- Bitcoin surged by 7.96% over the past week.

- Market fundamentals suggested that Bitcoin could experience a market correction soon.

As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of bull runs and market corrections. The recent surge in Bitcoin’s price has been nothing short of impressive, but as Burak Kesmeci’s analysis suggests, it might be time for a much-needed correction.

Just as anticipated, Bitcoin (BTC) saw a robust performance in October. Initially, the month began with a dip, but since then, it has registered substantial growth that surpasses its initial losses.

Since hitting a low of $58867, BTC has made a strong upswing reaching July levels of $69k.

Currently, at the moment I’m typing this, Bitcoin is being traded at approximately $69,028. Over the last seven days, it has increased by 7.96%, while on a monthly scale, its growth stands at 9.52%.

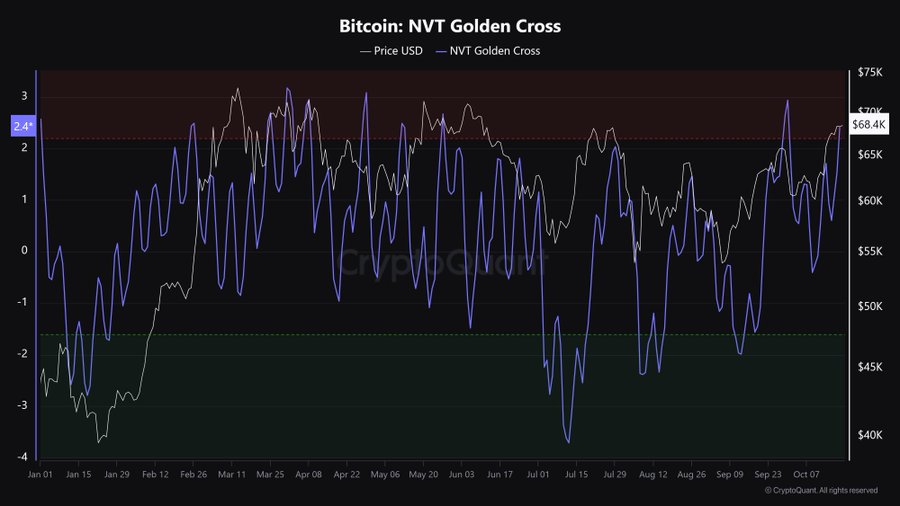

Current events have sparked mixed feelings among analysts, with some feeling hopeful and others concerned in about the same amount. For example, CryptoQuant analyst Burak Kesmeci proposed that Bitcoin could experience a market adjustment, basing his prediction on the NVT golden cross.

Market sentiment

According to Kesmeci’s examination, the Bitcoin’s NVT Golden Cross is now in a short-term high activity area.

In his opinion, there’s likely to be a downturn in the market first, before it tries to rise again.

To put it simply, for those new to this, when the NVT Golden Cross moves into a high-activity area, it indicates that Bitcoin’s current price might be above what its network usage would typically support.

Thus, it has become overvalued relative to the amount of value being transferred on the blockchain.

This implies a possible scenario of an overbought state, where the rate of price increase isn’t backed up by the actual network utilization.

Typically, these circumstances are followed by a readjustment in pricing, known as a correction, during which the market balances and sets the price according to the underlying network’s fundamental values.

Based on this analogy, Bitcoin will experience a pullback in the near term.

What BTC’s charts say

According to Kesmeci’s analysis, the present conditions seem unlikely to sustain a prolonged increase, and there might be a decrease to match the market demand.

So, the question at hand is, how long-lasting is this ongoing surge, and what insights do market signals provide?

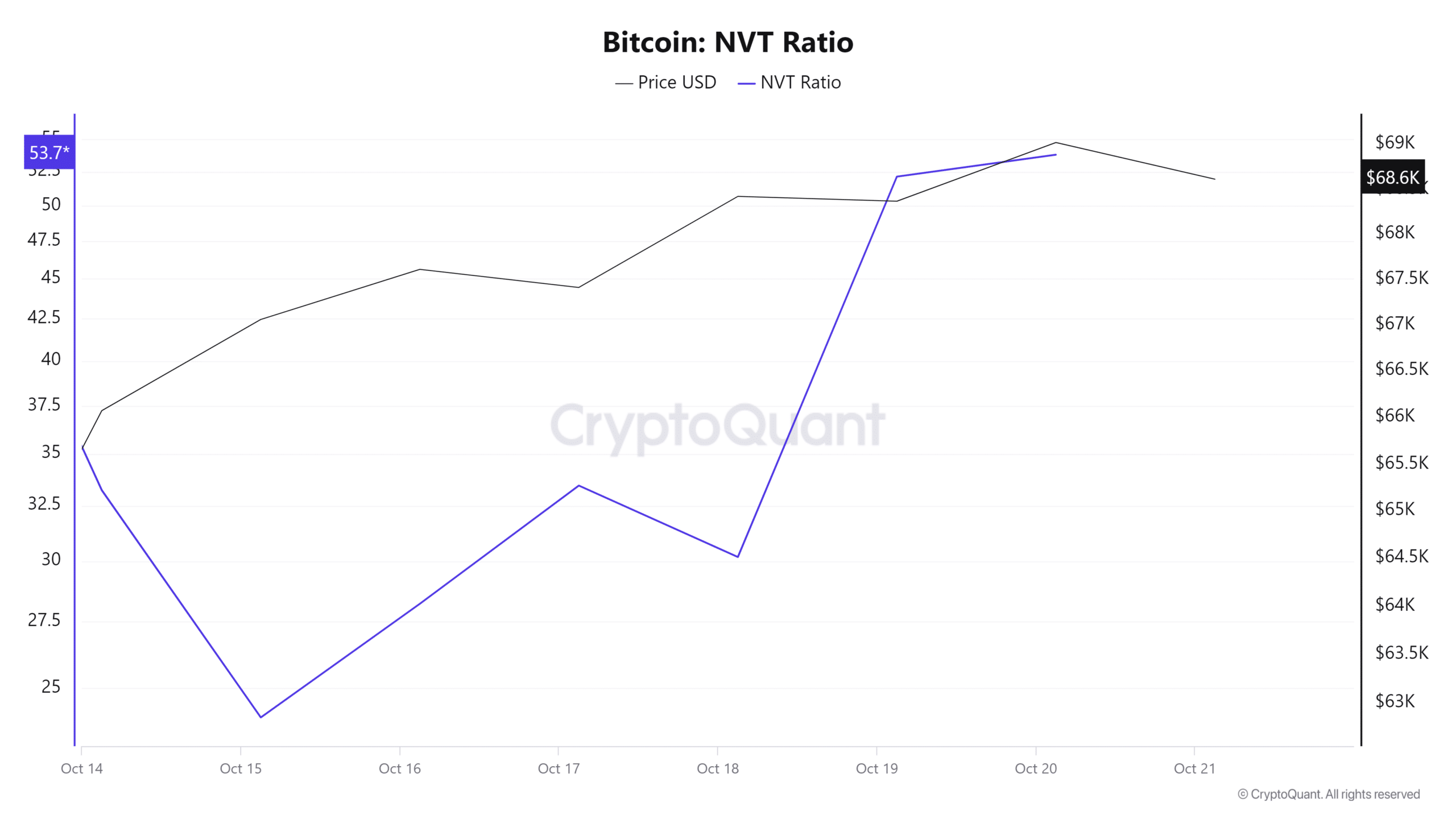

The first indicator to consider is Bitcoin’s NVT Ratio, which measures network value to transaction.

Based on data from CryptoQuant, it appears that the Network Value to Transactions (NVT) ratio has been climbing steadily during the last seven days. This trend suggests that Bitcoin’s current market value might be greater than its actual usefulness and network activity, which in turn indicates that prices are currently inflated and potentially unsustainable.

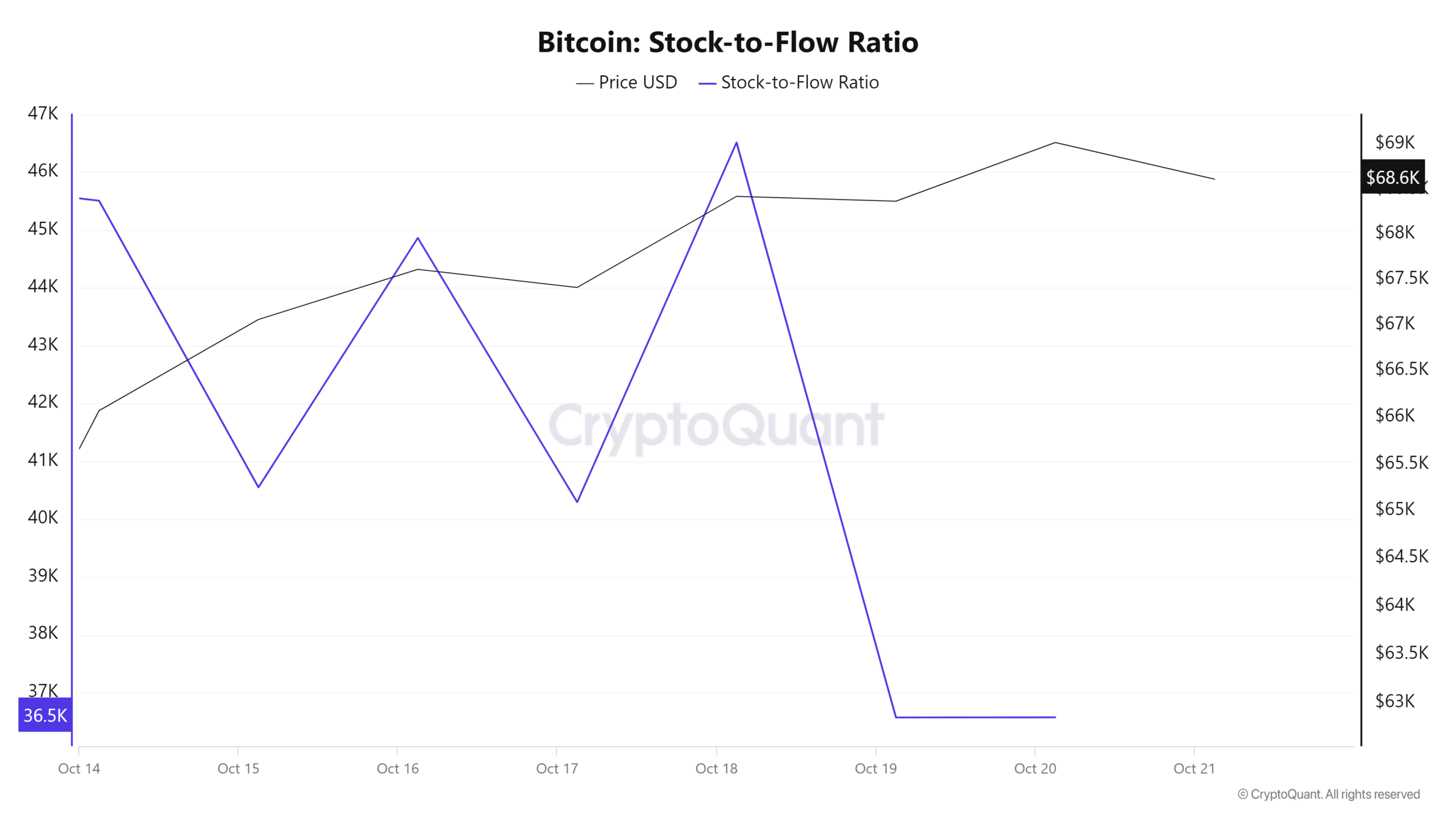

Moreover, it’s worth noting that the Stock-to-Flow ratio of Bitcoin has seen a decrease over the last seven days, which could indicate an increase in its supply. An uptick in Bitcoin’s availability often leads to a bearish market sentiment among investors, particularly if the demand doesn’t seem to be growing.

In simple terms, over the last week, Bitcoin’s Price DAA discrepancy has persistently been negative. This suggests a rapid price rise that might not be sustainable in the long term.

When the Price DAA is below zero, it indicates that the ongoing surge might be primarily fueled by speculative activity or temporary market demands.

Read Bitcoin’s [BTC] Price Prediction 2024 – 2025

To summarize, despite Bitcoin (BTC) reaching a new peak, the underlying economic factors indicate that a downturn could be just around the corner. In essence, this upward trend seems more fueled by speculation than genuine demand.

A correction will see Bitcoin drop to the $65872 support level.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- PI PREDICTION. PI cryptocurrency

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

2024-10-22 00:08