- Scroll crypto faced a swift rejection from the $1.4 zone.

- The psychological $1 level might see an influx of demand.

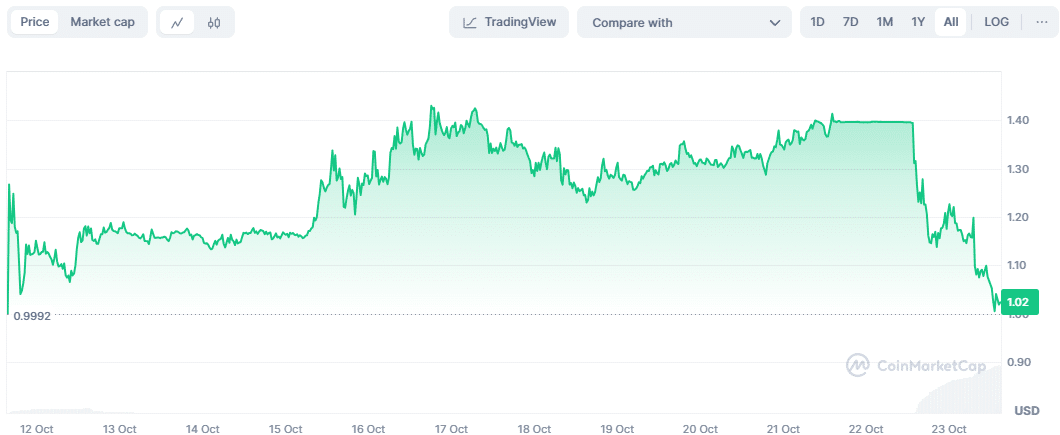

As a seasoned crypto investor who has weathered numerous market cycles, I can’t help but feel a sense of deja vu looking at Scroll [SCR]. The swift rejection from the $1.4 zone and the subsequent 30% drop in value over the past 48 hours is reminiscent of a rollercoaster ride that I’ve been on before.

As a forward-thinking crypto investor, I’ve found myself drawn to the potential of Scroll [SCR]. This innovative Layer 2 scaling solution operates using zKRollup technology, which essentially translates into lower transaction costs and enhanced throughput. In simpler terms, it’s like finding a faster and more cost-effective highway for my digital currency transactions.

It aims to enhance the Ethereum [ETH] network scalability, and the token began trading in October.

Over the last 48 hours, the token’s value has dropped significantly, almost reaching a 30% decrease, as the chart indicates a swift drop following the $1.4 mark.

Furthermore, as reported by DefiLlama, the Total Value Locked (TVL) amounted to approximately $793 million at the current moment.

The TVL (Total Value Locked) currently stands at approximately $794.7 million, which is about $200 million less than the $995 million it reached on October 16th.

This surge in actions is primarily due to the pre-airdrop farming activities, which were taking place before the Scroll token airdrop cutoff date on October 19th.

Strong downward momentum for Scroll crypto

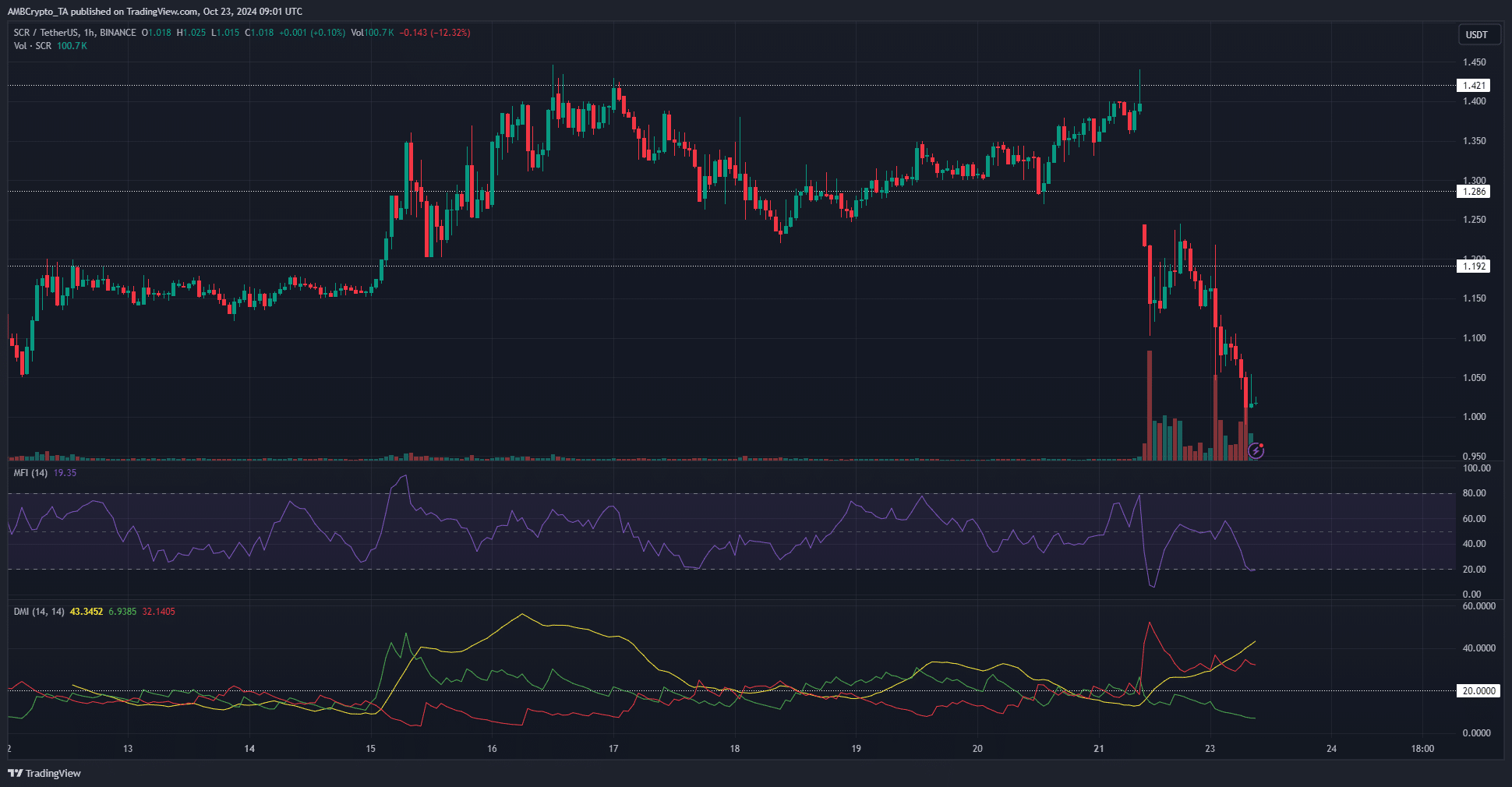

On a 1-hour basis, the Money Flow Index indicated a region approaching heavy sell-off. This suggested significant selling activity had transpired in the most recent period.

The price action took on a bearish bias within a matter of hours on the 21st of October.

After being turned down at the $1.4 mark, prices dropped rapidly below the $1.28 and $1.19 resistance points. Moreover, the buyers struggled unsuccessfully to push prices back over the $1.19 point, which could have transformed it into a new support zone.

Is your portfolio green? Check the Scroll Profit Calculator

After experiencing a recent decline of 17% following its latest rejection at $1.19, the market structure and trend for SCR have shown a strongly bearish pattern on an hourly basis.

In simpler terms, the ADX and DI indicators (represented by yellow and red) significantly exceeded the 20 threshold, suggesting a robust downward trend. Additionally, the selling pressure seems high, making it likely that the $1 level will break soon.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Quick Guide: Finding Garlic in Oblivion Remastered

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-10-24 00:07