- The insights into the XRP Ledger made for a bullish reading.

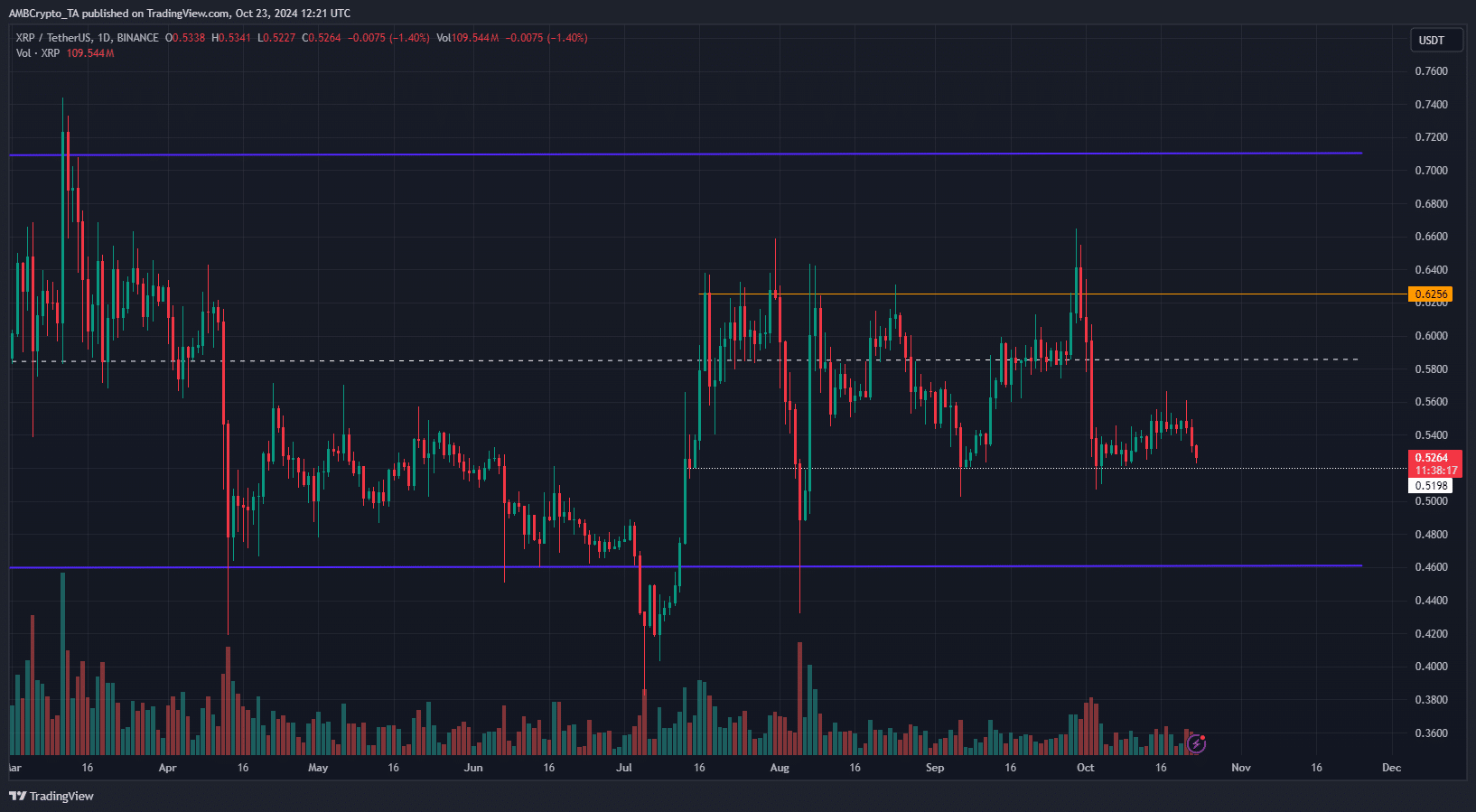

- The price action chart was quick to sink these hopes.

As an analyst with years of experience under my belt, I have seen enough market cycles to know when to be bullish and when to tread cautiously. The insights into the XRP Ledger are indeed encouraging, but as we all know, price action can sometimes be a cruel mistress.

As a researcher, I’m observing that XRP, or Ripple, continues to maintain its consolidation phase. At the moment, it’s holding onto the $0.52 price mark as a support level, suggesting some stability. However, whale activities haven’t shown significant signs of pushing prices upward yet.

The revelation that a whale removed approximately 52 million XRP valued at around $28.67 million from Bybit didn’t improve the general feeling or trigger a surge in optimism.

Meanwhile, during a recent interview, Elon Musk, the head honcho of Tesla, SpaceX, and the new proprietor of X (previously known as Twitter), fielded questions regarding the potential integration of Ripple (XRP) by financial entities.

XRP Ledger showed encouraging stats

In simpler terms, the Ripple (XRP) price trend on a daily basis didn’t show signs of increasing value. Instead, it exhibited a strong downward trend, and the significant fall in early October created a substantial imbalance leaning towards higher prices in the future.

Consequently, while it’s anticipated that XRP may rebound towards its local highs around $0.62 to $0.66 in the near future, there will likely be substantial resistance from sellers.

On the platform CryptoQuant, Wenry Seoul, Marketing Manager from Catalyze Research, pointed out that the daily transaction volume of the XRP Ledger is on par with those of Layer 1 network systems.

This is based on the activity between the 15th of September to the 15th of October.

Trade activity on the decentralized exchange decreased by about 6.83%, going from 6.88 million transactions to 6.41 million. However, despite this decrease, the total trading volume for these exchanges increased by 17.64% to approximately $4.6 million.

In terms of Automated Market Maker (AMM) Liquidity Provision, there was significant growth.

In simpler terms, AMMDeposit serves the function of adding funds to an already established Automated Market Maker (AMM) platform for trading, whereas AMMCreate facilitates setting up a brand-new AMM platform to trade two different assets.

The significant increase in both AMMDeposit and AMMCreate indicates a surge in liquidity deposits, suggesting growing levels of trust and confidence among users.

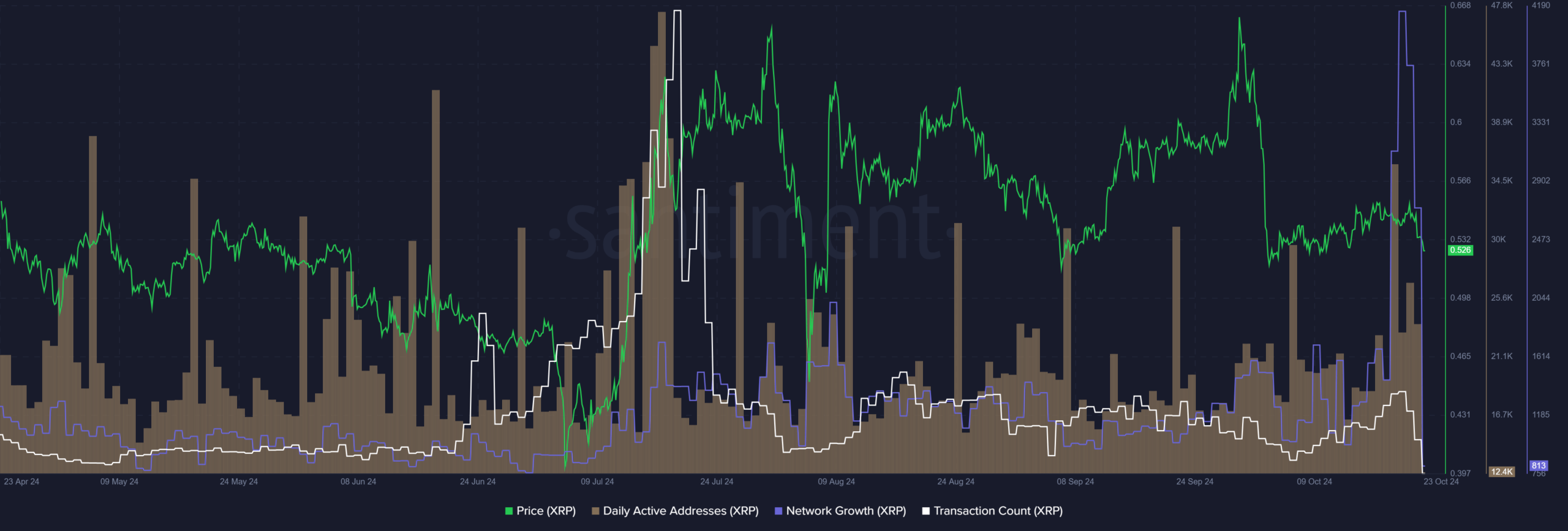

Network growth surpasses three-month highs

Read Ripple’s [XRP] Price Prediction 2024-25

Over the period between the 7th and 20th of October, I noticed a significant increase in transaction counts, which was quite promising. However, more recently, this upward trend seems to be slowing down. The remarkable expansion of the network, though, is particularly encouraging because it could potentially fuel demand for my crypto investments.

In simpler terms, if the token’s price remains stable around $0.52, its bullish supporters may successfully protect this crucial support level. However, considering the current trend, it seems like a dip to roughly $0.508 might occur first before we see an upward move towards $0.62.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Elden Ring Nightreign Recluse guide and abilities explained

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-10-24 06:15