- Bitcoin’s back-to-back ‘Super Signals’ hint at explosive gains—last seen before 10,000% rallies.

- Over 94% of Bitcoin holders were in profit as volume trends suggested strong bullish sentiment ahead.

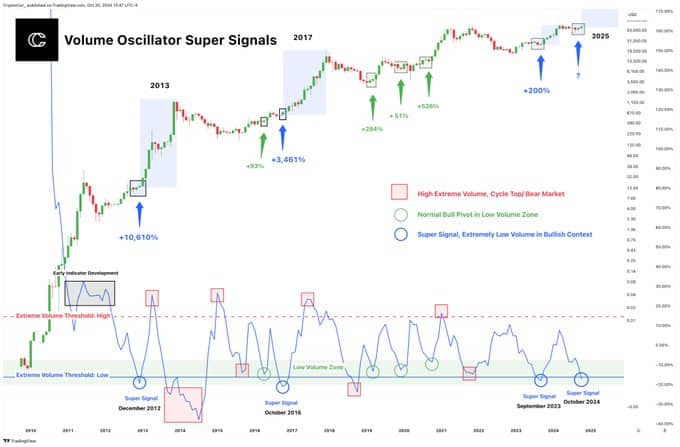

As a seasoned researcher who has witnessed the cryptocurrency market’s rollercoaster ride for years, I can confidently say that the current state of Bitcoin (BTC) gives me a sense of deja vu. The back-to-back ‘Super Signals’ and the overwhelming majority of holders being in profit are reminiscent of the bullish sentiments preceding massive rallies in 2012 and 2016.

In simple terms, the volume oscillator for Bitcoin (BTC) has just given two consecutive ‘Strong Indications,’ which is quite unusual and typically happens only during significant market uptrends.

historically, these signals have often appeared before significant stock market surges, with gains as high as 10,000% in 2012 and 3,000% in 2016.

In September 2023, there was an event that transpired, which came after a significant surge of over 200% in the value of Bitcoin’s price. Another strong indication occurred in October 2024.

In periods of very low trading activity within a thriving market, a phenomenon known as the ‘Strong Signal’ may emerge. Financial experts often interpret this situation as an indication of accumulation, where demand for buying stays consistent while potential sellers become scarce.

As a researcher, I find that the lack of previous substantial market surges provides additional evidence pointing towards a positive market trend, distinguishing this period from negative low-activity patterns.

Bitcoin’s price gains and market data

Currently, the price of Bitcoin stands at approximately $68,378.05. Its total market value is around $1.35 trillion, and over the past 24 hours, a trading volume of roughly $24.5 billion has been recorded.

This marks a 5.96% increase over the past seven days, showcasing steady gains. Bitcoin’s circulating supply stands at 20 million BTC.

The current value of open interests in Bitcoin futures contracts has grown by approximately 2.39%, reaching a total of about $40.69 billion as of now, suggesting heightened trading engagement and possibly positive market outlook among investors.

According to the data from CoinGlass, there was a significant increase of approximately 90.33% in the trading volume, reaching a total of around $42.62 billion. Meanwhile, the volume of options saw a substantial surge of nearly 182.07%, amounting to about $1.60 billion.

The amount of commitments made by traders, represented as Open Interest, rose by 2.29%. This now stands at a total of $24.31 billion. This trend, when considered alongside Bitcoin’s price fluctuations, seems to indicate a surge in optimism among traders.

Bullish sentiment

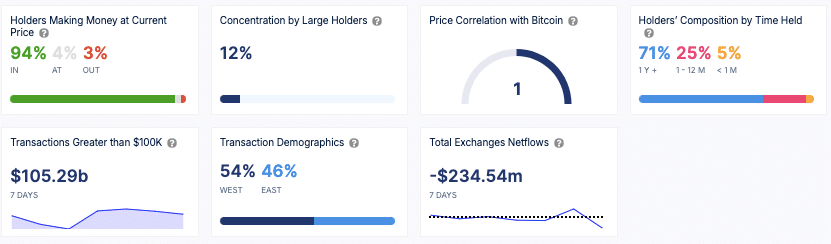

According to data from IntoTheBlock, approximately 94% of Bitcoin owners are currently making a profit due to the present prices, indicating a generally optimistic outlook within the market.

It was found through the examination that approximately 71% of Bitcoin owners have held onto their investments for more than a year, indicating a robust long-term investment pattern.

Approximately 12% of all Bitcoins are owned by larger holders, suggesting a somewhat centralized distribution among the wealthy investors or “whales.

Over the last seven days, I’ve noticed a significant movement of funds worth approximately $234.54 million leaving cryptocurrency exchanges. This could suggest that investors are hoarding their digital assets by transferring them into offline or cold storage wallets, potentially as a strategy for long-term holding.

Approximately 105.29 billion dollars worth of transactions exceeding 100,000 dollars each took place during the past week, primarily due to activity from institutional investors and significant traders.

Read Bitcoin’s [BTC] Price Prediction 2024 – 2025

Approximately half of the transactions originate from each side, with about 54% coming from the West and 46% from the East.

In essence, having two consecutive strong signals in Bitcoin’s history is quite unusual and has sparked excitement among investors, as it could potentially lead to price fluctuations reminiscent of past bull markets.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-10-22 06:16