- Buying pressure on BTC was rising, which suggested a continued price hike.

- However, a few technical indicators hinted at a correction.

As a seasoned crypto investor with years of experience riding the Bitcoin rollercoaster, I find myself at an interesting crossroads. The rising buying pressure and the subsequent price hike have been a welcome sight, but technical indicators hinting at a potential correction leave me a bit on edge.

Last week saw significant gains for Bitcoin [BTC] investors, with the digital currency’s price soaring by a substantial margin. This surge in value fueled optimistic feelings among investors, leading to a remarkable decrease in the quantity of BTC available on exchanges – reaching a new low. The question now is whether this trend will continue to drive further increases in Bitcoin’s price.

Investors are buying Bitcoin

According to information from CoinMarketCap, Bitcoin experienced an increase of more than 11% in its price during the past week. Currently, Bitcoin is being exchanged at approximately $67,866.54, and it has a market value exceeding $1.34 trillion.

Indeed, as previously mentioned by AMBCrypto, Bitcoin potentially surpassing $67k seemed plausible due to recent price growth. As a result, approximately 50 million Bitcoin wallets are now seeing profits, making up over 94% of all existing Bitcoin wallets.

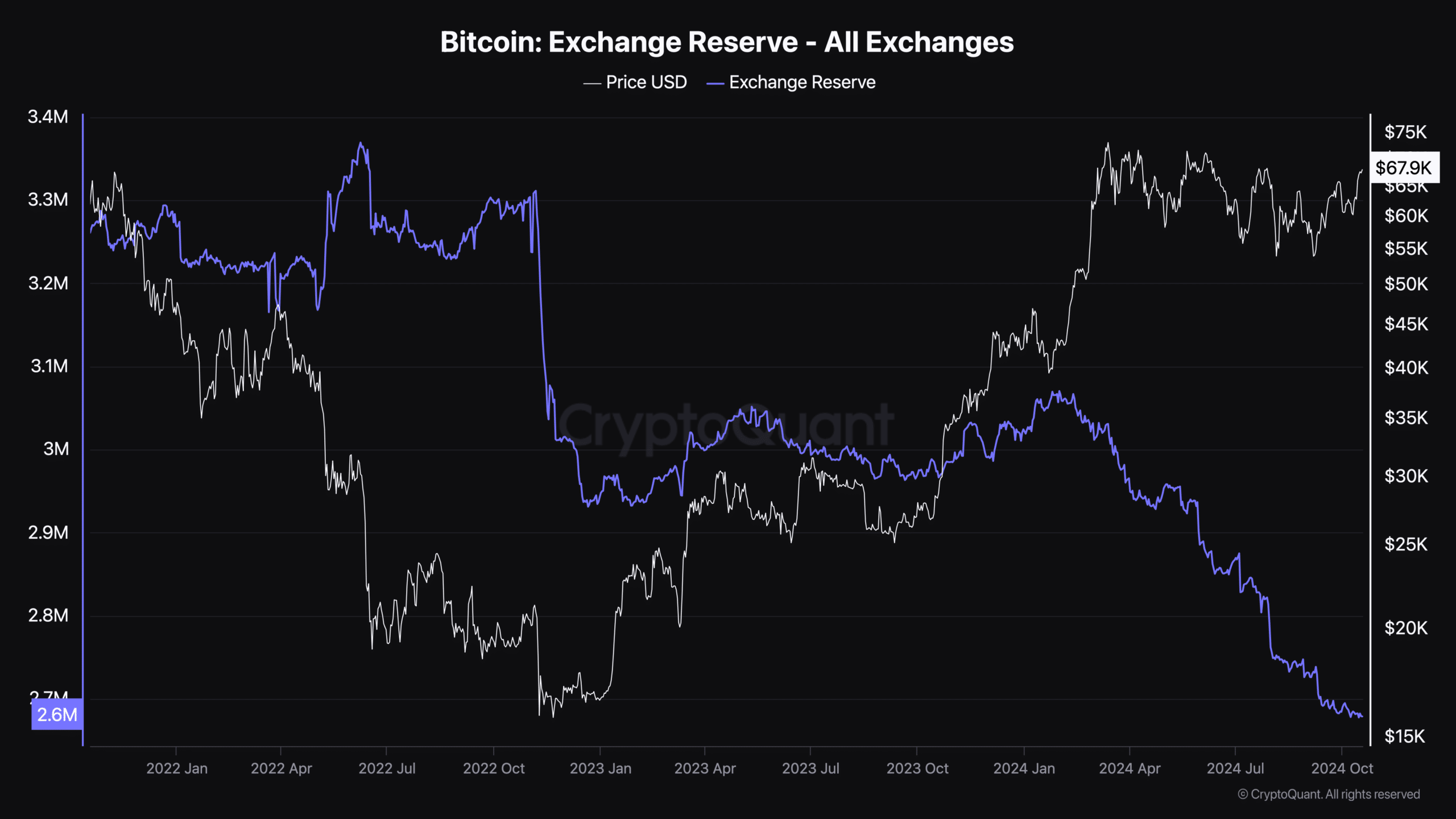

As these events unfolded, an important Bitcoin statistic hit a historic high: The amount of Bitcoin held on exchanges has fallen to its lowest level in the past five years. In simpler terms, fewer Bitcoins are being stored on exchanges, suggesting that investors expect the price to increase even more.

Therefore, AMBCrypto checked other datasets to find out whether buying pressure was high.

Where is BTC headed?

According to an analysis by AMBCrypto using data from CryptoQuant, it’s been observed that the reserves of Bitcoin exchanges have significantly decreased over the past few months. This decline suggests that investors are actively purchasing Bitcoin, as evidenced by their strong interest in the leading cryptocurrency.

Investors holding onto their cryptocurrency for a long time showed patience as indicated by the coin’s positive long-term trend (green binary CDD). Moreover, the derivatives market displayed a promising outlook.

As the funding rate for the coin increased, it showed that long position traders held a majority and were prepared to compensate short traders. Furthermore, Bitcoin’s trade volume demonstrated that buyers had more influence within the derivatives market, suggesting a strong bullish sentiment.

On the contrary, it appeared that U.S. investors held a different perspective. This was indicated by the minimal premium on Coinbase, suggesting that the selling mentality among American investors was prevalent. The escalating selling impulse might curb Bitcoin’s upward trend.

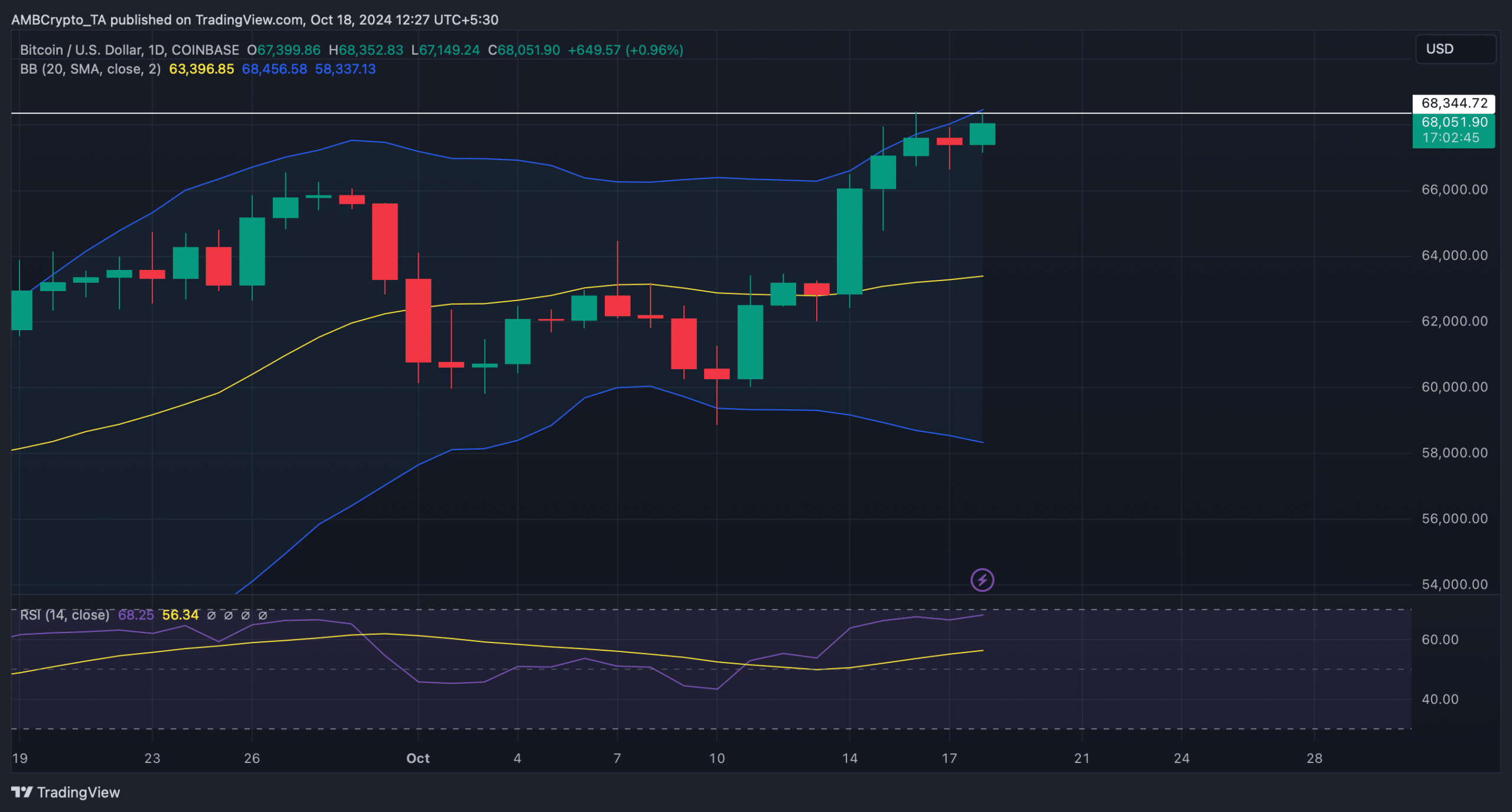

Consequently, AMBCrypto decided to examine Bitcoin’s daily chart for clarity on its direction. Our assessment indicates that Bitcoin is trying to breach the $68k level as resistance. Nevertheless, the market signals hint at a potential rejection.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

For example, when Bitcoin’s price reached the top band of the Bollinger Bands, it usually leads to a decrease in price due to market correction.

As a crypto investor, I’ve been keeping an eye on the Relative Strength Index (RSI). It seems like it’s almost reaching the overbought zone. If that occurs, there could be an increase in selling pressure, potentially leading to a price decline in the near future.

Read More

2024-10-18 14:15