- Helium has gained 12% in seven days and has outperformed most DePIN tokens.

- The RSI rose above 50 earlier this week for the first time in more than two weeks as buying pressure increased.

As a seasoned researcher with over a decade of experience in the ever-evolving world of cryptocurrencies, I find myself intrigued by the recent performance of Helium [HNT]. While the broader market has been gripped by bearish sentiments, HNT has managed to defy these trends and surge by 12% in just seven days. This is particularly noteworthy given its impressive outperformance of most DePIN tokens and even Bitcoin [BTC] in the last 24 hours.

Despite a generally gloomy outlook for cryptocurrencies as a whole, Helium [HNT] bucked the trend with a 3% increase to reach $6.88 at the moment of reporting. This growth has propelled HNT upward by around 12% in just one week.

In the past 24 hours, Helium Network Token (HNT) has surpassed Bitcoin [BTC] in performance and is currently one of the leading tokens in the category of decentralized physical infrastructure (DePIN).

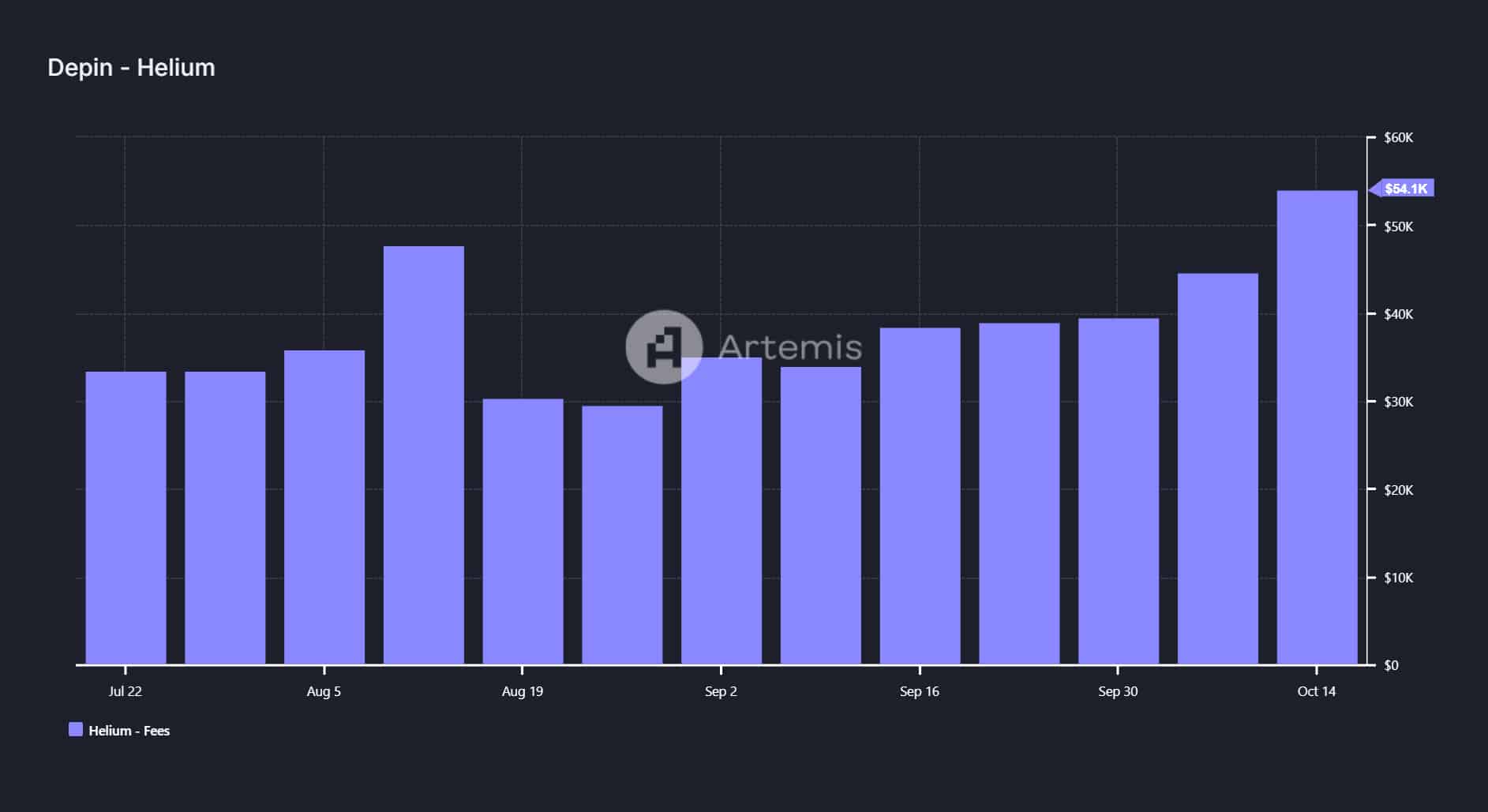

Over the past period, we’ve seen a surge in price (uptrend) corresponding to an increase in network activity. Interestingly, data gathered by Artemis indicates that the weekly transaction fees on Helium hit their highest point in the last three months.

The surge in costs and prices has rekindled optimistic feelings, potentially leading to a 12% rise in prices.

Bullish signs for HNT

Lately, positive trends surrounding HNT are indicating optimistic signals, as it’s bouncing back in a V-shape pattern on the daily graph. Essentially, this suggests that Helium is experiencing a robust recovery following a steep drop in its price.

As a crypto investor, I find it beneficial when the Moving Average Convergence Divergence (MACD) crosses above its signal line, signaling a potential bullish trend for me to consider capitalizing on.

However, the MACD line remains negative, showing that while bulls are gaining strength, the overall trend remains bearish.

The MACD histogram bars have flipped to green amid rising buying pressure.

As a researcher, I’ve observed an intriguing development: The Relative Strength Index (RSI) surpassed 50 for the first time since early October this week, indicating a surge in bullish momentum. This technical indicator points northward, signaling that the upswing in HNT is being driven by active buyers.

If the purchasing trend persists, Helium Network Token (HNT) might increase by approximately 12% and reach around $7.81 – a level corresponding to the 1.618 Fibonacci ratio from its current price.

As a researcher, I find myself observing that at the current price point, HNT seems to have concluded its V-shaped recovery. If the market’s optimism persists, there’s a strong possibility that it might continue climbing upward.

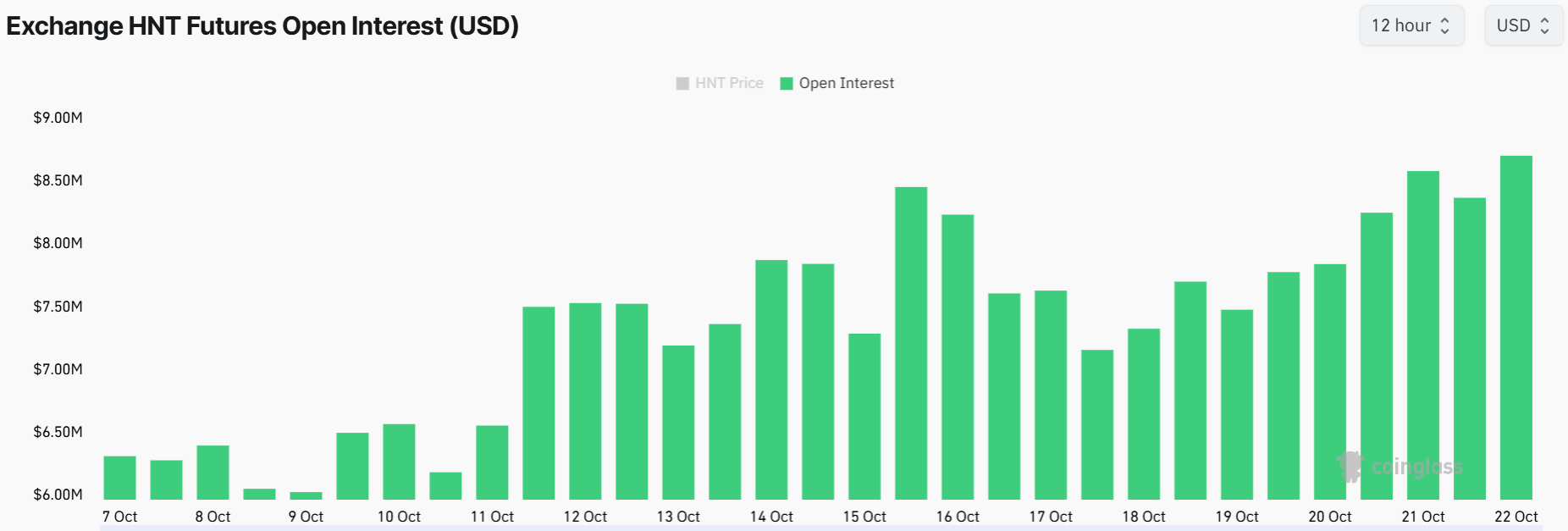

Rising activity in the derivatives market

Data from Coinglass shows that HNT is attracting interest from derivative traders. Futures trading volumes had increased by 60% at press time, while Open Interest spiked by 3% to its highest level in nearly three weeks.

As a researcher observing the market trends, I notice an upward trend in Open Interest, indicating heightened speculative activity surrounding Helium. This escalation might lead to increased volatility in the future.

As a researcher, I’ve noticed an intriguing equilibrium in our analysis: The Long/Short Ratio stands at approximately 1.04. This balance between long and short positions implies that even with recent positive movements, short sellers are refraining from initiating new shorts, indicating their faith in the ongoing uptrend.

Read Helium’s [HNT] Price Prediction 2024–2025

In addition to increased excitement in the futures market, a favorable overall outlook might also contribute to Helium’s upward trend.

Market Prophit’s data indicates that public opinion regarding Helium is optimistic, but sophisticated investors are maintaining a pessimistic stance.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

2024-10-23 07:52