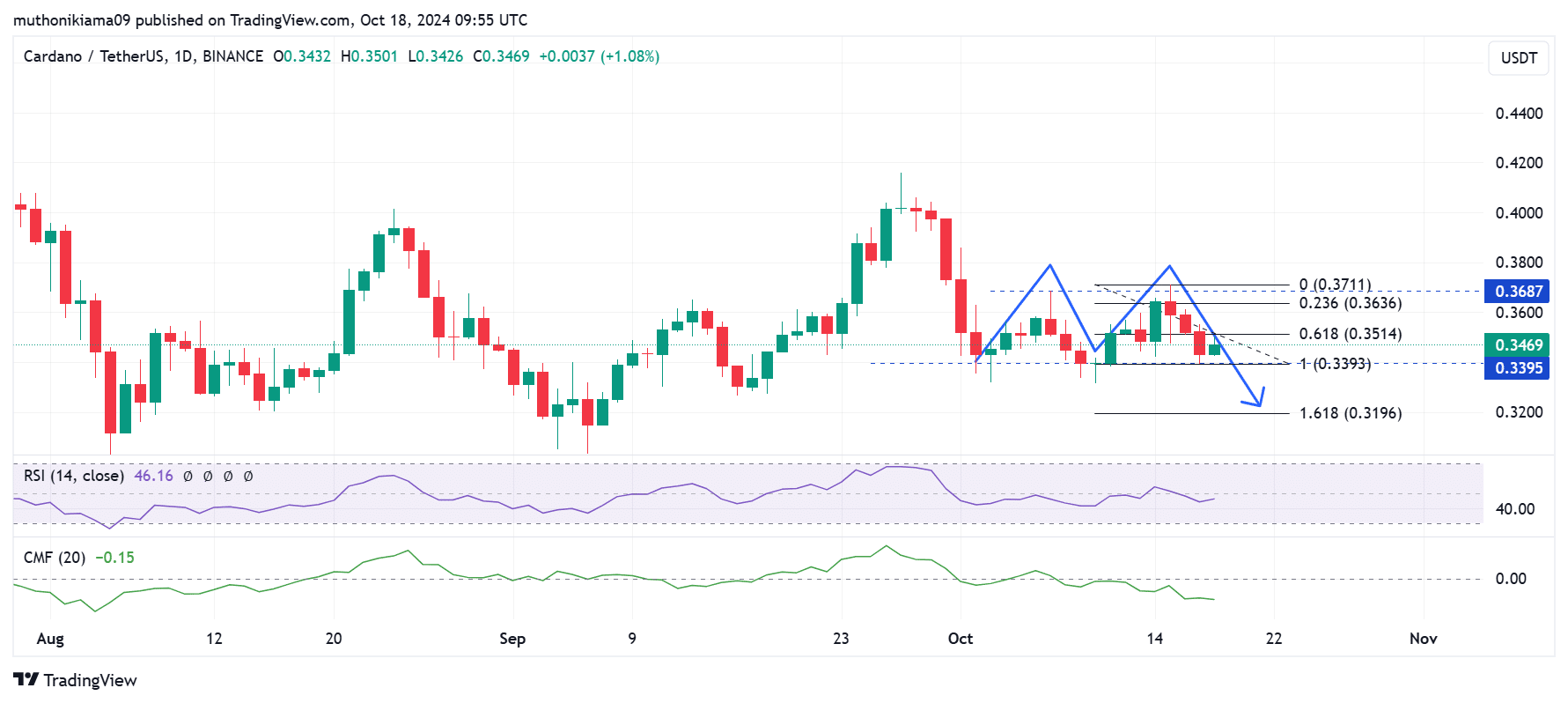

- Cardano has formed a double-top pattern on the daily chart suggesting a bearish reversal.

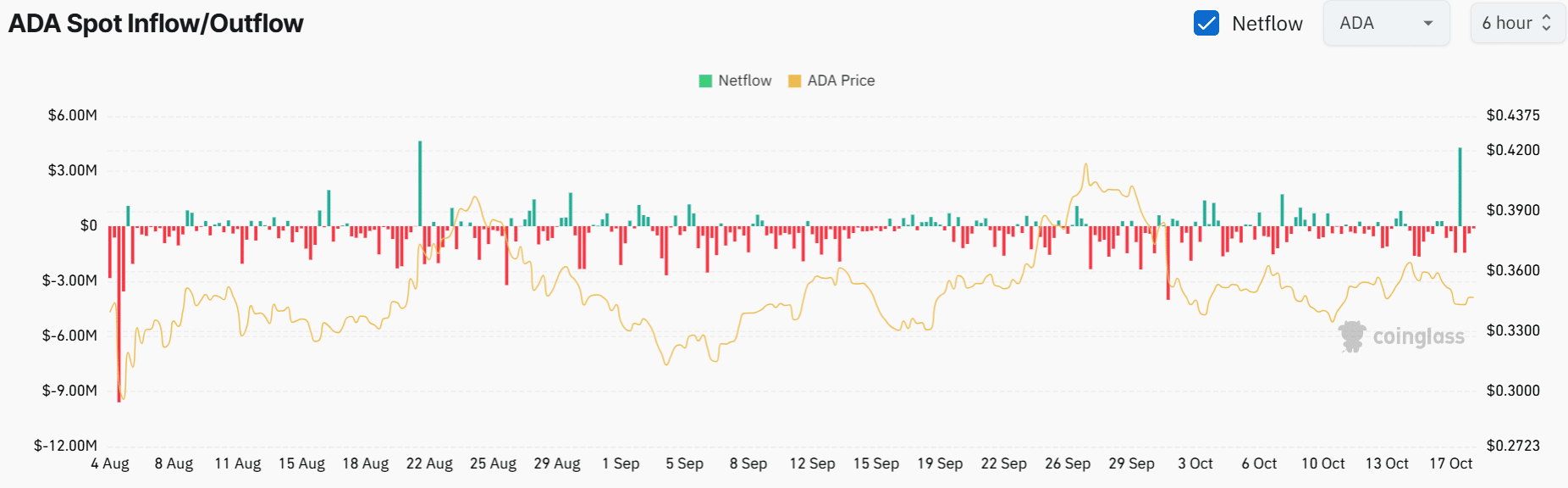

- The spike in ADA spot inflows indicates that selling pressure could intensify and push prices lower.

As a seasoned analyst with years of experience navigating the tumultuous waters of the crypto market, I must say that the current trend of Cardano [ADA] appears to be leaning bearishly. The double-top pattern on the daily chart and the spike in ADA spot inflows are clear indicators of potential selling pressure, which could lead to a downtrend if not countered by a surge in positive sentiment.

Compared to Bitcoin, Cardano [ADA] hasn’t performed exceptionally well over the past week, with a minor increase of only 0.4% to currently trade at $0.347. Additionally, the altcoin appears to be stabilizing as its price has been fluctuating within a tight band between $0.339 and $0.35 during the last day.

ADA’s bearish pattern emerges

The bearish trends around ADA could persist given that the daily chart shows the formation of a double-top pattern. This pattern usually shows a trend reversal, with ADA now poised for a downtrend if the sentiment fails to become positive.

In simpler terms, the price of ADA dipped towards the predicted double-top pattern’s neckline at approximately $0.339, which also coincides with a significant Fibonacci level. If ADA were to break this support and fall further, it could potentially lead to a steep decline in price down to about $0.319.

To overturn this bearish trend and signal an upward movement, ADA must surpass the price point of $0.37. Yet, the necessary buying power to achieve such growth appears to be absent at this time.

In simpler terms, the Relative Strength Index (RSI) currently stands at 46, indicating that sellers are dominating the market. Moreover, the RSI trend is descending, suggesting that the downward trend’s power is growing stronger. Furthermore, the Chaikin Money Flow (CMF), which measures buying and selling pressure, is negative, hinting at continued selling pressure in the market.

Data from Coinglass confirms that ADA traders are actively selling. The spot inflows recently surged to $4.28M, the highest level since mid-August. This suggests that traders are moving their coins to exchanges with the intent of selling.

Analyzing derivatives data

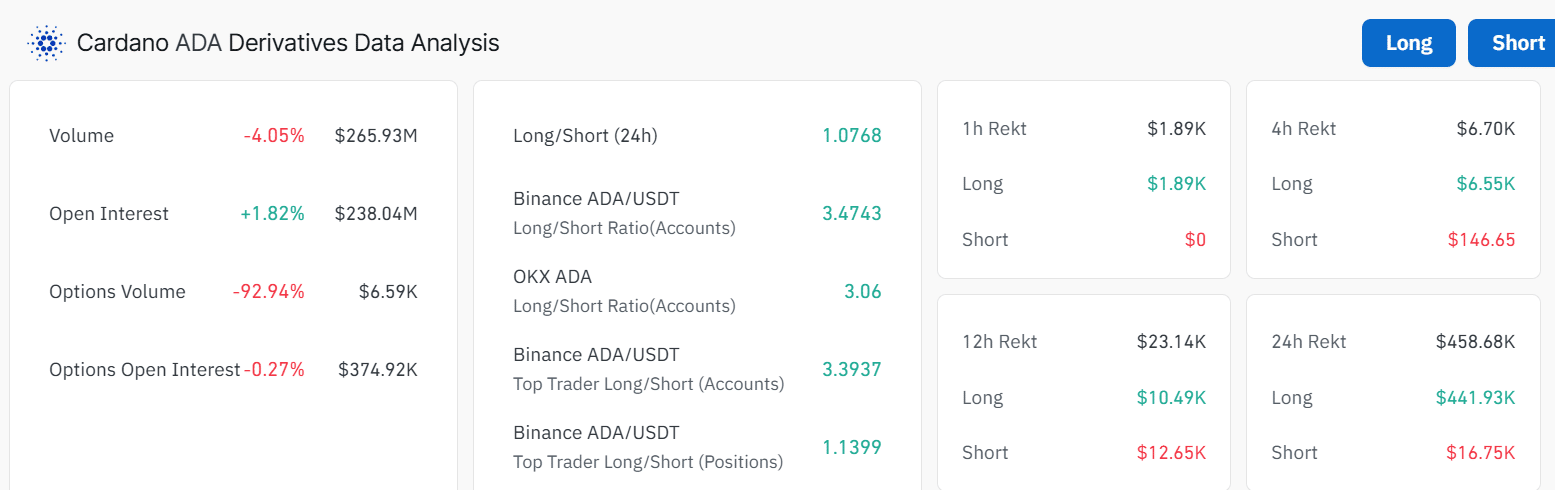

The derivatives market shows that while the sentiment is positive, bearish signals have persisted. ADA’s open interest had increased to $238M at press time per Coinglass. This metric is at the highest level this month indicating that interest in the altcoin is high.

ADA’s long/short ratio stood at 1.07 showing that there are slightly more long traders than short traders. On Binance, more than 90% of the open positions on Cardano are long indicating market optimism.

Read Cardano’s [ADA] Price Prediction 2024–2025

Despite this long bias, traders betting on ADA gains continue to record losses. In the last 24 hours, $441,000 worth of ADA longs were liquidated while only $16,750 shorts were liquidated.

Despite the current situation, an increase in whale activity might indicate a positive shift for ADA prices. Larger-than-usual ADA transactions have surged lately, which may imply that these ‘whales’ are amassing more of this cryptocurrency.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- How to Get to Frostcrag Spire in Oblivion Remastered

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- BLUR PREDICTION. BLUR cryptocurrency

2024-10-19 07:03