- Cardano is trading within a descending triangle pattern but some bullish signs suggest an upward breakout.

- However, retail and whale interest is needed for ADA to flip resistance and rally past $0.40.

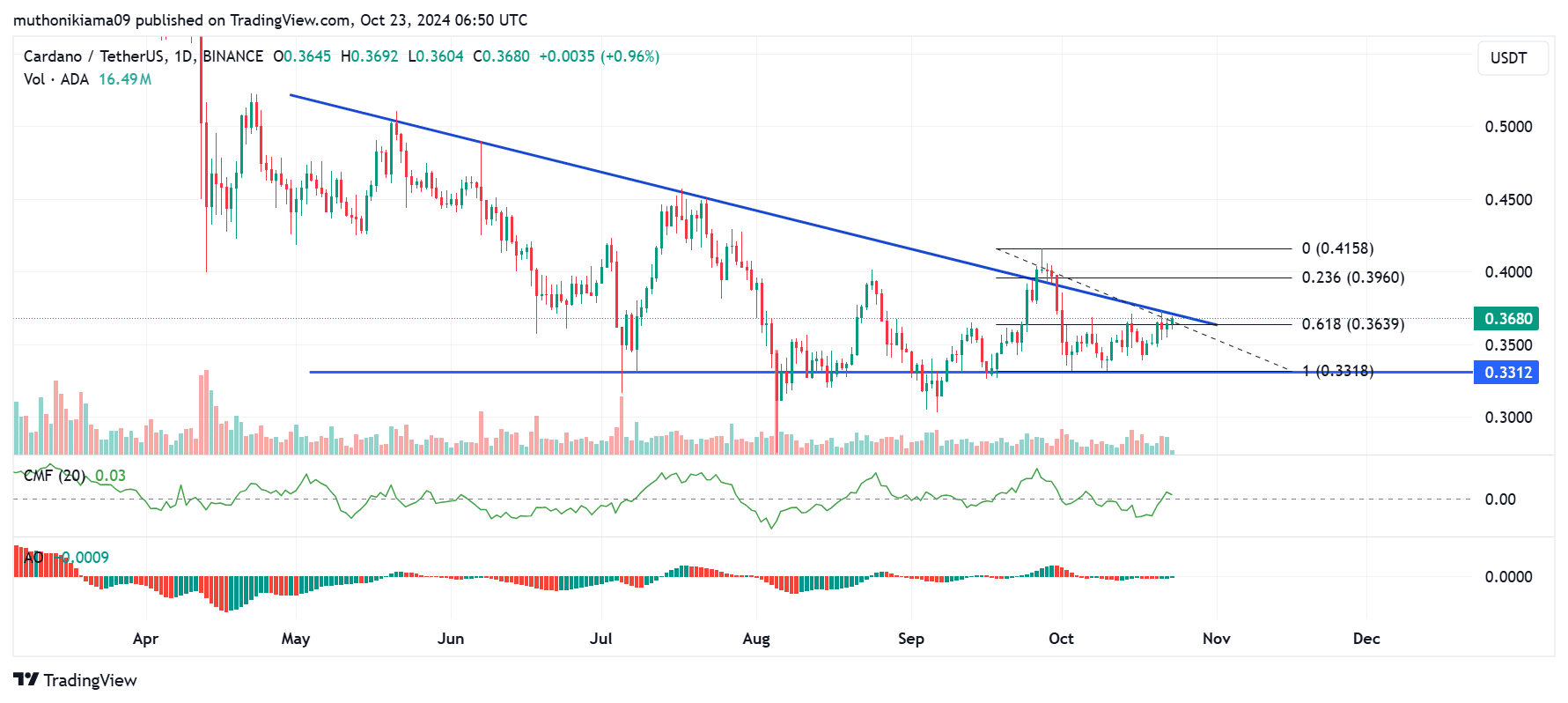

As a seasoned researcher with years of experience under my belt, I find myself cautiously optimistic about Cardano [ADA] at the moment. The descending triangle pattern suggests that ADA is poised for either an upward breakout or a downtrend continuation.

Cardano [ADA] traded at $0.367 at press time. In the last 24 hours, ADA price oscillated between $0.35 and $0.36 showing a lack of volatility. During this time, there were no significant changes in trading volumes, as seen on CoinMarketCap.

On the daily chart, ADA’s price movement follows a declining triangle formation, suggesting that every time ADA tries to increase, buyers are overpowered by sellers who push the price back down.

The narrowing triangle shape for ADA indicates it’s preparing for consolidation, ready to break free from its current trend, possibly heading either upward or downward.

At the 0.618 Fibonacci level ($0.36), there’s significant opposition for the upward trend of ADA. Whenever ADA has encountered this resistance, it either slows down or decreases in value. This indicates that there are fewer market participants eager to transact with ADA at this price point.

If ADA manages to surpass the $0.36 barrier and clear the top limit of the descending triangle structure, buyers might regain control, potentially driving prices up towards $0.40.

If Cardano cannot maintain its position above $0.33, it’s a sign that the downward trend is likely to continue.

Checking the technical indicators suggests a stronger possibility of a price increase, as the Chaikin Money Flow (CMF) has moved into positive figures after two weeks, indicating growing buying demand.

As an analyst, I’m observing that although the Awesome Oscillator bars appear green, they’re still showing a negative value. This intriguing setup suggests that while the broader market trend is still bearish, there might be early signs of a potential bullish reversal unfolding.

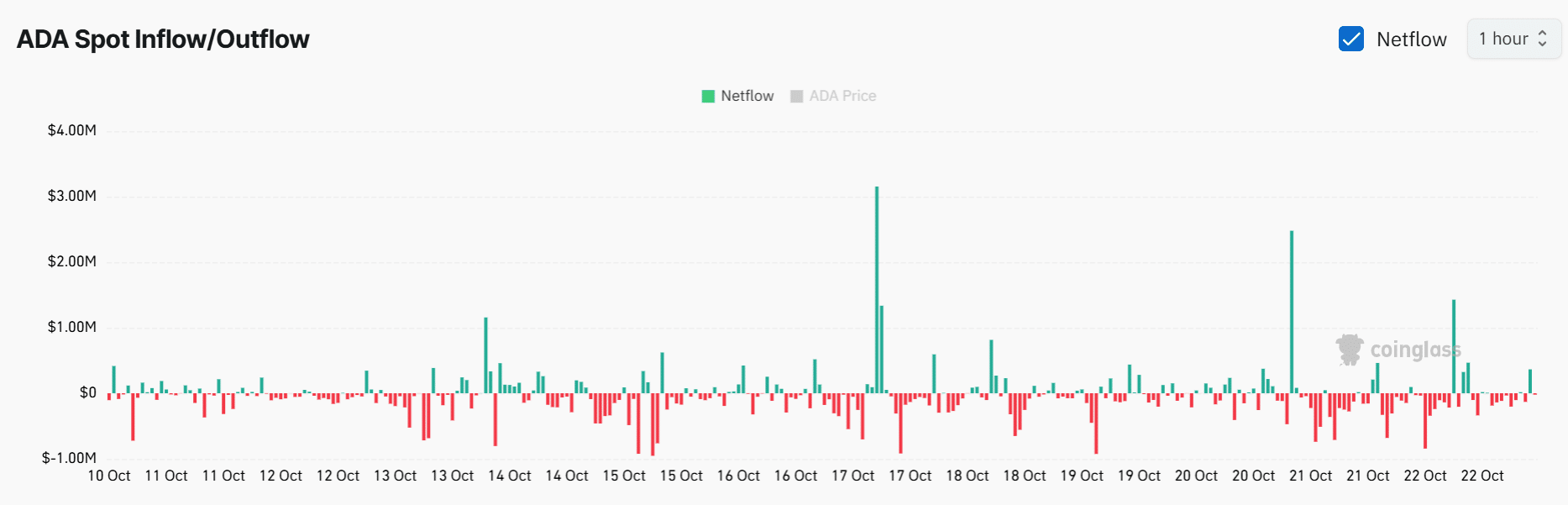

Spot netflows show sellers are active

According to the data from the spot exchange, it appears that sellers of Cardano have been quite active, particularly during periods of increased inflow into exchanges.

Meanwhile, there have been continuous withdrawals from Cardano, indicating a struggle between those looking to sell and those wanting to buy.

To enable buyers to assume command, it’s essential that there’s mutual enthusiasm among both regular and big-time traders. Although whales hold just 8% of the total ADA supply, a surge in significant trades might trigger volatility and rekindle optimistic feelings.

Read Cardano’s [ADA] Price Prediction 2024–2025

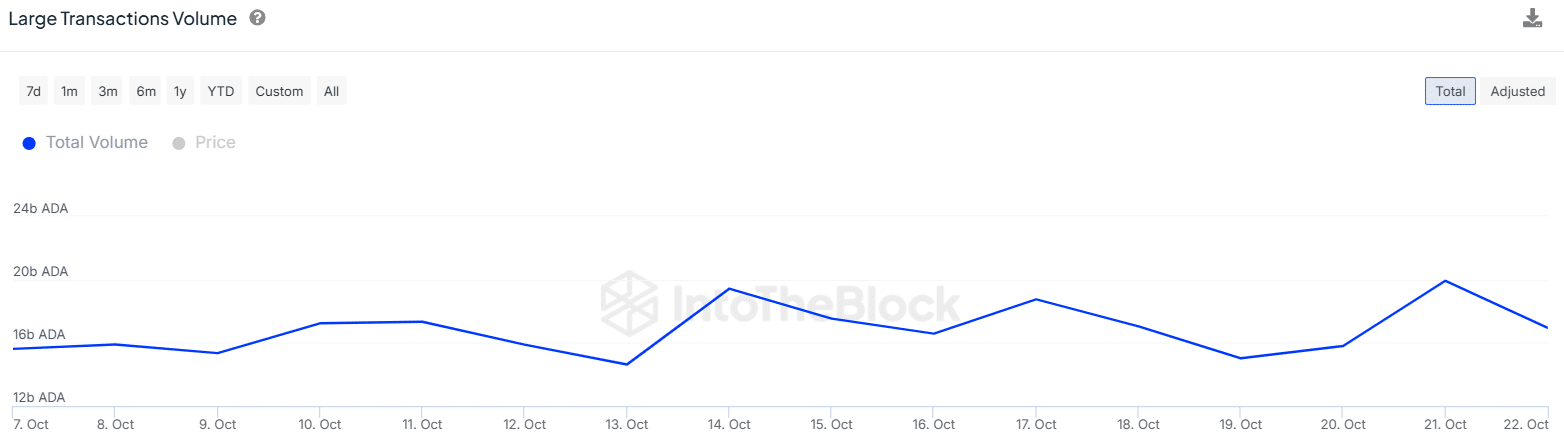

Despite the apparent reluctance of whales, there has been a significant decrease in large ADA transaction volumes exceeding $100,000. At the current moment, these volumes have dropped by approximately 15%, from 19.92 billion to 16.94 billion.

1) As smart money showed a bearish attitude towards Cardano, there was a drop in whale activity at the same time, according to Market Prophit. Yet, the enthusiasm among smaller investors continues to thrive, given the generally optimistic outlook.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

2024-10-24 03:03