- Bitcoin was still in the accumulation zone at press time.

- Long-term investors have good reason to be excited about this cycle’s price performance.

As a seasoned researcher who has witnessed the crypto market’s rollercoaster ride for years now, I must say that the current state of Bitcoin [BTC] is intriguing. The recent breakout from the descending channel and the strong bullish signs such as the “Super Signal” and heavy inflows into Bitcoin spot ETFs have certainly sparked a sense of optimism in me.

🚨 BREAKING: Trump's Tariffs May Rock EUR/USD!

Shocking new analysis predicts massive volatility ahead. Markets brace for impact!

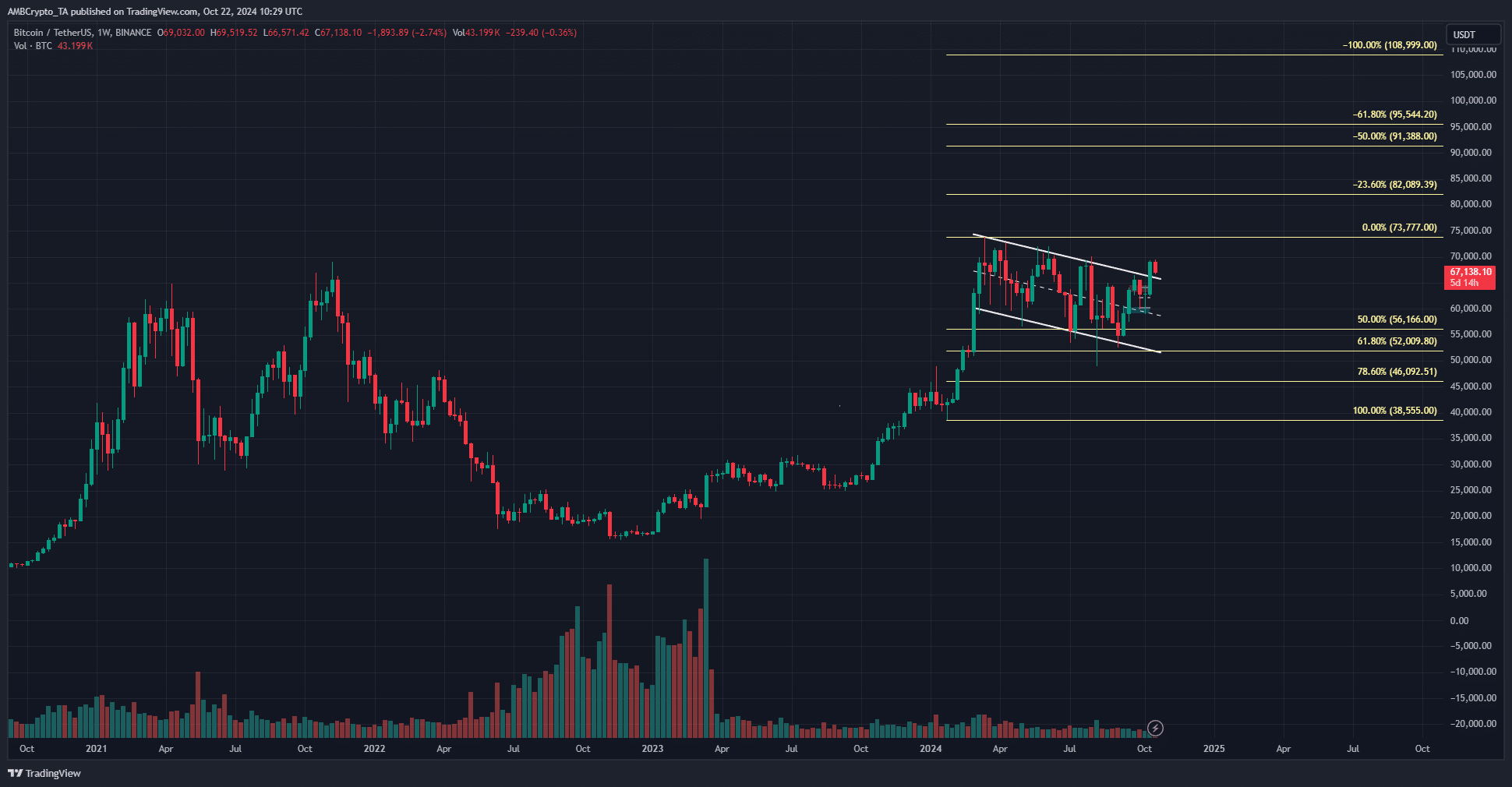

View Urgent ForecastBitcoin (BTC) saw another upward trend. Even though its overall pattern for the week remains bearish, breaking through the descending channel has given optimism to buyers. The “Super Signal” it exhibited lately is considered a powerful positive signal for the bulls.

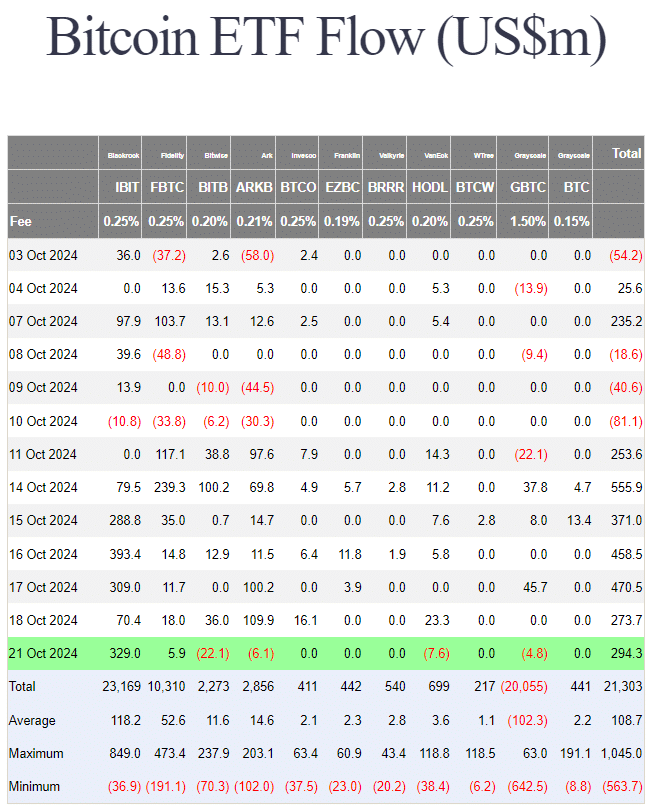

As a researcher, I have observed an intriguing trend in the data provided by Farside Investors. Last week witnessed substantial investments flowing into Bitcoin spot Exchange-Traded Funds (ETFs). Despite these optimistic movements, the value of Bitcoin stayed below the $70k mark.

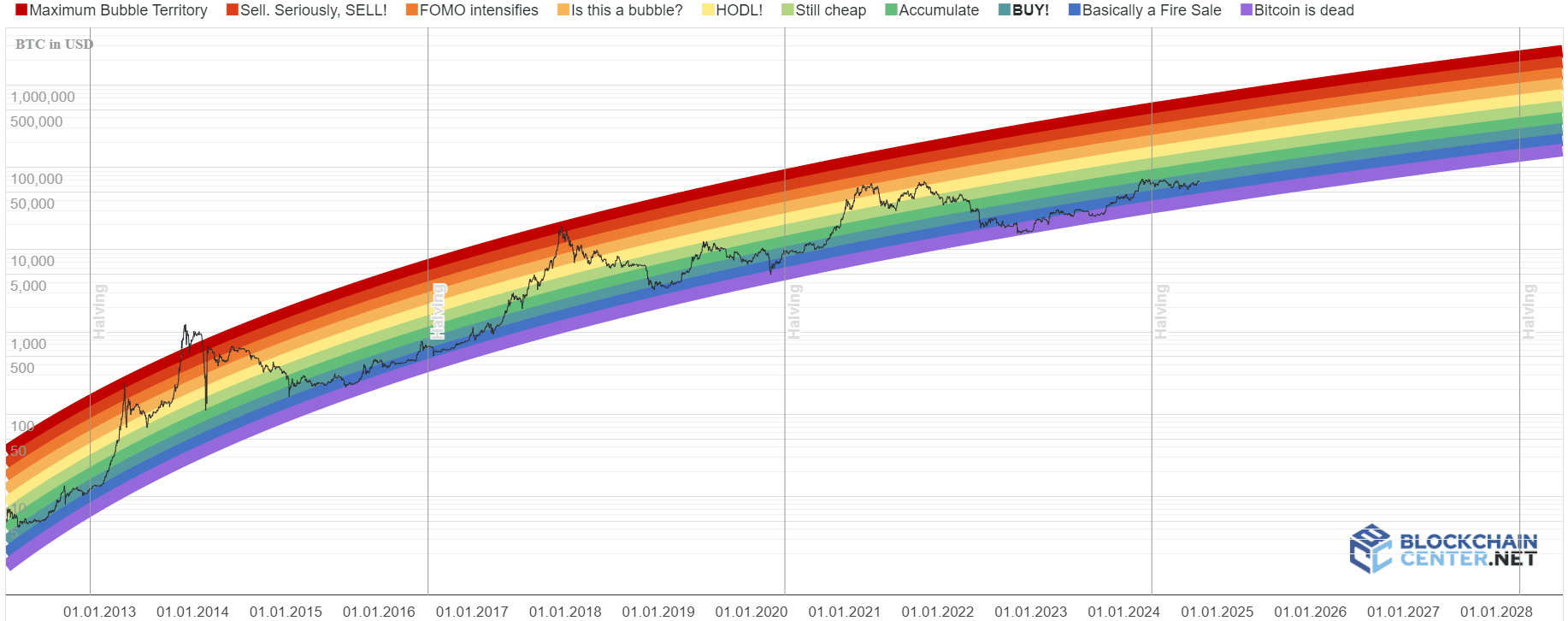

Bitcoin Rainbow Chart strongly advocates buying

The Bitcoin Rainbow Chart is a fun way to look at the price movements of the king of crypto across different cycles. It doubles up as a tool that can be used to assess current long-term bias, and potentially forecast the next cycle’s top.

The chart uses a logarithmic scale to represent the different price bands of BTC and gives a quick insight into whether it is a good time to buy.

It might seem unexpected since Bitcoin is only about 10% short of its All-Time High (ATH), but the Bitcoin Rainbow Chart indicates that it’s still in the “BUY!” range. The risk associated with buying is minimal, and investors should adopt a ‘HODL’ approach, which means holding onto their investments for the long term.

Previously, Bitcoin hit a record high price and then experienced a significant drop approximately 336 days following the halving event. This new peak was attained around the 18-month mark.

Should events unfold much like they have been recently, it’s predicted that by March 2025, the value of Bitcoin could potentially soar to around $288,000. At such a level, there might be questions about whether it’s experiencing a bubble.

A closer look at the weekly chart

The findings from the Bitcoin Rainbow chart were enormously bullish. Bulls just need to HODL for 6–9 months more.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Analysis of the weekly graph revealed a breakout from the downward sloping channel, indicating potential future price objectives.

For our current strategy, the aim is to reach either $82,000 or $95,500. Currently, we’ve already retracted to about 61.8% of the original movement. Breaking through the sequence of lower highs, with the initial break happening at around $70,000, would be an encouraging first step in our progression.

Read More

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- Gold Rate Forecast

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- OM PREDICTION. OM cryptocurrency

- Why Gabriel Macht Says Life Abroad Saved His Relationship With Family

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- EUR PKR PREDICTION

- Top 5 Hilarious Modern Comedies Streaming on Prime Video Now!

2024-10-23 06:15