- Implied volatility for Bitcoin options around US elections has hiked by nearly 50%.

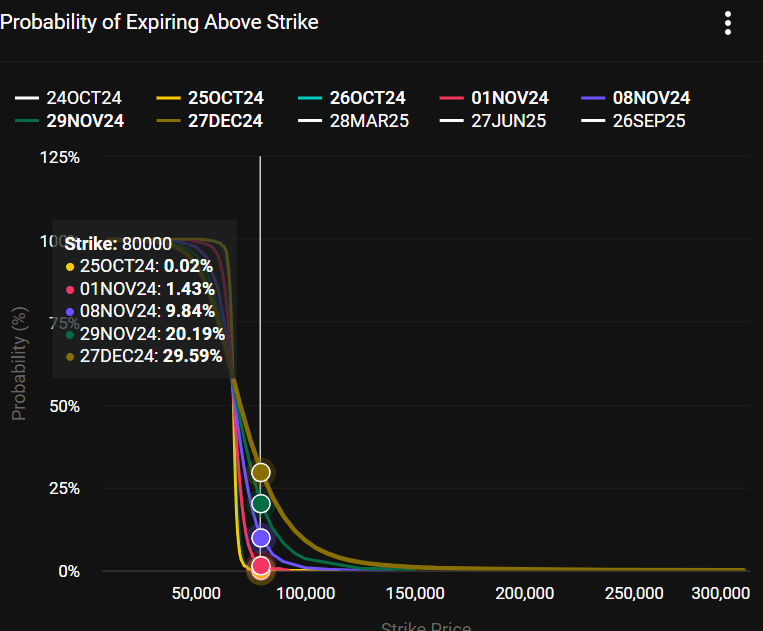

- Options traders priced a 20% chance of BTC hitting $80K by end-November.

As a seasoned analyst with over two decades of market experience under my belt, I find myself intrigued by the current state of the Bitcoin [BTC] options market ahead of the US elections. The bullish sentiment among traders, as evidenced by the surge in implied volatility and the preference for call options, is noteworthy.

As the U.S. presidential election approaches within just two weeks, Bitcoin [BTC] option traders continue to be optimistic, setting their sights on a potential price peak of $80,000 by November.

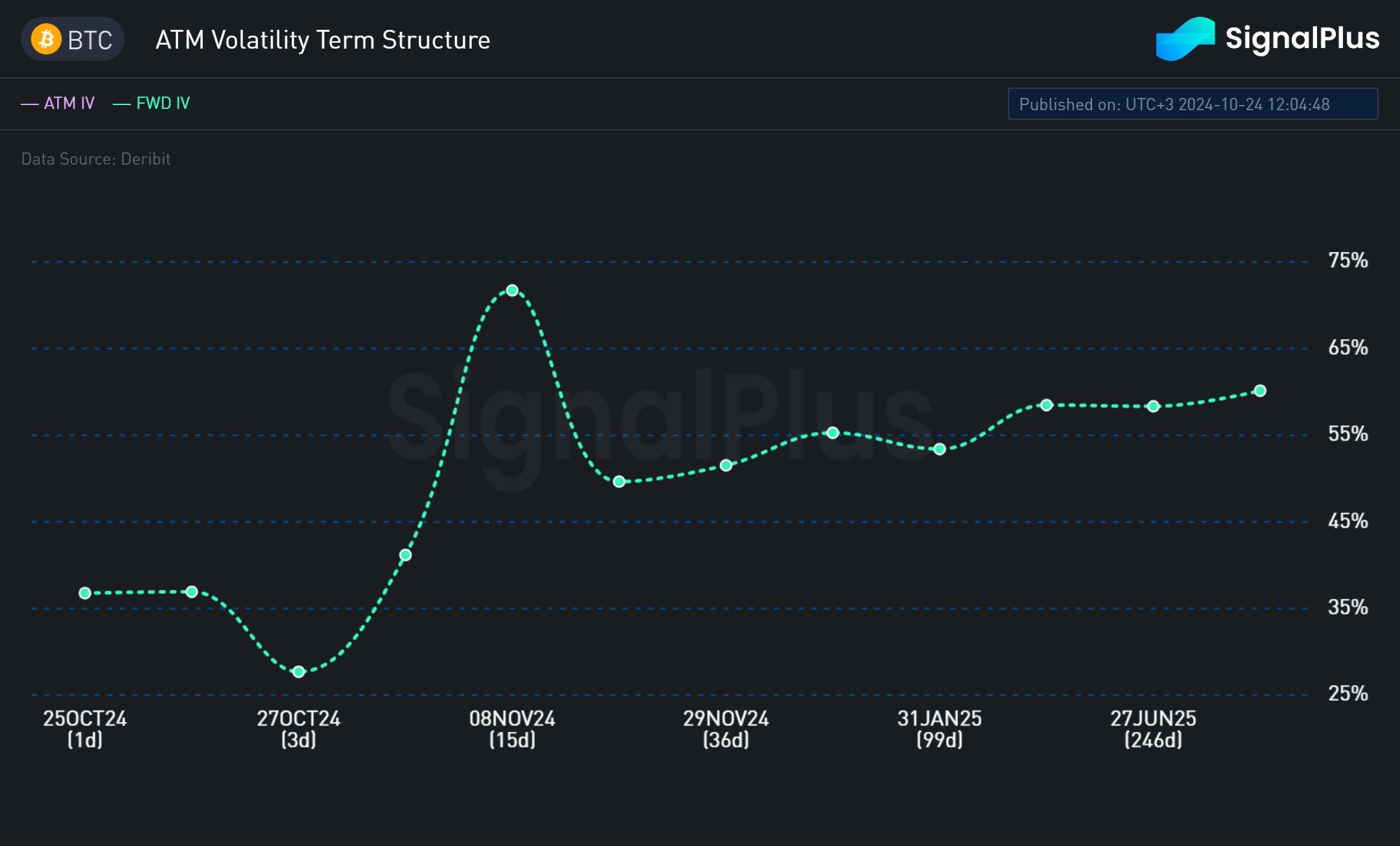

As a researcher, I observed that the upcoming election served as a significant source of market uncertainty, as evidenced by a near 71% peak in Forward Implied Volatility (FWD IV) on November 8th. This surge underscored the heightened apprehension and potential volatility in financial markets leading up to the election.

This suggests that the market was anticipating significant volatility in prices around the U.S. elections. Consequently, these fluctuations might trend upward or downward since large-scale investors are taking steps to protect their investments from potential risks by adjusting their positions.

Anticipation was high that market volatility would decrease following two significant events: the elections on November 5th and the Federal Reserve’s interest rate decision on November 8th. The decline in Forward Implied Volatility (IV) after November 8th supported this expectation.

Options bullish bets

However, despite the election concerns, the BTC options market has maintained a bullish outlook, as recently noted by crypto trading firm QCP Capital. It stated,

Volatility expectations for the short term are reaching their peak on the day of the election, showing a 10-point increase compared to the previous period. This trend also suggests that options for price increases (calls) are preferred over options for price decreases (puts), even though Bitcoin is currently around 8% below its maximum historical value.

Currently, the data from Deribit is reflecting a similar trend. Call options, which represent optimistic predictions about Bitcoin’s future price rise, are more popular compared to put options, which indicate bearish views, for contracts that expire on November 29th.

The options traders were pricing a 20% chance of BTC hitting $80K by the end of November.

In response to the arrangement, André Dragosch, who leads European research at Bitwise, described it as anticipating a ‘favorable or positive result,’ in simpler terms.

This evidence seems to back up the idea that most Bitcoin option traders are expecting a positive, or bullish, market trend.

To put it simply, Donald Trump is widely seen as the presidential candidate with the strongest support for cryptocurrency. In surveys and on prediction platforms like Polymarket, he currently leads Kamala Harris by about 20 points.

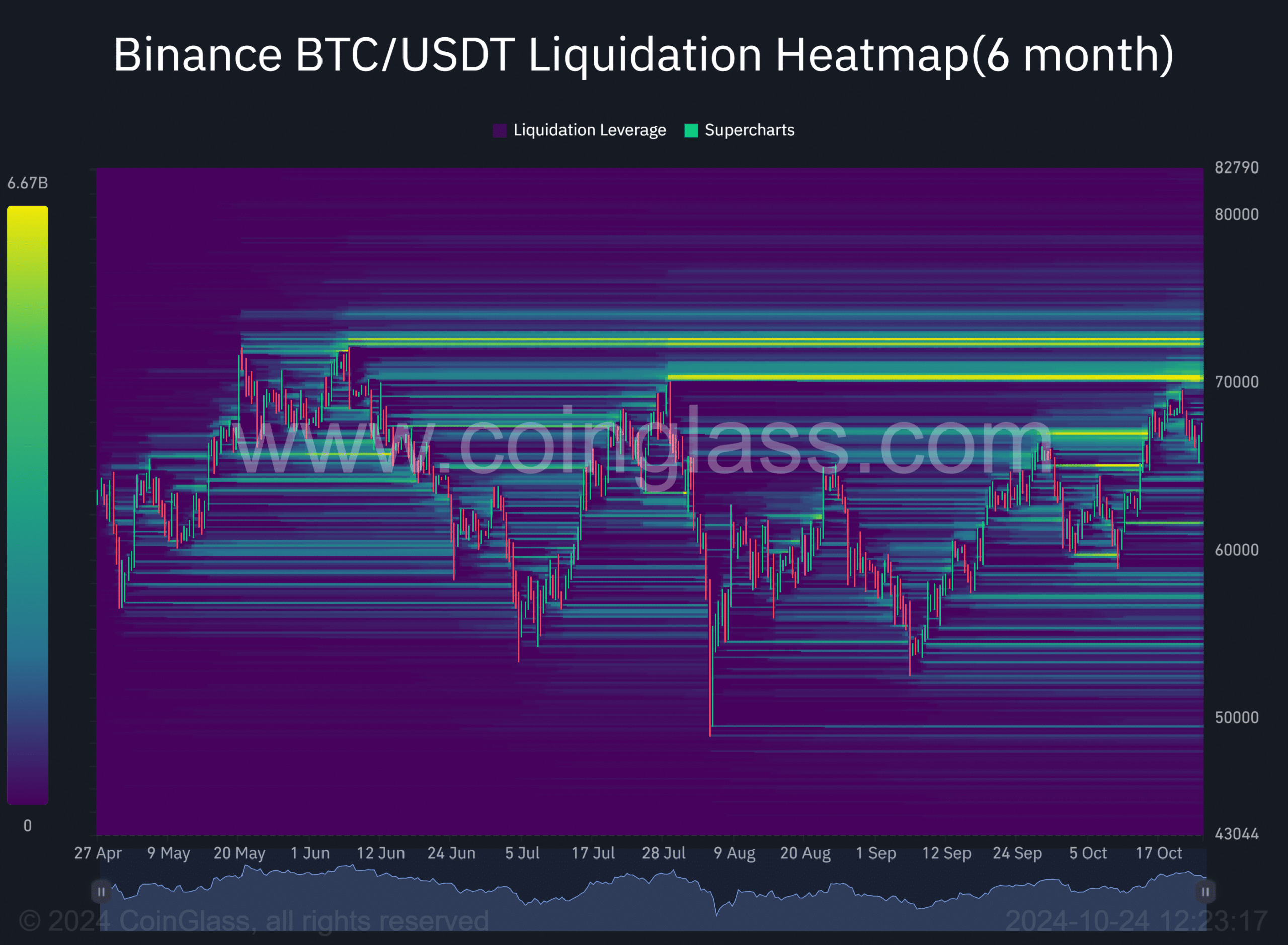

As a researcher, if Bitcoin (BTC) were to surge to $80K and successfully breach the psychological barrier at $70K, it would potentially force out approximately $7 billion worth of short positions.

Despite the ongoing U.S. earnings season, Bitcoin has experienced a temporary drop in strength. Currently, Bitcoin is valued at approximately $67,000, which is around 10% shy of its record high ($73,700).

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-24 21:11