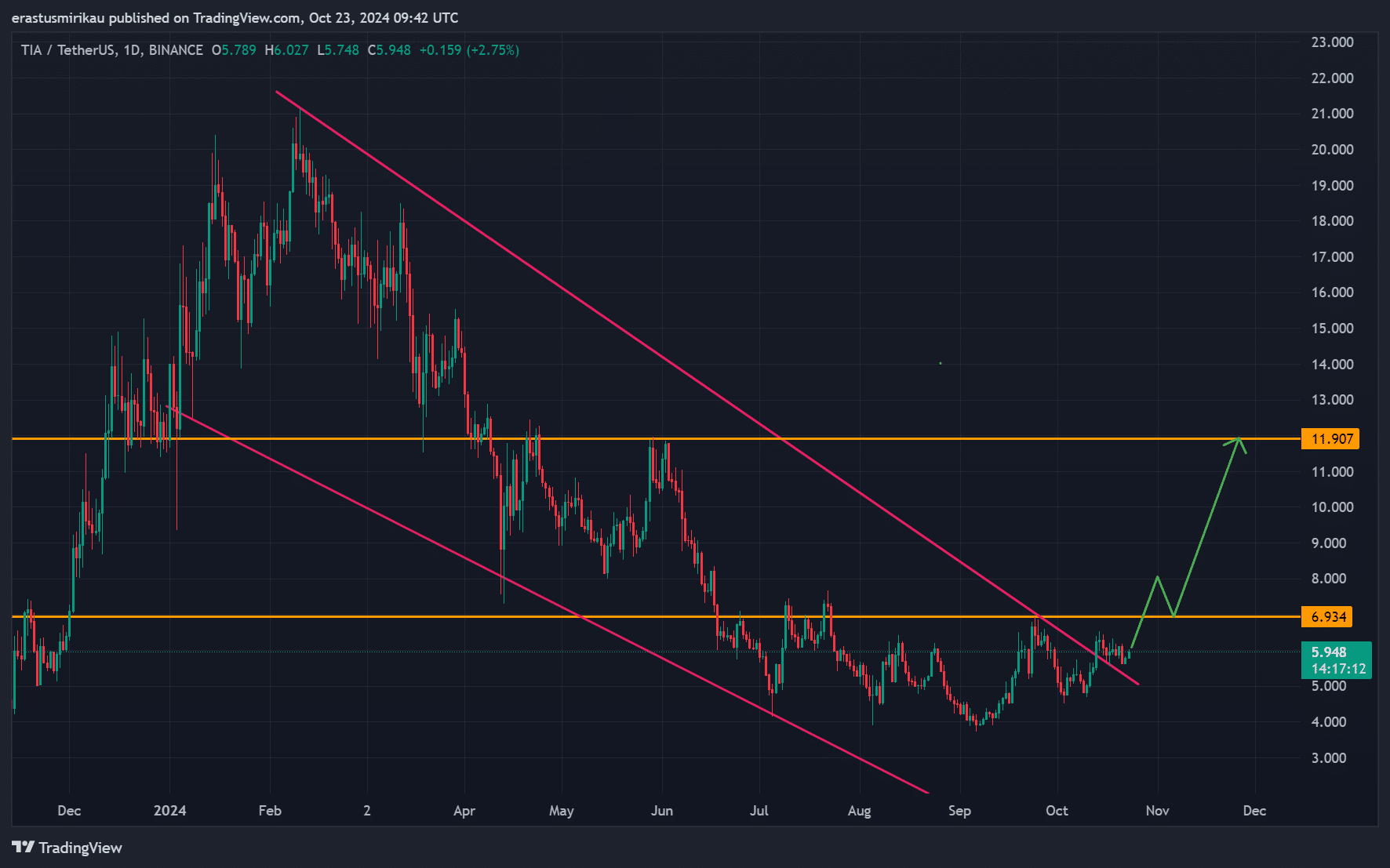

- Celestia has broken out of its descending channel, targeting $6.9 as the next resistance.

- Rising social dominance and increased open interest signal growing market confidence in TIA.

As a seasoned researcher with years of experience navigating the dynamic cryptocurrency market, I find myself intrigued by Celestia’s [TIA] recent breakout from its descending channel. With a discerning eye for technical patterns and an appreciation for the unpredictability of this space, I can’t help but feel a sense of anticipation for what lies ahead.

Celestia’s TIA has seen significant growth following its successful breakout from the downward trendline, hinting at a possible upward trend or bullish movement.

Currently trading at $5.97, representing a 4.39% increase, analysts are considering if TIA can maintain this positive trajectory.

Yet, the asset is about to encounter a significant hurdle: Will it manage to surpass the upcoming significant barrier at $6.9, thereby instigating a more extensive upward trend?

TIA descending channel breakout

The emergence from a downward trending pattern that’s been developing over several months has fueled hope and positivity within the market.

Currently, a significant hurdle lies at $6.9 for Celestia. Overcoming this barrier might trigger a prolonged upward trend. If it manages to do so, the next significant price point to aim for could be around $11.9.

If TIA fails to maintain a price above $6.9, it may retreat back to its previous consolidation range. Consequently, the upcoming days are significant, as traders keep a close eye on these key levels.

TIA technical analysis: RSI and MACD

Looking at some technical indicators, the Relative Strength Index (RSI) currently stands at 55.19, indicating a market that’s leaning slightly towards the bulls, yet still maintaining a balance overall.

However, it still remains below the overbought threshold, indicating that Celestia has room to move higher without hitting exhaustion.

Furthermore, the MACD (Moving Average Convergence Divergence) indicator is about to experience a bullish crossover, potentially boosting Celestia even more. These indicators imply that, should present tendencies persist, the token might continue to grow in value.

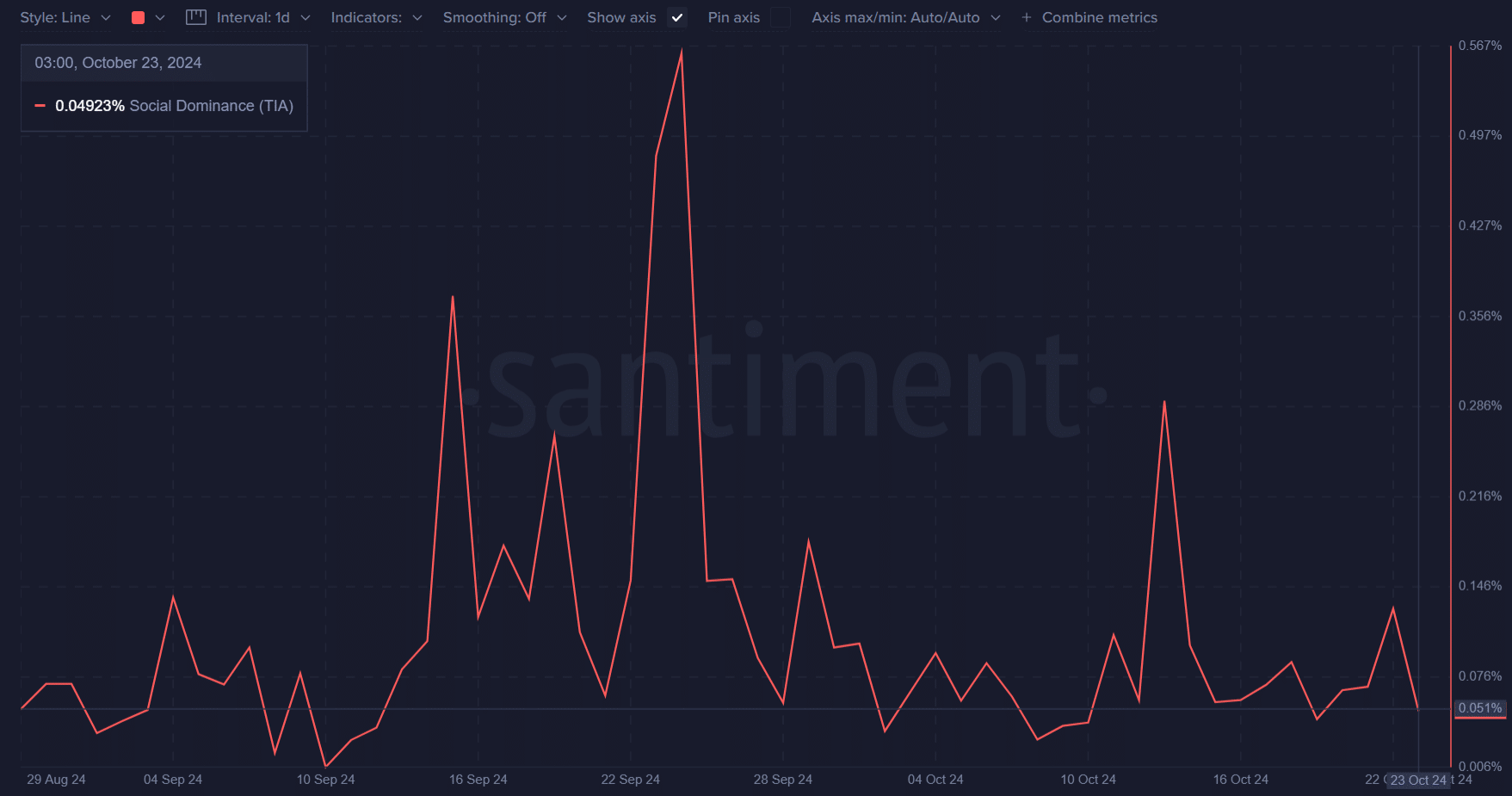

Social dominance and market sentiment

In the world of cryptocurrency, social sentiment can significantly impact price movement. Recently, TIA’s social dominance reached 0.049%, showing that it’s slowly gaining traction among retail investors.

A smaller-scale boost in social interaction frequently goes hand-in-hand with a rise in shopping enthusiasm. This could potentially fuel additional growth in prices.

Consequently, as TIA’s profile becomes more prominent, it might fuel a positive trend if an increasing number of investors begin to talk about and invest in the token.

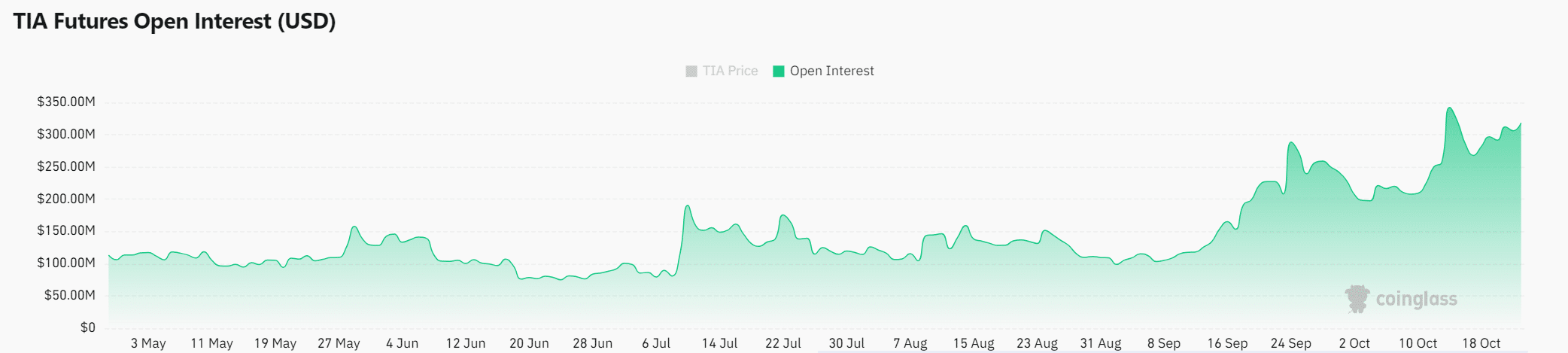

Open interest and market confidence

Open Interest for TIA futures currently stands at $317.32 million, marking a 0.66% increase. This rise suggests that traders are gaining confidence in the token’s short-term performance.

As a researcher, I observe that an escalation in Open Interest often signifies heightened involvement of traders, which might strengthen the market’s momentum. The surge in futures interest towards TIA not only intensifies my curiosity but also adds another dimension to my optimism about its potential breakthrough.

In summary, given its advanced technical infrastructure and increasing market attention, it seems that Celestia has strong potential for continued growth.

However, breaking through the $6.9 resistance is essential for the token to sustain its bullish momentum. Should TIA successfully clear this hurdle, it could target higher levels like $11.9.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

2024-10-24 05:43