- ETH pulled back below $2,600 after encountering strong resistance above $2,700.

- The pullback could be a trap that could set ETH up for a potential short squeeze as leverage soars.

As a seasoned crypto investor with a knack for spotting market trends, I must admit that the current Ethereum [ETH] situation has piqued my interest. The recent pullback below $2,600, while bearish at first glance, could potentially set the stage for an intriguing short squeeze.

On its third straight day, Ethereum [ETH] has been experiencing a downtrend following an obstacle at around $2700. Yet, some are suggesting that this decline could be temporary.

According to a recent study by CryptoQuant, the number of ETH positions taken with the expectation of falling prices has significantly increased beyond the $2,700 mark.

As a researcher observing the market dynamics, I can confirm that the anticipated price retracement indeed occurred at the previously resistant level. At present, it seems that selling momentum is stronger than buying interest, causing the price to dip down to $2584, as observed at this moment.

The analysis warned that the surge in shorts and appetite for leverage could expose ETH to a short-squeeze scenario.

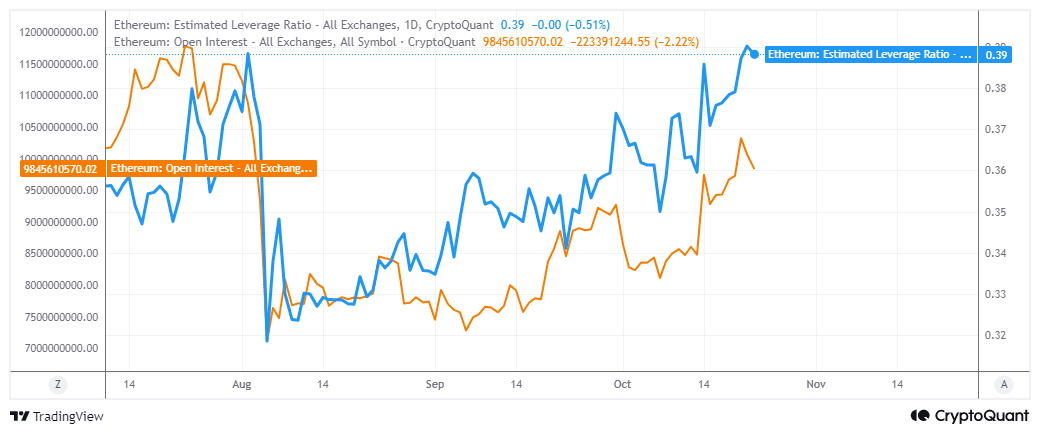

The open interest on Ethereum has been steadily increasing since September 6th, suggesting a resurgence of enthusiasm towards the derivatives market.

More importantly, ETH’s estimated leverage ratio recently soared to levels last seen in early July.

Source CryptoQuant

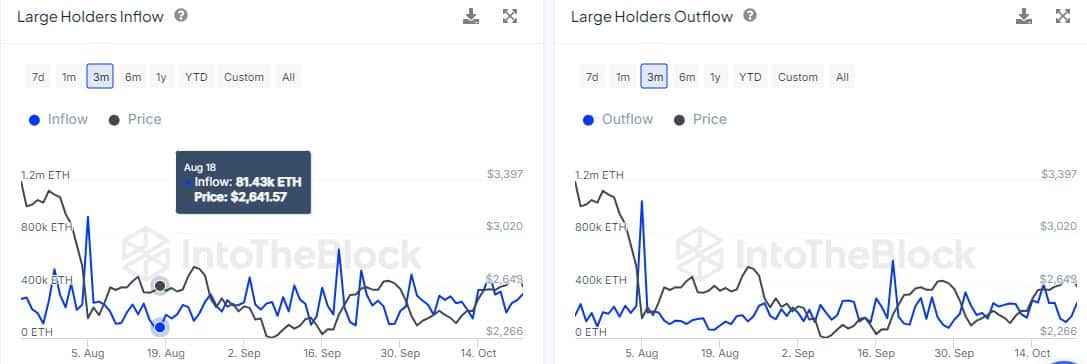

An increase in heavily shorted positions might create a ripe environment for large investors (whales) to manipulate the market by driving prices higher. However, how likely is such an event?

Assessing ETH demand to establish a short squeeze

A clear indication that a short squeeze might occur is when large investors (often referred to as ‘whales’) begin actively buying up more shares.

Based on data from IntoTheBlock, there was an increase in Ethereum moving to larger wallets. Specifically, from 194,280 ETH on October 19th, this figure rose to 335,870 ETH by October 22nd.

This confirmed that large holders have been accumulating more ETH as prices dipped.

Instead, we see a significant increase in the amount of ETH held by large entities. On October 20th, this figure stood at 122,380 ETH, but by October 22nd, it had grown to 267,180 ETH.

During this timeframe, there were slightly more Ethereum transactions involving selling compared to those with net buying. This aligns with the downward trend in the Ethereum market prices observed during the same period.

Contrary to the prevalence of bears (negative market trends), major investors actually acquired more Ethereum tokens than they disposed of in the past 24 hours. They bought a total of approximately 68,690 ETH, equivalent to over $177 million.

As a crypto investor, I’ve noticed a trend that seems to indicate whales might be trying to rebound the prices.

Read Ethereum’s [ETH] Price Prediction 2024-25

In simpler terms, it appears the coin might have an exciting remainder of the week ahead, possibly featuring another surge and an effort to break through its current resistance level.

Ethereum has been subject to fluctuating circumstances, and there’s an increasing trend in Open Interest and demand for margin trading.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What You NEED to Know!

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

2024-10-23 17:44