- While ADA has been trading within a bullish symmetrical channel, momentum is building toward a breakout—but significant supply looms ahead.

- On-chain metrics indicate ADA could surpass this level if momentum continues to strengthen.

As a seasoned analyst with years of trading experience under my belt, I find myself optimistic yet cautious about Cardano [ADA]. While the bullish symmetrical channel and rising momentum suggest a breakout could be imminent, the looming supply zone is a significant factor that can’t be ignored.

Over the previous week and month, Cardano [ADA] has exhibited little movement, recording nearly identical gains of approximately 3.65% and 3.69%. However, a potential change could be brewing, as ADA surged by 4.94% within the last day.

The crucial point here: For how much longer might this upward trend persist? The digital coin, ADA, is nearing a significant area of supply that may decide its future trajectory.

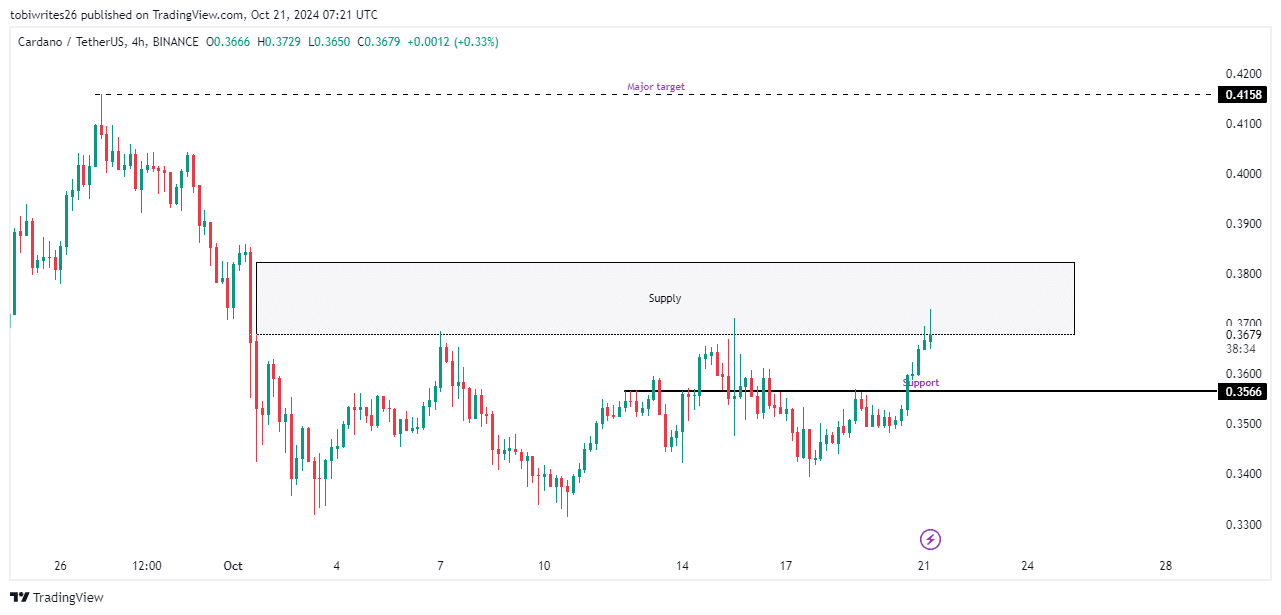

A move up or down? What the technical chart suggests

As an analyst, I’ve noticed that the asset under review, ADA, appears to have reached a crucial supply zone on the chart. This area is significant due to its potential for intense selling activity, which could potentially instigate a downward trend in its price.

The specified support area for ADA extends roughly between $0.3680 and $0.3823. For ADA to hit its goal price of $0.4158, it needs to surpass these boundaries.

If ADA doesn’t manage to surpass this current threshold, there might be a trend toward lower prices that could take it down to approximately $0.3566. This level may serve as a foundation for a possible price increase in the future.

Right now, it’s been observed that most traders are maintaining a generally optimistic stance, and Cardano (ADA) could potentially make an effort to surpass its resistance area.

Foundational bullish momentum on the rise

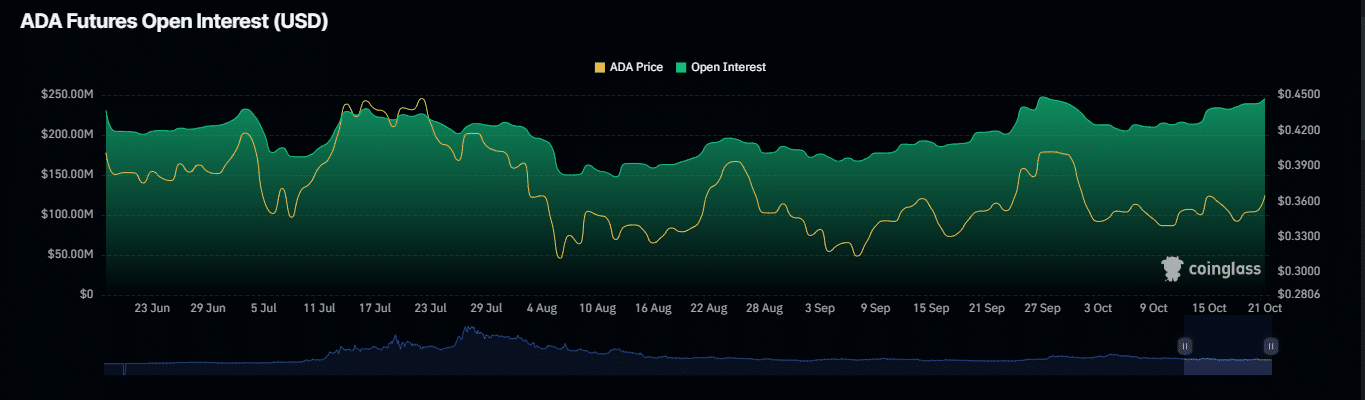

Significant growth in metrics like Open Interest and Funding Rate, key signs of bullish trend for ADA, suggest a possible price surge ahead.

Currently, the Open Interest (OI) stands at a level of $252.62 million, marking an uptick of 6.49%. This surge indicates that the market is maintaining its optimistic outlook, which traditionally aligns with rising price patterns.

In simpler terms, the number represented by “OI” refers to the quantity of derivatives contracts that have not been settled on a particular asset. This figure provides insight into the current market feelings towards that asset. An upward percentage change, for instance in ADA, typically suggests positive or bullish market trends.

Furthermore, the funding rate on ADA’s perpetual futures market, which represents periodic payments between traders, stands at a favorable 0.0132%. This indicates a positive sentiment towards the asset and supports its optimistic trend. (Coinglass provides this data.)

Market decline expected for ADA

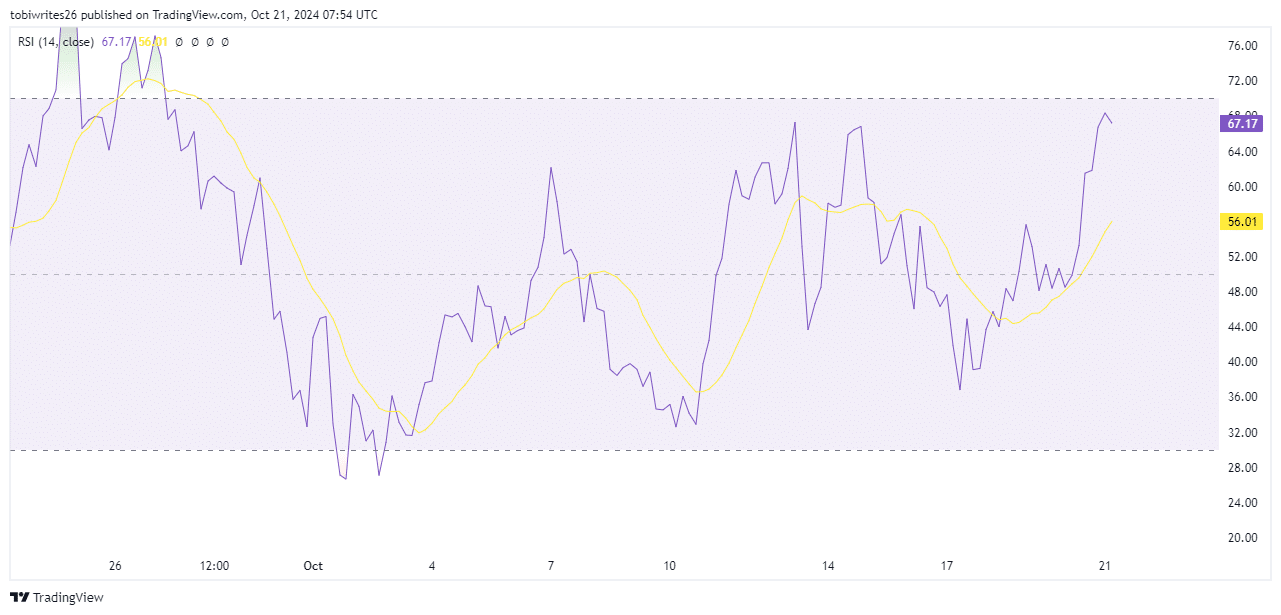

Based on the Relative Strength Index (RSI), it appears that ADA could potentially experience a drop during the upcoming trading periods.

Right now, the Relative Strength Index (RSI) stands at 67.36, edging closer to the overbought region which is above 70. Should Cardano (ADA) breach this level, a potential price decrease might occur.

If things continue as they are, we might witness a drop from the current supply area, potentially guiding Cardano (ADA) towards a lower resistance point.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

2024-10-21 21:11