- Market sentiment is currently in the “greed” zone, driving more traders to buy and pushing crypto prices higher.

- Short liquidations have dominated in recent trading sessions, signaling strong bullish momentum.

As a seasoned researcher with over a decade of experience in the financial markets, I have witnessed countless trends and cycles that shape the trajectory of various asset classes. In my humble opinion, the recent surge in crypto prices can be attributed to three main factors: positive market sentiment, Bitcoin’s price performance, and liquidation of short positions.

Over the past day, there’s been a substantial drop in crypto trading activity, with the volume decreasing by more than 30% compared to the previous period.

Although there’s been a drop in trading volume, surprisingly, the total market value of cryptocurrencies has experienced a slight rise. This leads us to wonder: Why are cryptos seeing an increase, even with reduced trading activity?

Positive market sentiment boosts crypto prices

As a crypto investor, I’ve noticed an encouraging upward trend in the prices of cryptocurrencies I hold. This bullish movement could be attributed to the overall positive vibe surrounding the market. Based on data from Coinglass, this positive sentiment seems to be consistently prevalent in the crypto space.

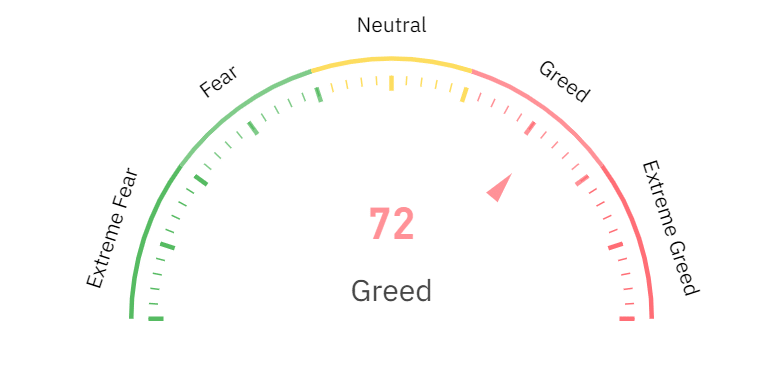

The Fear and Greed Index, a popular indicator of investor sentiment, is currently showing “greed.”

A strong sense of desire for more, frequently observed among traders, usually corresponds with heightened purchasing actions. This is because many traders get motivated by the fear that they might miss out on potential profits, a phenomenon commonly known as FOMO (Fear Of Missing Out).

Today’s rise in cryptocurrency values might be due to this belief, since fear of missing out (FOMO) encourages more purchases, which in turn boosts prices.

When the Fear and Greed Index shows ‘greed’, it usually means that many traders are eagerly jumping into the market, which increases the demand for purchasing assets. Consequently, this increased demand pushes the prices of significant assets higher.

As a researcher, I must emphasize that such market rallies typically precede a period of correction. The exuberance brought about by the fear of missing out (FOMO) can rapidly transform into fear, uncertainty, and doubt (FUD), leading to market volatility.

Bitcoin’s price surge supports market growth

One significant reason behind the rising trend of cryptocurrencies is the increasing value of Bitcoin, which holds the top position in terms of market capitalization and influence.

Over the past couple of days, Bitcoin has managed to breach its previous barrier at $63,000 and has been steadily increasing. It has remained above $68,000 in value.

In the most recent trading period, I’ve witnessed Bitcoin soaring as high as $69,000, which undeniably fueled the surge in our collective market capitalization.

The steadiness of Bitcoin’s price above crucial thresholds lays a robust base for the entire cryptocurrency market, since its performance frequently dictates trends among other digital assets.

As Bitcoin continues to climb, other digital currencies are rising along with it, pushing the overall market higher as well.

Short liquidations drive prices higher

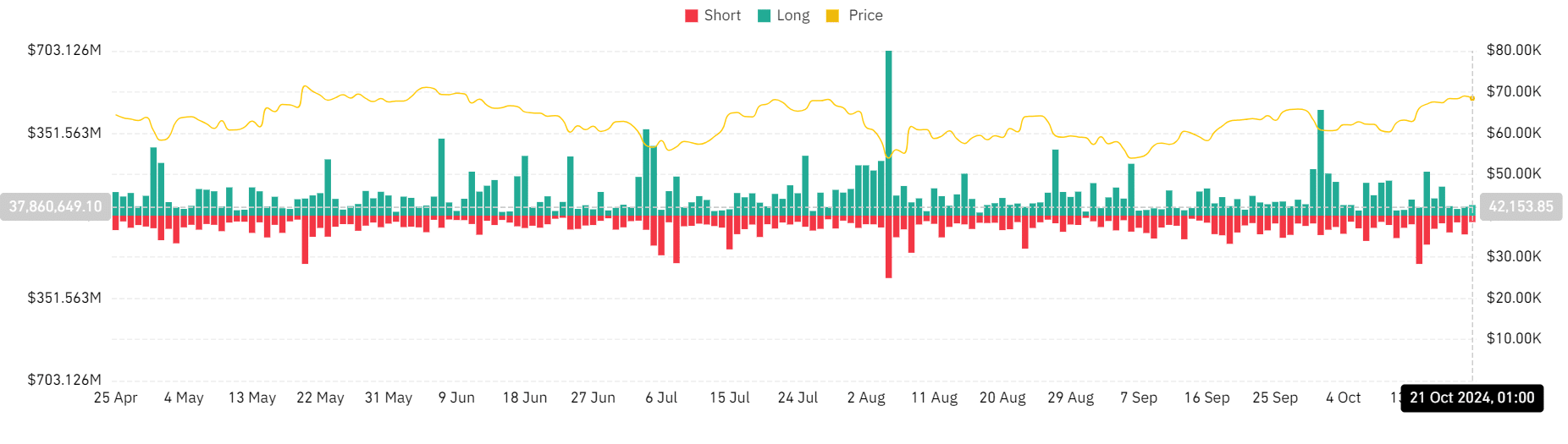

A look at the crypto liquidation graph suggests one possible cause for the recent surge in crypto prices. Over the last several days, there’s been a significant spike in the closing out of short positions.

On October 8th, approximately $71 million was released from positions held by those who had borrowed (short liquidations), compared to about $41 million in positions closed by those who owned the assets (long liquidations).

Approximately $28 million was almost equally distributed between closing short positions and opening long positions during the following trading period.

However, in the most recent session, short liquidations spiked to almost $80 million, compared to just $38 million in long liquidations.

The growing number of swift liquidations suggests that traders who had anticipated a decrease in prices are being pushed to abandon their trades, since the market prices keep climbing higher.

Closing short positions results in increased demand for purchasing, causing prices to rise even more, which makes the market appear increasingly optimistic or bullish.

Why is crypto going up?

The increase in the crypto market is due to multiple reasons, such as a favorable overall market feeling shown by the Fear and Greed Index, robust Bitcoin price action, and the closing out of bearish bets (short positions).

Together, these elements are driving the market higher, even as trading volume declines.

Even though the present momentum looks favorable, it’s important for traders to keep a watchful eye as sudden spikes in price may trigger market adjustments or corrections shortly.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-22 03:04