- Toncoin showed signs of being overvalued on the charts

- Medium-term holders have been selling the token after the failed breakout past $6

As a seasoned crypto investor with a penchant for analyzing charts and on-chain metrics, I find myself cautiously watching Toncoin [TON]. The recent downward trend and bearish market structure on the daily timeframe have raised some red flags.

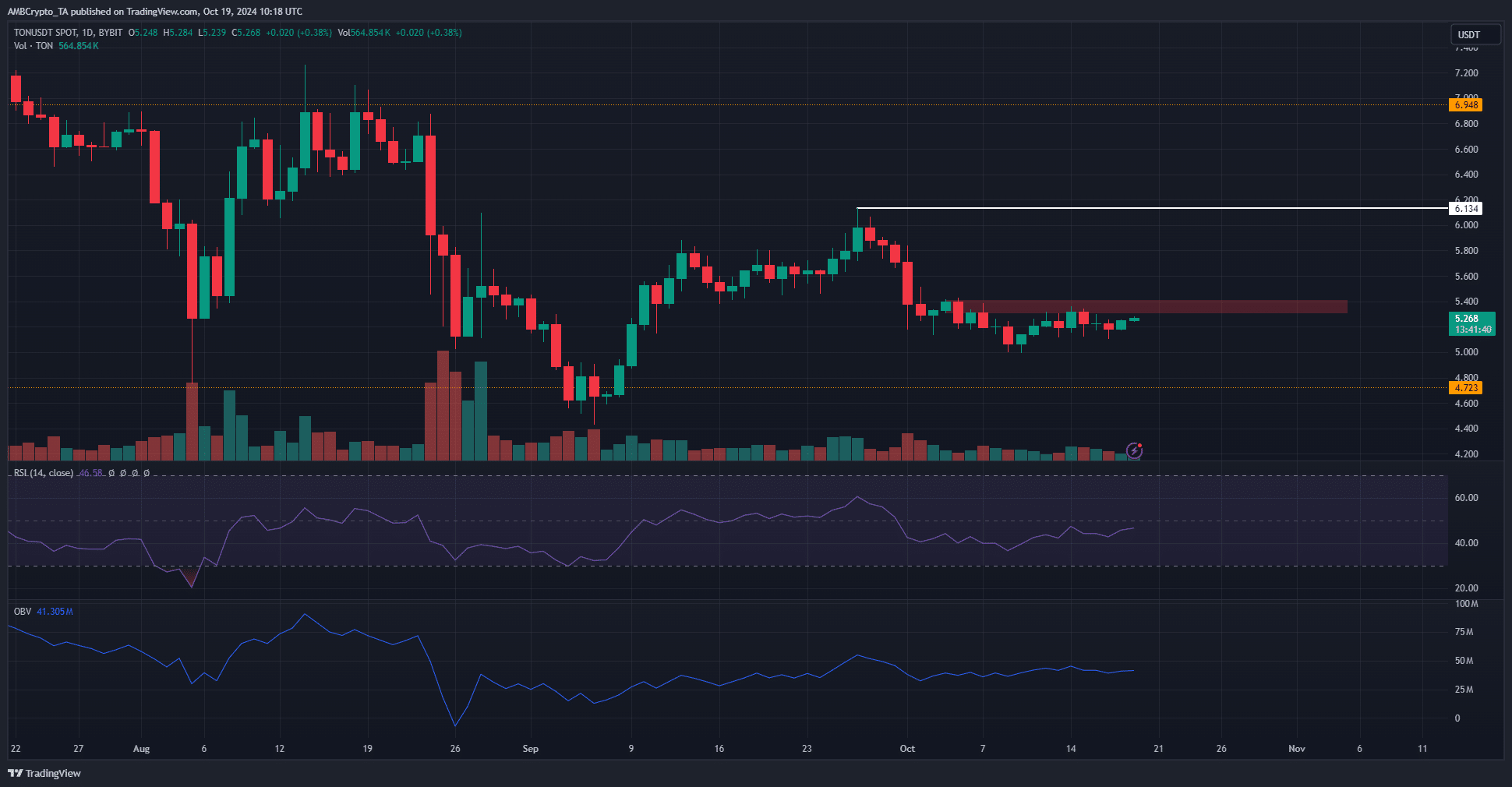

Currently, Toncoin [TON] has dropped nearly 14% from its peak in late September ($6.13). Furthermore, its daily chart shows a bearish trend for the 10th largest cryptocurrency by market capitalization.

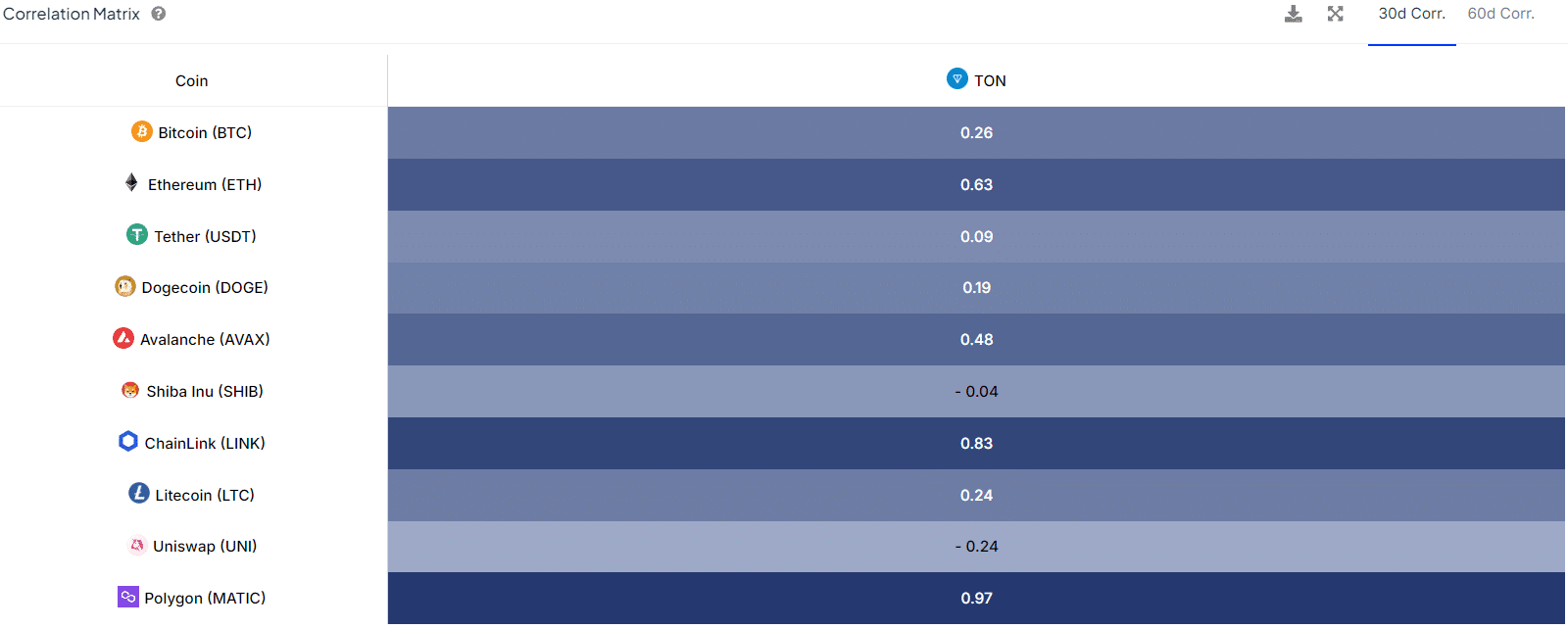

The correlation matrix also highlighted the recent underperformance of Toncoin. For instance – Over the past month, it has had a +0.26 correlation with Bitcoin [BTC], with the latter rallying by 10.5% over the same period.

As a researcher delving deeper into the subject, I’ve been exploring additional key performance indicators to gauge TON’s potential for closing the gap.

Evidence for accumulation in recent weeks

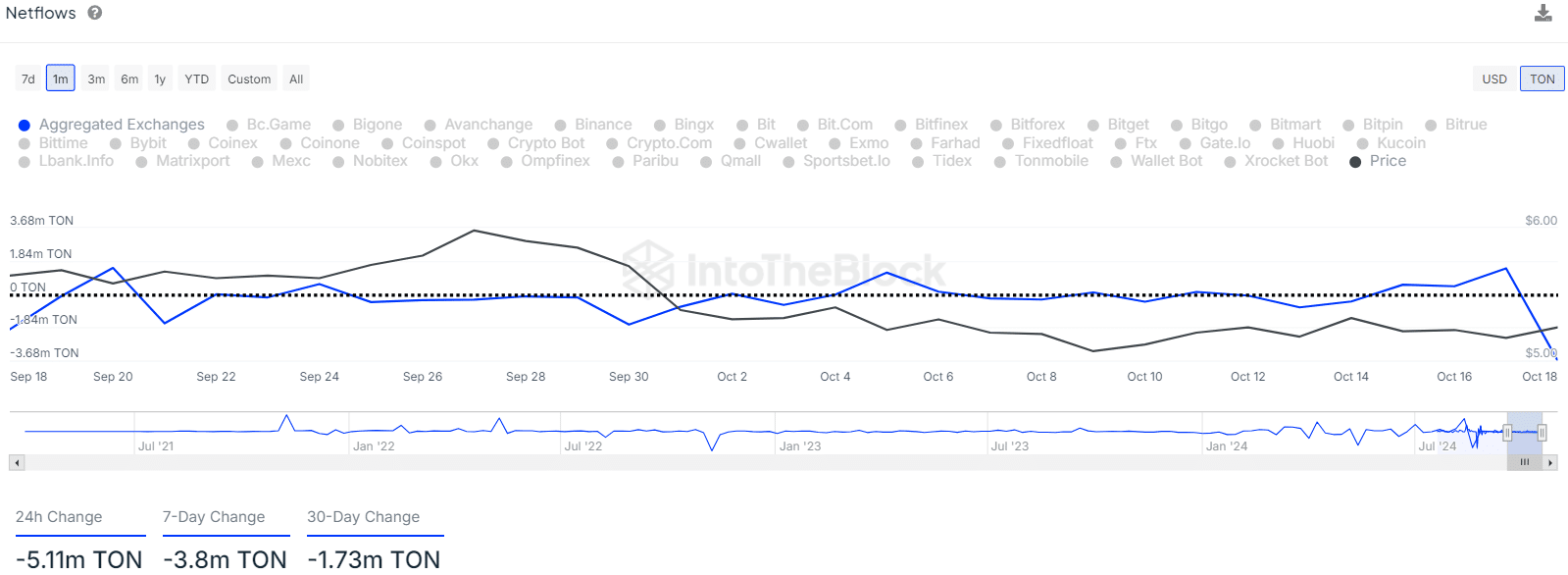

Over the past 24 hours, I noticed a significant movement of approximately 5.11 million TON being withdrawn from exchanges. This action, known as accumulation, often indicates a bullish sentiment among crypto investors. Interestingly, the net flows over the last month showed a figure of -1.73 million TON, suggesting a different trend.

Essentially, the pattern we’ve observed in the last day doesn’t align with the trend that has been prevalent over the past month. There have also been signs of selling activity and token influxes earlier this week.

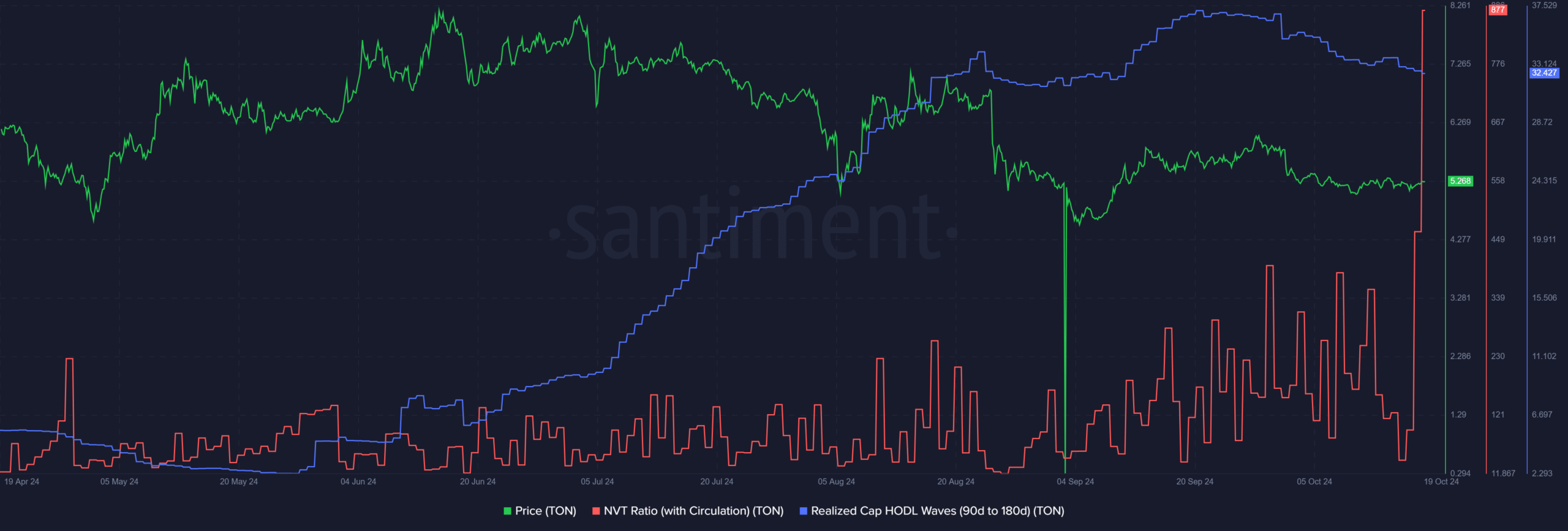

The Network Value to Transactions (NVT) Ratio, derived from daily circulation, has been on an upward trend since September. This rising NVT suggests that the asset’s market capitalization is significantly greater than the number of transactions it processes, which could potentially indicate that the asset is overvalued.

Over the past three weeks, there’s been a decrease in long-term HODL positions (between 90 to 180 days). This suggests that these coins have either been sold or transferred, which is a sign of distribution. Such a trend might influence the potential for an uptrend on the charts.

Price action clues for traders and investors

In simpler terms, the data from HODL waves and the increase in NVT suggest negative trends on the blockchain. Additionally, the daily price chart indicates a bearish market outlook. The highest point recently was $6.13; if TON manages to exceed this level, it could signal the start of an upward trend.

Read Toncoin’s [TON] Price Prediction 2024-25

The OBV and the RSI indicated lackluster demand and neutral momentum, respectively.

In simpler terms, if there’s a resistance area above TON at around $5.4, which is a potential obstacle for further price increase, TON buyers should unite and push prices up or they might miss out on the potential growth as Bitcoin continues to rise.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-20 02:15