- Traders were over-leveraged at $1.597 on the lower side and $1.663 on the higher side.

- POPCAT’s Long/Short Ratio stood at 1.045, indicating a strong bullish sentiment among traders.

As a seasoned researcher who has navigated through countless market cycles, I can confidently say that POPCAT’s current performance is nothing short of remarkable. The impressive 18% surge within 24 hours and the heightened trading volume suggest a strong bullish sentiment that’s hard to ignore.

The Solana-backed meme coin, Popcat (POPCAT), is causing a stir in the crypto world due to its outstanding achievements.

On the 24th of October, as significant cryptocurrencies such as Bitcoin, Ethereum, and Binance Coin struggled to pick up speed, there was a substantial increase in value for the memecoin.

POPCAT’s current price momentum

Currently, the value of POPCAT is hovering around $1.644, having seen a substantial increase of more than 18% within the last day.

Over these days, the trading volume saw a 23% rise, suggesting that more traders and investors are actively participating than they were the day before.

As an analyst, I believe the current surge could be attributed to the recent breakout from Solana’s consolidation phase and the escalating trend of Solana-centric meme tokens gaining traction in the crypto market.

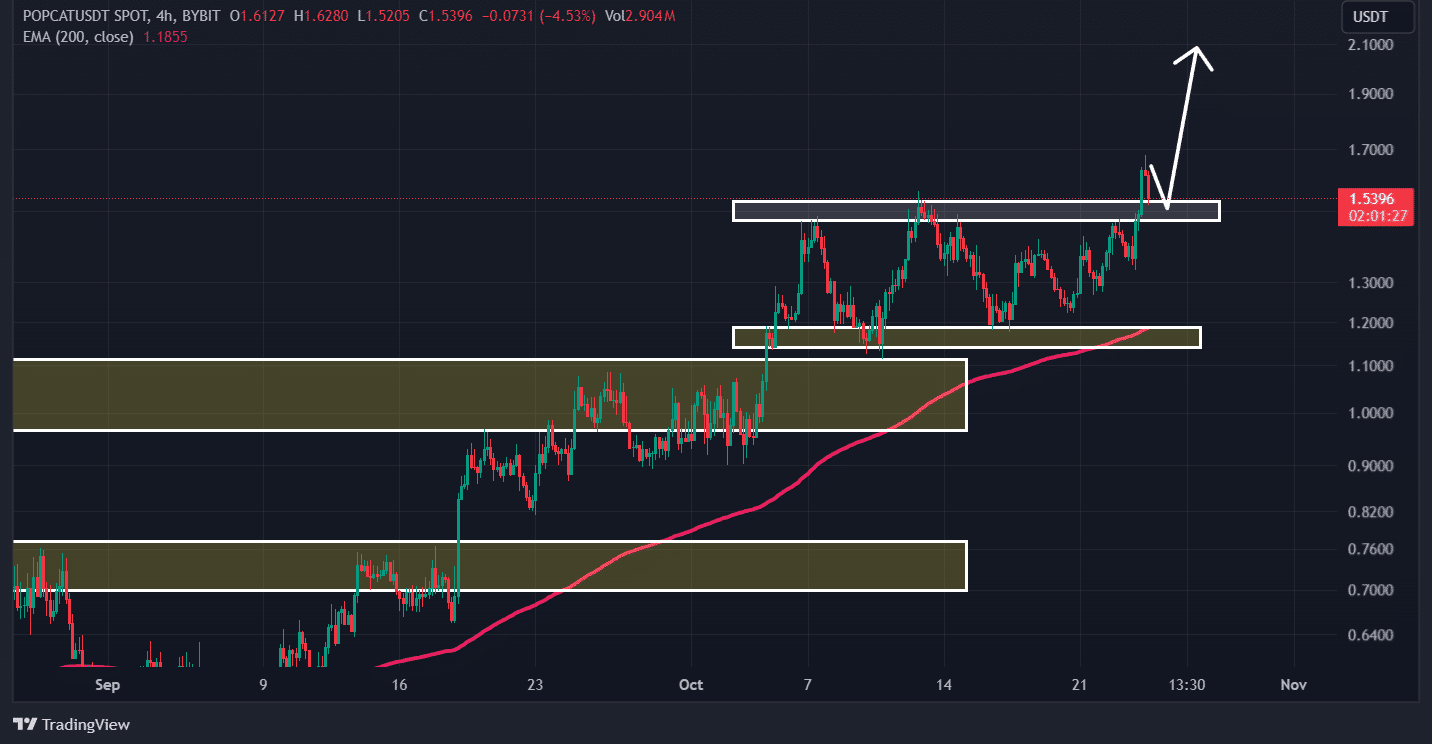

Technical analysis and key levels

Based on the technical assessment provided by AMBCrypto, Popcat showed signs of optimism as it successfully broke free from a robust consolidation area spanning between $1.13 and $1.54, causing the overall feeling to shift from a decline to an increase.

After the recent surge, there’s a good chance that the meme coin could hit a new peak within the next few days.

Bullish on-chain metrics

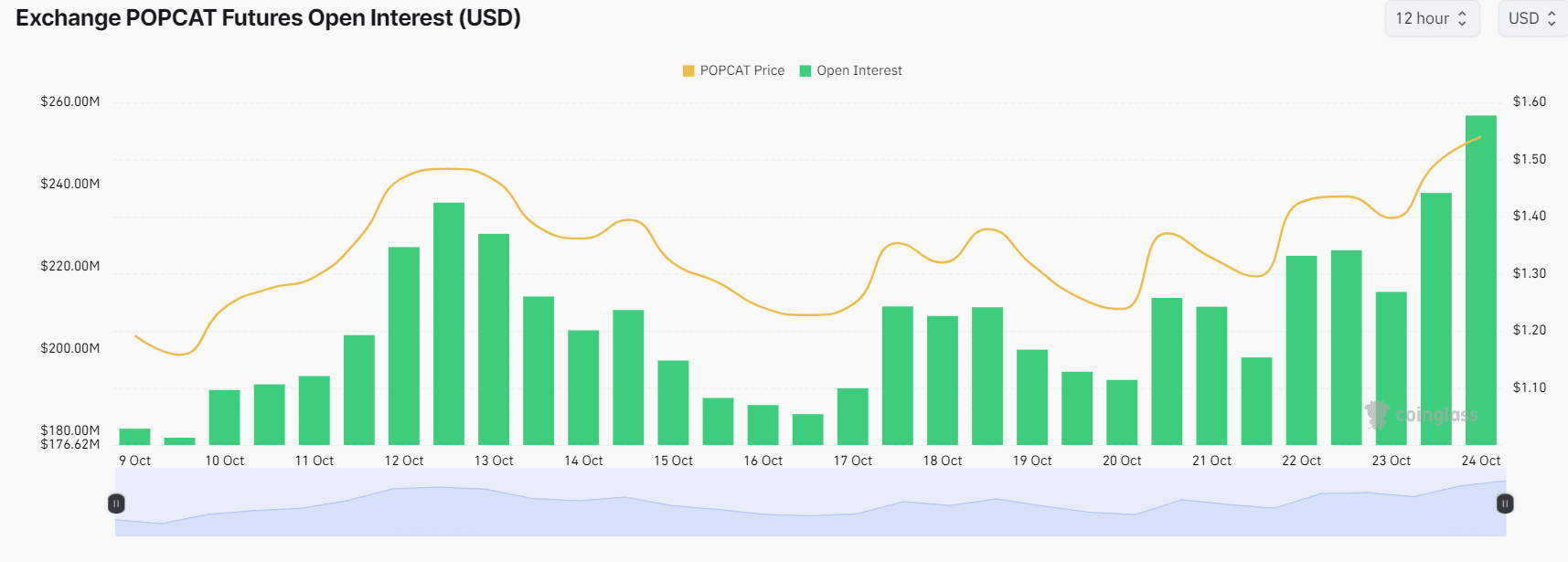

The positive stance towards POPCAT, as suggested by POPCAT’s forecast, is backed up by data from the blockchain. Specifically, according to CoinGlass, a firm specializing in on-chain analytics, the Long/Short Ratio of POPCAT stood at 1.045 at the time of publication, suggesting that traders are showing significant optimism about the token’s price increase.

Furthermore, there’s been a significant increase in Open Interest (OI) by 29% within the last 24 hours and an additional 8.6% rise over the last four hours.

The increased enthusiasm among potential traders and investors, coupled with the accumulation of more positions than before in recent days.

Currently, approximately 53.2% of leading traders have opted for long positions, contrasting with about 48.8% who are holding short positions. This trend, combined with an elevated Open Interest and a Long/Short Ratio exceeding 1, is typically taken into account when strategizing to establish long positions by both traders and investors.

Major liquidation levels

Currently, significant liquidation points are around $1.597 (on the lower end) and $1.663 (on the upper end), as per Coinglass. Traders appear to be excessively leveraged at these price levels.

If the feelings about a certain asset stay the same and its price climbs up to approximately $1.663, it would lead to around $1.27 million being wiped out from positions that were previously shorted (or bet on a decrease in price).

Read Popcat’s [POPCAT] Price Prediction 2024–2025

If the sentiment shifts and the price falls to around $2.16 million, which is roughly equivalent to 1.597 (the figure).

The information about liquidation suggests that at present, buyers (bulls) have a stronger influence over the assets, possibly sustaining the current positive market trend.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

2024-10-24 18:16