- Aave is showing positive momentum, driven by a 675% surge in Optimism user addresses.

- Transaction count has dropped while exchange reserves rise, signaling potential short-term selling pressure.

As a seasoned crypto investor with a decade of experience under my belt, I find myself intrigued by Aave’s recent surge in Optimism user addresses. It’s not every day that we see such an impressive 675% growth in just a week, outpacing even the likes of Chainlink and Raydium.

In the realm of Decentralized Finance (DeFi), Aave [AAVE] has been a standout performer, experiencing a phenomenal surge in user activity. Over the course of only seven days, there was an impressive 675% rise in Aave users on the Optimism network.

This expansion surpasses significant competitors such as Chainlink and Raydium, leading some to speculate if Aave could burst through its resistance levels and initiate a bullish trend towards 2024.

But is this surge enough to propel the token to new highs?

How is AAVE performing in the current market?

Currently, AAVE is being exchanged for approximately $157.37, showing a small rise of about 0.69% in the past day.

Although there was a modest upward trend in its price movement, Aave’s rapid increase in adoption on Optimism could potentially lay the groundwork for a more substantial rise.

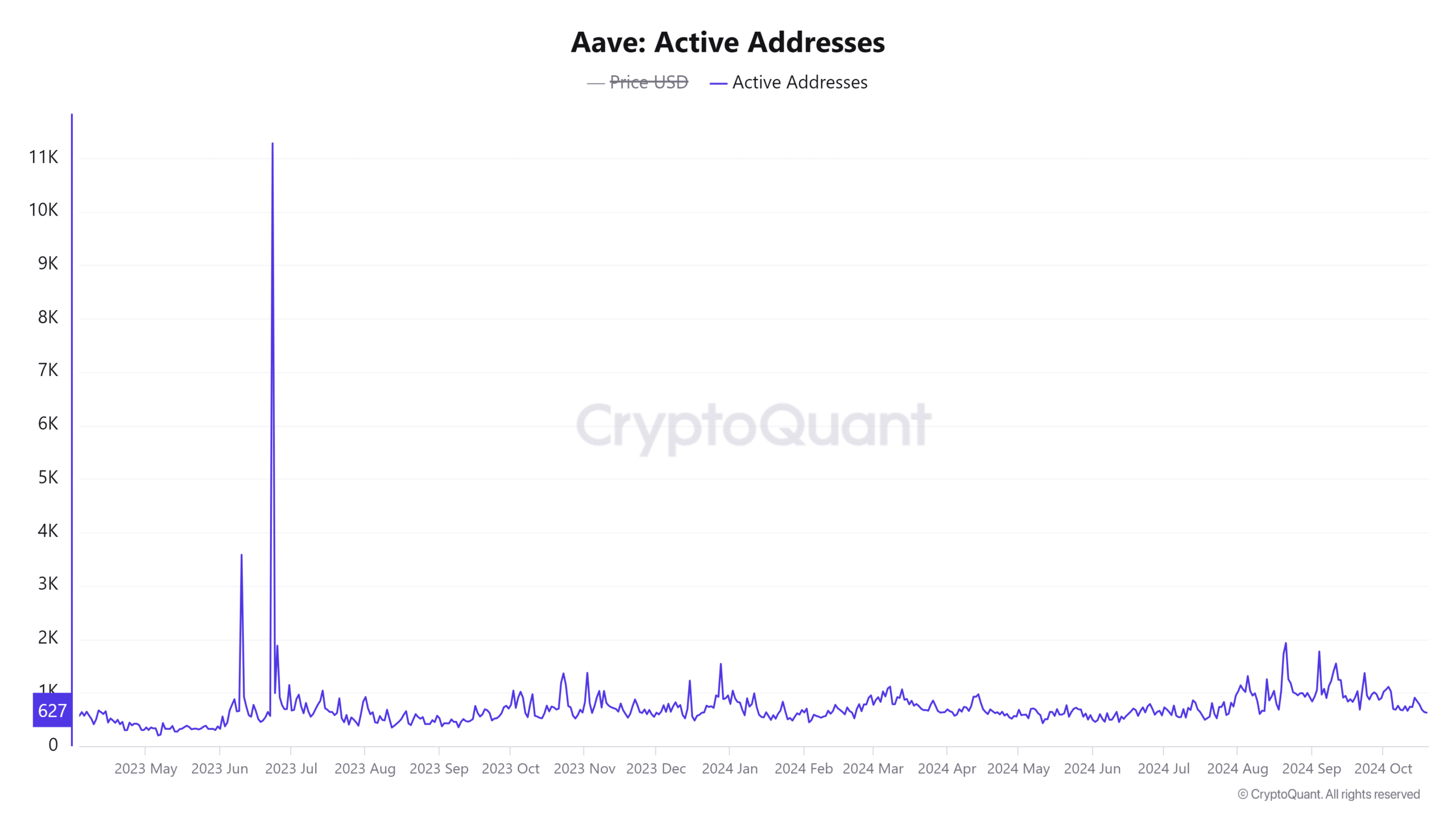

On the other hand, there’s been a significant increase of 18.75% in the number of active addresses over the past 24 hours, totaling 1,233 active wallets.

The increase in active users suggests a growing curiosity about Aave, however, the market is yet to witness a significant surge to validate continued positive trajectory.

AAVE price chart: can it breach key resistance?

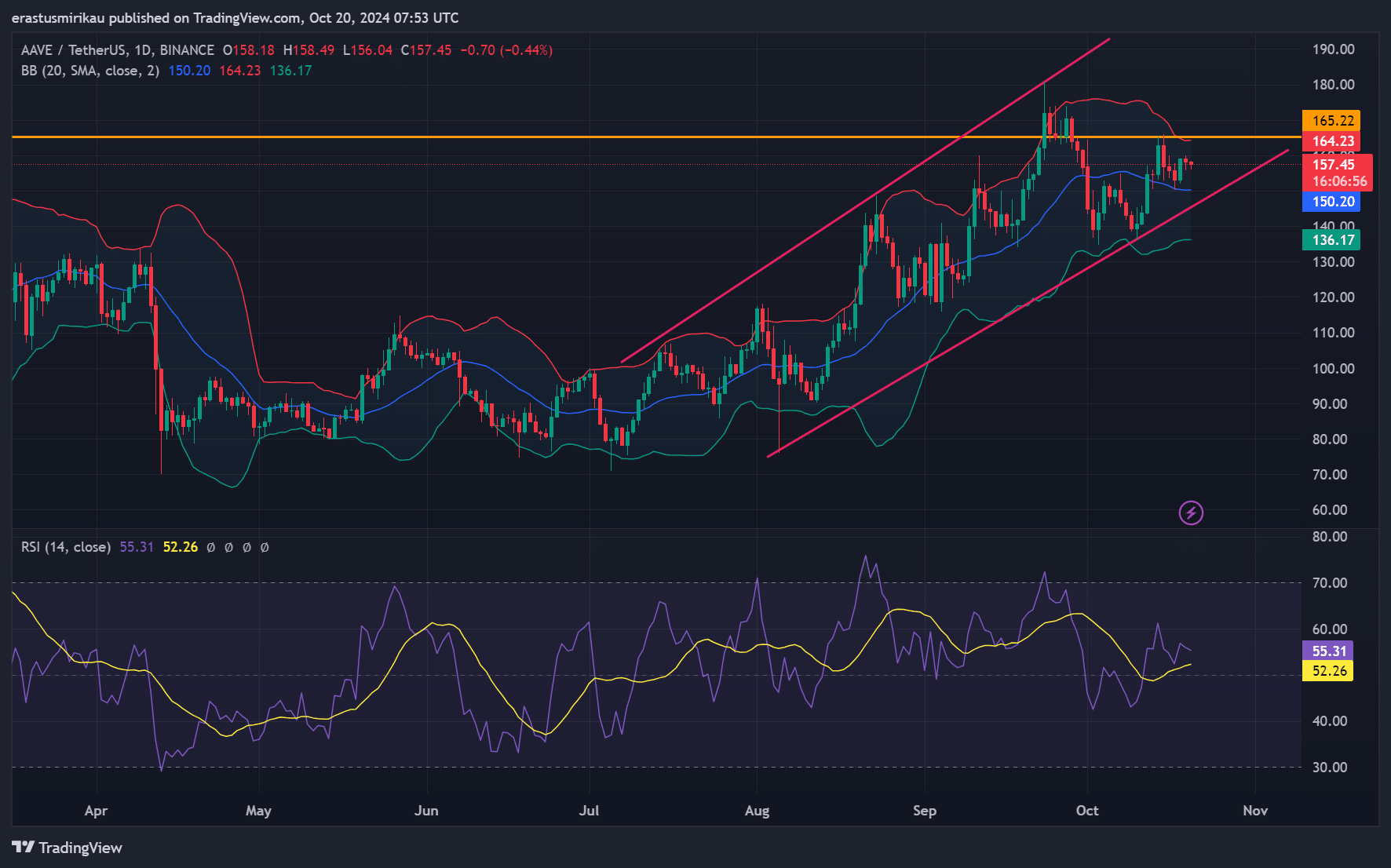

Looking at Aave’s daily chart, the token remains within a clear ascending channel.

At the price point of $165.22, a substantial barrier exists that’s hindering any further advancement, as the token has found it challenging to finish trades above this level during recent market interactions.

At the current moment, the Relative Strength Index (RSI) stood at 52.26, suggesting that neither the buyers (bulls) nor the sellers (bears) currently hold a clear upper hand in terms of momentum. This implies a balanced situation.

Furthermore, since the AAVE trade has surpassed its 50-day moving average at around $150.20, the overall sentiment continues to lean slightly optimistic. To maintain this upward momentum, it’s crucial that the price overcomes the resistance at $165.22.

Are the transactions telling a different story?

It’s worth noting that according to CryptoQuant’s data, there was a slight decrease of around 2.9% in the number of transactions over the past 24 hours.

As someone with over a decade of trading experience under my belt, I can tell you that this short-term dip might be indicative of a period of hesitation among traders. We’ve been here before – waiting for the market to provide a clear direction. It’s not unusual for traders to pause and reassess their strategies during such times, especially when the market seems uncertain or volatile. In my career, I’ve learned that patience is key in these situations. The market will eventually give us a clear signal, and we just have to be ready to react accordingly.

Furthermore, this decrease might be indicative of the fact that although there has been a significant increase in user addresses on Optimism, the associated transaction volume isn’t as high as one might expect just yet.

Exchange netflow shows mixed signals

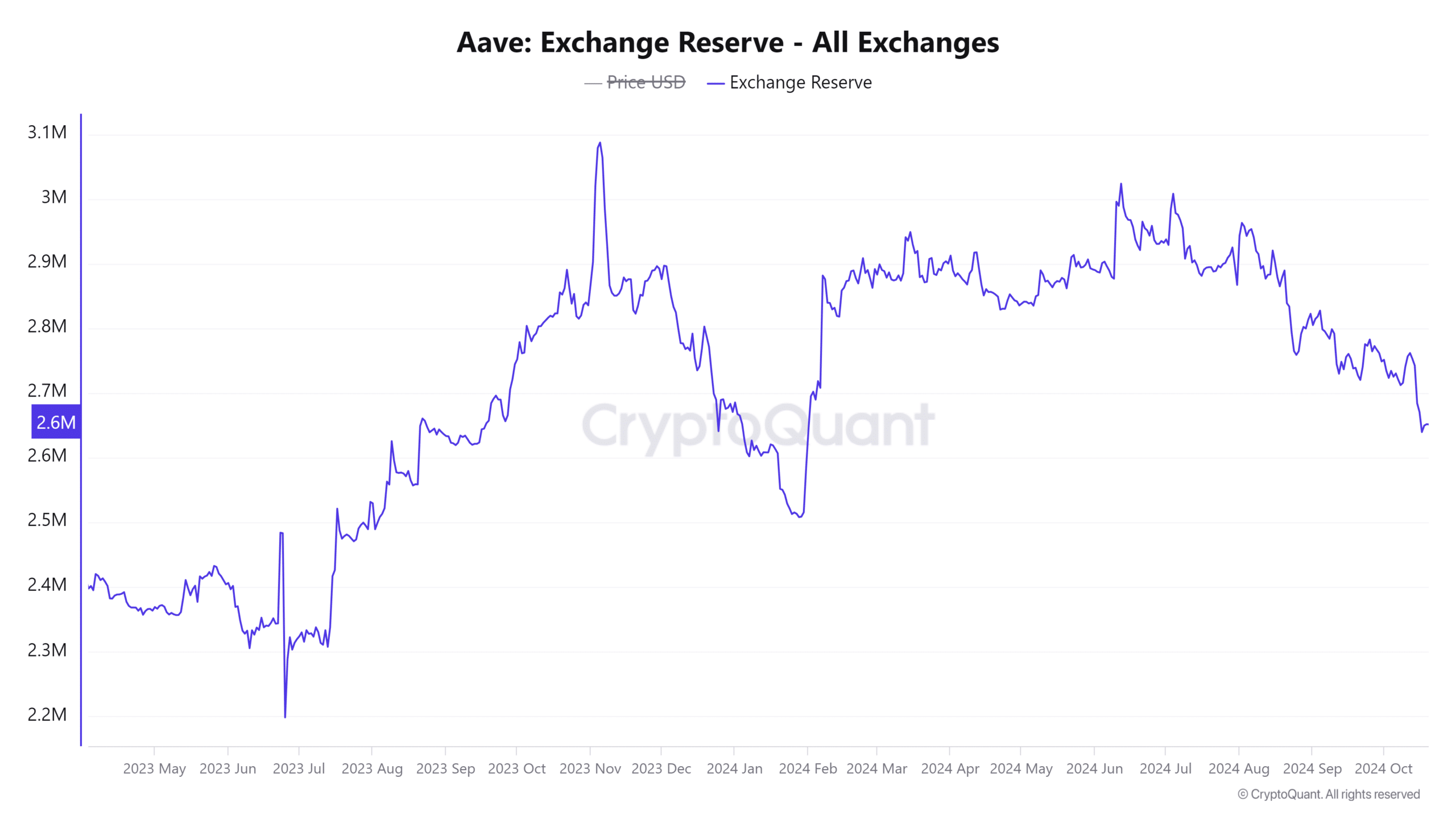

Looking at our reserve of 2.6511 million coins, it shows an uptick of 0.25% over the past 24 hours.

Normally, a surge in tokens held on exchanges suggests that there’s an increase in tokens being readied for potential sales. If the number of people buying (demand) doesn’t match this increased supply, it may lead to a temporary drop in price due to selling pressure.

Is Aave ready for the next rally?

Although the strong push for Aave, fueled by its rapid expansion on Optimism, indicates a potential upcoming surge, there are still some warning signs to consider.

Read Aave’s [AAVE] Price Prediction 2024–2025

If it can break through the $165.22 resistance, it could spark a new rally.

Yet, the increasing reserve amounts and decreasing transaction numbers suggest possible temporary hurdles might arise. Consequently, it’s advisable for traders to stay alert as the market unfolds further.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- LPT PREDICTION. LPT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-10-20 23:04