- XRP is trading in an ascending channel pattern, which could lead to a rally toward $0.66.

- XRP’s RSI currently sits at 60, suggesting the asset may be poised for a potential price surge.

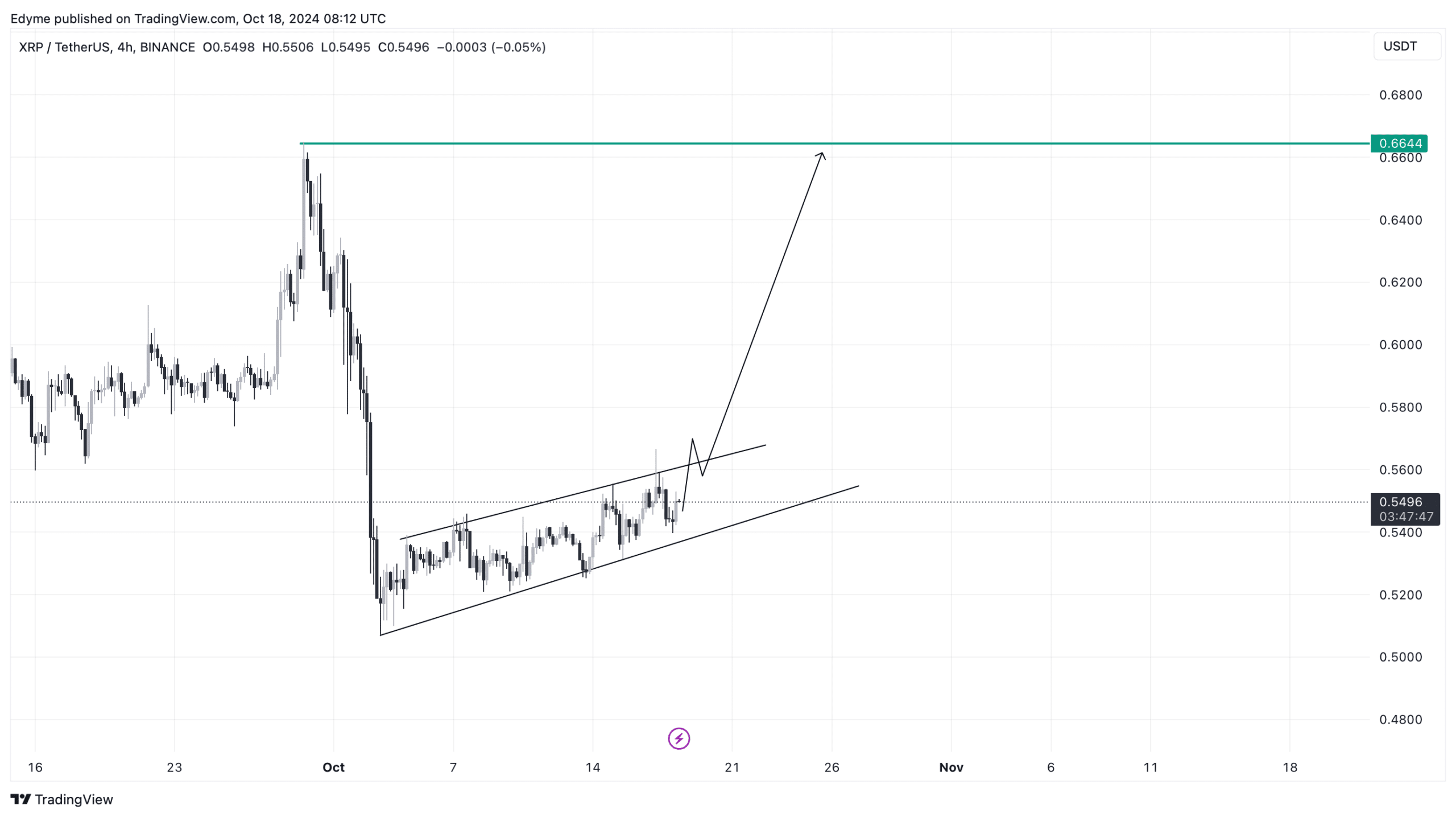

As a seasoned analyst with years of experience dissecting cryptocurrency charts and market trends, I find myself optimistic about XRP’s current trajectory. The ascending channel pattern on its 4-hour chart, coupled with an RSI reading of 60, suggests that we could be in for a bullish ride towards $0.66. However, it’s essential to remember that the crypto market can be as unpredictable as a roller coaster ride at times.

Over the last few weeks, XRP has experienced a steady upward trend. However, it’s important to note that there haven’t been any substantial drops in its price. At the same time, it hasn’t shown a significant surge either during this period.

Over the last fortnight, XRP has experienced a growth of 5.2%, and within the last seven days, it has gained an additional 2.3%. However, there’s been a slight change in the daily trend as XRP witnessed a minor drop in value during the past day.

Ignoring other factors, a technical analysis of XRP’s graph suggests that the value of this asset might increase significantly up to approximately $0.66, provided that crucial support points remain robust.

The bullish technical picture

An examination of XRP’s graph indicates a positive outlook for the asset. It’s predicted that XRP might rise to approximately $0.66, given current trends. However, this increase can occur only if XRP maintains its support level at around $0.52.

As an analyst, I’ve noticed that over the past few hours, XRP appears to be moving within an ascending channel on its 4-hour chart. This channel pattern, when broken to the upside, can often be a bullish indicator, suggesting potential upward momentum for the asset.

Currently, if XRP continues to follow its ascending channel pattern on the 4-hour chart, it might potentially increase towards approximately 0.66, given that it successfully breaks through and closes above the upper limit of the channel at around $0.56. However, for this bullish outlook to hold true, XRP must also ensure that its price remains above the lower boundary of the ascending channel, which is located at approximately $0.52.

To highlight, the ascending channel pattern is a frequent occurrence in technical analysis, characterized by prices moving upwards within a rising trend line. Being contained within this pattern typically suggests a positive or bullish market perspective.

Should XRP successfully surpass its upper limit and end the session with a strong candle, it signals a bullish trend, boosting the likelihood of additional growth. It’s crucial for XRP to hold its ground at approximately $0.52 to sustain this positive momentum.

Fundamental outlook on XRP

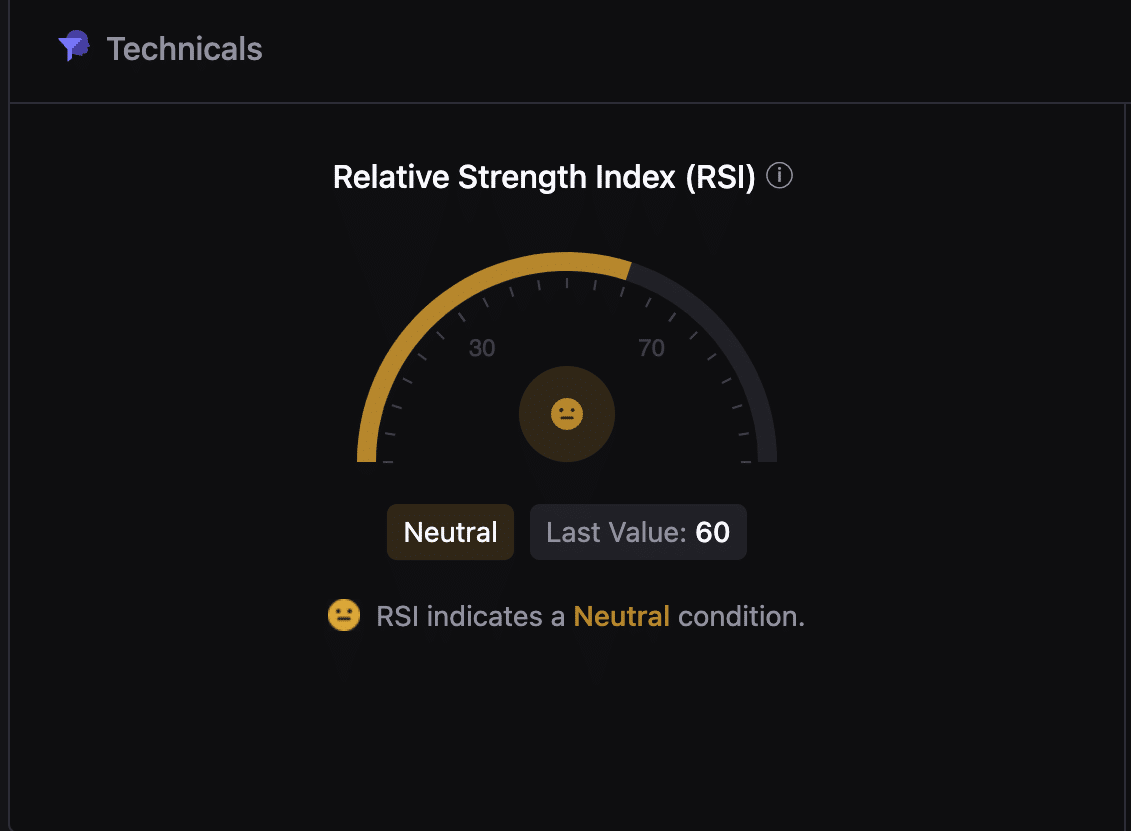

Viewed from a basic standpoint, the market indicators for XRP are showing positive trends as well. One significant factor to consider is the Relative Strength Index (RSI), which currently stands at 60. This RSI is a tool that gauges an asset’s momentum, helping determine whether it’s overbought or oversold.

Reading a level of 60 implies that the Ripple token is neither excessively bought nor sold, keeping it in a neutral state. This equilibrium suggests that the price may continue to grow as it hasn’t yet reached an overbought state, which might trigger a decrease due to oversaturation.

Read XRP’s Price Prediction 2024–2025

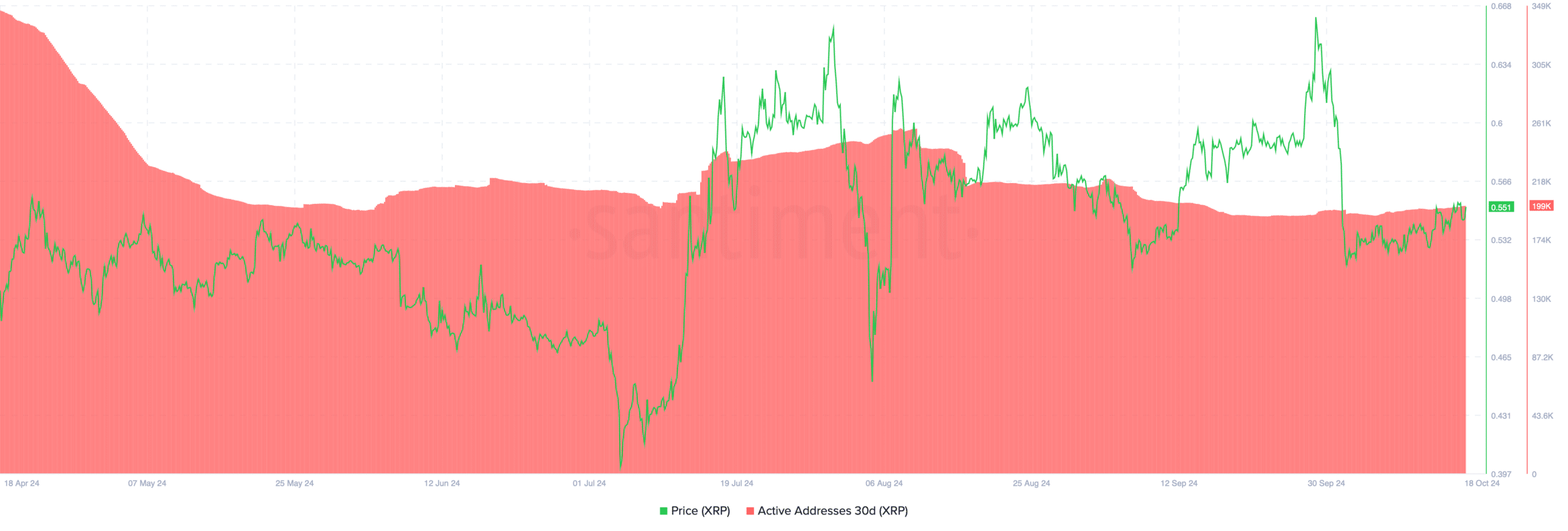

Another essential metric for XRP’s market sentiment is its active addresses, a reflection of retail interest in the asset. Data from Santiment shows that active addresses surged to over 250,000 in early August.

The number has dropped slightly recently, hovering around 190,000 to 199,000 for a few weeks now. This decrease is minor, but it indicates that retail participation is still robust and there’s ongoing market interest.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- PGA Tour 2K25 – Everything You Need to Know

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

2024-10-18 17:43