- 15 million LUNC tokens were burned, but the price fell 4.19% amid dropping market interest.

- Futures open interest hit $9.27 million, marking a significant decline as trading volume plunged by 66.35%.

As a seasoned researcher with years of experience navigating the cryptocurrency markets, I find myself constantly intrigued by the ebb and flow of Terra Luna Classic [LUNC]. The recent burn of 15 million tokens seems like a bold move to boost value over time, but the immediate market response suggests it may take more than that to ignite significant price growth.

The Terra Luna Classic [LUNC] system is experiencing a variety of advancements as market trends, token destruction, and future trading activity take shape.

From my perspective as an analyst, the latest token burns and price fluctuations hint at a possible market transition. Yet, the most recent price swings and open interest statistics present a more intricate scenario.

LUNC price update and market activity

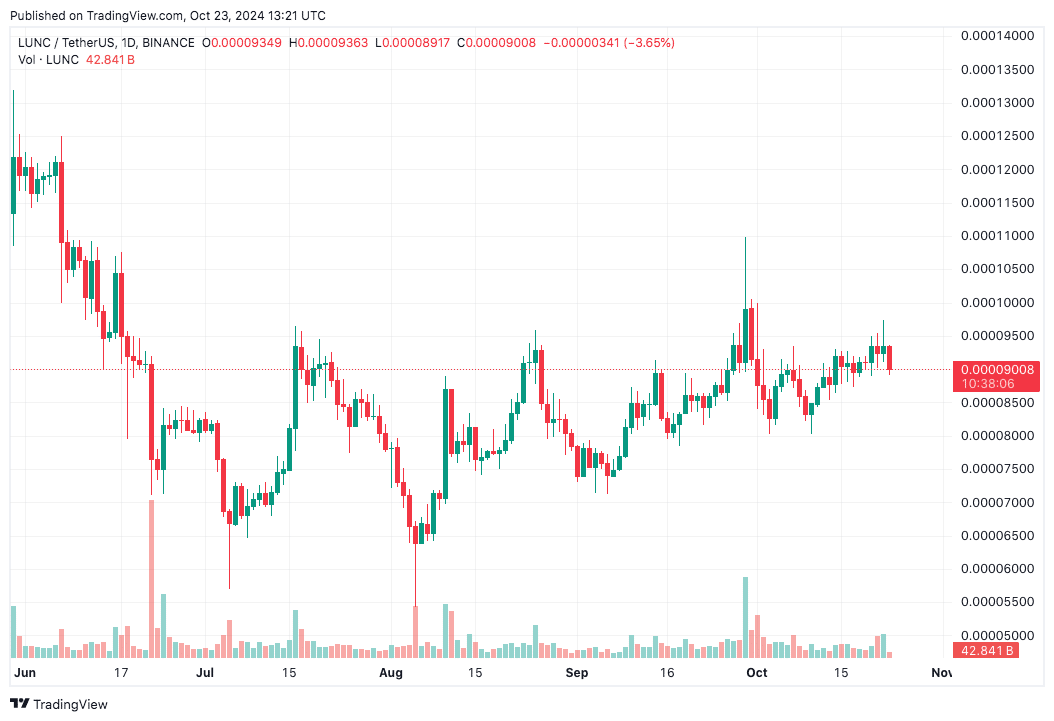

Terra Classic (LUNC) stands at $0.00009008 as of press time, reflecting a decline of 4.19% over the past 24 hours. The 24-hour trading volume for LUNC is reported at $27,294,595.

Over the past seven days, LUNC has registered a modest increase of 0.37%, suggesting some stability in a largely volatile market. LUNC’s circulating supply is estimated to be around 5.7 trillion, bringing its market capitalization to approximately $513.1 million.

After the burning of 15 million LUNC tokens on the 22nd of October as part of continued attempts to decrease supply, this price shift may be a result, with the aim of boosting prices.

Although the deflationary strategy is designed to enhance worth progressively, its quick effects have been relatively modest, as evidenced by the latest decline in price.

Technical analysis: Ascending support and resistance levels

Over the past few weeks, the LUNC price graph demonstrates an upward slope, which suggests continuous efforts by buyers to drive the value upwards. This incline has served as a foundation for the price, resulting in a series of successive lower highs.

If the price maintains this upward trajectory, it could signal further bullish momentum.

Key resistance is noted at the $0.00012740 level, which represents the next target for a potential breakout. A successful breach of this level could lead to further price gains, provided buying pressure sustains.

On the negative side, potential support points have been marked at approximately $0.00008850 and $0.00006390. If the market experiences a drop, these levels could provide some stability, especially if the rising trendline is unable to maintain its position.

A fall below these support levels might indicate a bearish trend reversal.

Futures market: Declining open interest and volume

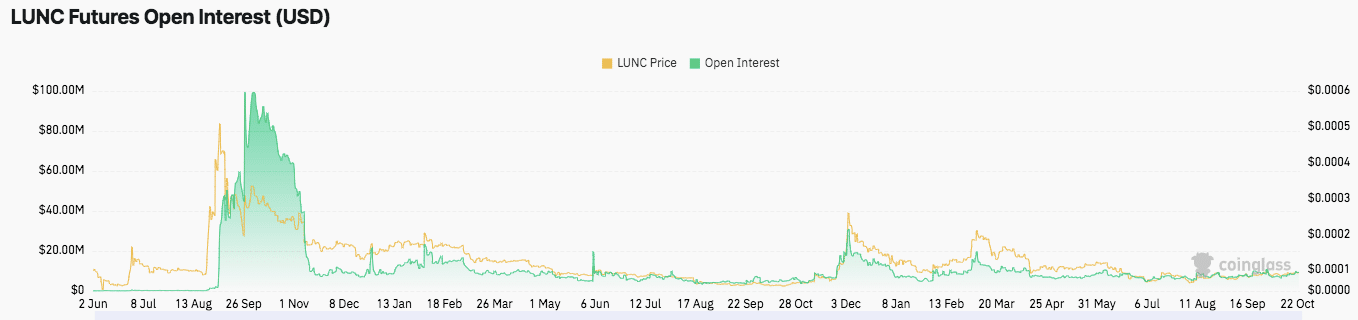

According to data from Coinglass, the open interest in the LUNC futures market has significantly decreased, now sitting at approximately $9.27 million – a drop of 4.68% compared to its previous levels.

The decline in open interest follows a pattern that has been noticed throughout the last year. Open interest reached almost $100 million in September 2022, but since then, it’s been on a steady decrease.

As an analyst, I observe that lower open interest indicates a reduction in active market participants. This could lead to lessened market activity and volatility in the immediate future.

Is your portfolio green? Check the LUNC Profit Calculator

Additionally, volume in the LUNC futures market has dropped by 66.35%, reaching $10.45 million.

This decrease could suggest a decline in speculative activity, possibly influenced by several aspects such as the current market’s price stability and general investor sentiment.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-10-24 13:11