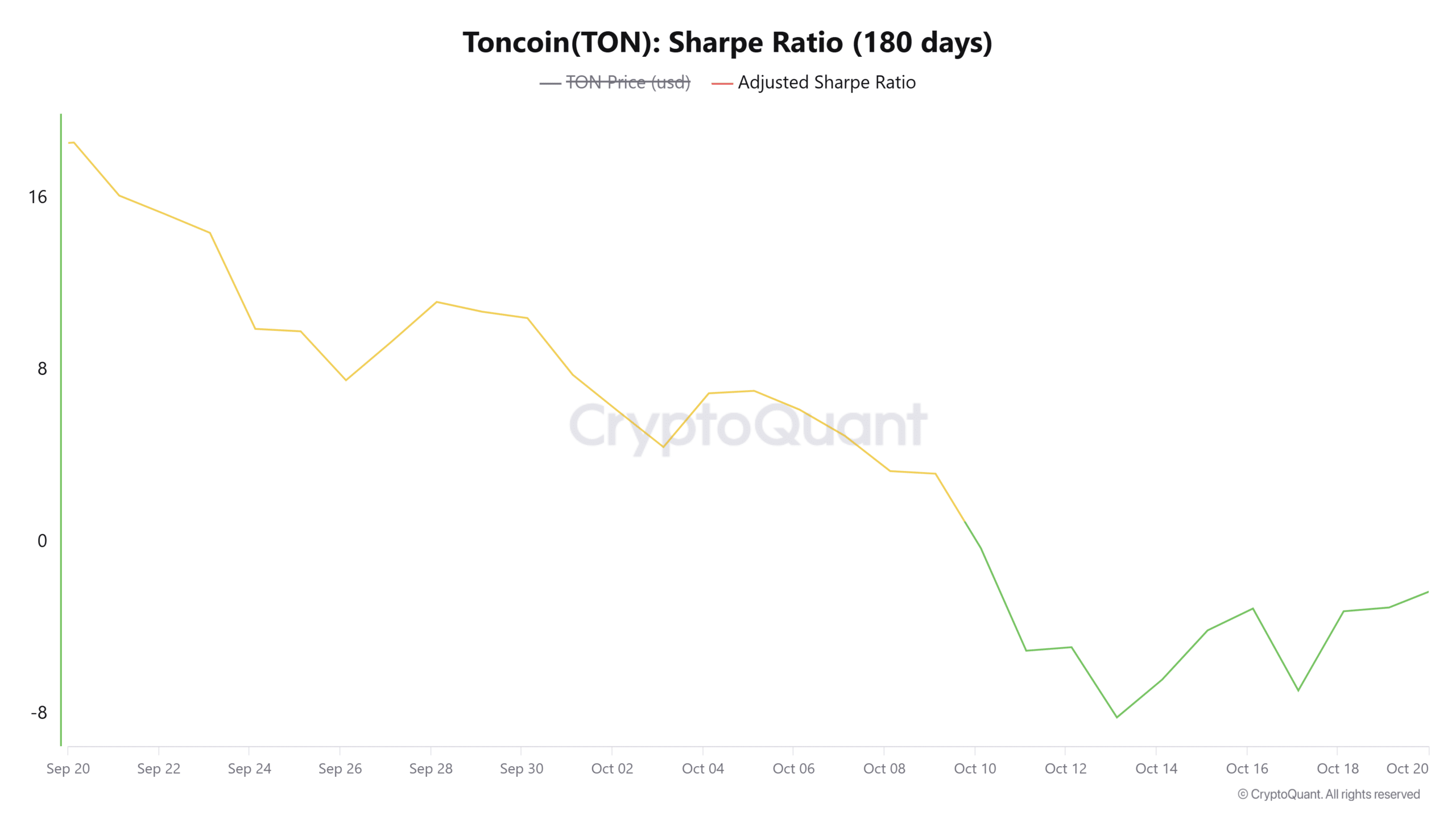

- TON’s Sharpe ratio has flipped negative showing low rewards to holders.

- TON risks an 18% drop if the price fails to make a bullish breakout from consolidation.

As a seasoned crypto investor with battle-tested nerves and a knack for reading market trends, I find myself cautiously watching Toncoin [TON]. The negative Sharpe ratio and the risk of an 18% drop if TON fails to break out from consolidation have me a bit concerned.

In the past 30 days, Toncoin (TON) has not performed as well compared to Bitcoin (BTC) and other alternative coins, experiencing a 5% decline in value. Currently, TON is trading at $5.28, with minor fluctuations preventing substantial price changes.

Examining the Sharpe Ratio indicates that investors are currently experiencing relatively small returns. At the moment, this indicator has dipped below zero and reached its lowest point in a month.

A negative Sharpe ratio shows that the risk of holding Toncoin is higher than the reward. With TON failing to post significant gains, a predominantly low and negative Sharpe ratio could dampen interest in the token causing further dips.

TON stagnates amid low volatility

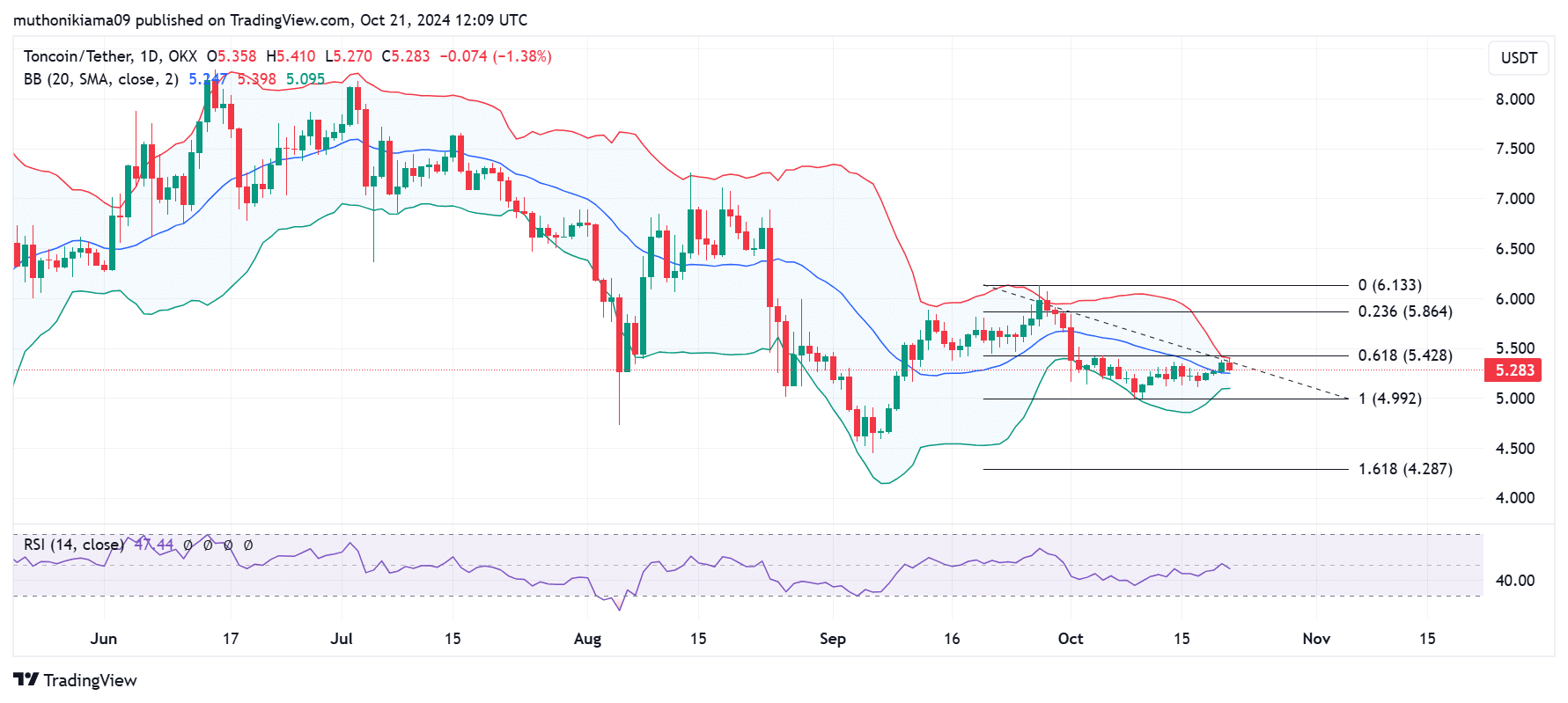

Over the past fortnight, TON’s daily price range has fluctuated from approximately $5 to $5.40. Notably, the Relative Strength Index (RSI) has stayed beneath 50, indicating minimal buyer enthusiasm to drive a breakout.

Currently, the Relative Strength Index (RSI) for TON is 47, indicating that there are more sellers active than buyers at this moment. This discrepancy stands out against the general market trend, as the Crypto Fear and Greed Index indicates a strong interest among retail investors in cryptocurrency assets.

TON’s failure to make a significant price movement, whether upwards or downwards, occurs during a period of low market volatility, as indicated by the narrowing Bollinger bands.

As a researcher analyzing market trends, I observed that the specific token I was studying reached the top boundary at $5.39. However, it encountered resistance there. If this price should breach upward, such an event might indicate the beginning of an uptrend in the market.

If Toncoin doesn’t manage to move beyond its current consolidation period, there’s a potential for a significant 18% decline in price, which could take it down to approximately $4.28 – a level based on the 1.618 Fibonacci ratio.

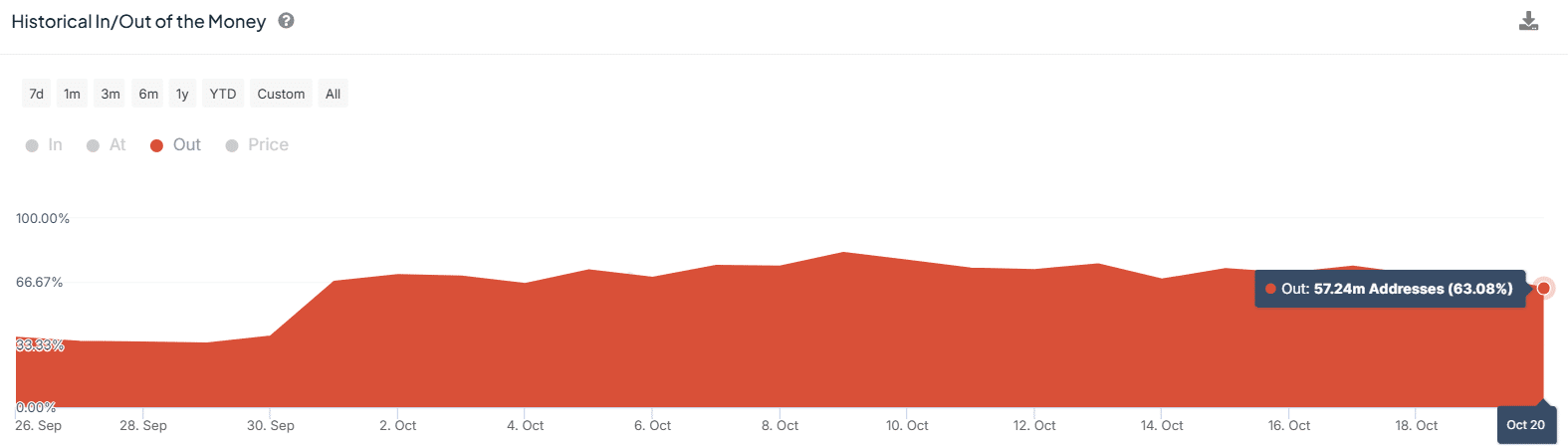

Wallets using TON that are facing losses may be contributing to this decline, as data from IntoTheBlock indicates an increase of 29% over the past three weeks, bringing the total to 63%.

If these traders opt to limit their losses, it might intensify the selling activity, potentially leading to additional price drops.

TON blockchain shows signs of recovery

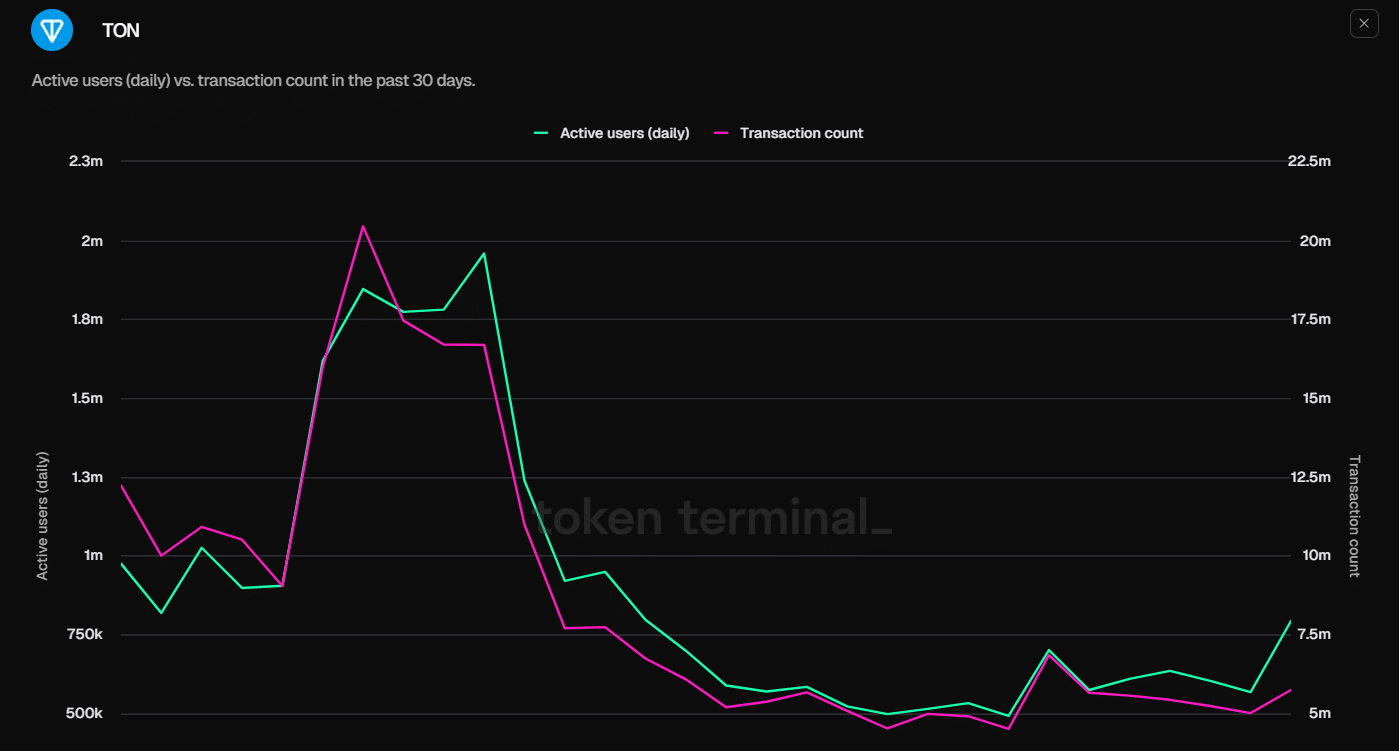

Usage of the TON blockchain spiked significantly towards the end of September. But ever since then, there’s been a noticeable drop in the number of active users and transactions on the platform.

Read Toncoin’s [TON] Price Prediction 2024–2025

According to TokenTerminal’s data, there seems to be a minor improvement as of October 20th. On this day, the number of daily active users on TON rose significantly from approximately 567 thousand to around 792 thousand. Additionally, the daily transaction count experienced an increase, going up from 5 million to nearly 5.7 million.

As I’ve observed in past trends, an uptick in network utilization often sparks growth. Given that the current revival persists, it might rekindle optimistic feelings towards Toncoin.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-10-22 12:07