Chain’s final sunset plans

Although traders primarily focus on market movements with Binance Coin (BNB), it’s important to note that the broader Binance ecosystem is currently undergoing a transitional phase, as the BNB Beacon Chain nears its shutdown. The BNB Beacon Chain operates using the Tendermint consensus mechanism, while the BNB Smart Chain (BSC) employs a hybrid approach that combines Proof-of-Stake and Proof-of-Authority mechanisms.

On October 16th, BNB Chain announced that it will be retiring the BNB Beacon Chain, which is set to happen next month. This retirement is part of BNB Chain’s plan to streamline its blockchain system by concentrating on the Smart Chain, their main platform. The BNB Chain Fusion project, in essence, aims to enhance efficiency by integrating the functions of the Beacon Chain into the BNB Smart Chain.

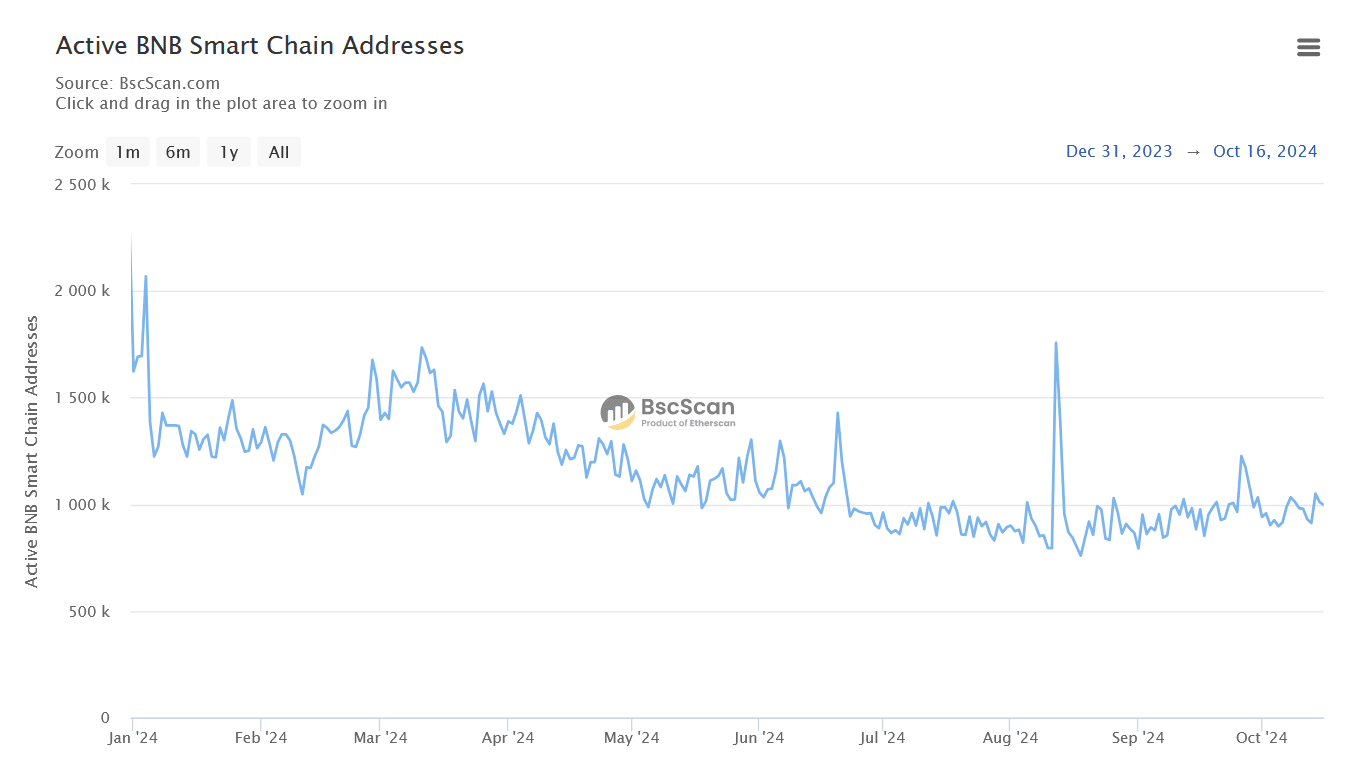

BNB Smart Chain’s active addresses stabilize

By combining the features of the Beacon Chain, the necessity for the intermediary cross-chain link between the two systems has been eliminated, streamlining the network structure. BNB Chain emphasized the intricate development challenges and security vulnerabilities associated with this cross-chain bridge as key reasons for its deprecation.

As a crypto investor, I find it noteworthy to mention that the BNB Smart Chain’s explorer tool, BSCScan, indicates a vibrant and active ecosystem on the BNB Smart Chain.

In the past few weeks, active daily usage has consistently remained above 1 million – a figure that dropped slightly from June through September. This consistent uptick might indicate sustained user interest as the platform continues to develop.

Will BNB finally break above $600?

As a researcher, I observed an impressive surge in the price of BNB, reaching $587 on October 14th. This was followed by another daily increase, propelled by the breakthrough above $595 on October 15th, resulting in a continuous bullish trend during the week. This midweek momentum has positioned the price of BNB at a crucial range according to chart analysis.

As investors aim for a new year peak, a refusal close to the all-time high might entice short-term optimists to cash out, potentially causing the value to decrease. If a consistent decline takes place below the 50-day and 100-day exponential moving averages, which are closely grouped between $566 and $560 on the daily chart, it will suggest ongoing price instability.

For a brief moment, if there’s a slight dip, the 200-day Exponential Moving Average (EMA) at $535 might serve as significant support. This comes after a more robust demand area around $471, close to the lower limit of BNB’s price range.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-18 12:07