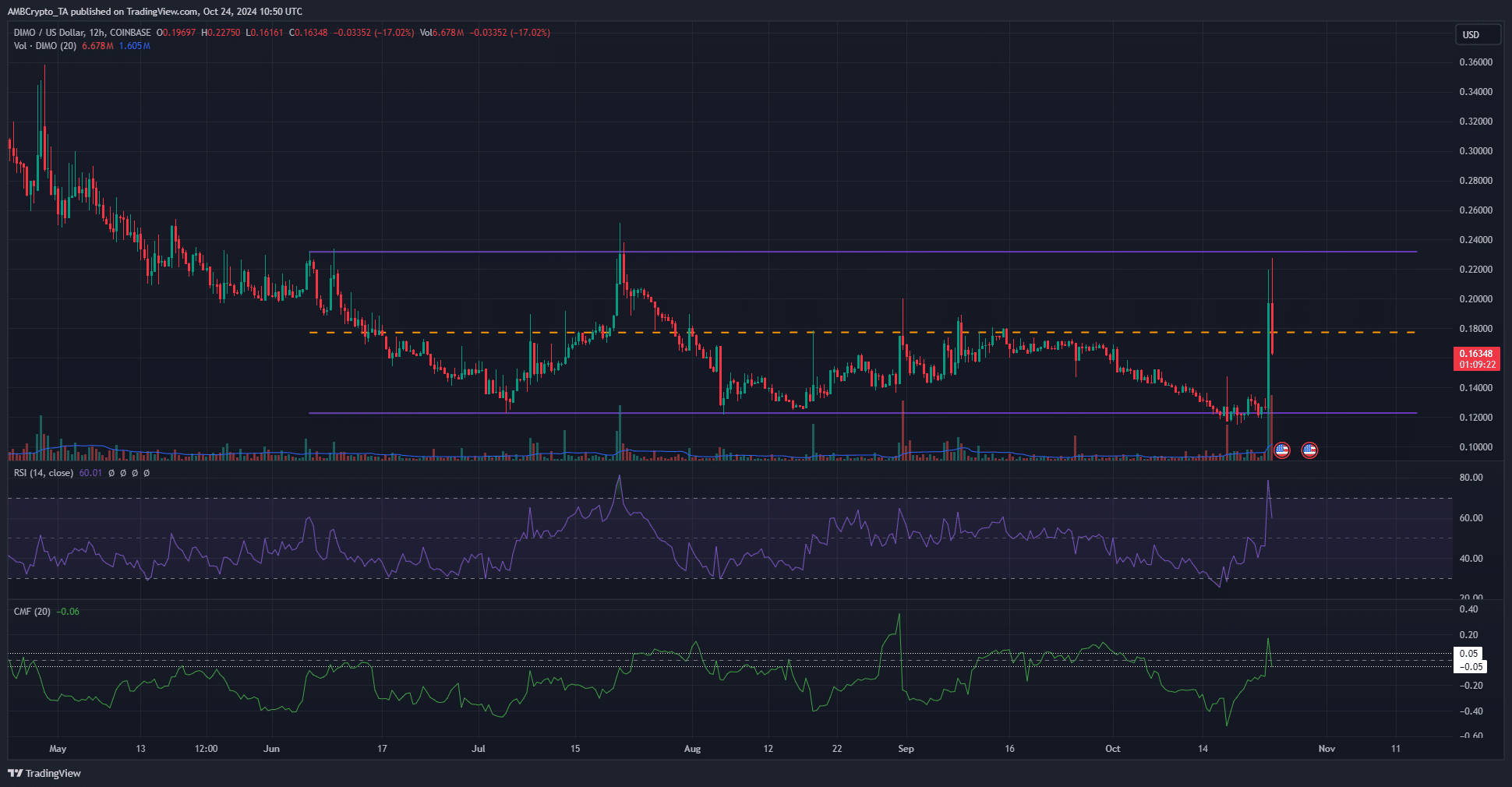

- DIMO crypto has traded within a range since June.

- The lack of steady buying volume meant the recent surge would need time to expand further.

As a seasoned crypto investor with over a decade of experience in this wild and unpredictable market, I’ve seen my fair share of price surges and drops. The recent 82% jump in DIMO was intriguing, but as a wise man once said, “If it seems too good to be true, it probably is.

Over the last day, DIMO saw a significant surge of approximately 82%, climbing from $0.122 to $0.227. However, in more recent trading, its price has slipped back down to $0.163.

As a seasoned trader with over two decades of experience in the financial markets, I have seen countless instances where a significant pullback like this one, representing a 28% move from recent highs, can instill fear and doubt among investors. However, I’ve also learned that such moments often present opportunities for those who remain calm and disciplined. The fact that the $0.18 support zone was breached suggests that the bears have taken control temporarily, but the question now is whether the bulls will regroup and push prices back above this level to resume the upward move. I always remind myself of the old adage: “The market can stay irrational longer than you can stay solvent.” So, while I’m not making a definitive prediction, I am keeping a close eye on this situation, as it could present an intriguing buying opportunity for those with a long-term perspective.

Rejection from the range highs in recent hours

Currently, at this moment, DIMO cryptocurrency has experienced a decrease of about 28% from its peak price of $0.227. The Relative Strength Index (RSI) on the 12-hour chart temporarily spiked into an overbought state, reaching 78.75, before subsequently dropping again.

For a considerable part of October, the Cash Money Flow (CMF) remained at approximately -0.06, which is below -0.05. This indicates that selling pressure has largely outweighed buying pressure, a fact corroborated by the price chart over the past two months.

Over the past few months, DIMO cryptocurrency has been following a specific trading pattern and hasn’t deviated much since June. An ordinary movement from the lowest point of $0.123 to the highest point of $0.232 typically takes around a week’s time, as we observed in July.

This one-day move meant the market was likely overextended.

Regardless, the bulls might aim for regaining the $0.18 level as a base of support and stabilize there momentarily before another strong push forward.

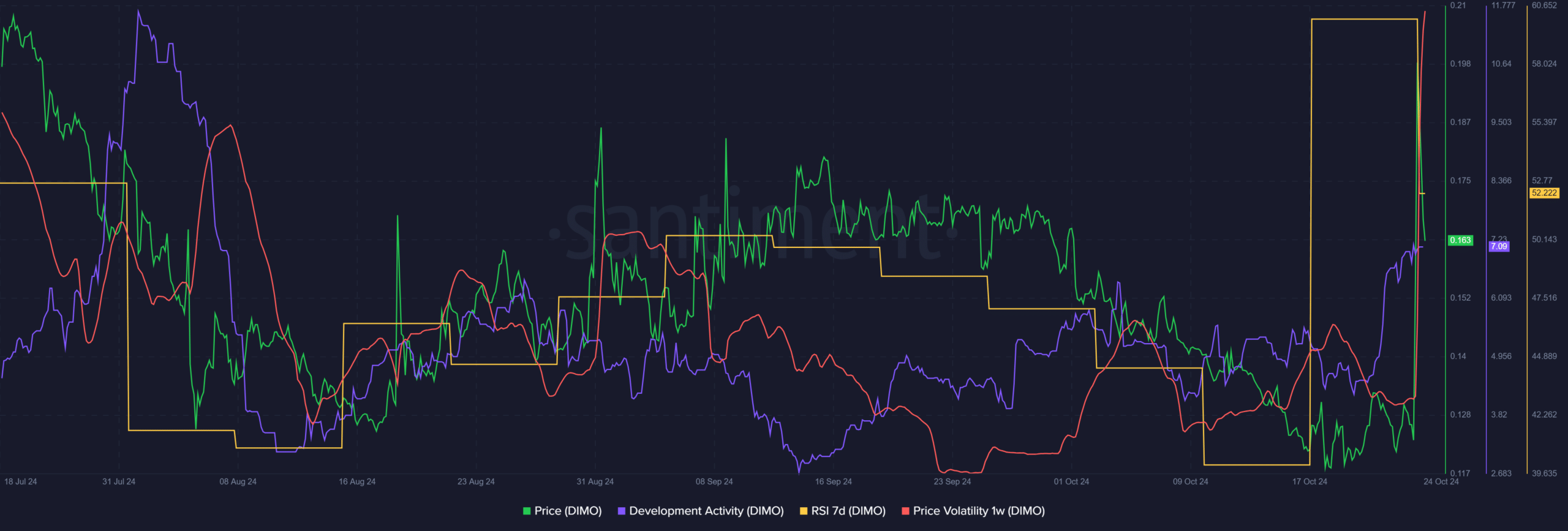

Encouraging sign for long-term DIMO crypto investors

2024 witnessed a satisfactory progress in the token’s developmental metrics. However, the activity level was notably lower than that of May 2024, but it has remained consistent since July. This steady state is a promising indication for long-term investors.

Realistic or not, here’s DIMO’s market cap in BTC’s terms

Despite being in a period of consolidation, there was persistent action occurring unseen.

Without consistent buying interest, it’s unlikely that a DIMO breakout above the range’s highest point will happen soon. However, if there is a breakout followed by a retest at the $0.23 level, it could present a good chance for purchasing.

Read More

- OM/USD

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Solo Leveling Season 3: What Fans Are Really Speculating!

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-10-25 07:03