- TON’s user base drops sharply, but past trends suggest potential for another explosive surge.

- With 91% of tokens in large holders’ control, TON faces centralization concerns amidst bearish indicators.

As a researcher with years of experience studying cryptocurrency markets and their trends, I find myself intrigued by the current state of TON. The recent drop in daily active users has certainly raised some eyebrows, but I’m not one to jump to conclusions too quickly.

The number of daily active users on the TON network has significantly decreased, going from more than 5 million at its highest point to approximately 1.58 million as reported by IntoTheBlock’s data.

This considerable drop has sparked discussions over whether the initial excitement is waning, or if a fresh wave of growth is imminent.

Over time, the number of TON’s daily active users has experienced significant surges, often linked to particular events or overall market enthusiasm. During the first stage, from late October through mid-December, there were no substantial increases in user activity.

During the span from late December up until mid-March, there was a steady rise, suggesting an increasing level of user curiosity.

From mid-March until late April, there was a significant surge in the number of daily active addresses, likely due to rising prices and increased market excitement. This time frame, from May up until early July, exhibited some volatility, with brief spikes occurring occasionally.

Between late August and early October, there was a significant increase noticed, reaching the peak levels recorded throughout the entire year.

Yet, user activity has recently declined, settling at 1.58 million—though it remains higher than early levels.

Price trends and concentration

At the moment of reporting, TON’s price stood at $5.26, marking a 0.34% drop over the last day and a 2.11% rise in the previous week. The trading volume currently amounts to about $299.64 million, with the total market capitalization roughly equating to $13.32 billion.

Remarkably, a significant portion (around 91%) of this token’s total supply is controlled by major investors, suggesting a high degree of control or ownership concentration among them, which is indicative of a highly centralized system.

73% of investors find themselves in a financial loss when it comes to TON, while just 15% are currently profitable. This cautious outlook persists among market participants. Moreover, the correlation between TON’s price and that of Bitcoin is relatively low (0.12), suggesting that TON’s price movements are not heavily influenced by fluctuations in Bitcoin’s price trends.

During the last seven days, transactions over $100,000 amounted to a staggering $42.01 billion. However, there was an overall outflow of funds from exchanges worth $8.81 million, indicating that more TON tokens were leaving exchanges than entering them.

On-chain metrics remain mostly bearish

Based on on-chain analysis for TON, the overall sentiment appears predominantly bearish. Three key factors contributing to this are:

The sole bullish indicator is net network growth (+2.97%), hinting at potential user expansion despite current downturns.

Read Toncoin’s [TON] Price Prediction 2024–2025

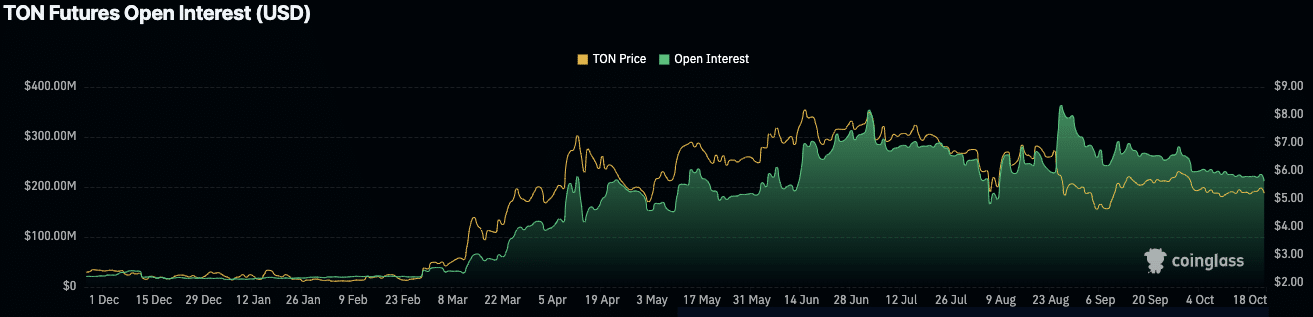

The amount of commitments made by traders on futures contracts, as indicated by Coinglass data, has experienced fluctuations as well. It peaked at over $300 million at the start of August, but has since fallen to $214.18 million, representing a 1.99% reduction in current trading.

Although the current indicators point towards a cooling phase, history has shown that TON’s user base has a tendency to grow swiftly when there is renewed interest or significant market events occur.

Read More

2024-10-23 12:08