- Balance on BTC accumulation addresses surged 93% in 2024, now holds $194 billion.

- Does the massive holding strategy signal a further price rally for BTC?

As a seasoned researcher who has closely observed the cryptocurrency market for several years now, I find the surge in BTC accumulation addresses to be a compelling sign of bullish sentiment. The nearly 2x increase in holdings within just 10 months suggests a significant shift in investor behavior and confidence in Bitcoin’s long-term potential.

According to investor trends predicted for 2024, it appears that the HODLing strategy is becoming increasingly popular when it comes to investing in Bitcoin [BTC].

Based on figures provided by CryptoQuant’s analyst Burak Kesmeci, there are currently approximately 2.9 million Bitcoins being held in accumulation addresses. This equates to a value of more than $194 billion, representing a nearly 2-fold (or 93%) increase from the amount held in January.

By January 2024, these addresses owned approximately 1.5 million Bitcoins. However, over the next ten months, this number almost doubled. They have been steadily amassing more Bitcoin, showing patience and courage, without cashing out their investment.

Is it a bullish cue?

In 2018, Bitcoin accumulation accounts owned approximately 100,000 coins. By the time of the 2021 bull market, these accounts had amassed a staggering 700,000 coins, showcasing a significant increase in ownership over time.

Nevertheless, Kusmeci pointed out that substantial growth was observed in the year 2024, marking an impressive increase of approximately 93%. This rise took the figure from 1.5 million in January to a significant 2.9 million.

Is it a bullish cue, perhaps signaling that holders expected a further BTC price appreciation?

It’s noteworthy that Bitcoin Exchange-Traded Funds (ETFs) tied to the U.S. market were introduced in January 2024. This development may have sparked optimism, which possibly contributed to an increase in the number of Bitcoin wallets amassing the cryptocurrency.

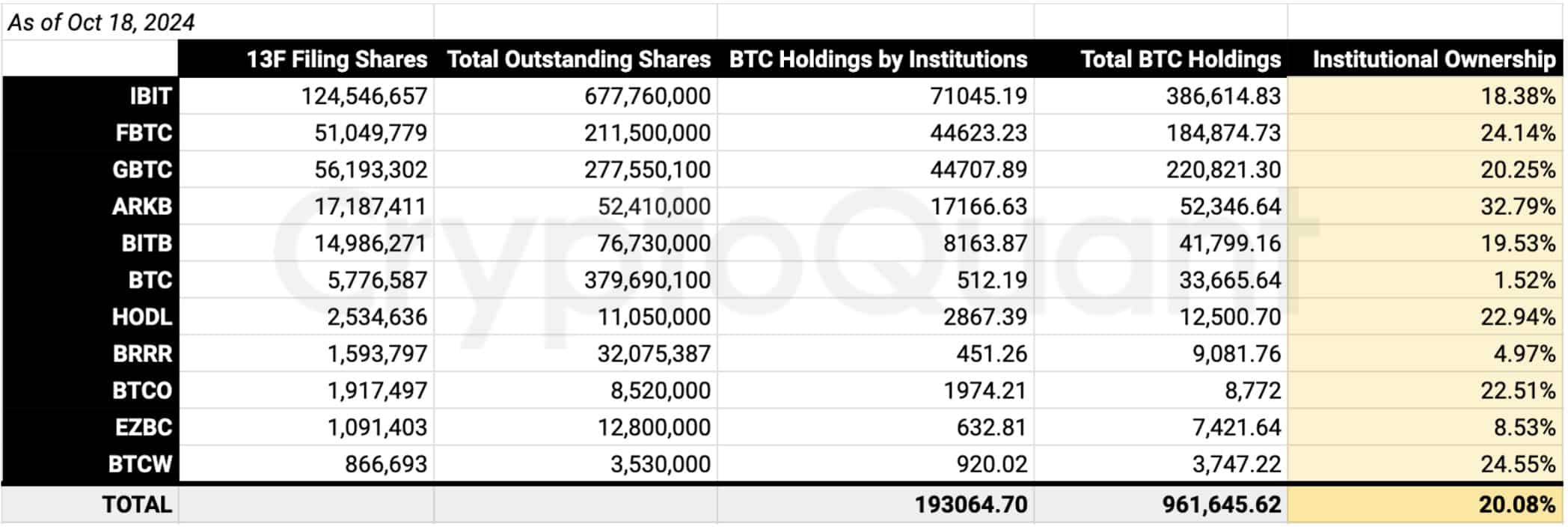

As of the 18th of October, the products held 961K BTC, worth over $65 billion.

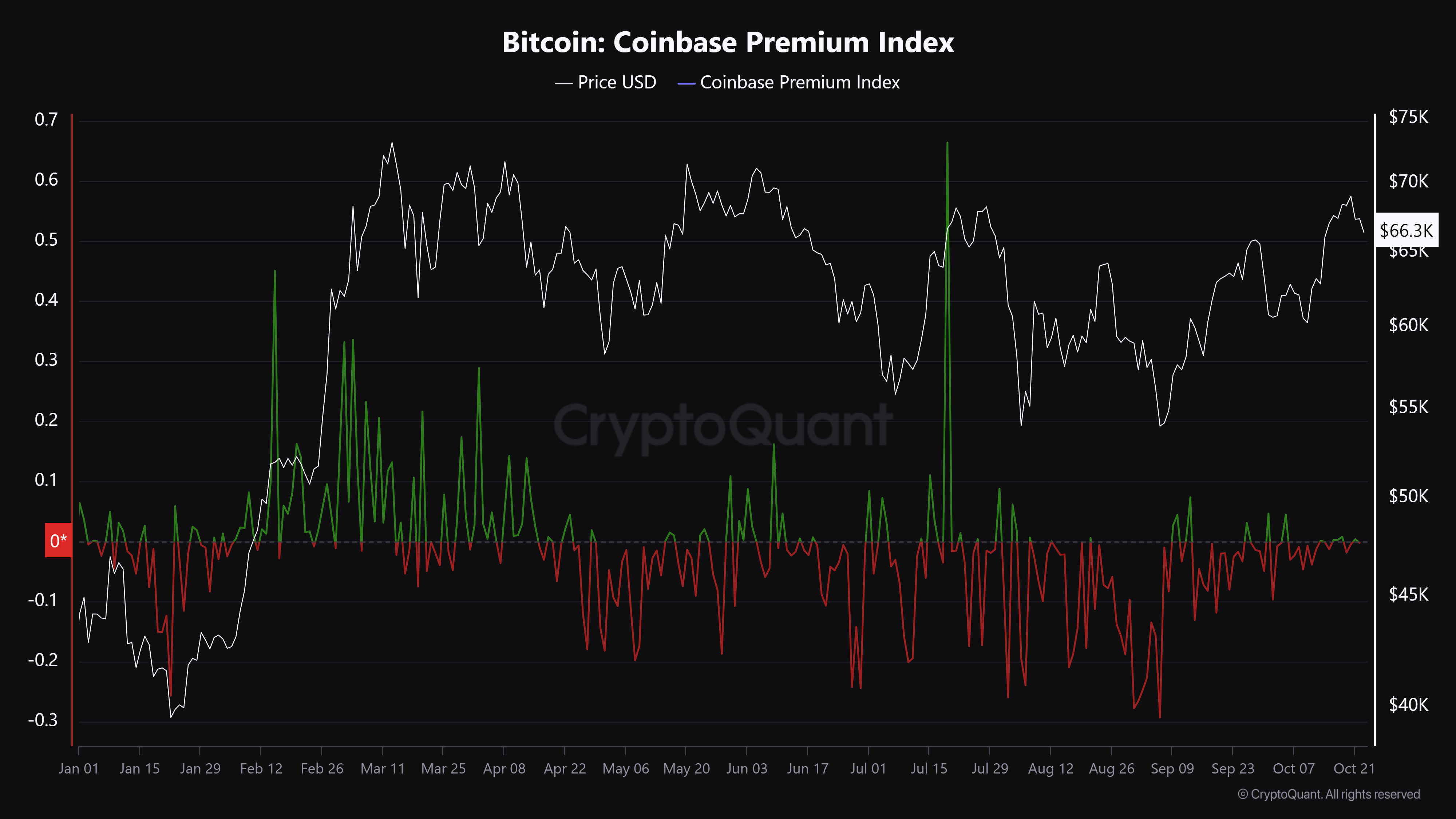

In Q1 2024, American investors’ enthusiasm following the approval of the U.S. spot BTC ETF was clearly reflected in a significant increase in demand for the asset. This surge is evident in the spikes (represented by green lines) observed in the Coinbase Premium Index.

In March, Bitcoin reached a record high (ATH) of over $73K due to renewed optimism. Could this trend continue?

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Masters Toronto 2025: Everything You Need to Know

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- The Lowdown on Labubu: What to Know About the Viral Toy

2024-10-23 18:15