- XRP was up by 1% in the last 24 hours, but its price action was still poor

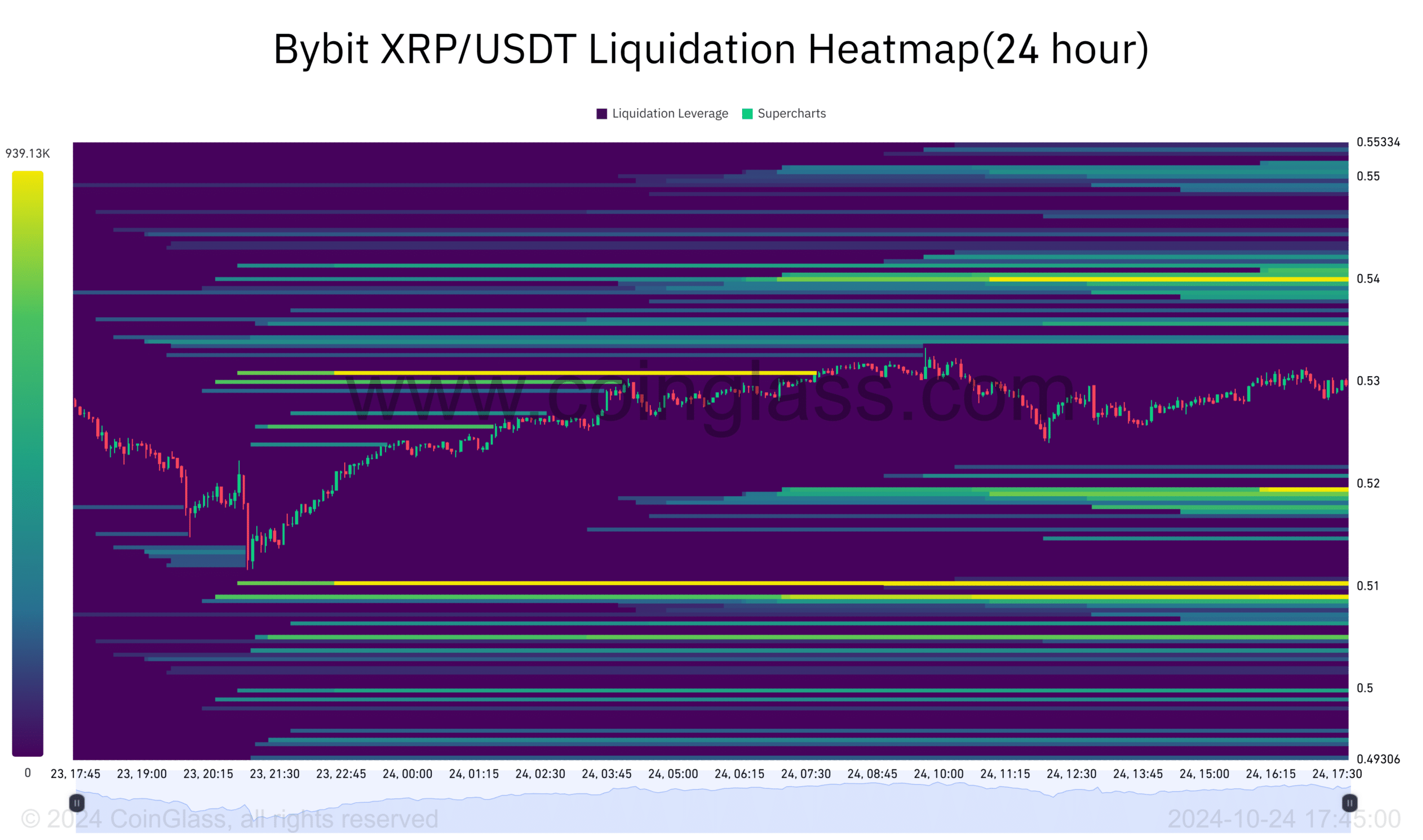

- XRP liquidations sat both below and above its press time price levels

As a seasoned researcher with years of experience navigating the cryptocurrency market, I find myself intrigued by XRP’s recent performance and outlook. The token has been in the spotlight for various reasons, but its price action remains challenging to decipher.

Recently, XRP has been drawing attention for a couple of reasons. One factor is ongoing legal issues between XRP and the U.S. Securities and Exchange Commission (SEC). Additionally, Ripple‘s CEO has shown his backing for Kamala Harris in the upcoming U.S. elections.

Over the last week, XRP has experienced a significant decline, dropping more than 4%. However, there was a slight recovery within the last day as it increased by 1.1%. Interestingly, its 24-hour trading volume surged by over 22%, reaching an impressive $1.07 billion.

The increase caused the proportion of trading volume to market capitalization to reach 3.58%, sparking worries about a prominent cryptocurrency like XRP.

XRP price action and prediction

As I pen this analysis, it appears that the movement of XRP’s price is congealing within an expansive ascending triangle formation. Notably, this structure has lately breached below its lower trendline.

Based on my years of trading experience and analysis of market trends, I believe this breakout could potentially indicate further declines for XRP. However, it’s crucial to remember that these predictions are not guaranteed, and a successful retest is needed to confirm this assumption. In my personal investment journey, I have learned the hard way that the market can be unpredictable at times, so it’s always best to exercise caution and make informed decisions.

Another smaller ascending triangle pattern formed too, also breaking south – A sign of potential weakness. If the retest confirms the breakout, XRP could register further declines on the price charts.

On the other hand, this unexpected surge might actually be a deliberate tactic, often seen in financial markets, intended to push investors with weaker resolve to sell their holdings.

As a crypto investor, I’m keeping my eyes peeled on XRP. Given the current situation, there’s potential for a substantial surge in its value. However, predicting the exact trajectory of its price movement is quite challenging at this point.

Liquidations and performance comparison

Examining the XRP liquidation chart, it appeared that there was a significant concentration of liquidity, with pockets found both higher and lower than its current market value at the given moment.

Approximately a million dollars’ worth of XRP liquidations were positioned at the price point of $0.54014, and an additional 900,000 dollars’ worth were found at $0.51946.

This implies a potential for the price trend to swing up or down since prices tend to cluster at areas of significant trading volume, which can amplify subsequent price actions. Furthermore, there were multiple liquidation orders worth over $1.2 million located around $0.51022 and $0.50.

This suggests that the price of XRP might move up or down, contingent upon the market’s strategy for securing liquidity.

It’s noteworthy that there’s been a significant increase in newly established pools on the XRP Ledger network for its Automated Market Maker (AMM). In fact, an impressive 66% of all XRP pools have been set up just within the last week.

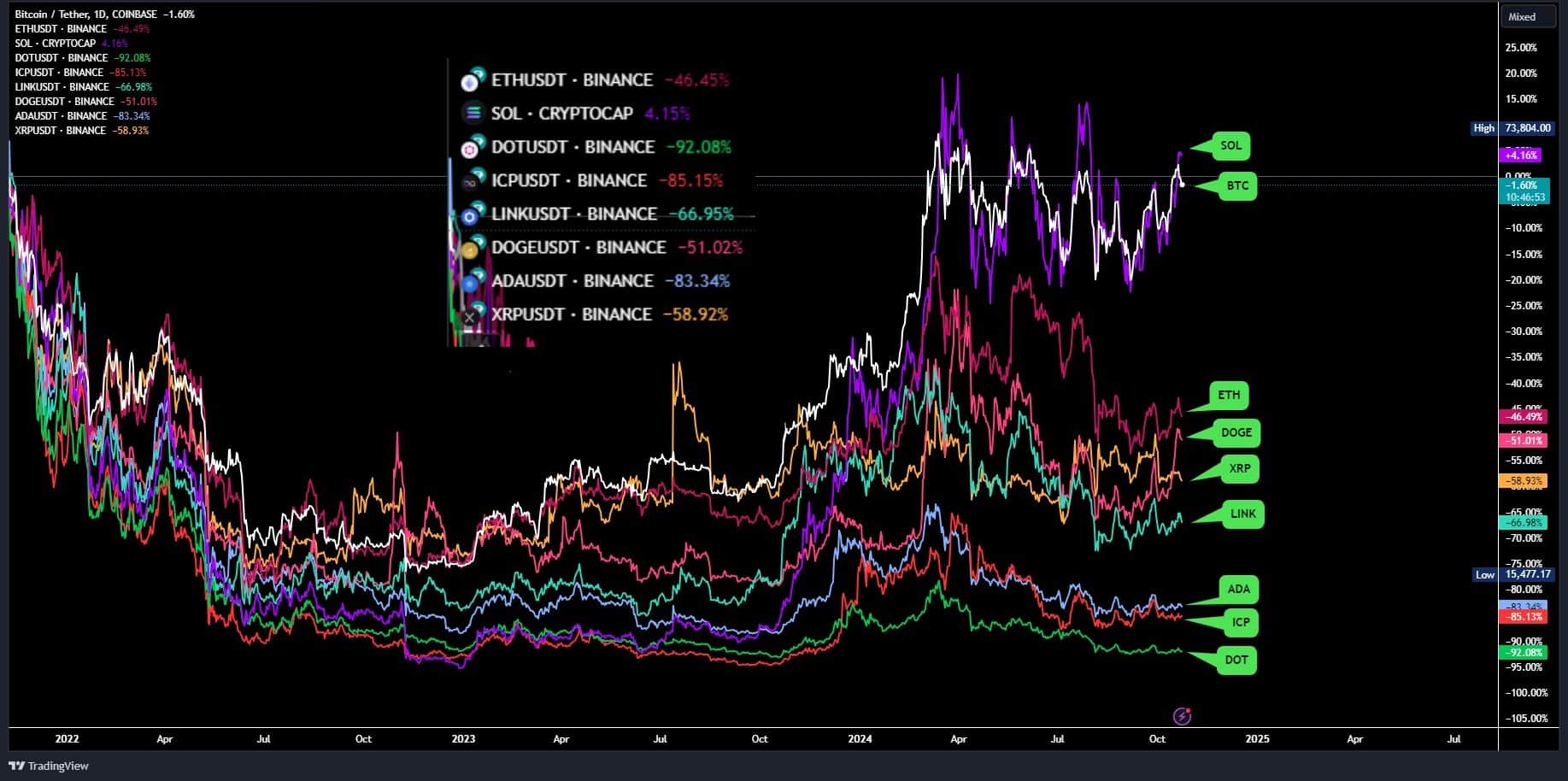

Among the leading digital currencies, XRP is presently placed fifth, with Bitcoin (BTC), Solana (SOL), Ethereum (ETH), and Dogecoin (DOGE) ahead of it in terms of performance.

Standout is Solana, being the sole coin among the leading ones that has surpassed Bitcoin in performance since 2021. On the other hand, contenders like XRP have found it challenging to maintain a comparable speed.

Regarding XRP’s immediate fluctuations, there’s a degree of ambiguity. Nonetheless, the overall prospect for the long run is optimistic. It’s essential to consider that some elements should fall into place first for this bullish view to become widely accepted.

Traders should remain cautious but optimistic, especially with potential upward movement looming.

Read More

2024-10-25 08:08