- Dogecoin experienced a 1.4% decline following a large sell-off but quickly bounced back with a 4% rise, trading around $0.148.

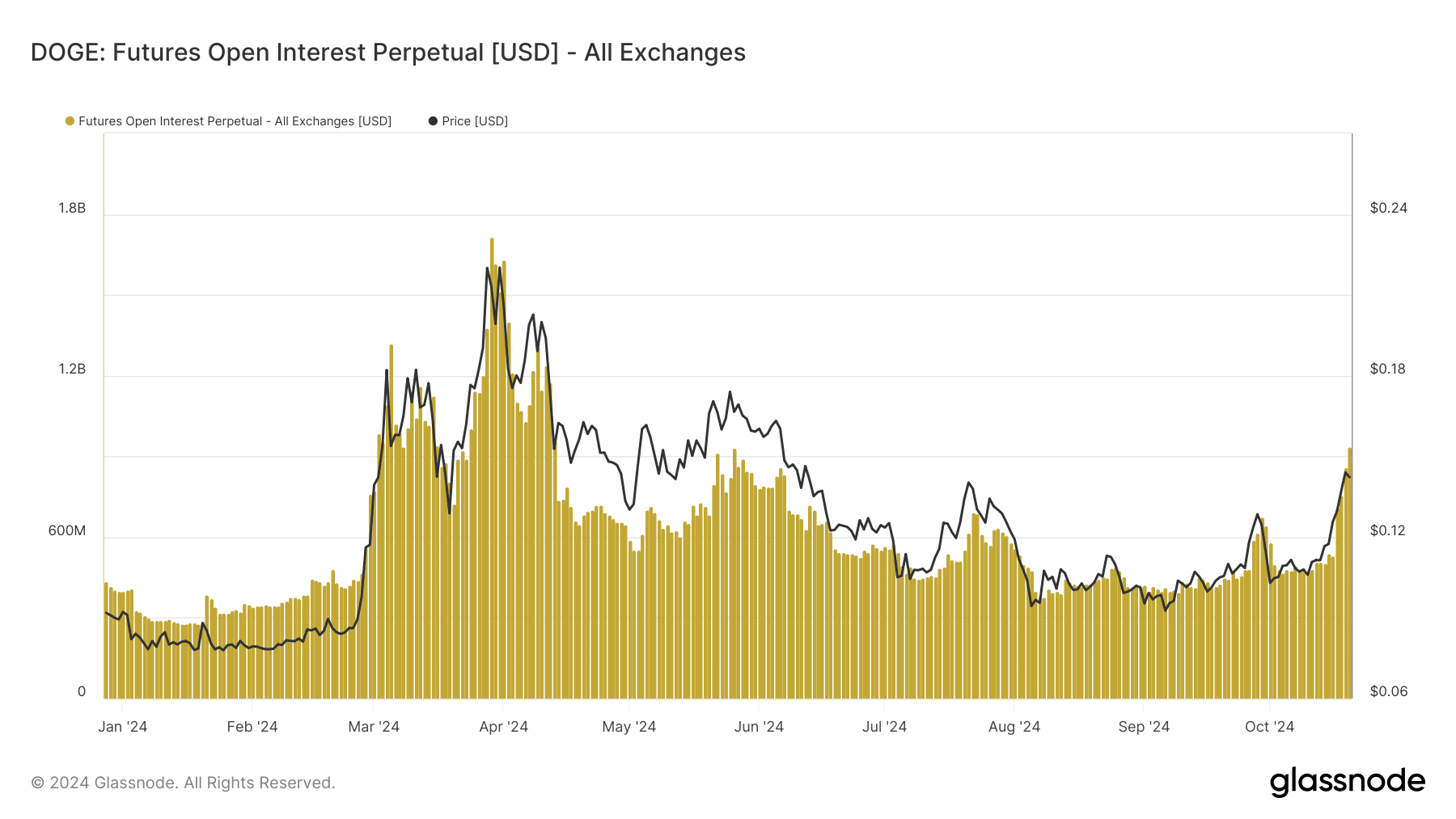

- DOGE’s open interest surged to $940 million, indicating strong trader interest.

As a seasoned researcher with years of experience in the crypto market, I have learned to navigate its volatile tides with caution and patience. The recent events surrounding Dogecoin [DOGE] have been an interesting study, to say the least.

Over the last seven days, Dogecoin (DOGE) has been moving upwards and crossing important price thresholds. But when the cost reached a noteworthy peak, there was a substantial transfer of DOGE to an exchange, suggesting a possible selling spree might be underway.

Dogecoin sees sell-off

According to information provided by Whale Alert, a significant amount of Dogecoin (approximately 176 million) was transferred to Binance exchange on October 20th. This transfer, worth over $25 million, seemed like a major selling event.

As a researcher delving into cryptocurrency transactions, I’ve discovered that the wallet associated with the recent transaction is still brimming with approximately 10 million DOGE, equivalent to around $1.6 million at current market rates. This transfer follows Dogecoin’s price spike, fueling speculation among investors that some holders might be capitalizing on the price rise by cashing out.

Dogecoin bounces back from sell-off

Regardless of recent drops, Dogecoin has demonstrated its robustness. Analyzing the price chart suggests that intense selling forced a momentary decline in the previous trading day. However, the trading volume significantly increased to around $333 million, indicating that temporary selling pressure from traders was more dominant.

DOGE saw a 1.4% decline, trading at around $0.142 at one point.

Presently, it’s worth noting that Dogecoin has recovered and is once again gaining traction. Its price has surged by more than 4%, currently standing at about $0.148. Analyzing the Relative Strength Index (RSI), it appears that DOGE is still in an overbought state, suggesting that demand for Dogecoin remains robust.

Moreover, the most recent point of potential resistance, previously observed in June, is now serving as a new support area at $0.130. This price level was surpassed in subsequent trading sessions.

More open interest, but warning signs flash

Based on Glassnode’s data, it appears that the recent sell-off was short-lived and open interest has surged substantially over the last few days. As I write this, Dogecoin’s open interest is approximately $940 million, which is a significant increase from $760 million on October 18th. This means that around $200 million has been added in just two days.

As the increase in open interest demonstrates increased trader engagement and a beneficial cash flow, the present condition of Dogecoin’s RSI calls for caution.

Indicating that the Relative Strength Index (RSI) continues to signal an overbought state, there seems to be hints suggesting a possible upcoming price adjustment.

In summary, Dogecoin currently holds a robust stance following the recent market drop, yet investors need to keep an eye out for possible price adjustments over the next few days.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-10-21 19:03