- ARPA crypto saw a 43% price surge in the last 24 hours, with its market capitalization now exceeding $91 million.

- Despite signs of overbought conditions, ARPA maintained a bullish momentum.

As an experienced analyst with years of observing the crypto market’s unpredictable dance, I can confidently say that ARPA’s performance over the last 24 hours has been nothing short of remarkable. It’s like watching a rocket take off, defying gravity and shattering expectations.

According to data, ARPA crypto has emerged as the highest gainer in the last 24 hours.

Despite some recent adjustments within the past day, this asset continues to hold the number one position among the leading 500 cryptocurrencies by market cap.

ARPA crypto emerges as top gainer

Over the last day, ARPA cryptocurrency has climbed to take the lead among the best performing assets, as reported by CoinMarketCap. It has seen a significant increase of more than 43%, thereby firmly establishing itself as the greatest winner in terms of value growth.

Due to this significant surge, the company’s market value now exceeds $91 million. Simultaneously, its trading activity has soared, multiplying over 40 times, resulting in an astounding $378 million in daily transactions.

Signs of corrections

Despite an impressive surge in the value of ARPA cryptocurrency, a closer look at its day-by-day chart suggests that a potential price adjustment may be on the horizon.

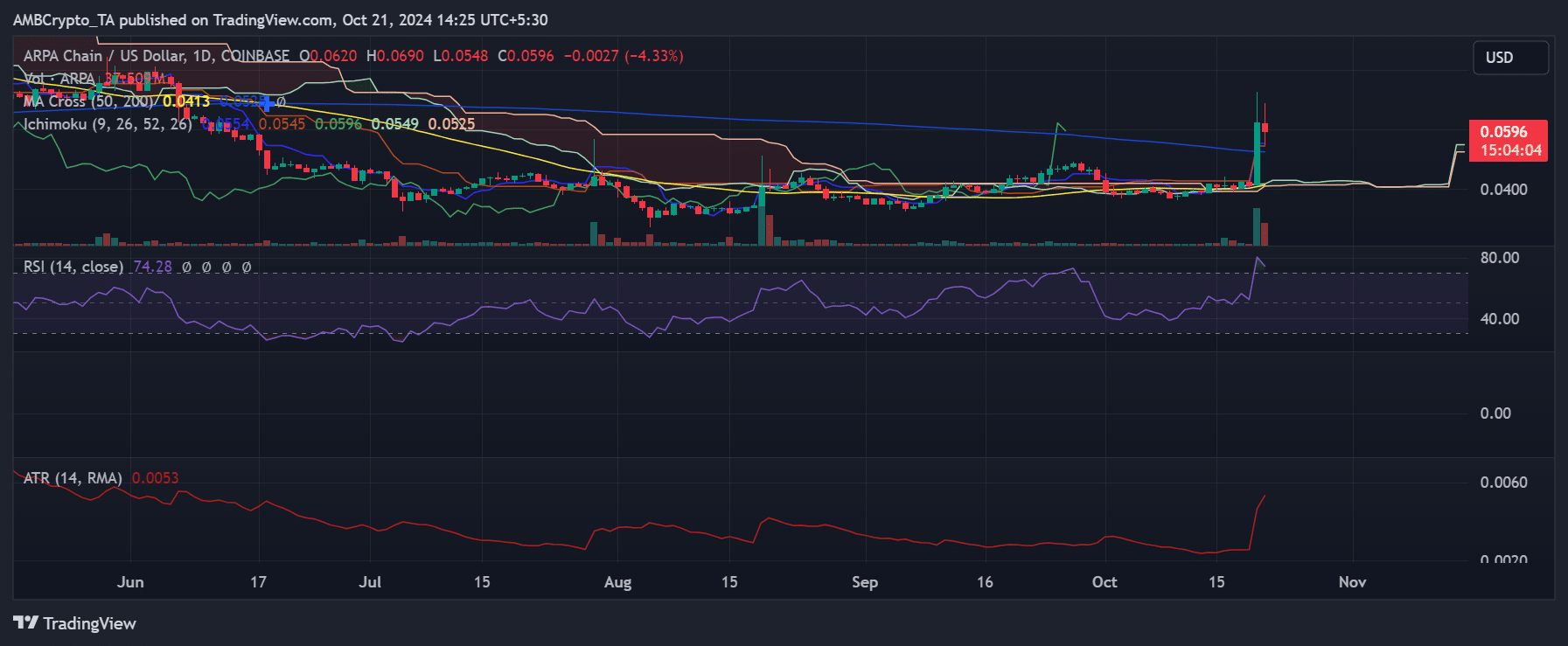

Upon reaching a peak of $0.0690, I’ve noticed a slight pullback of approximately 4.33%. Currently, the price is hovering near $0.0596, suggesting that it has met with some resistance in this range.

Based on my years of trading experience and market analysis, this correction could be the beginning of a consolidation period or a pause before another possible price spike. In the past, similar market behaviors have often preceded significant price movements, so it’s crucial to keep a close eye on the situation and make informed decisions accordingly.

Furthermore, at the moment of reporting, it was observed that the stock was doing exceptionally well, trading over its 50-day moving average, approximately $0.0413. This suggests a strong upward trend in price due to increased bullish sentiments.

The spike has also breached the upper bound of the Ichimoku Cloud, signaling a breakout.

Yet, such quick changes in price have sparked worries that the growth might be reaching an overextension point, considering that momentum signals hint at a potential upcoming break or slowdown.

RSI and ATR point to overbought and high volatility

As a crypto investor, I noticed that the Relative Strength Index (RSI) for ARPA was sitting comfortably in the overbought territory at 74.28 when I last checked. You see, once the RSI exceeds 70, it’s a signal that an asset might experience a short-term correction due to the decrease in buying pressure. So, keep an eye on ARPA, just in case!

This matches the decrease in price from its peak for the day, suggesting that traders might be cashing out following the swift rise of ARPA.

Furthermore, the Average True Range (ATR) – a measure of market volatility – has spiked up to 0.0053, indicating increased volatility during the latest trading periods.

The rise in volatility typically occurs alongside significant price changes, indicating that the ARPA cryptocurrency could potentially undergo additional ups and downs before finding a steady pattern.

What to expect next for ARPA crypto

Keep a close eye on the ARPA cryptocurrency as it approaches a significant resistance level around $0.0690. If it manages to break through this barrier, the price could potentially climb up to $0.075, suggesting that the upward trend is continuing.

On the negative side, you might find quick assistance close to approximately $0.0548. A more robust support area is located around the 50-day moving average, which is roughly $0.0413.

Considering the present situation where prices are excessively high and market turbulence is high, ARPA could potentially experience a period of stabilization or sideways movement prior to making its next substantial price shift.

A temporary phase of flat price movements might give technical signals such as the Relative Strength Index (RSI) time to decrease, possibly setting up conditions for a mid-term price increase.

If ARPA can’t hold onto its crucial support points, there’s a chance it could experience a significant drop, potentially falling as low as $0.050 or even lower.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-10-22 02:48