- Bitcoin Cash bulls have been a no show after a promising mid-month performance.

- Assessing BCH ownership and address stats.

As a seasoned researcher with years of experience in the cryptocurrency market, I have seen my fair share of bull runs and bear markets. The mid-October bounce in Bitcoin Cash (BCH) was indeed promising, but the subsequent lackluster performance has left me somewhat skeptical.

After Bitcoin Cash (BCH) experienced a significant price surge around mid-October, some investors might be wondering if it’s still a good idea to invest. A large one-day price increase can sometimes indicate whale accumulation. However, Bitcoin Cash has failed to maintain this bullish momentum since then.

Bitcoin Cash has been steadily distancing itself from its recent August lows, indicating a potential recovery following its previous slump. The significant price increase around the middle of October (14th) had fueled anticipation and renewed interest in the cryptocurrency.

Since that point, Bitcoin Cash has found it difficult to maintain further growth, suggesting a decrease in demand during this period. Selling pressure was relatively light, thus enabling Bitcoin Cash to preserve much of its mid-month advancements. At the moment of reporting, Bitcoin Cash is trading at approximately $258.6.

A lack of strong selling could suggest that those who made significant purchases in the middle of the month haven’t cashed out yet. This suggests that their optimistic views persist, but it doesn’t guarantee that Bitcoin Cash (BCH) will keep rising.

But what does on-chain data say about this?

No signs of strong Bitcoin Cash accumulation?

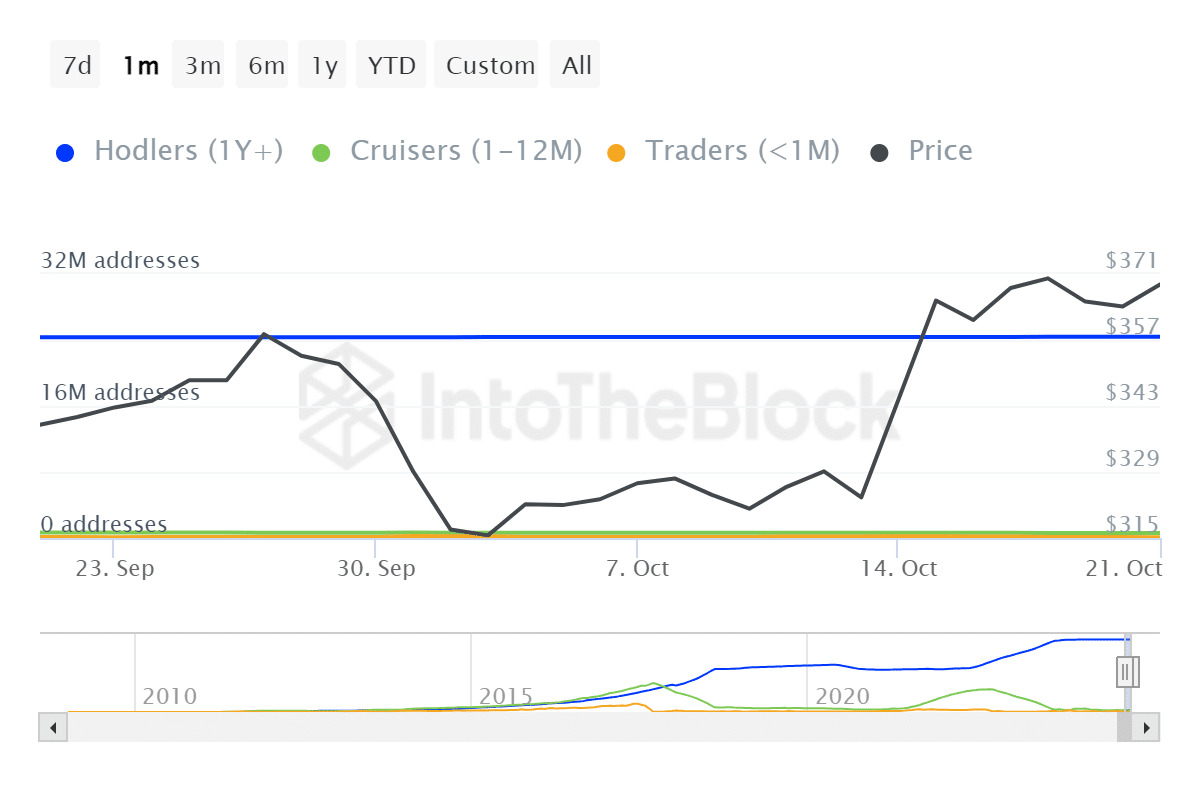

Data on ownership shows a slight increase in the number of HODLers since mid-October. Initially, there were approximately 24.34 million HODLer addresses on September 24th, which has now grown to about 24.39 million addresses.

The number of cruisers decreased significantly from approximately 653,710 locations on September 22nd, down to 618,460 locations. Similarly, traders saw a decrease in their numbers, going from around 107,640 addresses to 94,820 addresses during the same timeframe.

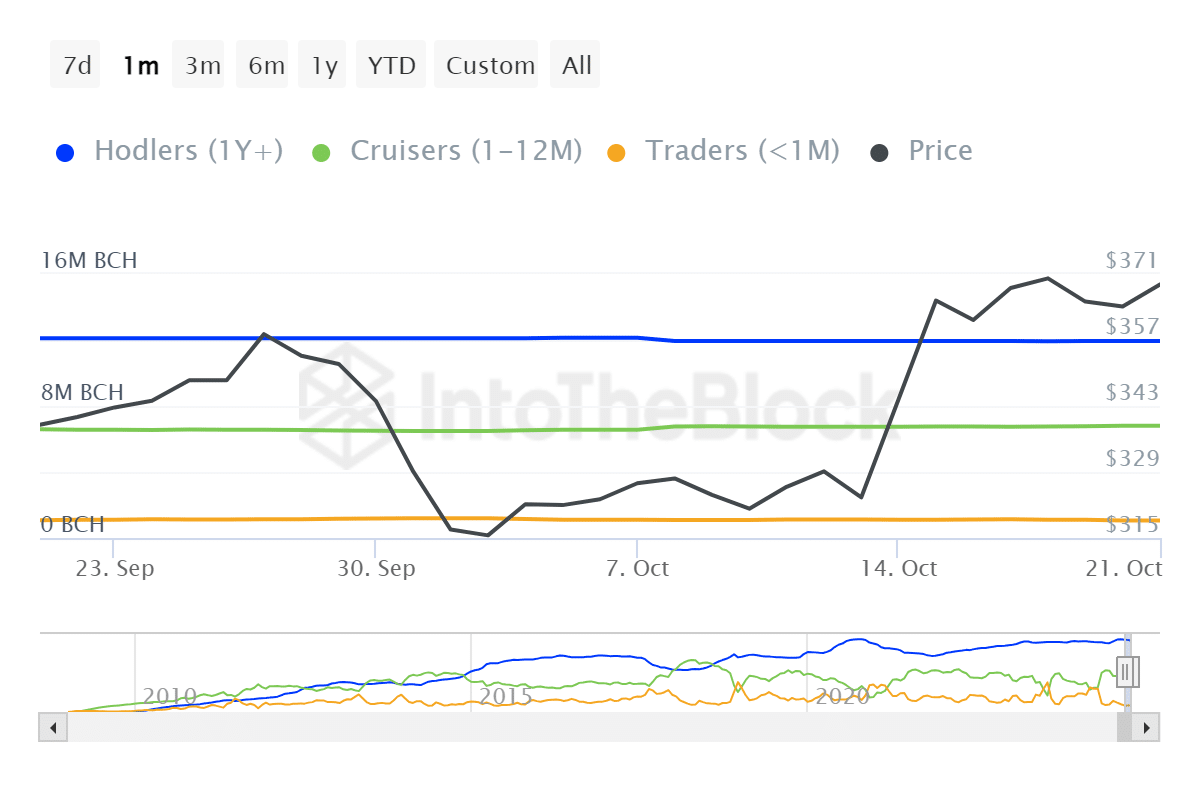

The data indicates a transition towards long-term strategies, with fewer addresses in use. However, regarding activity since the midweek surge, holder balances have slightly decreased from 11,940,000 BCH to 11,930,000 BCH, which could imply that some users may have chosen to cash out.

During the given timeframe, the amounts held by cruisers increased, moving from 6.75 million BCH to 6.8 million BCH. Meanwhile, trader balances decreased, going from 1.11 million BCH to 1.07 million BCH based on recent information.

As a crypto investor, I haven’t seen clear-cut signs yet that there’s significant accumulation happening in the market.

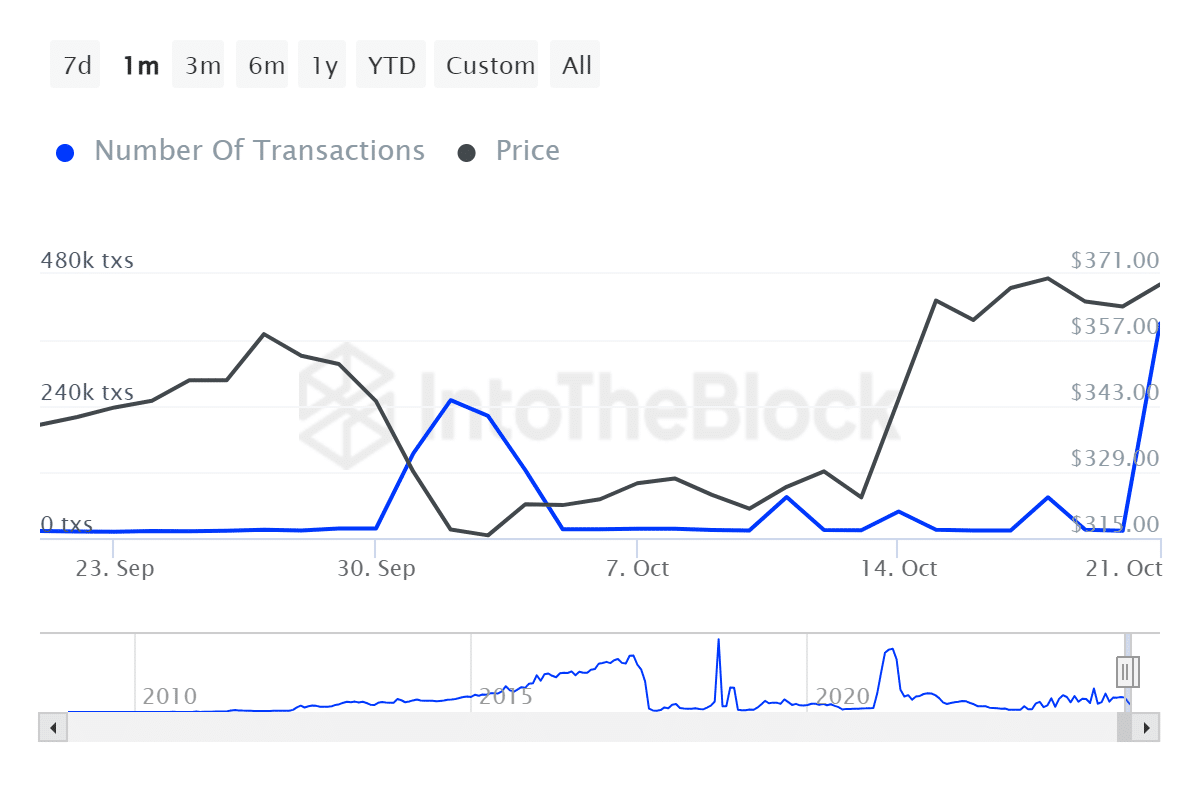

Lately, there seems to be a surge in positive trading during the middle of the month that might have aimed to stimulate more activity. Notably, Bitcoin Cash has seen its highest level of transactions since the middle of August.

Read Bitcoin Cash’s [BCH] Price Prediction 2024–2025

Transactions increased significantly, jumping from approximately 13,000 on October 20th to more than 368,000 on October 21st. It remains uncertain if this sudden increase in transactions and the rise around mid-month are connected.

Nevertheless, this renewed surge in transaction activity may offer more confidence to investors.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-10-23 13:11