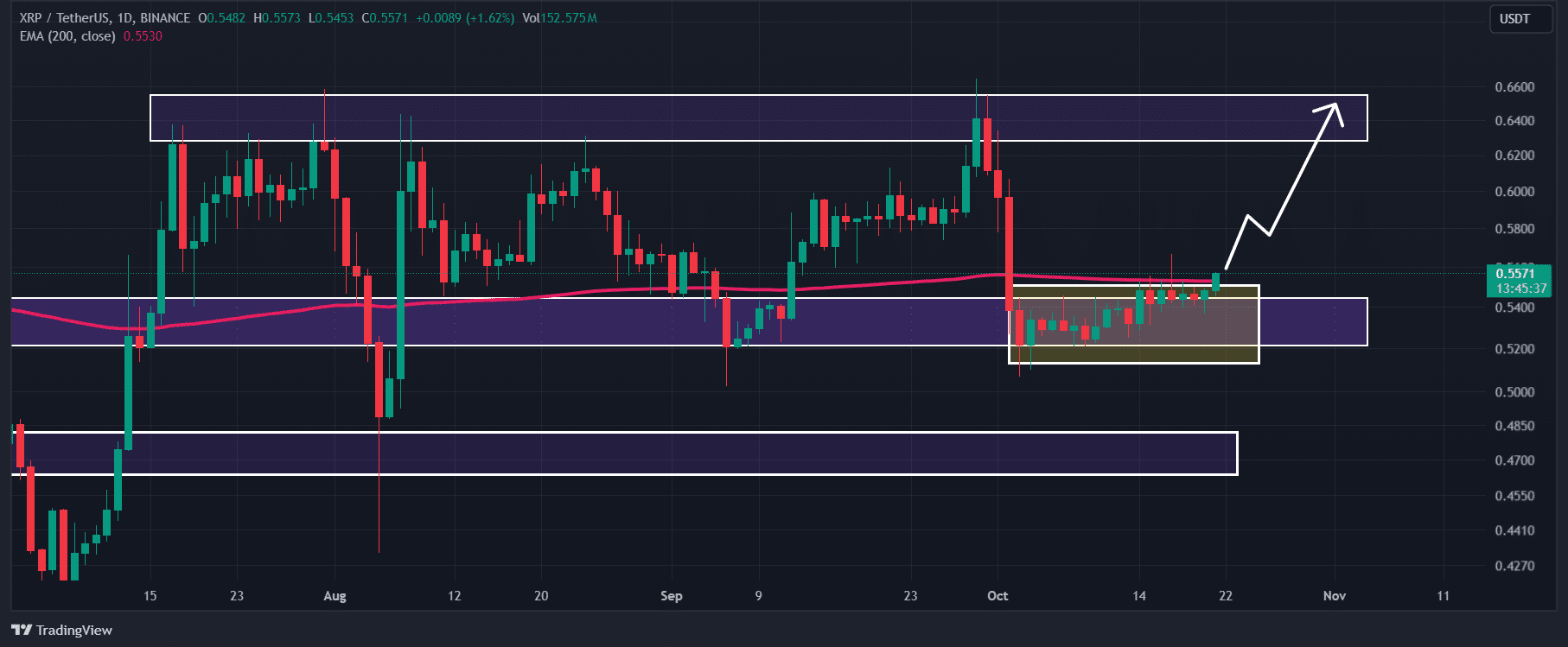

- XRP could soar by 17% to reach the $0.65 level if it closes a daily candle above the $0.558 level.

- Combining these on-chain metrics with the technical analysis, it appears that bulls are dominating the asset.

As a seasoned crypto investor with over a decade of experience navigating market volatility, I must admit that the recent developments surrounding XRP have piqued my interest. The 52 million XRP tokens moved by a whale and the subsequent breakout from consolidation are strong indicators of an imminent bull run.

In the midst of optimistic feelings about the cryptocurrency market, XRP has at last burst through a lengthy period of holding steady and appears to be pointing towards a possible price increase.

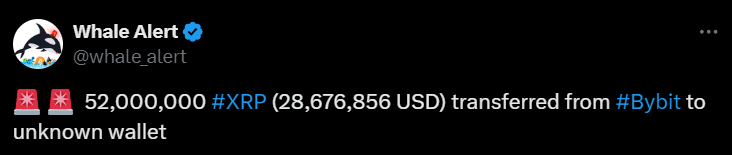

Whale adds 52 million XRP tokens

On platform X (previously known as Twitter), the blockchain transaction tracker Whale Alert shared an update about a large-scale crypto investor, also known as a “whale,” who recently withdrew approximately 52 million Ripple (XRP) tokens valued at around $28.67 million from the South Korean cryptocurrency exchange Bybit.

Although the overall market has been surging, XRP has not kept pace with similar gains up until now. However, signs from on-chain analysis suggest a potential change might be underway.

XRP technical analysis and key levels

Based on AMBCrypto’s assessment of technical patterns, XRP seems poised for an uptrend. It has burst through a three-week-long holding pattern and surpassed its 200-day Exponential Moving Average (EMA), suggesting potential growth.

As a crypto investor, I’m optimistic about the future of my assets, but I can’t help but feel a sense of uncertainty. Will my investment rally or will it hold steady in this consolidation phase? The answer lies in whether XRP manages to close its daily candle successfully.

According to current trends and past performance, if XRP finishes its daily price chart above $0.558, it’s likely that the value of this asset may increase by approximately 17%, potentially reaching around $0.65 over the next few days.

Bullish on-chain metrics

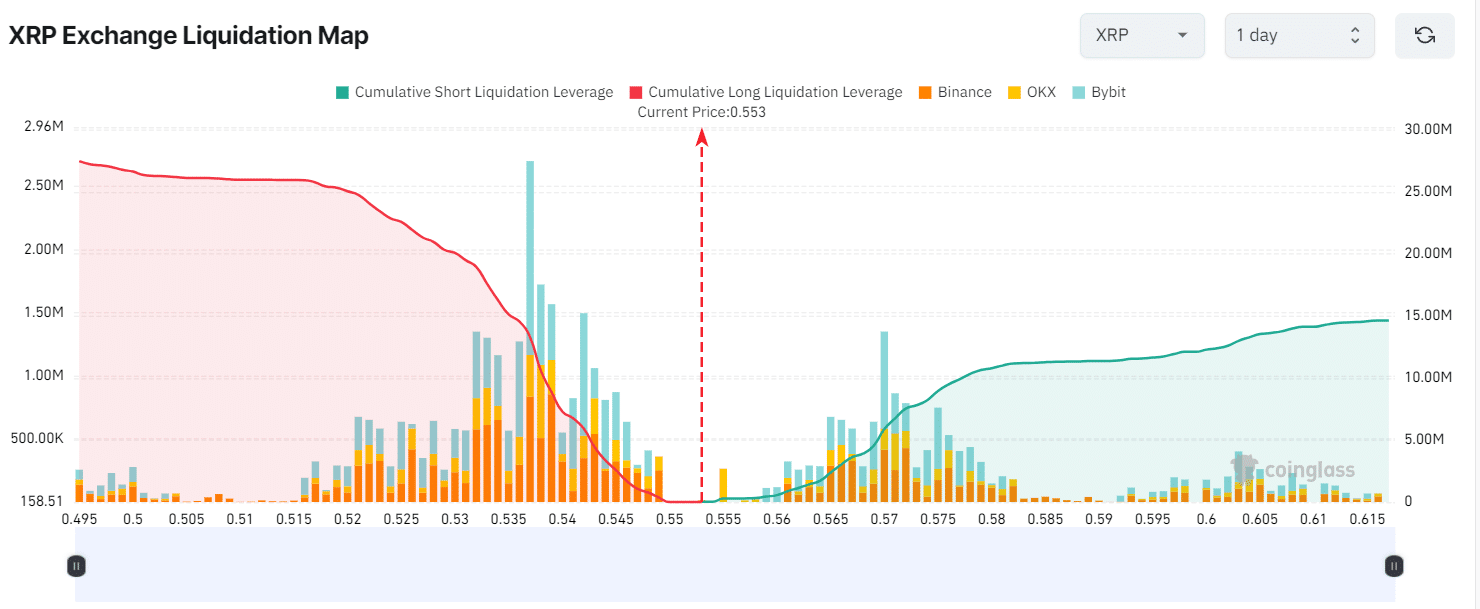

At the moment I’m reporting, key liquidation points for XRP stood at approximately $0.537 on the downside and $0.57 on the upside. As per the insights from the on-chain analytics company Coinglass, traders seem to be heavily leveraged at these levels.

Should the optimistic outlook continue and the price reaches $0.57, approximately $5.88 million in short positions will get closed out.

If the sentiment reverses and the price falls to about $0.537, it’s estimated that around $13.3 million in long positions will need to be closed out or sold off.

Over the past day, there’s been a 2.5% increase in Open Interest for XRP, indicating a rise in trader engagement possibly due to the recent breakout. This trend seems positive and could be a promising signal for XRP investors.

Instead of showing strong interest from traders, the long/short ratio for XRP currently stands at 0.98, indicating a lack of intense trading activity.

By examining both the on-chain data and technical indicators, it seems that at present, the buyers (bulls) have the upper hand in this asset; however, their power level is still fairly modest.

However, the overall sentiment for XRP is currently bullish.

Read XRP’s Price Prediction 2024 – 2025

Current price momentum

Currently, the value of XRP is close to $0.5532, following a significant increase of approximately 2.35% in its price within the last day.

Over that time frame, the trading activity saw a staggering increase of 115%, suggesting high involvement from traders and financiers, which may be attributed to the latest market surge.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-22 05:44