- ETH has crossed $2700 and could trigger a bullish reversal.

- Should ETH eye $4K, the current value could offer a great buy opportunity.

As a seasoned researcher with over a decade of experience in the crypto market, I can confidently say that these latest developments surrounding Ethereum [ETH] are indeed intriguing. The crossing of $2700 by ETH, as predicted by analyst Peter Brandt, does seem to indicate a bullish reversal. If we consider the bullish inverse head-shoulder pattern and the reclaiming of the Q2/Q3 support at $2850 as suggested by Crypto McKenna, it’s not unreasonable to speculate that ETH could potentially eye $4K.

Last week, the value of Ethereum (ETH) increased by 11%, surpassing $2,700 – a significant threshold that well-known analyst Peter Brandt predicted might cause a bullish turnaround in its price trend.

As an analyst, I observed that Brandt held firm on his optimistic stance as Ethereum (ETH) surpassed the neckline resistance at $2700, which marked the completion of a bullish inverse head-and-shoulders pattern.

“$ETH closing price chart inverted H&S pattern. I am flat in ETH.”

Will the ETH uptrend extend?

Another market analyst, Crypto McKenna, shared a similar ETH bullish ETH projection.

He cited that reclaiming $2850 (Q2/Q3 support) could set the altcoin towards $3600, especially if Trump wins the upcoming elections.

It appears that Ethereum has reached its lowest point and seems ready for an upward trend. Once it surpasses $2,850 again, I will consider it a positive sign and become more willing to take risks.

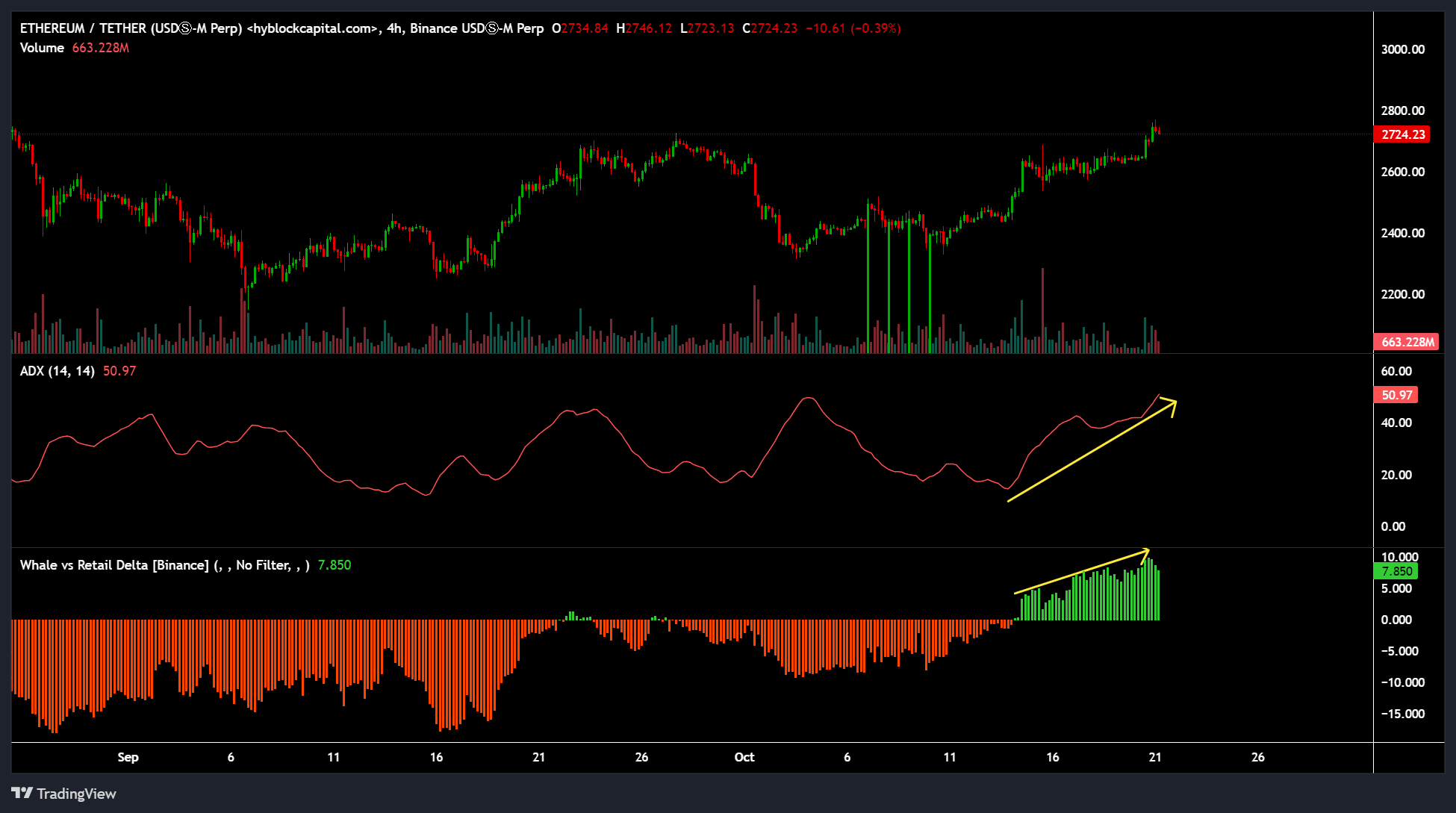

The above outlook was also supported by increasing whale interest for the past few weeks.

As per Hyblock’s Whale vs. Retail Delta, the metric recently shifted to green and reached levels not observed since the U.S. approval of spot ETFs in July.

This situation indicated that institutional investors (smart money) took on more long positions concerning Ethereum in the Futures’ continuous market than individual traders (retail), suggesting their confidence and optimism about Ethereum’s potential growth.

Furthermore, the latest upward trend appears robust, being supported by a Average Directional Index (ADX) value of 50.

If the uptrend extended, it could push ETH forward, especially amid a surge in recent exchange netflow.

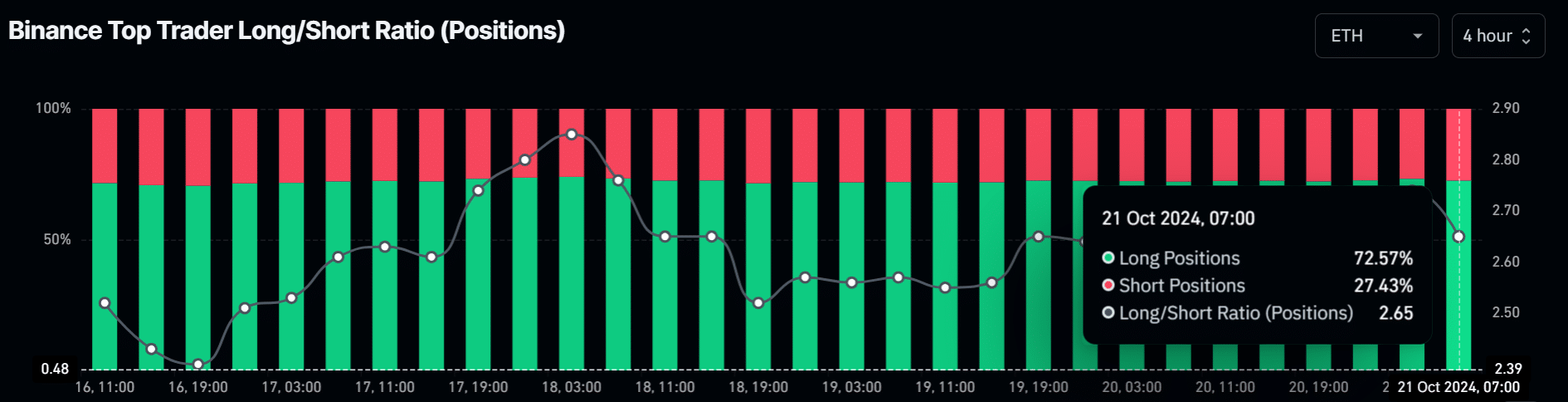

The smart money bullish sentiment on ETH was further supported by the Binance Top Trader Long/Short ratio. At press time, the metric’s reading showed nearly 73% of positions were long on ETH.

Read Ethereum [ETH] Price Prediction 2024-2025

This suggested that leading traders on the platform anticipated Ethereum’s upward trend persisting, aligning with McKenna and Brandt’s optimistic forecast for its price increase.

Currently, Ethereum (ETH) is priced at approximately $2,723. This figure represents a 48% decrease from its cycle peak of $4,000. Given this discrepancy, ETH presents an appealing risk-reward balance and an asymmetrical opportunity for potential gains if the upward trend manages to reach or surpass its March high of $4,000.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Quick Guide: Finding Garlic in Oblivion Remastered

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- BLUR PREDICTION. BLUR cryptocurrency

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

2024-10-21 20:07