- Stacks blockchain relies on the Proof of Transfer model, which taps Bitcoin’s Proof of Work consensus mechanism

- The Nakamoto mainnet rollout marked a significant step towards enhancing Stacks’ transaction speed, security capabilities

As a researcher with extensive experience in the crypto sphere, I am excited about the upcoming Nakamoto hard fork for Stacks (STX). The prospect of faster transaction speeds and enhanced security capabilities is indeed intriguing. However, the journey to this point has been bumpy, and I share the community’s frustration over delays. But as they say in crypto, “the only way is up.

The Stacks (STX) Bitcoin Layer 2 project has shared a revised schedule for the upcoming Nakamoto hard fork, with the Stacks Foundation announcing that core developers plan to activate the mainnet at Bitcoin Block #867,867, estimated to take place around October 30th, according to the countdown on their website.

Appropriately, as we approach the 15th anniversary of the Bitcoin whitepaper, the Stacks Foundation has announced that you’ll experience quick transaction confirmations on the primary layer-two solution for Bitcoin.

In simple terms, choosing the next block for the hard fork is the final step in the process leading up to the activation of the Nakamoto consensus mechanism.

Despite the fact that the approach towards the completion of the Nakamoto process has been rocky, with setbacks causing annoyance within the Stacks community. As per the original schedule, the Foundation aimed to finalize the Nakamoto activation at Bitcoin Block 864,864. Yet, this did not occur as planned.

Expectations post-Nakamoto

The Nakamoto hard fork is an essential update for the Stacks blockchain, addressing issues within its current structure. These problems include long confirmation times resulting from Bitcoin’s block production speeds and micro-blocks that are made inefficient due to constraints in the existing protocol.

When turned on, it initiates a series of key enhancements aimed at resolving the mentioned problems, with the main one being the separation of Stack blocks from Bitcoin’s block production timeline. This separation allows for faster block creation, essentially boosting transaction speed.

Furthermore, the Nakamoto’s release emphasizes a level of finality that is tightly linked with the finality of Bitcoin transactions. Once a transaction is verified in the Stacks blockchain, it becomes just as challenging to undo as rearranging or altering the entire Bitcoin system itself.

Nakamoto plans to enhance the cryptographic lottery method for ensuring fairness. The focus is on strengthening the algorithm against Miner Extractable Value (MEV) by introducing competitive bidding and boosting the randomness in miner selection. This modification will significantly diminish Bitcoin miners’ potential to unjustly exploit their position and gain undue value.

Stacks (STX) price action

Last month, asset manager Grayscale included Stacks (STX) in its list of top 20 crypto assets with a potential for returns based on prevailing market narratives and fundamentals. With market participants largely expecting crypto prices to continue rising in Q4/2024, Stacks (STX) may be well-positioned for further price hikes.

Over the last week, driven by Bitcoin’s resurgence, the price of STX has surged by 12%. This uptick adds to a significant 30% increase in its value over the past month.

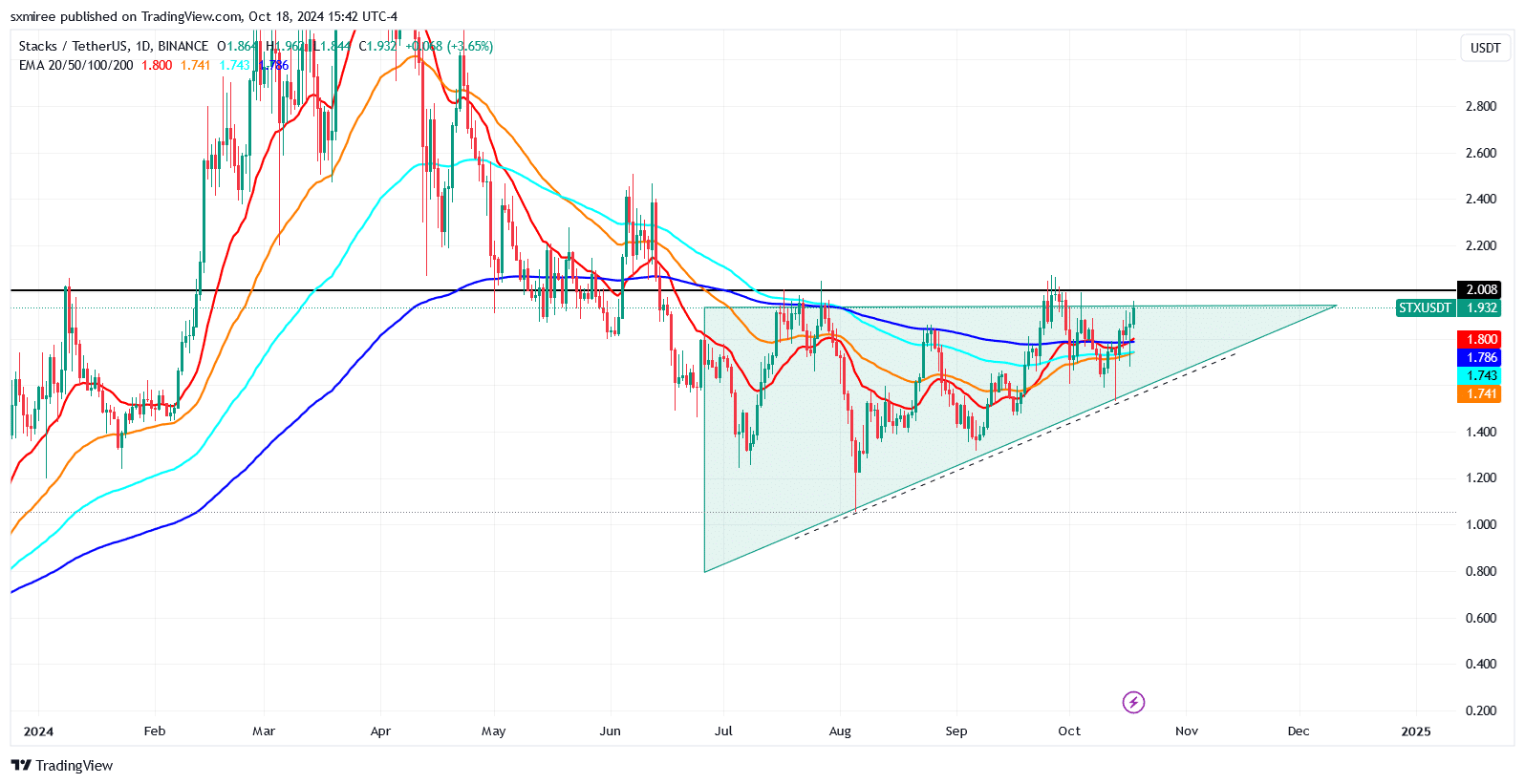

At the current moment, on a daily basis, the stock symbol STX is continuing to trade inside an uptrending triangle (ascending triangle), sitting comfortably above both its immediate and extended Exponential Moving Averages (EMA).

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Masters Toronto 2025: Everything You Need to Know

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

2024-10-19 12:07