- USDT dominance dropped this week, confirming $62 as BTC’s new local low

- Weekend action would be crucial for BTC’s next move as it neared key support on the charts

As a seasoned researcher with a decade of experience in the ever-evolving world of cryptocurrencies, I find myself constantly intrigued by the dance between Bitcoin (BTC) and Tether (USDT). This time, the shift in liquidity dynamics has caught my attention. The declining dominance of USDT and the subsequent surge into BTC is a pattern I’ve seen before, but each iteration feels unique.

As an analyst, I haven’t observed the market reaching the excessive greed stage that typically precedes a market peak, similar to the time when Bitcoin [BTC] attained its All-Time High (ATH) of $73k in March.

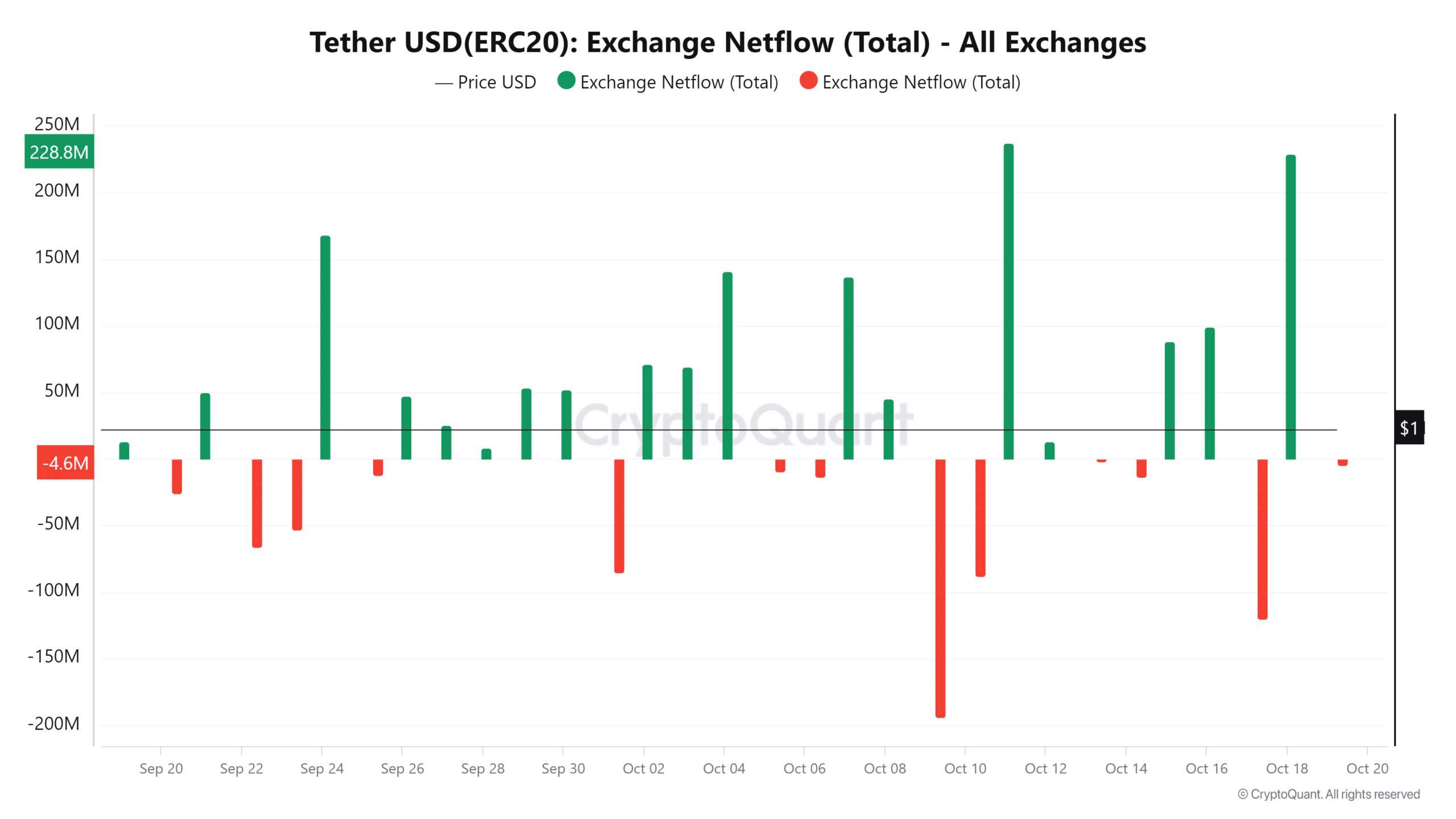

Over the last week, there’s been a significant increase in market liquidity. This change appears to be linked to Bitcoin breaching crucial psychological barriers. The influx of liquidity seems to suggest that investors are shifting their capital from Tether [USDT] and moving it towards Bitcoin, indicating a decrease in Tether’s dominance – a possible sign that funds are leaving stablecoins for Bitcoin.

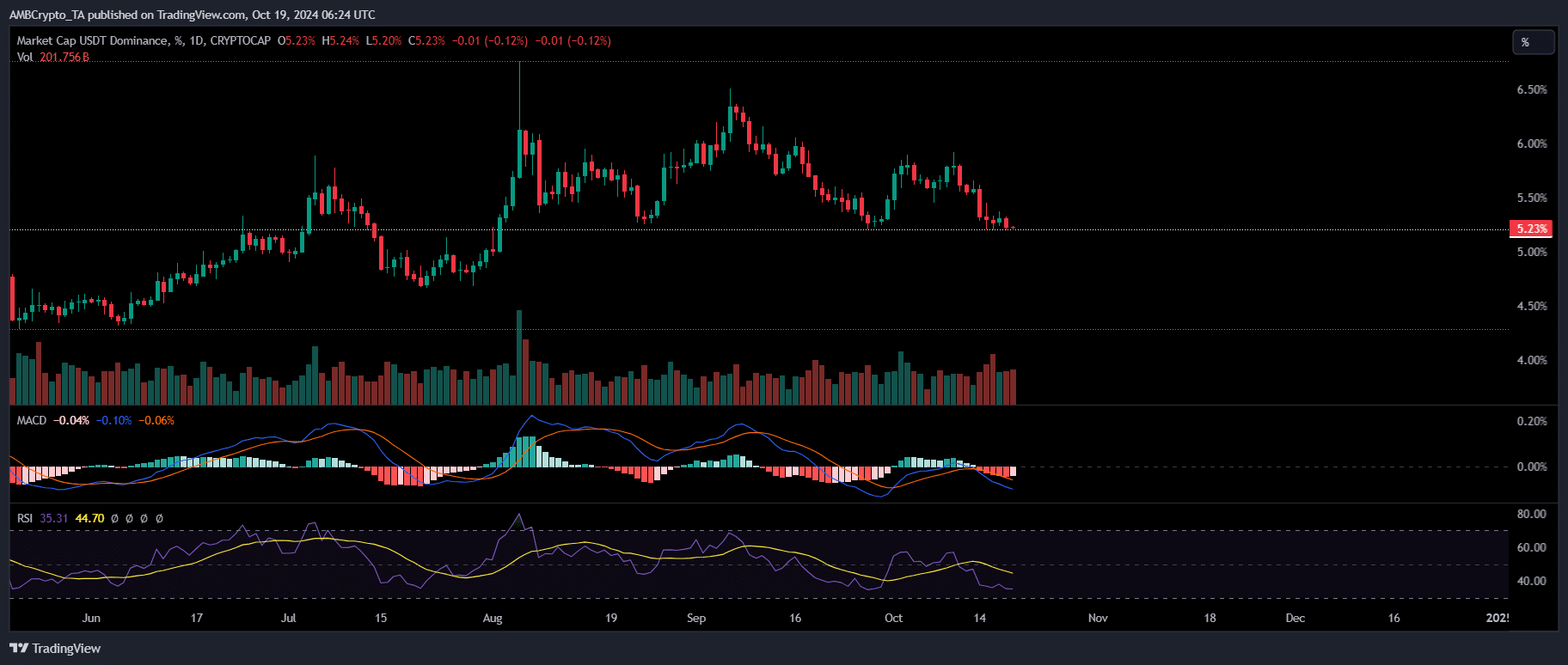

This trend was confirmed by a bearish MACD crossover on the same day.

Essentially, large amounts of money have moved into Bitcoin because many investors saw $62k as a lower price point and took advantage of it by buying at a discount. Furthermore, another notable achievement underscored the increasing importance of USDT and USDC, strengthening their influence on Bitcoin’s price fluctuations.

At present, USDT (Tether) and USDC (US Dollar Coin) account for nearly half of the total trading activity among significant cryptocurrencies. In other words, this underscores their role as reliable choices when Bitcoin approaches a peak in the market.

Currently, as I’m typing this, USDT appears to be approaching a crucial support point. This is a level it has previously tested on two occasions since July. Every time Bitcoin attempted to push beyond $65,000, it encountered considerable resistance, leading to notable drops in price.

If USDT’s influence increases over Bitcoin (currently trading at around $68,346), it might cause a drop in prices due to sellers cashing out while the rally is still strong, suggesting that there may be some anxiety or panic in the market.

Tracking USDT dominance is key

As an analyst, I’ve noticed a bearish MACD crossover and a falling Relative Strength Index (RSI), which hint at a potential continued decrease in USDT dominance. This trend might even lead us back to the early July levels when Bitcoin was approximately $68,000.

As a crypto investor, I’m observing a consistent pattern suggesting that Bitcoin might have an exciting bullish run over the weekend. This upward momentum seems to be driven by robust optimism, with significant liquidity pouring into Bitcoin from USDT.

However, caution is warranted. While USDT outflows have been gaining momentum, they could trigger a short-term correction. Still, this doesn’t guarantee an outright pullback unless this behavior continues for the next few days.

Read Bitcoin (BTC) Price Prediction 2024-25

Keeping a close eye on the USDT dominance graph is crucial. Any deviation from the current downward trend could potentially mark the conclusion of this bullish phase.

If history is any guide, it could push BTC back below $62k – The established local low.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-10-19 18:15