- The consolidation phase has officially ended.

- DIA is poised to multiply in value, and investors could examine opportunities to buy.

As a seasoned analyst who has navigated through multiple market cycles, I find myself quite optimistic about DIA [DIA]. After a tumultuous bear market since 2022, DIA has shown resilience and has managed to hold onto its $0.35 support zone for several months.

In the past few weeks, DIA (DIA) has shown robust performance. This $127 million-valued asset has managed to hold its ground during the bear market that began in 2022 and has consistently stayed near the $0.35 support level since May 2022.

A significant event occurred when the token surpassed both $0.81 and $1, marking a substantial progression. This surge beyond previous highs set in March indicates that the token has exited its consolidation period during the bear market.

Chances of a northward price expansion look good

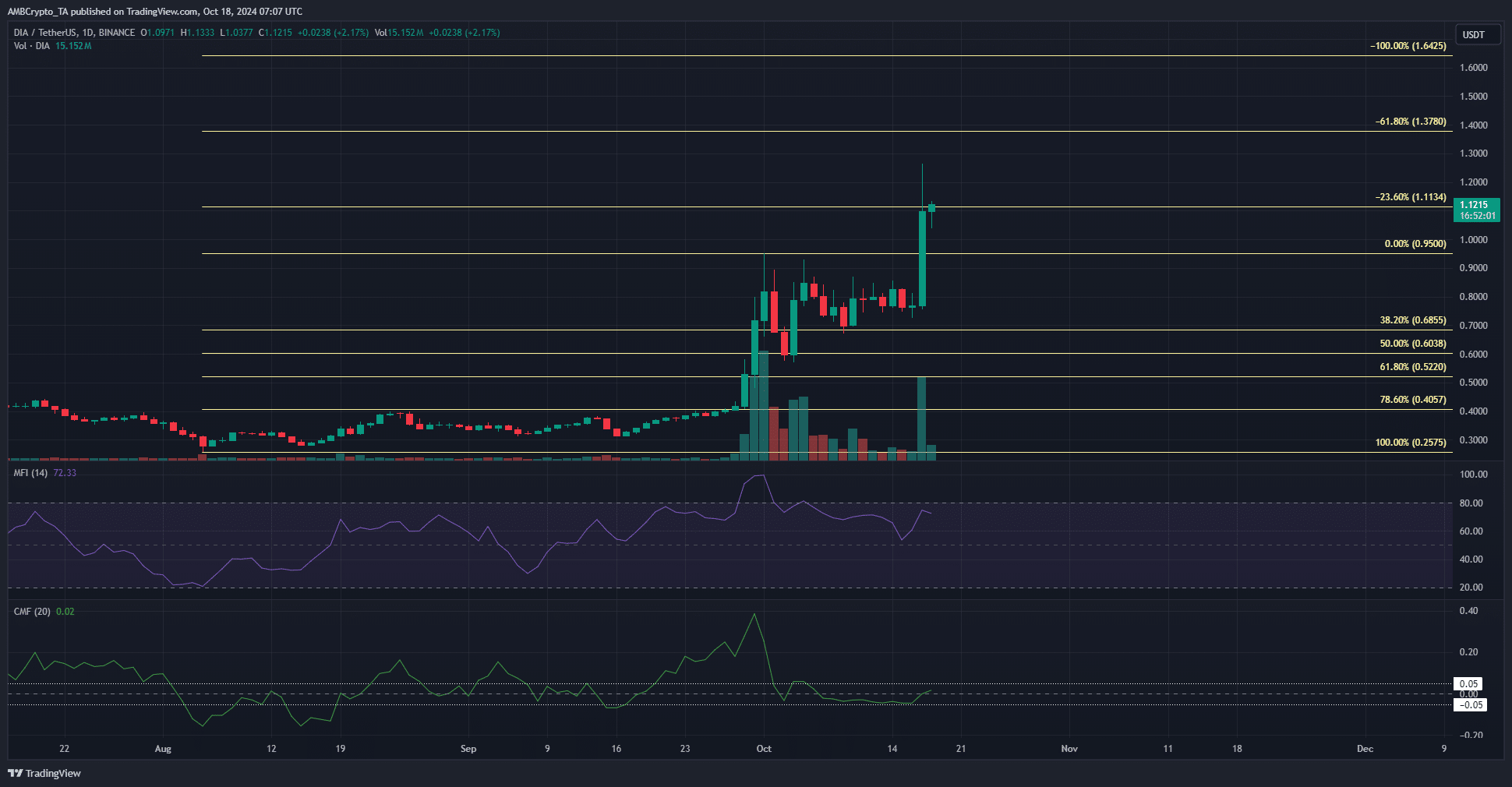

The Fibonacci extension lines were drawn from the upward trend in DIA crypto that started in August. This surge in price picked up speed as September came to a close, peaking at a 134% increase over just three days, only to drop subsequently.

Currently, the potential increase level of 23.6% at approximately $1.11 is being challenged. There’s a chance that buyers supporting DIA might push prices upwards. If, however, prices are rejected, a drop to around $0.95-$1 could present an attractive buying opportunity.

As a researcher, I observed that the Relative Strength Index (RSI) indicated robust bullish momentum. However, the Chaikin Money Flow (CMF) was merely at +0.02, suggesting that while buying pressure was present, it wasn’t particularly intense. Looking ahead, the $1.37 and $1.64 price points may function as potential resistance levels.

Short-term bullish sentiment goes bonkers

On October 17th in the morning, the Open Interest stood at approximately $3.4 million, with DIA being traded at around $0.79. Six hours later, the price had risen to $1.12 and the Open Interest increased significantly to about $24 million. This substantial increase in Open Interest indicated a surge of speculative activity.

Realistic or not, here’s DIA’s market cap in BTC’s terms

In simpler terms, the value of the spot market has surged significantly, yet a substantial rise in open interest over the past day might lead to increased volatility for the token. As such, investors and traders are advised to proceed with caution and tighten their risk management strategies.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-10-19 01:11