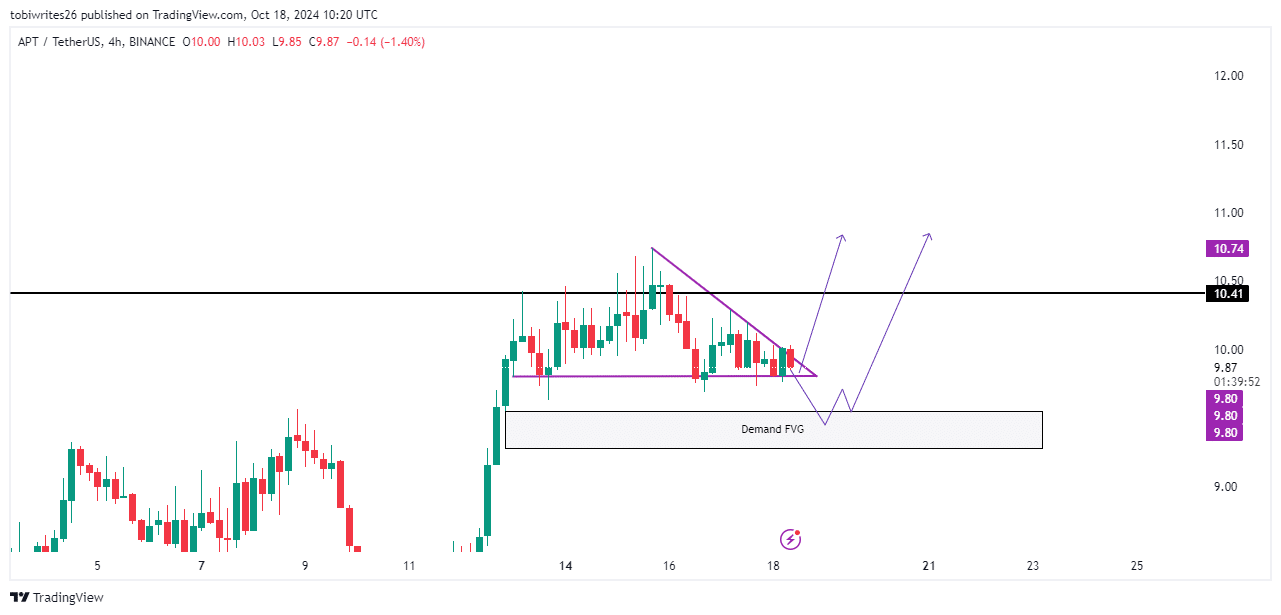

- APT signals two likely outcomes at press time: a rally from its bullish pattern or a retracement toward a demand zone.

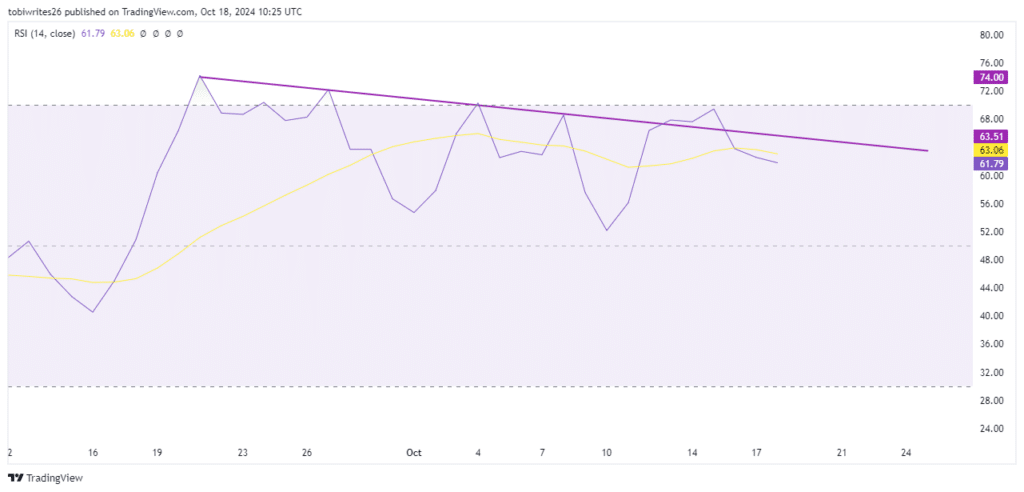

- However, the Relative Strength Index (RSI) suggests a conditional trend that could shape its upcoming price action.

As a seasoned researcher with years of market analysis under my belt, I find myself intrigued by the current state of Aptos’ [APT] price action. The asset’s momentum, while impressive, has shown signs of slowing, leaving us at a crossroads.

After an outstanding 1-month period where it saw a growth of 70.82%, Aptos’ [APT] progress seems to have decelerated. The asset has been unsuccessful in breaking through a significant resistance level despite multiple attempts. At present, its daily price increase stands at only 0.77%, suggesting a dwindling excitement compared to the dramatic uptick observed in the previous week.

According to AMBCrypto, the current period of uncertainty in the market could be drawing to a close, as it’s predicted that APT will soon move in a clear and definite manner.

What’s next for APT? A move up or down?

APT currently faces two potential outcomes—both leaning bullish, but taking different paths.

Initially, APT’s price movement follows a favorable trend marked by a flat base as its lower boundary and an ascending upper boundary. Maintaining this trend might lead to a surge past the significant barrier at $10.41.

Instead, there’s a possibility that APT may not sustain its uptrend, instead slipping into a potential support area ranging from $9.55 to $9.28. If strong demand is present within this range, it could cause the price to rise and break through the current resistance level.

As market conditions change, AMBCrypto evaluates which of these possible situations seems more probable to occur.

Demand zone draws traders’ attention

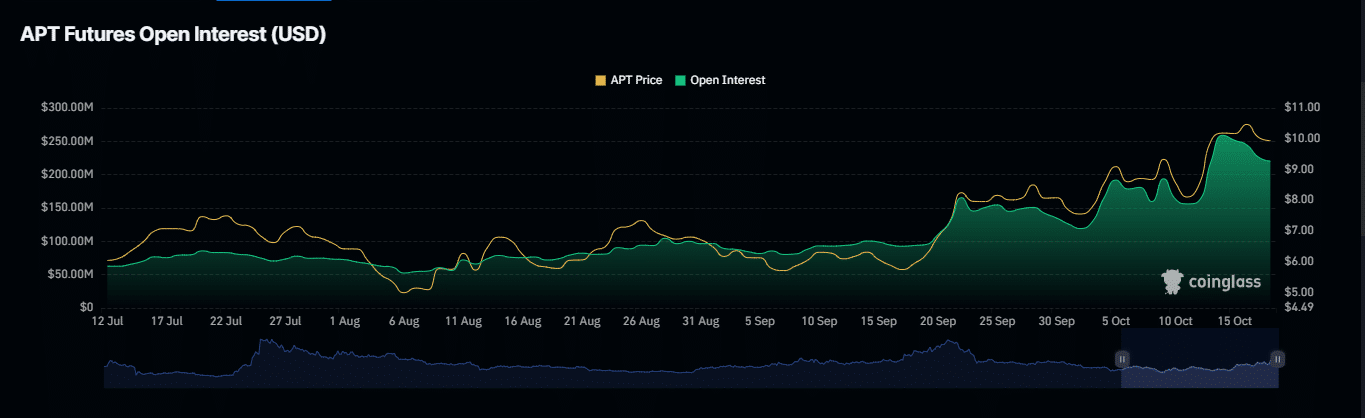

It’s plausible that APT will fall within the earlier mentioned trading range, as suggested by trader behavior. The trend is backed up by two important factors from Coinglass: Open Interest and Liquidation figures.

The amount of ongoing contracts, or Open Interest, has decreased by about 1.53% and now stands at approximately $221.90 million. This decrease suggests more traders are holding short positions compared to long ones, which might be putting pressure on the price of APT, causing it to drop.

The market’s movement within the bullish pattern has also triggered $407.35 thousand of long liquidations. At this rate influences a downward trend which will further erode APT’s value.

Using these indicators, among several others, it appears that APT could be headed down towards its demand area, suggesting a possible drop.

Potential roadblock ahead for APT

The Relative Strength Index (RSI) has frequently fallen beneath a resistance level, which seems to follow APT’s price drops quite closely.

Read Aptos’ [APT] Price Prediction 2024–2025

Should APT reach the specified support area and subsequently initiate its predicted bullish rebound, it will encounter a critical resistance point. If it fails to surpass this barrier, the progression might stall, potentially postponing additional bullish impetus.

Regardless of APT’s optimistic viewpoint staying solid, its further growth hinges on whether it manages to surpass this obstacle posing as resistance.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

2024-10-19 02:47