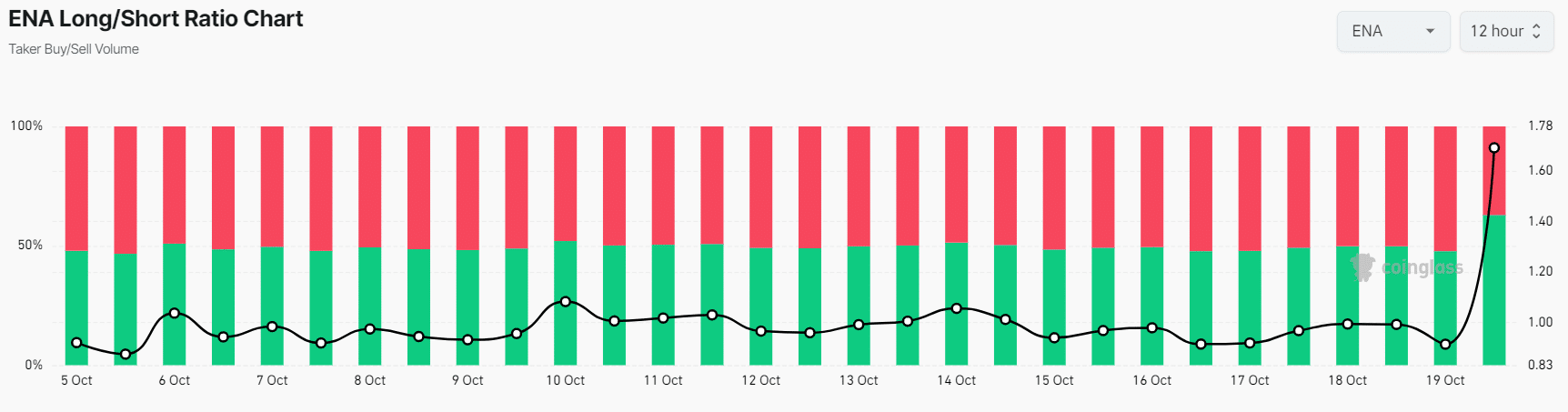

- ENA’s Long/Short Ratio in the past 12 hours stood at 1.69, indicating strong bullish sentiment.

- The major liquidation levels were near $0.395 and $0.409, with traders over-leveraged at these levels.

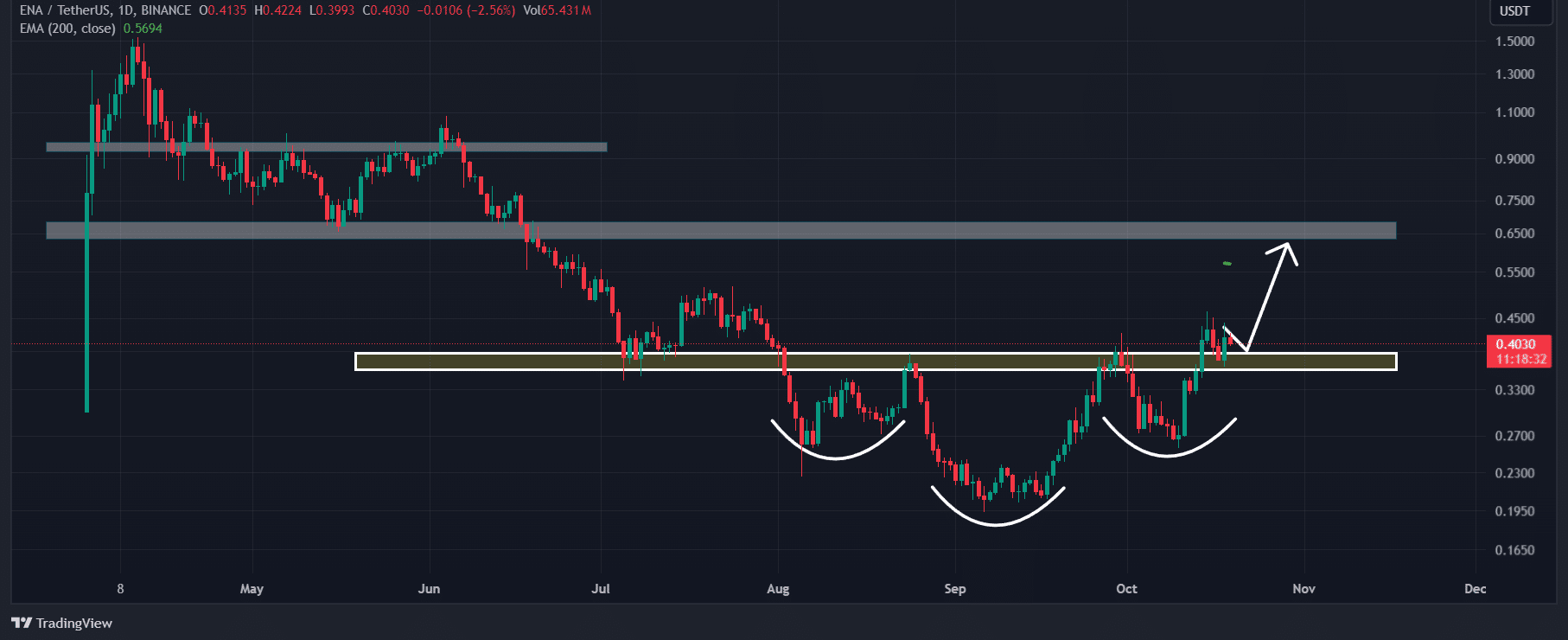

As a seasoned analyst with over two decades of experience in traditional and digital asset markets, I find myself quite intrigued by the current trajectory of Ethena [ENA]. The breakout from an inverted head-and-shoulder pattern and the subsequent retest of the breakout level at $0.362 is a bullish sign that resonates with my technical analysis expertise.

Most cryptocurrencies, spread throughout the digital assets world, are currently undergoing significant price increases or adjustments (price declines).

In the current context, it seems that the well-known cryptocurrency Ethena (ENA) linked with Telegram, is showing optimism. It has just revisited its bullish trending price pattern and appears ready to surge significantly in the upcoming days.

Ethena’s successful breakout

Based on AMBCrypto’s technical assessment, Ethena has just surpassed an optimistic inverted head-and-shoulder chart formation and has convincingly verified its escape point at approximately $0.362.

After the retesting of its breakout point, Enara (ENA) has started moving upwards, indicating a promising trend for its token holders.

Given the current surge in ENA’s price trend, it appears quite likely that the token might climb up to around $0.65 – an increase of approximately 60% – within the near future.

As a crypto investor, I’ve noticed a significant surge of interest in this particular asset over the past few days. Reminiscent of past experiences with ENA, there’s a palpable anticipation that it could be poised for another promising week.

Often, investors and traders interpret the emergence of an inverted head and shoulder pattern followed by a retest as a positive sign, suggesting a strong possibility that the price has successfully broken out in an upward direction.

Bullish on-chain metrics

The optimistic perspective of ENA is reinforced by the Long/Short Ratio, as reported by Coinglass, which reached a high of 1.69 over the previous 12 hours, marking the highest level since late September 2024.

This notable long/short value indicated strong bullish sentiment among traders.

Furthermore, ENA’s Open Interest has stayed consistent over the last 24 hours, indicating that traders may be holding off on further trades until the asset finishes the day with a closing price above $0.45.

At press time, 62.86% of top traders held long positions, while 37.14% held short positions.

Major liquidation levels

Additionally, significant liquidation points were found around $0.395 (on the downside) and $0.409 (on the upside), as reported by Coinglass. Traders were heavily leveraged at these critical points.

If the market’s overall opinion stays the same and the price reaches $0.409, it would force out approximately $1.87 million in short positions.

If the sentiment changes and the price falls to around $0.395, it would result in roughly $1.41 million being wiped out from long positions.

Read Ethena’s [ENA] Price Prediction 2024–2025

The information about the liquidation indicates that short sellers had been actively positioning themselves, anticipating a drop in price below the $0.395 mark. However, given the overall positive outlook in the crypto market, such a decline seems improbable.

Current price momentum

Currently, ENA is close to $0.402 in value following a slight increase of approximately 0.55% over the last day. Over the same duration, there was a 20% rise in trading activity, suggesting increased interest from investors.

Read More

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- PI PREDICTION. PI cryptocurrency

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

2024-10-20 14:18