- PENDLE crypto netted 43% recovery gains in the past 30 days of trading.

- Looking into key market re-entry points as whales trimmed their exposure.

As an experienced crypto investor with a knack for spotting market trends and patterns, I find the recent performance of Pendle (PENDLE) intriguing. The 43% recovery over the past 30 days is a testament to its resilience, but the $5 psychological resistance remains a significant hurdle.

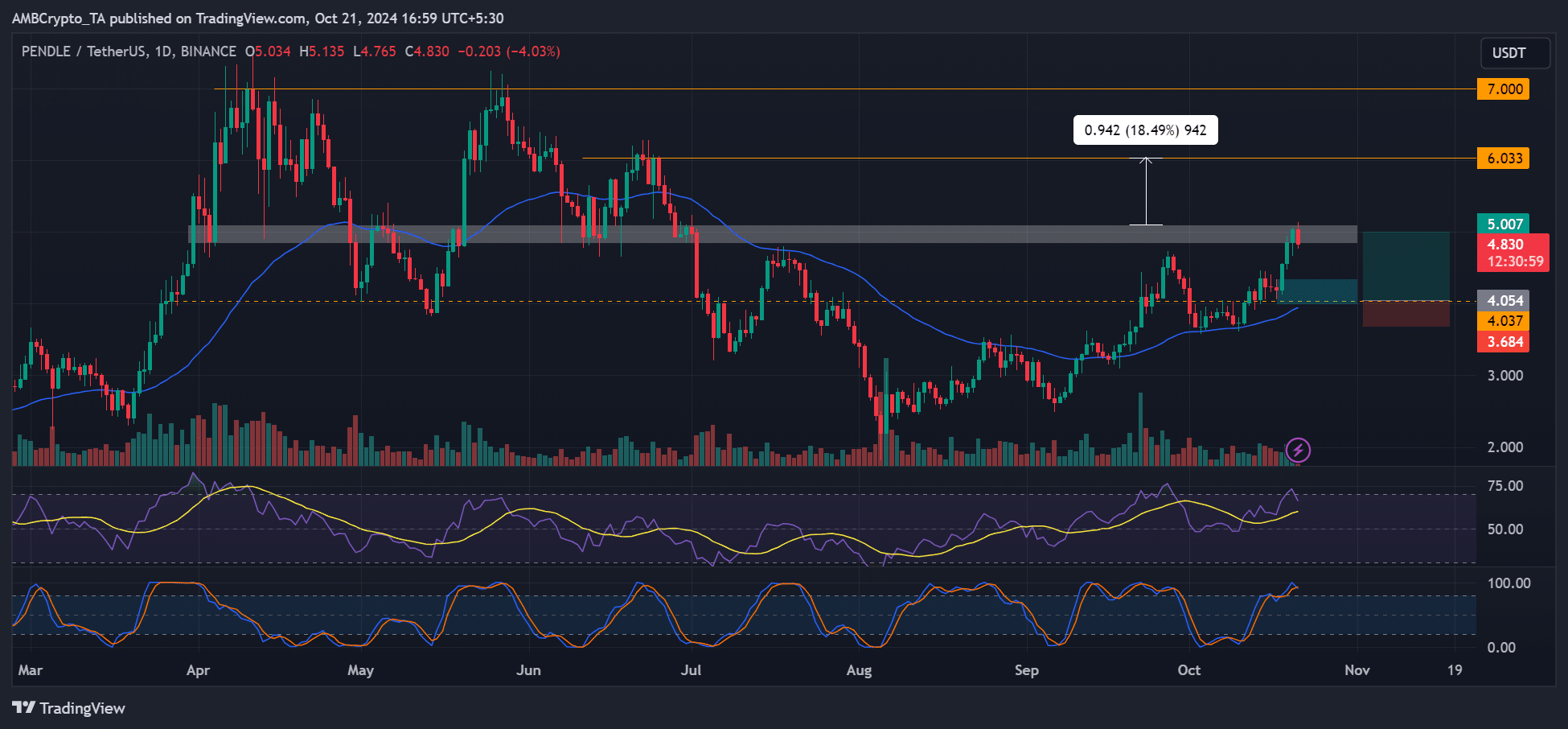

As an analyst, I’m reporting that my analysis shows PENDLE has continued its October recovery and reached a fresh monthly peak of $5.13. This impressive climb represents a significant gain of approximately 43% over the last 30 trading days.

But could the $5 psychological barrier, which has proven significant in the past, potentially break through it decisively?

PENDLE crypto hits a hurdle

Currently, the obstacle has already drawn in short sellers, evident in today’s red candlestick. This might speed up profit-taking by short-term investors.

Initially, there’s an opportunity for a price bounce back towards the short-term resistance level around $4, which is also where the 50-day Moving Average (represented by the blue line) lies. If this happens and the market trend remains bullish, the goal would be to reach $5, representing a potential profit of approximately 23%. However, this scenario will materialize only if PENDLE’s price drops back down to $4 first.

The second scenario would be a retest and flipping of $5 to support (marked white), allowing bulls to eye the $6 target. Such a move could offer an 18% potential gain.

If the price drops beneath $4, it would nullify the long position. Thus, a stop loss might be wisely set slightly below that point.

Pendle whales trim their exposure

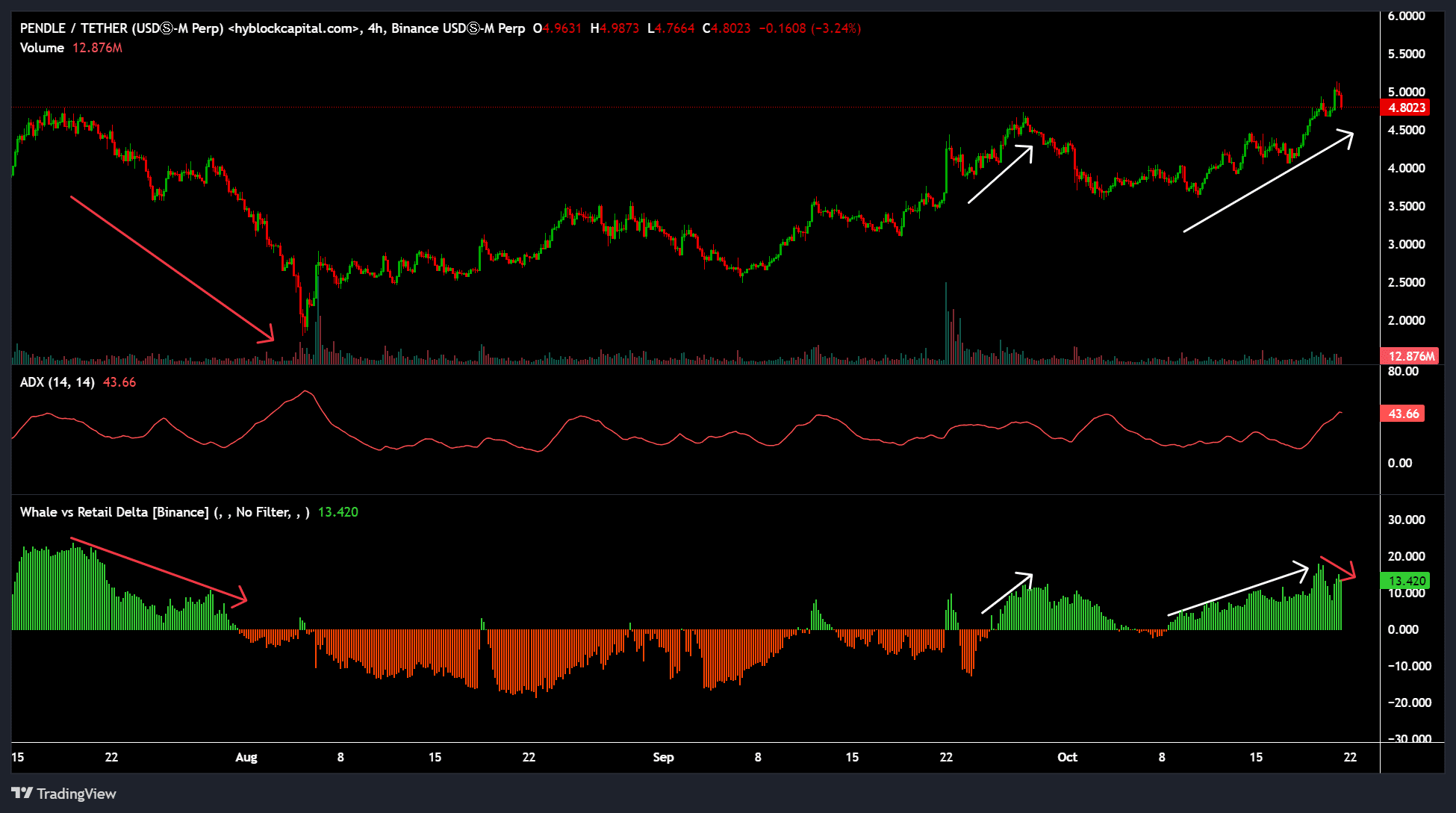

Despite the robust upward trend indicated by an ADX (Average Directional Index) of 43, the behavior of whales warrants a note of caution.

Historically, if whales (large investors) take on more positions than retail traders (Green Whales vs Retail Delta), the price of PENDLE usually increases. Conversely, when whales decrease their exposure, a decline in the price of PENDLE typically occurs.

Since early October, whales have added more PENDLE, driving an uptrend in prices. However, whale players have slightly trimmed their exposure at press time. This could partly explain the profit-taking at the $5 roadblock.

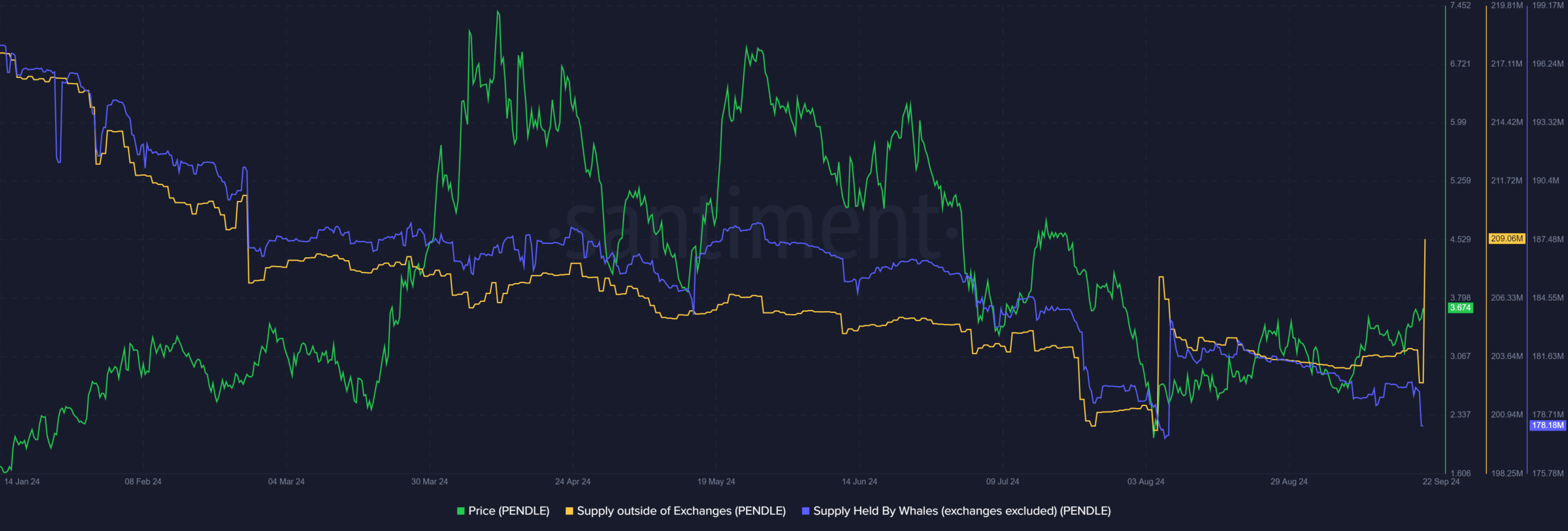

The observation made was backed up by data from Santiment, indicating a minor decrease in the amount held by Whale investors (represented by blue).

It’s important to mention that we saw an increase in Supply beyond the Exchanges, which could be indicative of accumulation, possibly by retailers. However, this doesn’t automatically mean that it will cause a rise in PENDLE.

Read Pendle [PENDLE] Price Prediction 2024-2025

During the stock market drop in August, there was an increase in buying activity, primarily driven by large investors, which subsequently caused PENDLE to rise. Yet, it might be difficult for PENDLE to have a significant surge, as these big investors seem to be stepping aside.

If the price moves away from the $5 barrier, it might make the initial optimistic prediction more plausible. However, if there’s a drop below the underlying support level of the 50-day Exponential Moving Average (EMA), it would challenge the bullish perspective.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-10-22 02:15