- BNB is trading on an upward trendline, with potential to break $615 resistance and surge to $700.

- Technical indicators like RSI and open interest suggest further price movement, signaling a possible rally ahead.

As a seasoned crypto investor with scars from the 2017 bull run and the 2020 crash etched deeply into my financial psyche, I can’t help but feel a sense of cautious optimism when I look at BNB’s current market performance. The token’s recent upward trendline, backed by technical indicators like RSI and open interest, suggests that we might be on the cusp of another bullish phase.

Starting in October, the digital currency known as BNB (Binance‘s native coin) has been steadily climbing. Following some ups and downs throughout September, including a drop to around $477 at one point, this token has bounced back and is currently regaining its initial losses.

The comeback we’ve seen is largely driven by a positive market sentiment, which has significantly boosted Binance Coin’s standing within the industry.

Over the past two weeks, BNB has seen a 5.5% increase in value, with a 2% rise in the past week alone. However, despite this positive momentum, the token experienced a 1.9% pullback in the last 24 hours, bringing its current price to $595.

Prior to this, BNB hit a 24-hour high of $610.

Although there’s been a minor drop, BNB’s recent market trends hint at a potential surge in the forthcoming weeks.

Technical indicators point to further upside

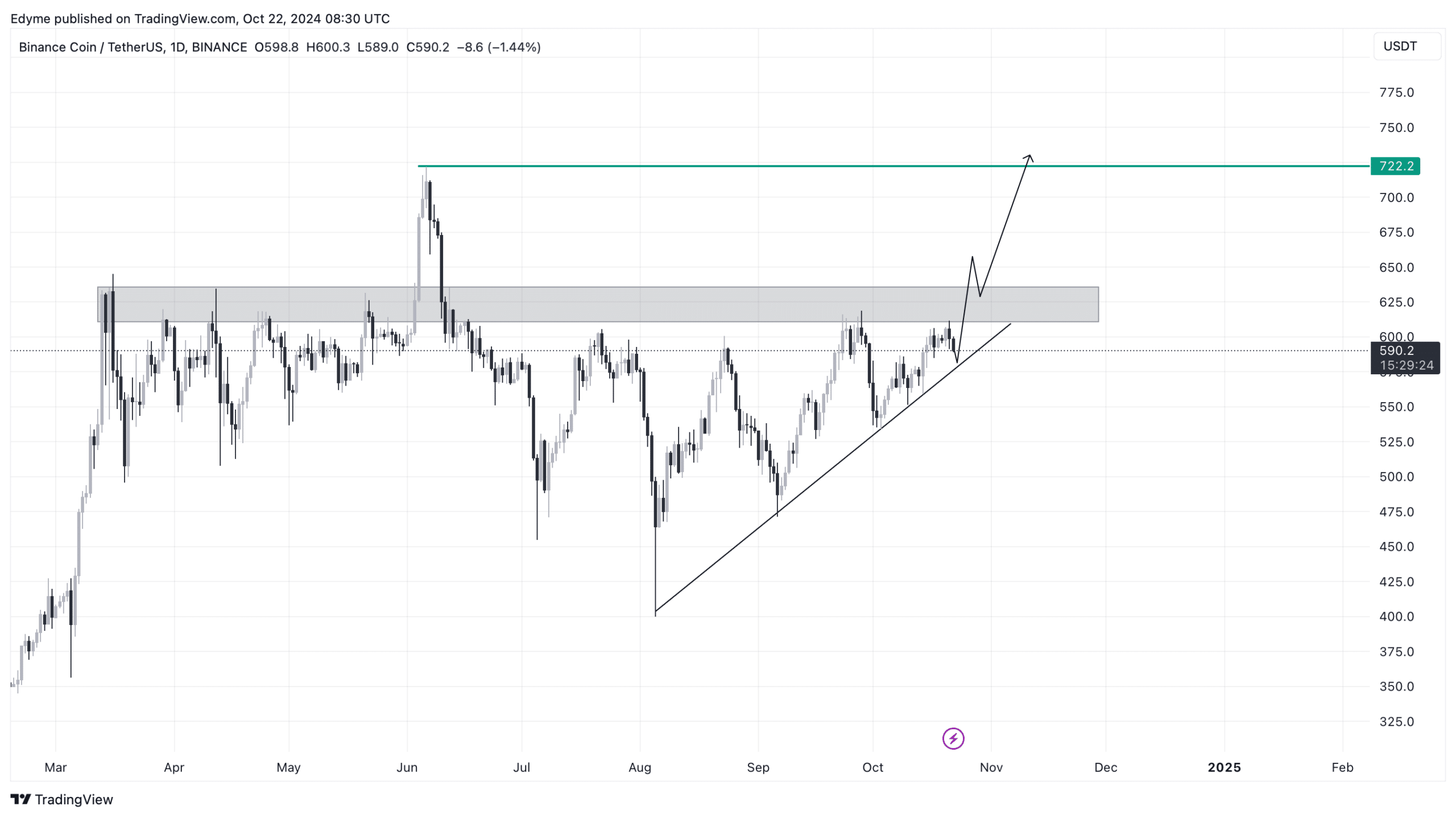

As an analyst, I’ve noticed that the day-to-day price chart of Binance Coin (BNB) shows a consistent upward trajectory. Such a trend usually suggests ongoing growth. Interestingly, this upward trendline has functioned as a robust safety net, preventing BNB’s price from dipping below it in the past few weeks.

Should the asset continue on its current path, it may attempt to breach the upcoming significant resistance at approximately $615. This is an important region where the price has historically encountered resistance.

Breaking through this level with success might pave the way for the asset to soar up to around $700, possibly reaching its previous high of $722 in June.

A rising trendline, such as the one seen in Binance Coin’s (BNB) recent market activity, is a significant technical indicator of a potentially bullish market. This pattern emerges due to recurring higher bottoms, implying that investors are increasingly purchasing the asset at progressively higher price points to boost its value.

If a cryptocurrency’s value persistently climbs along an ascending graph line, this suggests that there is continuous demand to buy the asset, potentially resulting in a leap over the resistance barriers.

For BNB, this trendline has been stable for quite a few weeks now, suggesting a possible continuation of its upward trajectory.

Fundamental outlook on BNB

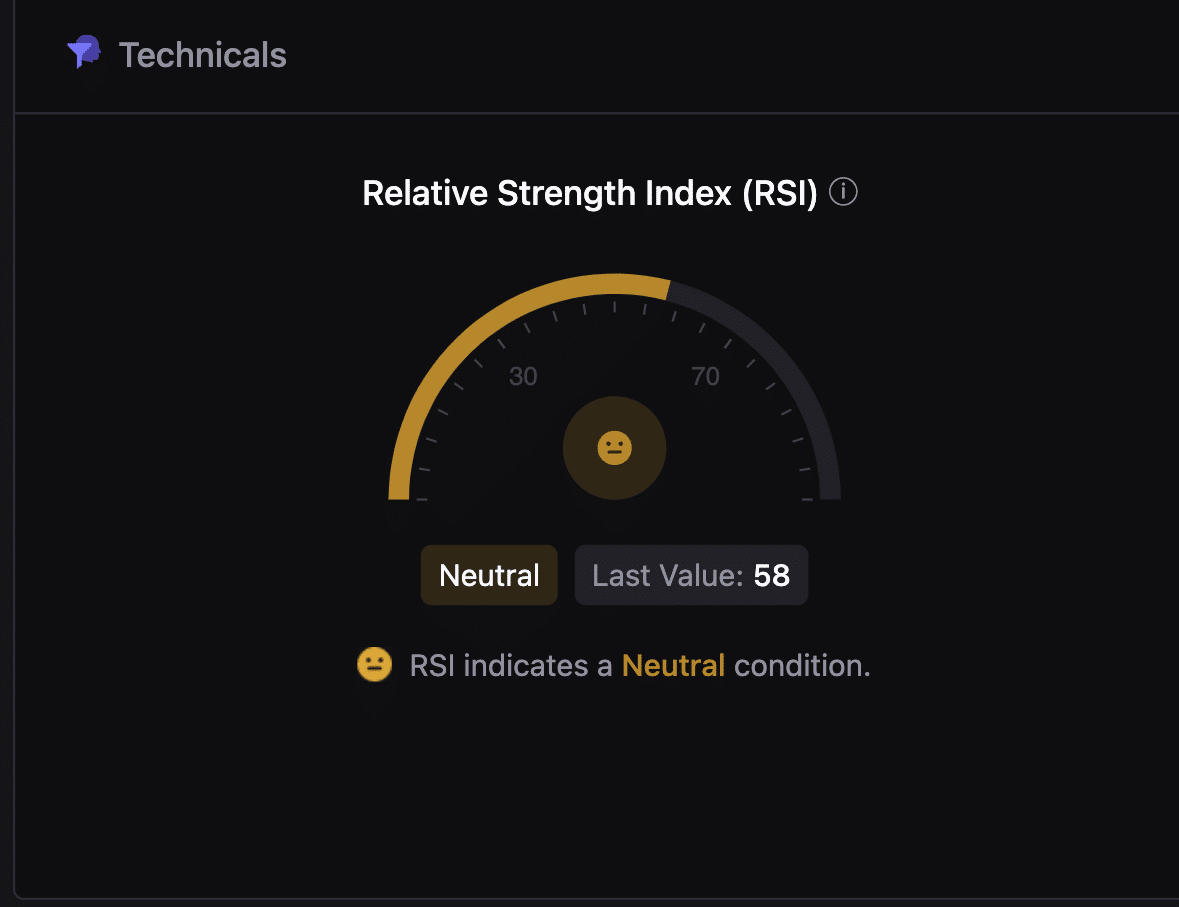

Besides technical trends, another clue hints at possible future growth. One of these signs is the Relative Strength Index (RSI), a tool that measures the rate and direction of price fluctuations, often called a momentum oscillator.

In simpler terms, the Relative Strength Index (RSI) can vary from 0 to 100. If the value is above 70, it’s often seen as an overbought market, meaning the asset might be due for a correction. On the other hand, when the RSI is below 30, it suggests an oversold market, indicating potential for the asset to rise. At the moment, BNB’s RSI is at 58, which indicates a balanced or neutral market condition.

At this stage, the Binnacle Coin is not yet oversold, suggesting there may be potential for further price increases as it hasn’t reached a point where substantial selling pressure becomes a concern.

Additionally, data from Coinglass reinforces the optimistic perspective by indicating a somewhat ambiguous trend in BNB’s open interest.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

As a researcher, I’ve noticed an intriguing shift in Binance Coin (BNB) derivatives market. The total number of ongoing contracts, or the open interest, has dipped by 3.27% to stand at approximately $541.43 million. However, contrary to this decrease, the open interest volume has experienced a significant rise, jumping by an impressive 38.94%, reaching a new high of $645.18 million.

The rising amount of open interest indicates a surge in the number of market players and their activities, implying that traders are preparing to take advantage of possible future price fluctuations in BNB.

Read More

2024-10-22 23:36