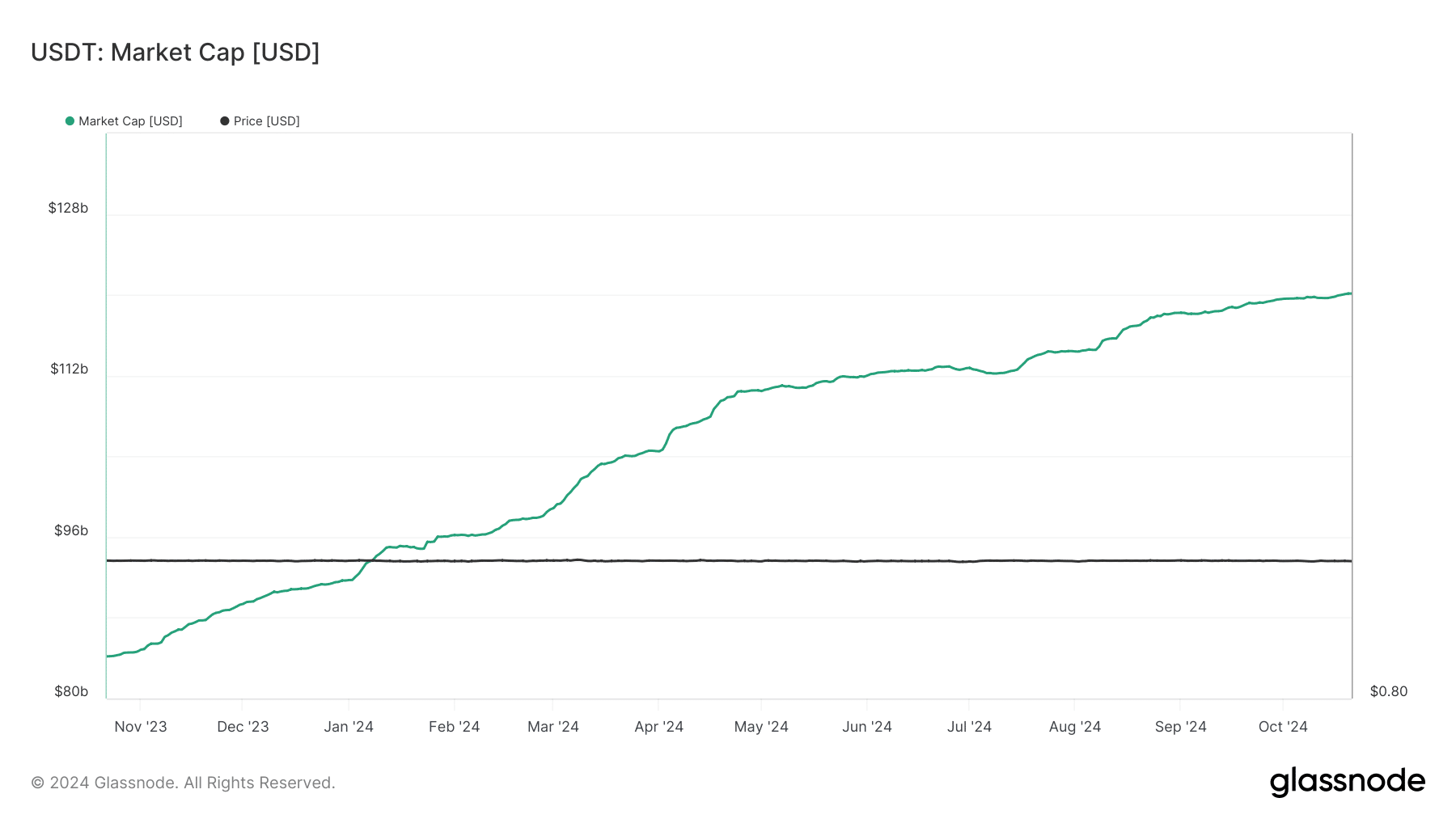

- USDT’s market cap has grown by over $28 billion in the past nine months.

- Tron dominates USDT transaction volume, capturing over 70%.

As a seasoned researcher who has witnessed the evolution of blockchain technology and digital assets, it’s fascinating to observe the remarkable growth of USDT’s market cap. Over the years, I’ve seen many projects rise and fall, but USDT’s consistent expansion is truly noteworthy.

The USDT market cap has hit an impressive $120 billion, reaffirming its dominance as the largest stablecoin by market cap.

As an analyst, I’ve observed a persistent growth trajectory for USDT, even amidst increasing rivalry within the stablecoin market. Particularly noteworthy is its expansion on the Ethereum and Tron networks, where it consistently records substantial trading volumes and active user engagement.

USDT market cap surges to over $120 billion

Over the last few months, an examination of the U.S. Dollar Tether (USDT) market capitalization on Glassnode reveals a significant increase.

At the beginning of this year, the market value of USDT was around $92 billion. Now, as we speak, it’s over $120 billion. In other words, within nine months, USDT has gained an impressive $28 billion in market value, a testament to its robust demand and usage.

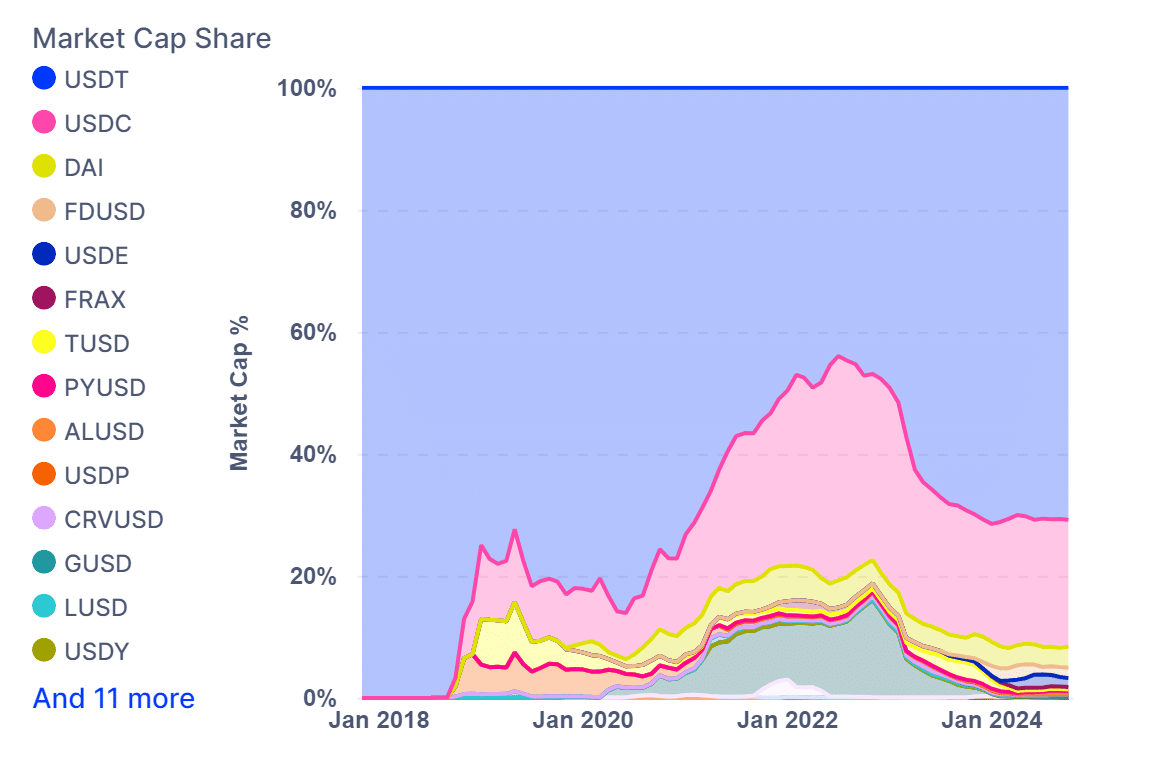

USDT’s market cap dominates other stablecoins

Based on figures from IntoTheBlock, USDT currently ranks first in terms of market value and is also the most actively traded among all stablecoins.

The majority of USD Tether’s transactions take place on both the Ethereum and Tron blockchain networks, with over three-quarters (70%) of its total transaction volume happening on the Tron network.

Despite Ethereum’s popularity for handling USDT transactions, its relatively high transaction fees have driven many users towards Tron, a platform that boasts lower costs and quicker processing times.

As platforms like Arbitrum and Optimism expand their capabilities, they’re now facilitating transactions using Tether (USDT), thereby increasing its influence across multiple blockchain ecosystems.

In comparison, USDT, a rival to USDC, leads in terms of market value and transaction volume, further reinforcing its dominant position.

What’s next for USDT?

Reaching over $120 billion in circulation, USD Tether (USDT) is encountering growing challenges from rival stablecoins such as USD Coin (USDC), as they vie for dominance in the digital currency market.

Yet, due to its substantial liquidity, robust user community, and cross-blockchain presence, USDT appears poised to continue leading the way in the realm of stablecoins.

The success of USDT in the long run hinges on its aptitude to handle changing regulatory issues and uphold openness about its reserve holdings. Yet, without any indications of letting up, USDT remains dominant in the stablecoin sector, reinforcing its position.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-10-23 08:07