- Bitcoin was experiencing a psychological surge, making a correction unlikely for now.

- However, when the fundamentals eventually take over, panic could ensue.

As a seasoned analyst with over two decades of market experience under my belt, I must say that the current Bitcoin surge is nothing short of remarkable. The psychological momentum driving this rally is undeniable, and it’s hard not to get swept away by the frenzy. However, as I always say, “Every high tide brings in a new low,” and I can’t help but wonder if we’re about to see a significant correction.

Concerns about the market becoming too hot are escalating now that Bitcoin [BTC] has breached the $68K milestone, ending a four-month lull, despite a significant drop in the Relative Strength Index (RSI).

From my perspective as a crypto investor, venturing trades slightly above this crucial threshold might hint at a possible peak for BTC. Should this level prove to be a persistent barrier, a downward trend could be imminent, possibly leading to widespread selling pressure and even panic-selling among investors. Yet, it’s important to remember that while these signs are suggestive, they are not definitive predictions. Always do your own research and never invest more than you can afford to lose.

Bitcoin’s surge — Psychology over fundamentals

Firstly, it’s essential to consider that Bitcoin is heavily influenced by macroeconomic factors.

At present, a combination of factors – including the rise following the Bitcoin halving, the approaching end of the election period, the excitement around “Uptober,” and reductions in Federal Reserve interest rates – have collectively pushed Bitcoin up to $68K within a ten-day span, without any significant downturn.

As someone with years of experience in the stock market, I can tell you that while technical indicators might suggest an upcoming reversal, it’s crucial not to ignore macro factors that could influence large investors’ decisions. In my personal journey as a trader, I’ve seen instances where macroeconomic conditions have significantly impacted the beliefs and actions of big players in the market, causing them to view certain zones as key buying opportunities. Therefore, it is essential to consider these factors when making investment decisions, as they can play a pivotal role in shaping market trends.

As an analyst, I’m suggesting that even with current levels, major players may view this as a promising opportunity. This positive psychological push could attract more buyers, driven by increasing fear of missing out (FOMO) as the market sentiment intensifies.

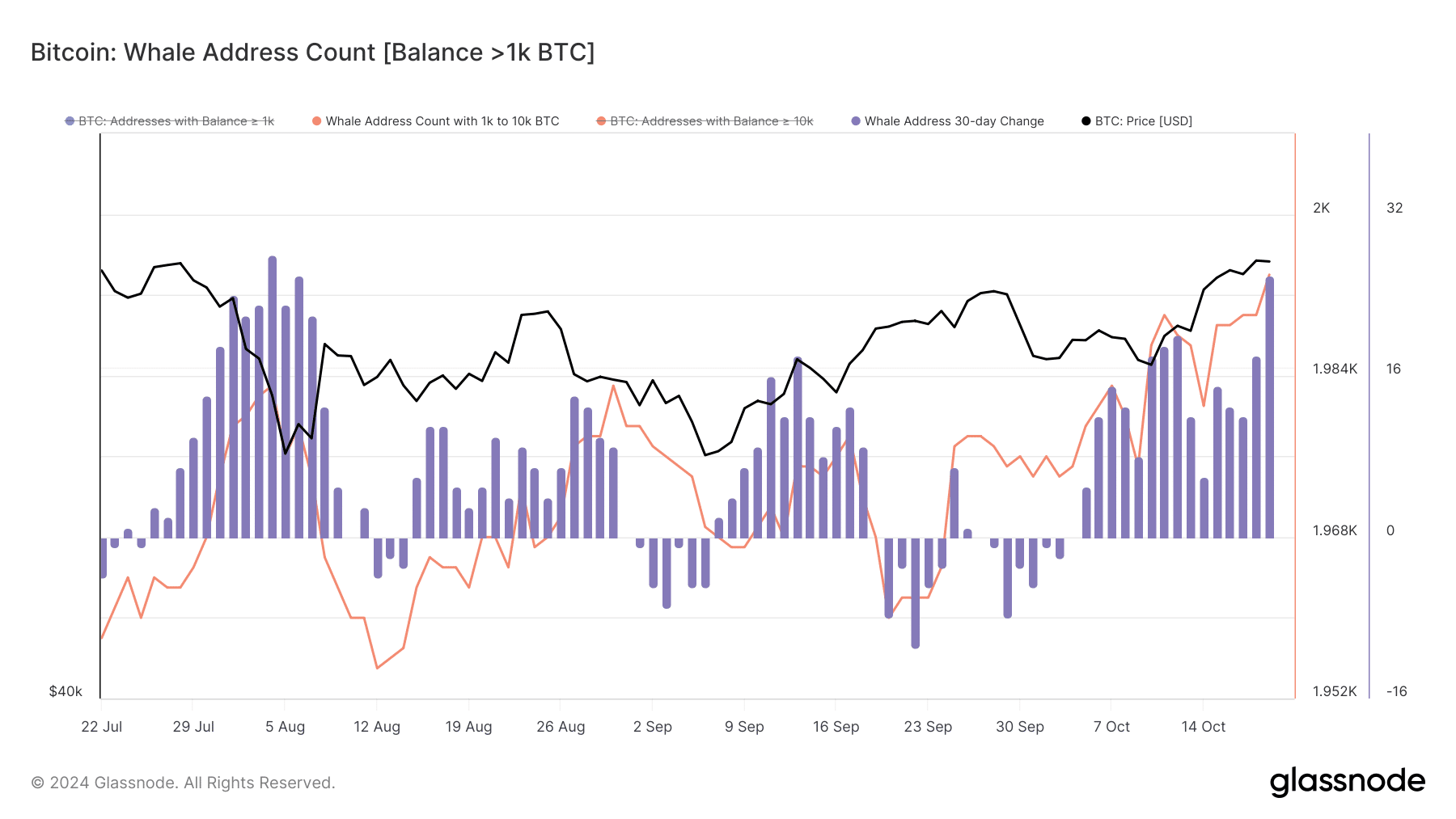

The increase in whale activity is evident as wallets containing 1K to 10K Bitcoin reach their highest level in three months. Notably, the previous significant rise coincided with a 5% daily price jump that pushed Bitcoin beyond $66K.

Essentially, whales (large investors) have significantly influenced market trends by combating downward pressure since the beginning of October. Their actions have strengthened the idea first proposed by AMBCrypto that significant external factors are attracting major investors into the market.

All in all, this trend appears to be primarily influenced by psychological factors. Consequently, efforts to sell Bitcoin with a bearish outlook appear unpromising as substantial price corrections seem unlikely at present.

Market buzz leading the way to $73K

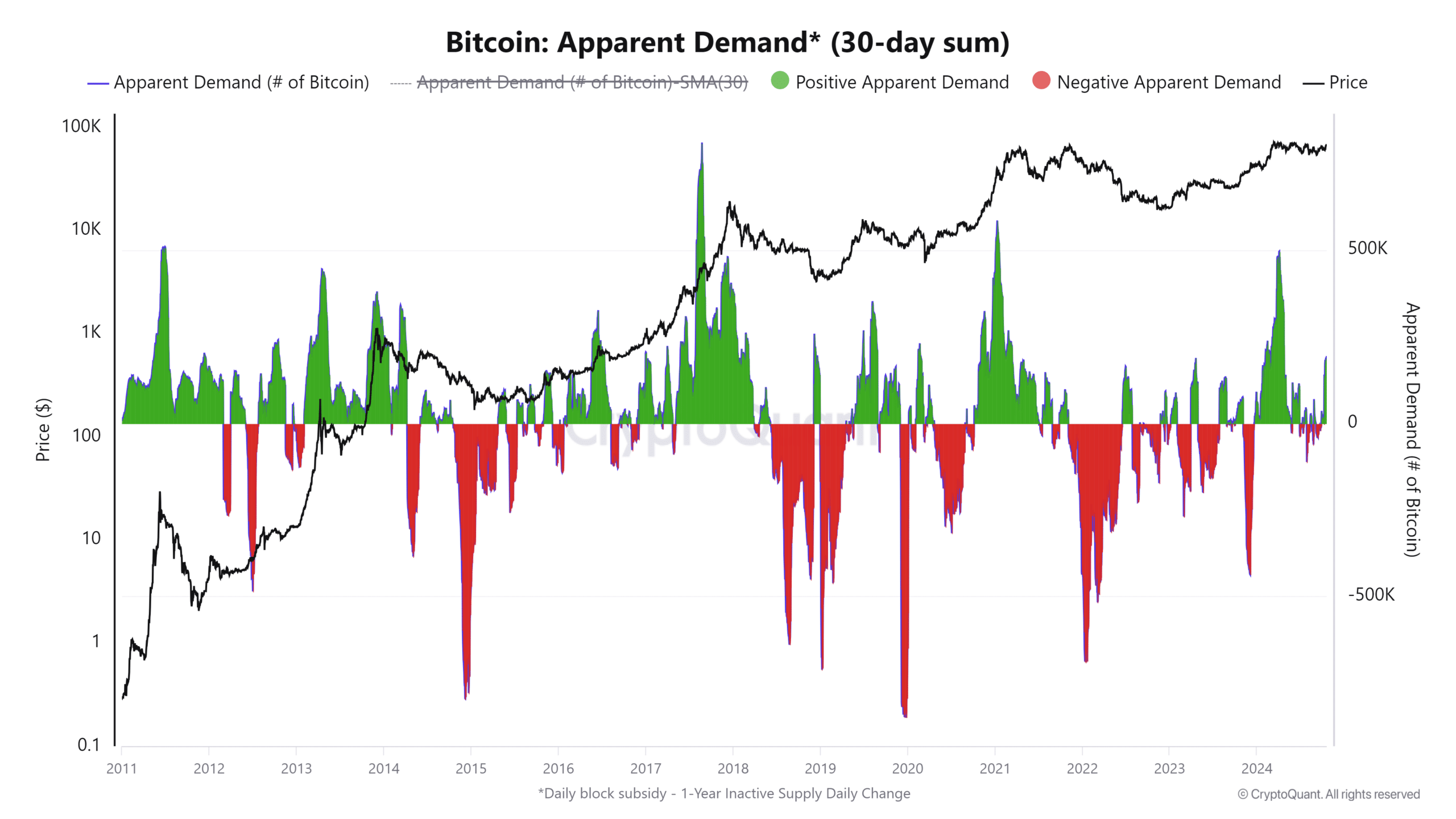

historically, the halving event has often signaled the start of a bull market for Bitcoin; increases in the 30-day average demand (represented by the green spikes) tend to correspond with reductions in Bitcoin supply during halving occurrences.

Reducing supplies often leads to extended market upswings, providing substantial benefits for shareholders over the long haul.

It’s intriguing that just the broad expectation alone, regardless if the fundamentals are immediately realized, can spark a sudden surge or ‘breakout’.

As expected, this period showcased the typical behavior of the market – Bitcoin swiftly rose to $68K following widespread anticipation of a rally caused by halving.

If the increased whale activity persists, as it appears to be doing, we may well see Bitcoin reaching its record high of $73K by the close of this quarter.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What You NEED to Know!

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-10-21 02:15