- UNI is approaching a critical breakout, testing the $8.66 resistance level after a strong rally.

- Social dominance and rising open interest signal increased trader confidence for further upside.

As a researcher with years of experience in analyzing cryptocurrencies, I have seen my fair share of bull markets and bear markets, but Uniswap’s current momentum is truly captivating. The recent listing on Upbit has fueled its impressive rally, pushing UNI towards a potential breakout at the $8.66 resistance level.

In a noteworthy surge, Uniswap (UNI) has experienced a strong short-term rally after being listed on the South Korean exchange, Upbit. This listing seems to have ignited a spark, causing the price to jump by over 6%, and trading volumes to skyrocket an astounding 110% higher.

At the moment when the news is released, UNI is valued at $8.16. The pivotal issue now is if this upward trend persists, allowing the price to surpass the significant barrier at $9.67 and potentially reach even greater goals.

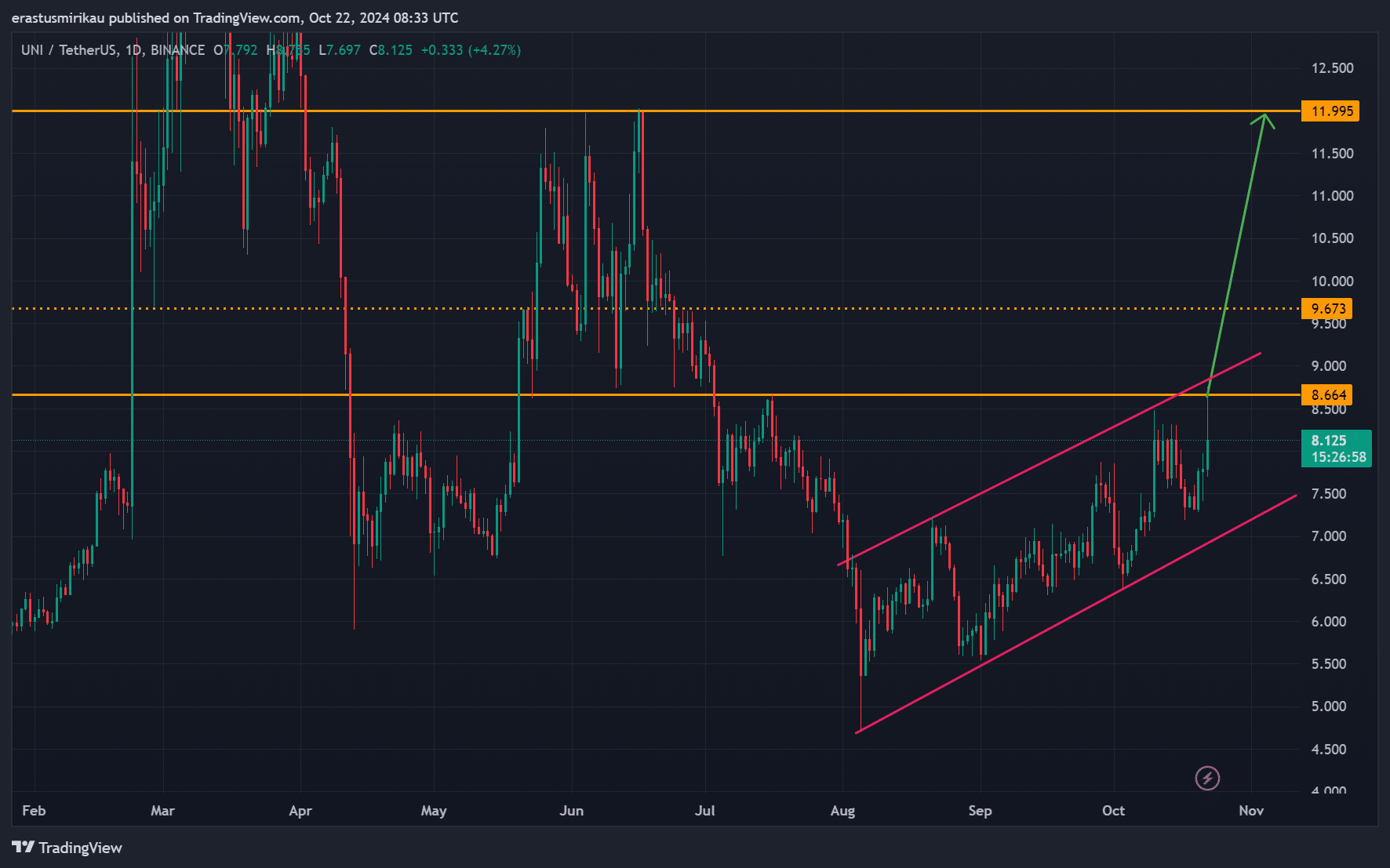

UNI chart analysis: Is a breakout imminent?

Each day’s graph suggests that Uniswap could be on the verge of bursting out from its upward-sloping trendline. At present, the token is probing the significant barrier at around $8.66, a point that has thwarted past efforts to climb further upwards.

Breaking this barrier would set the stage for UNI to challenge the $9.67 resistance.

Should the current level exceed $8.66, there’s potential for the price to rise towards $11.99. But if Uniswap doesn’t manage to surpass this threshold, a drop back towards support around $7.50 might occur. This could be more likely if the general market shows signs of weakness.

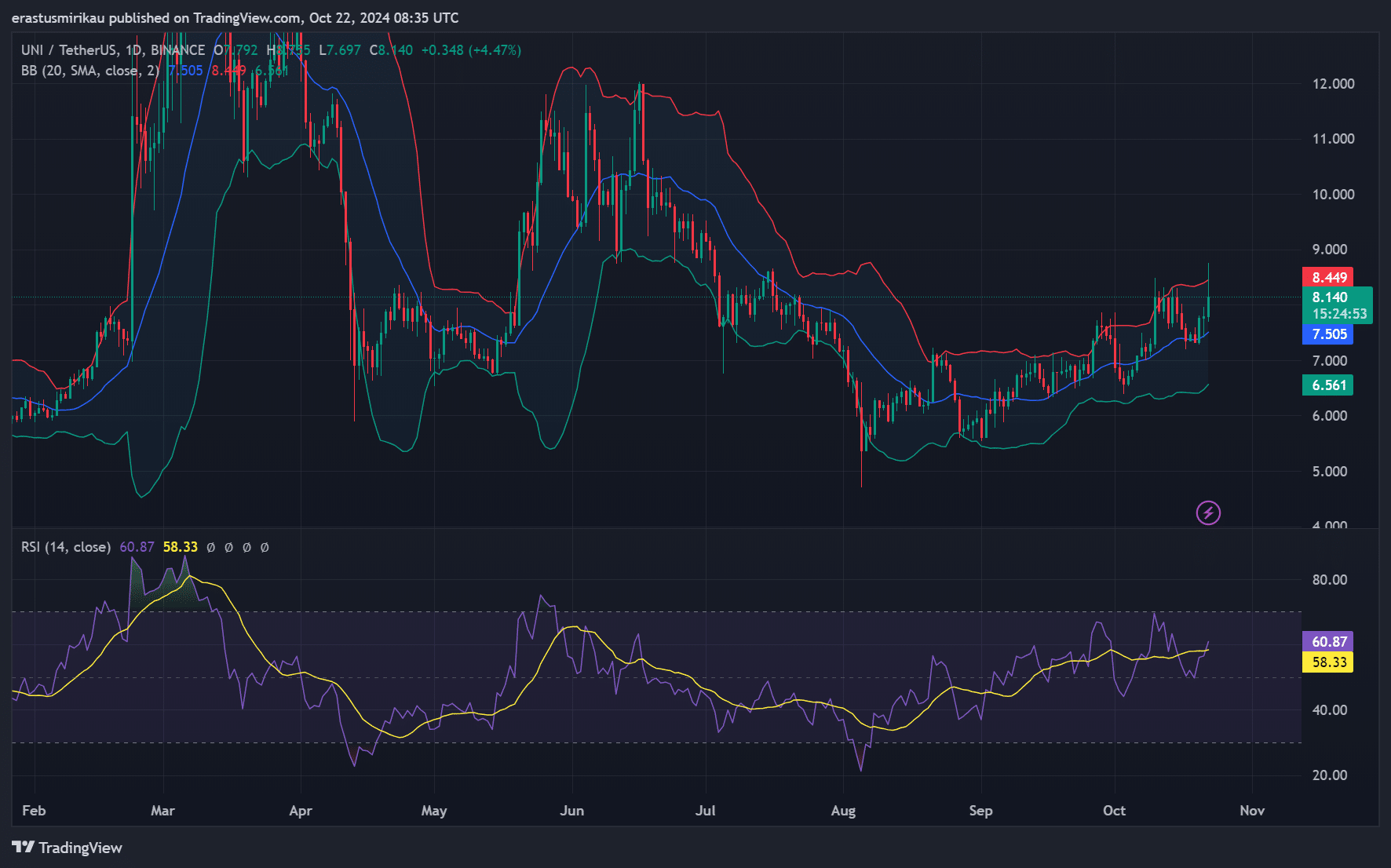

UNI technical indicators: How do BB and RSI align?

Technically speaking, Uniswap appears to be moving towards its upper Bollinger Band limit, suggesting a rise in volatility and possibly further price growth. Meanwhile, the Relative Strength Index (RSI) sits at 60.87, slightly below the overbought zone.

It seems that the bulls might continue pushing prices upwards for now, but there’s a potential danger of the upward trend slowing down or even reversing if the Relative Strength Index (RSI) nears 70. This could potentially trigger a temporary decline.

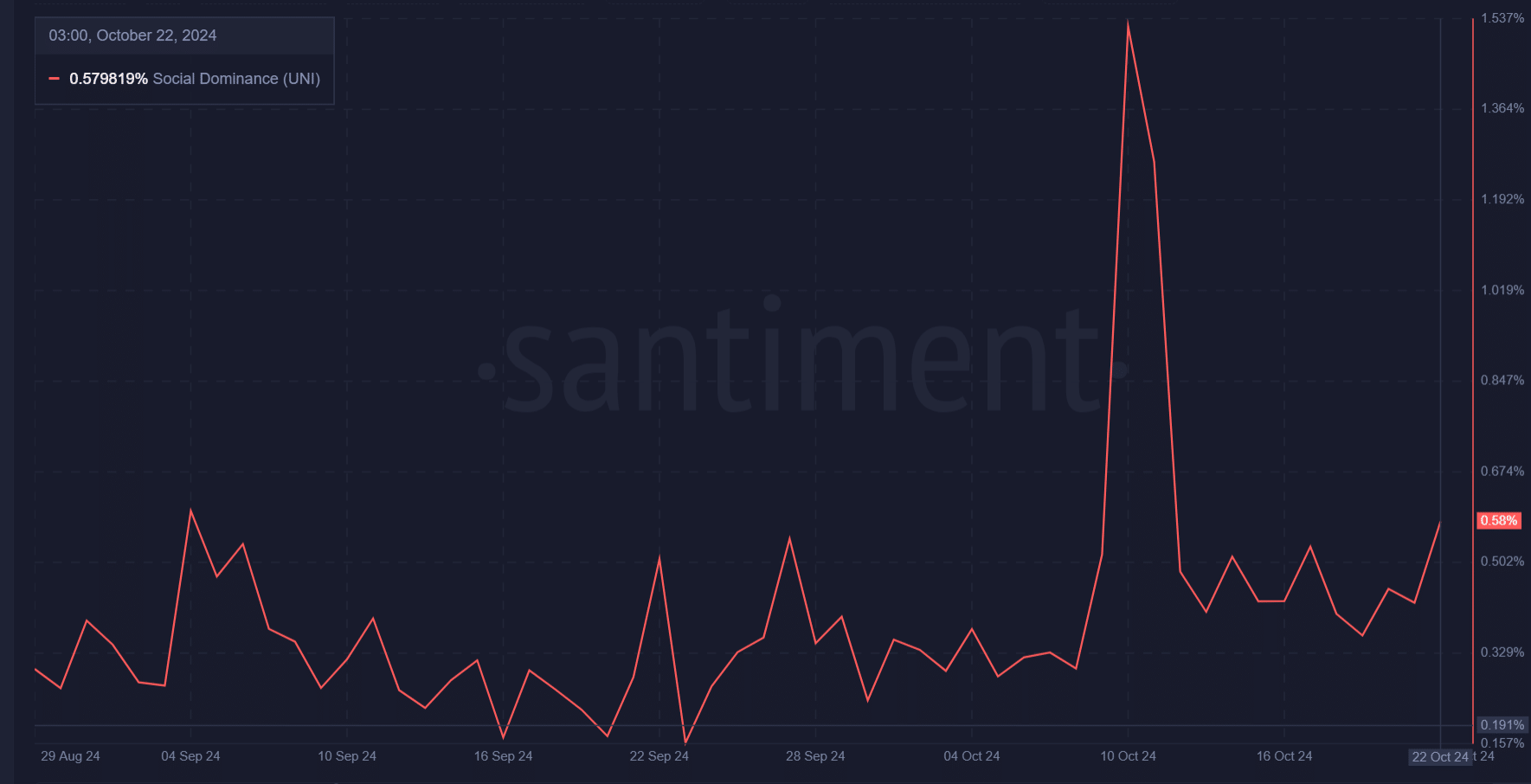

UNI social dominance: What does sentiment suggest?

The social influence of UNI has risen to 0.579%, suggesting an expanding role in community conversations and trader opinions. This rise is subsequent to a substantial surge observed earlier this month, signaling the sustained curiosity about Uniswap’s listing on Upbit and recent market fluctuations.

As a result, the rise in social dominance indicates growing interest from the crypto community, potentially leading to additional price increases since more traders are keeping a close eye on UNI.

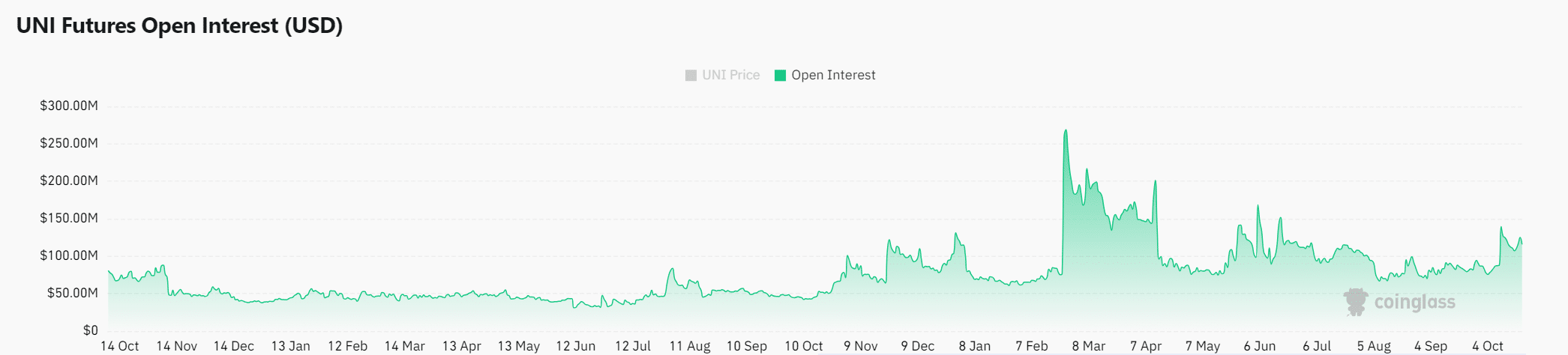

Open interest surges: Will it drive price higher?

Beyond just the upward trend in prices, it’s worth noting that the number of outstanding contracts for UNI has risen by 11.76% to hit $129.94 million. This significant growth indicates an influx of new traders joining the market, likely due to their expectations of a bigger price movement ahead.

Therefore, growing open interest indicates rising confidence in a bullish continuation.

To sum up, UNI seems ready to make a significant leap, but it needs to surpass the $8.66 barrier first to aim for $9.67 and possibly reach $11.99. The technical indicators are in alignment and the market sentiment is positive, suggesting that UNI could see more growth ahead.

On the other hand, for the bulls to prevent a decline, they must maintain their strength. Therefore, traders ought to closely monitor the price movements of UNI in the forthcoming days.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- LUNC PREDICTION. LUNC cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-10-22 19:35