- Binance’s volume reached $1oo trillion.

- Market indicators showed that BNB had been experiencing a positive market sentiment.

As an analyst with over a decade of experience in the crypto market, I must say that the recent milestone achieved by Binance is nothing short of impressive. Reaching $100 trillion in trading volume, including derivatives markets and spots, is a testament to the exchange’s extensive reach and the growing interest in the crypto market.

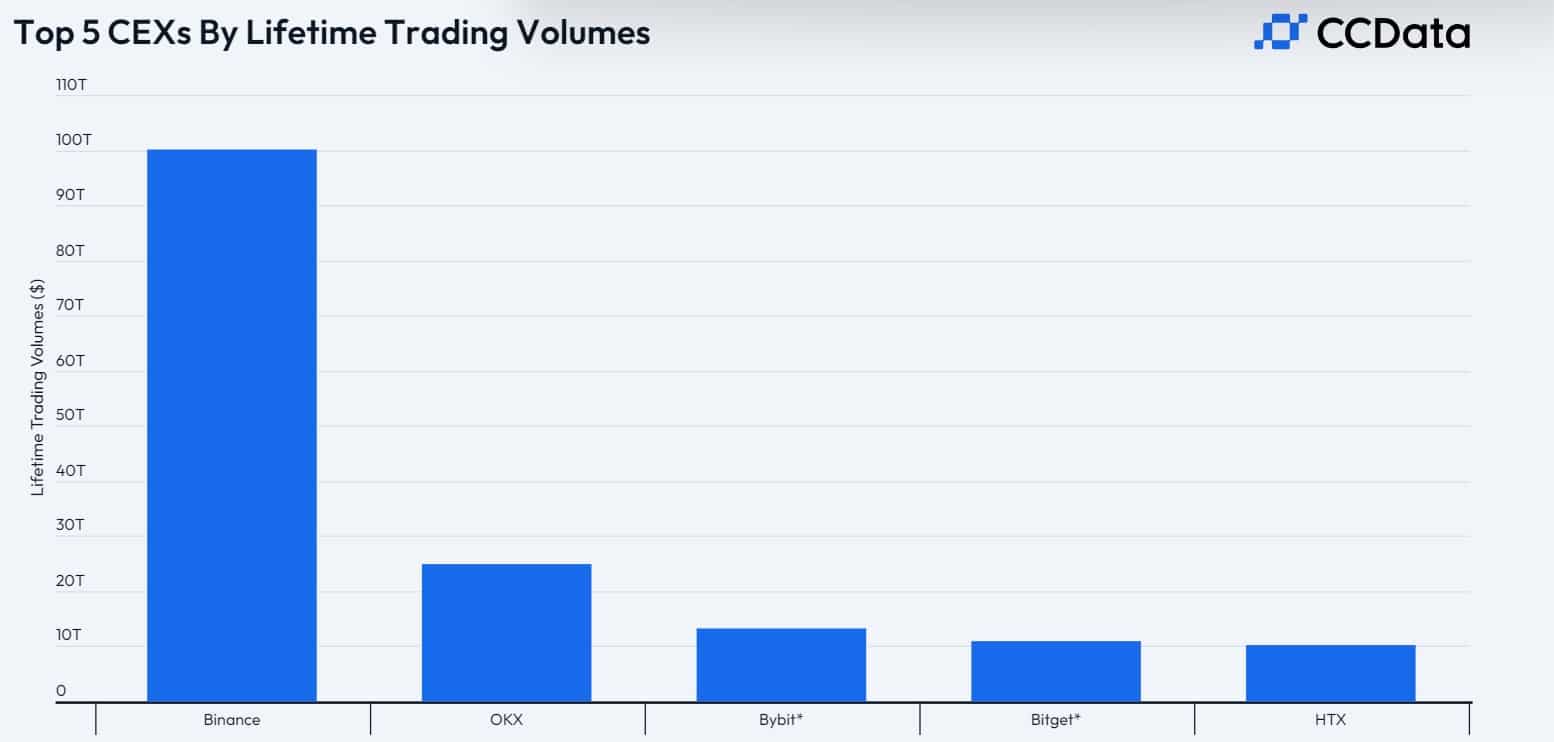

Based on CCData’s report, Binance has soared to unprecedented heights, making it the initial Centralized Exchange (CEX) to accumulate a staggering $100 trillion in total trading volume. This figure encompasses both derivative markets and spot markets.

Through this action, the exchange has climbed to the summit among all other platforms. This remarkable expansion underscores the exchange’s broad influence and the significant investment flowing into the cryptocurrency market.

Similarly to other platforms like OKX, several others have experienced substantial growth. Consequently, OKX ranks as the second-biggest exchange, boasting a total trading volume of an impressive $25 trillion throughout its operation.

In third place, Bybit reported a trading volume of approximately $13.2 trillion, with Bitget trailing behind at about $10.9 trillion in volume.

Impact on BNB?

With Binance steadily increasing its market presence, there’s growing interest among investors towards Binance Coin (BNB), the exchange’s native token.

Over the past day, the value of that particular cryptocurrency, known as an altcoin, has experienced a slight drop based on its price trends. Currently, Binance Coin (BNB) is being traded at approximately $595, signifying a 0.30% decrease compared to its previous day’s value.

Before now, BNB was on a rising trend, experiencing a 3.63% increase in the previous week. Additionally, it has seen a growth of 3.42% over the last month as well.

Despite the daily decline, the Binance still enjoys an overall positive market sentiment.

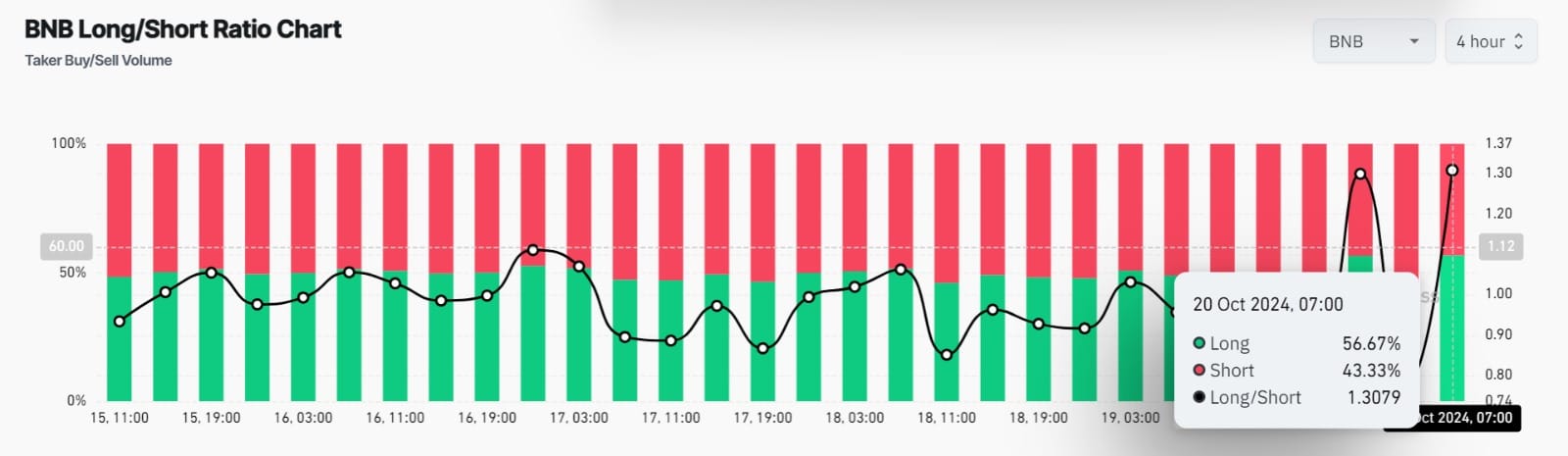

At this moment, the Long/Short Ratio for the altcoin was 1.3079, as observed within a 4-hour time frame. This implies that during the recent hours, more investors have been opting to take long positions rather than short ones.

Therefore, longs were dominating the market as they anticipated prices to gain in the near term.

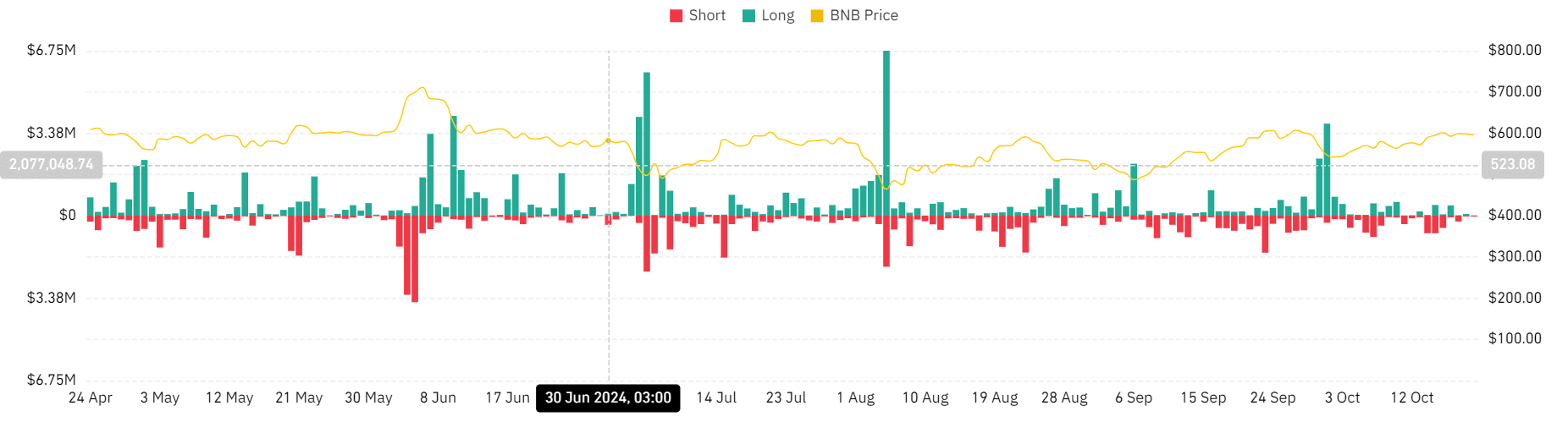

The reduction in total liquidations during the last week adds weight to the increased demand for long positions.

Over the past three weeks, I’ve noticed a significant decrease in liquidations for my long positions, from a hefty $3.77 million to just $14.37k. This drop-off implies that even during market dips, short traders are paying me to maintain our trades.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Essentially, the significant increase in trading activity on Binance has created advantageous circumstances for BNB. During this period of heightened activity, BNB has also benefited from a generally optimistic market outlook.

Under the present circumstances, BNB aims to challenge its next substantial resistance point, which is around $618.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-20 14:11