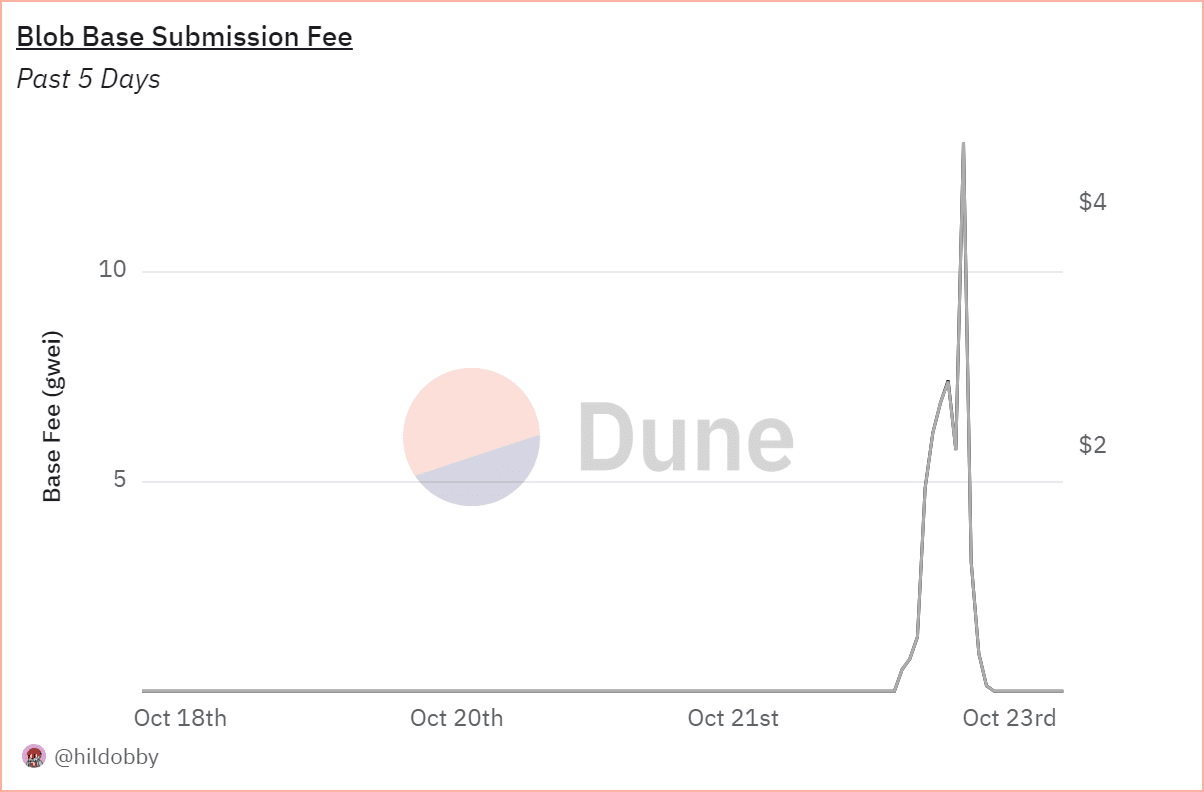

- Ethereum fees surged to over $4 recently.

- This was the third time since the Ethereum upgrade that the fee surged.

As a seasoned analyst with a decade of experience in the cryptocurrency market, I’ve witnessed the rollercoaster ride that is Ethereum [ETH]. The recent surge in Blob fees to over $4 was indeed intriguing, marking the third such occurrence since the Dencun upgrade. This trend is not entirely unexpected, as the digital world mirrors the real one in its unpredictability.

After the implementation of Blobs as part of the Dencun update, transaction fees for Ethereum (ETH) significantly dropped. This upgrade not only decreased costs within the Ethereum network itself, but also across Layer 2 (L2) platforms.

On the other hand, a spike in Blob charges can be attributed mainly to the distribution of a novel L2 network’s token as a result of recent activities.

Ethereum L2 Blob fees spike

According to information from Dune Analytics, Blob fees noticeably surged on October 22nd, reaching more than $4. This is the third substantial increase in fees since the Dencun update was implemented.

The rise in activity can be attributed to the distribution of Scroll’s governance token (SCR), which came as part of an airdrop for the Ethereum L2 network Scroll. This temporary spike in activity was due to users receiving SCR tokens.

With the Dencun update, blobs became available, specifically designed to minimize transaction fees within Ethereum’s layer-2 (L2) systems.

By adopting blobs and proto-danksharding, the cost of transactions on Ethereum’s secondary networks significantly decreased because an increased number of transactions were shifted away from the primary Ethereum network, allowing for more efficient processing.

What this spike means for L2s

Despite the Blob fee surge being caused by short-term network overload due to the airdrop, it underscored the potential for such occurrences to introduce fluctuations in transaction costs.

For the third occasion now, Blob’s fees have increased since they were initially implemented. Yet, even with these periodic rises, Ethereum’s Layer 2 solutions consistently provide cheaper transaction fees than the main network.

Through the Dencun update, which primarily emphasizes cost reduction using Blobs, Ethereum L2 fees have largely remained affordable and reasonable.

This latest surge is unusual, primarily driven by the high level of activity on the network due to the distribution event for the Scroll token.

How Ethereum fees have trended

Although there was a short-term increase in Blob transaction costs, Ethereum fees have predominantly stayed low post the Dencun update. In fact, these fees have notably decreased, especially since an increased number of transactions shifted towards Layer 2 solutions.

Read Ethereum’s [ETH] Price Prediction 2024-25

Based on data from Crypto Fees, it shows that the typical daily fee over the last week was roughly $6.7 million, and within a 24-hour period, the fee was about $5.4 million.

During significant network events, it’s clear that traffic build-up (or congestion) can still happen, as demonstrated by the surge in Blob fees. Nevertheless, Ethereum’s persistent efforts to minimize costs are proving advantageous for users, ensuring relatively lower transaction fees on the whole.

Read More

2024-10-24 01:11