As a seasoned crypto investor with a decade of experience navigating the volatile and ever-changing landscape of digital assets, I find myself deeply concerned about the ongoing regulatory crackdown by the U.S. Securities and Exchange Commission (SEC). The uncertainty surrounding the cryptocurrency sector is a double-edged sword that stifles growth while fueling speculation.

💥 EUR/USD Faces Historic Test Amid Trump Tariff Turmoil!

Market chaos looms — top analysts release an urgent forecast you must see!

View Urgent ForecastOver time, the U.S. Securities and Exchange Commission (SEC) has closely examined the world of cryptocurrencies. Experts have debated that the absence of clear regulation in this area may be hindering the sector’s expansion.

It’s been reported that, alongside other cryptocurrency exchanges, Coinbase is being scrutinized by the Securities and Exchange Commission (SEC) as part of their ongoing efforts to regulate this sector.

Coinbase against crypto crackdown

To address this ambiguity, Coinbase has chosen to take a forward-thinking approach by submitting two fresh requests under the Freedom of Information Act (FOIA).

By submitting these documents, the exchange seeks to understand the Securities and Exchange Commission’s (SEC) perspective on cryptocurrency regulations and to provide clarity on the rules governing crypto assets – an area that remains a contentious issue among industry players.

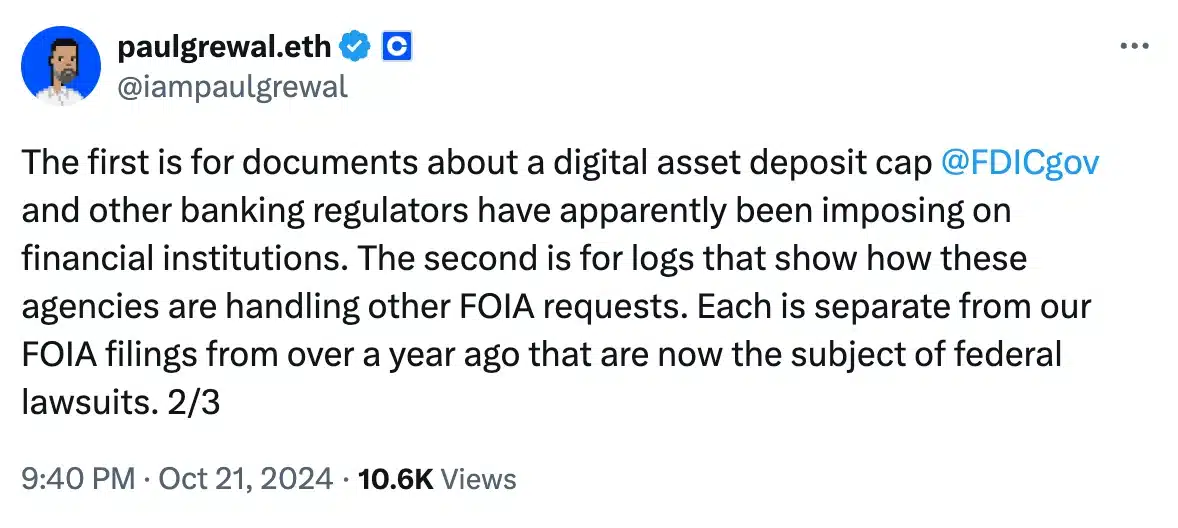

Providing additional insight into the subject, Coinbase’s Chief Legal Officer (CLO), Paul Grewal, shared crucial aspects of the submissions and underscored their importance.

In an ongoing attempt to gain insight into the methods regulatory bodies use regarding digital assets, we’ve submitted two additional Freedom of Information Act (FOIA) requests. Essentially, if the government persists in being unclear, so too will Coinbase.

Grewal clarified that the initial Freedom of Information Act (FOIA) inquiry centers around gathering records concerning the limitation set by banking regulators, such as the Federal Deposit Insurance Corporation (FDIC), on the deposit of digital assets within financial institutions.

What’s more?

The second query is about gaining access to records that explain the process these organizations follow when handling Freedom of Information Act (FOIA) requests from other parties.

As a cryptocurrency investor, I’d like to point out that the recent filings aren’t linked to the Freedom of Information Act (FOIA) requests Coinbase made more than a year ago. Those earlier requests have, however, progressed beyond just being simple requests and are now ongoing federal lawsuits.

It’s been claimed that the Federal Deposit Insurance Corporation (FDIC), which safeguards bank deposits in the U.S., has advised banks to cap cryptocurrency firm deposits at only 15% of their overall deposit amounts.

The reason this action has sparked debate is because it’s alleged that the FDIC set the limit without consulting the public first, which is usually necessary under U.S. law for regulatory bodies when making similar decisions regarding banking matters.

SEC against the crypto industry?

As expected, Coinbase isn’t the only crypto company under fire from the SEC.

Ripple Labs is once again facing closer examination, following the Securities and Exchange Commission’s submission of a ‘Pre-Argument Statement for Civil Appeal’ (Form C), indicating their intention to contest an earlier court decision as part of the ongoing legal dispute.

The case between Ripple Labs and the SEC, which dates back to 2020, has been a prolonged and highly publicized conflict over the regulatory treatment of XRP and digital assets.

In the face of continued regulatory scrutiny, Bitwise’s Chief Investment Officer, Matt Hougan, has noted that Coinbase seems to be the main organization profiting from the heightened U.S. enforcement efforts within the cryptocurrency industry.

He had put it best when he said,

“The hostile regulatory environment is creating an artificial “moat” for Coinbase’s business, helping sustain extremely high margins and allowing them to over-earn in the short-term.”

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- OM PREDICTION. OM cryptocurrency

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Attack on Titan Stars Bryce Papenbrook & Trina Nishimura Reveal Secrets of the Saga’s End

- Top 5 Hilarious Modern Comedies Streaming on Prime Video Now!

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

2024-10-22 13:44